Do you have all your mutual funds investments in different companies and are looking for aggregating them at a common place? If so, there’s some good news for you. Now you can convert all your existing Mutual funds into demat form, which means that you can now have it electronically stored in your demat account, just like shares! Note, that once your mutual funds are in demat form, you can sell them either through stock broker platform (your demat account) or through the normal way of selling it through your Depository participant (like you do, right now.)

Advantages of converting your Mutual funds into demat form ?

1. Centralization : Once you convert mutual funds in demat form, you will then get just a single statement for your holdings. Right now, if you have investments in say 10 AMC’s, you must be getting statements from all those AMC’s. How to choose a good mutual fund

2. Monitoring : Once you have all your mutual funds at one place, you will be able to monitor them better, & you can see the performance at one go. Compare that to when they were at different places; we tend to be lazy to look at all of them and just keep ignoring them.

3. Fast transactions : : If you have all the mutual funds in demat form, you will be able to sell those mutual funds in stock markets whenever you need money. Mutual funds are now, tradable in stock markets, so you can buy and sell them in stock exchange in real-time. If you don’t have them in demat form, selling them would not be as convenient.

Steps to convert your Mutual funds into demat form

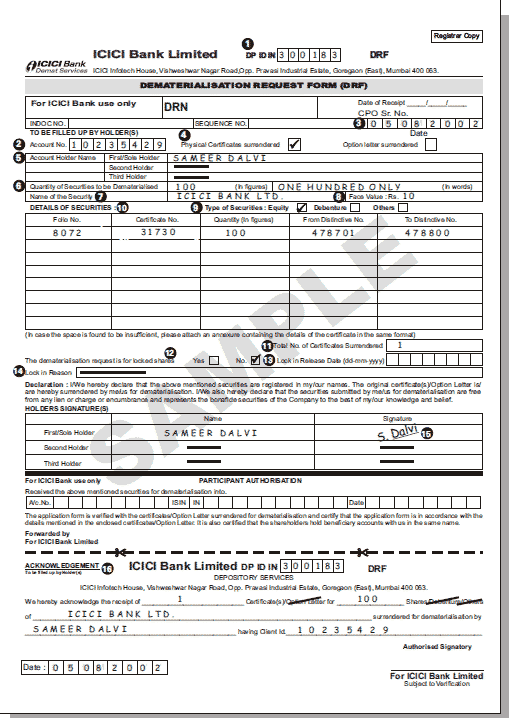

a) Obtain and sign DRF : The first step, is to ask your demat provider (like ICICIDirect, Sharekhan, Reliance Money) for a ‘Dematerialization Request Form’ (DRF) for conversion of mutual funds units held in physical form into demat form. Obtain it, duly fill it and sign it. You should be able to find the DRF form at your demat provider website. [DDET Click here to see a Sample DRF form] [/DDET]

[/DDET]

b) Sign all the statement of Accounts from your Mutual Funds : You will have to collect the statements from all the AMC’s which have the mutual funds names which you want to convert, once you have them, you have to sign it. You will get all these statements in your email box most probably. This step is important to make sure you have documentary proof that you own those mutual funds and have their names, so if you have investments in 5 different AMCs, you should collect all 5 statements.

c) Submit and Acknowledgement: Submit the duly filled and signed DRF along with and Account Statement issued by the Mutual Fund House to the Depository Participant. Acknowledgement will be given by the Depository Participant for the document acceptance, subject to verification.[DDET Click Here to see all Important points before submitting a Dematerialization Request]

1. The investor should check with their Depository participants (DPs) for the dematerialization Request Form to convert mutual funds units held in physical form into demat form.

2. The details in the DRF, i.e. Name(s), holding pattern and signature should match with the details as appearing in the account statement.

3. The form is duly filled and signed by all unit holders as per the holding nature and is complete in all aspects.

4. All the schemes as available in a folio are mentioned in the DRF and the unit balances as specified are matching with the closing balances available in the folio. No partial units or selected schemes available in the folio will be accepted for conversion.

5. Units requested for dematerialization should be should be free from credit hold, lien or any other hold. In case any units are under hold for want of credit status, conversion will be processed only after clearance of such hold.

6. Dematerialization request should not be submitted if the units are lien or locked for any Income Tax or other legal purpose.

7. Rejection letter will be sent by the Depository Participants if the documents are not in order, units are under lock, or rejected by the Registrar during the conversion process providing reason thereof.

8. Investors can check with their Depository Participant on the status of the request if no intimation has been received within twenty-one days.

9. No separate confirmation letter will be sent by the Registrar for successful transfer of physical units in demat form.

10. Post dematerialization of units the investors can only transact through the stock exchange platform. They will have to approach their broker for purchase / redemption of units.

11. Physical requests received by the Registrar of DSP BlackRock Mutual Fund for purchase/redemption of units will be rejected.

Source : http://www.dspblackrock.com/services/dematerialisation.asp

[/DDET]

d) Processing : The Depository Participant will process the application for conversion of physical units into electronic form. For this, the DP would sent the request form and Statement of Account to the Asset Management Company (AMC) / Registrar and Transfer Agent (RTA).

e) Confirmation : The AMC / RTA will after due verification, confirm the conversion request sent by your DP and credit the mutual fund units in your demat account.

Selling Mutual funds in Demat form

Note that converting the mutual funds will require you to have a demat account first, so incase you don’t have a demat account , you will not be able to convert them , because unless you have a demat account, how can it be stored . Now once you have converted the mutual funds in demat form , you can sell them through your demat account in stock market , which would attract brokerage as per defined by your Depository participant, however you can also sell your mutual funds through the normal old way where you put a request for sell through a Redemption Form .

Conclusion

This is one of those simple and small steps, towards simplifying your financial life. Once you do this, it can motivate you to take further steps in automating many things which will improve your financial life. Dematerialization of mutual funds will make sure your documentation will improve . Let me know if you plan to do this on comments section .. also lets discuss if anything is not covered in article . Has anyone done this already ?