Marriages are made in heaven! But what about families who have to fund the marriages by taking loans? Those, who sell their assets and properties for these, at the most, 1-2 day events? Does it make sense at all?

You, as parents have goals for your children education sometime in future. Despite the pressure you undergo today to spend a lot on money for your children marriages sometime in future, will it be relevant to spend so much on that goal?

This is the second series of articles which sees how social and economical changes in our country will have impact on our financial goals in future, so that we can take decisions for saving for those goals today ! (Read first article of the series about Child Education here).

source

When we coach our clients in their financial lives, we see that one of the main goals in their life is “Children’s Marriage.” For most, the present cost of this goal is around Rs 10,00,000, and by the time their children will be marrying, it definitely would cost a bomb!

These investors keep investing money for that goal for several years and work hard all their life at it.

But the question is –

After 20-25 years when the time comes, will it be worth spending so much on this goal? Can’t you lower the target of that goal and instead use the money on something else which would add more value to your life? What about buying a better house? How about living a 20% better retirement than you have planned? Or best, why don’t you just fund the education of say 2 kids from the streets? That to me, is more inspiring, more satisfying and a much better act to boot !

What happens today?

Now a days, marriages have become more of an event where the whole focus has deviated from the main goal of the rituals, the gathering of friends & loved ones, spending quality time and shifted to show-bazzi, razz–matazz, DJs, expensive decorations, partying, showcasing 100 types of food, and functions which last long hours !

And the biggest problem, if it can be called that, is that all this is done for people who actually don’t matter most of the time! I personally come from Uttar Pradesh and I have seen marriages there, If you want to compete with our state in Show-bazzi and non-sense extravagance, I give you an open challenge !

We all know, what is the goal of marriage. It’s bringing together two individuals and their families. They enjoy the event, get to know each other and perform rituals which really contribute to marriage. For people who don’t know, the Arya Samaj rituals which is the simplest and purest form of Hindu marriage, takes only an hour to complete the marriage !

And it has all the rituals from Hindu vidhi! Even with regular marriages it does not take much time to complete the marriage. It’s normally, a balancing acts between parents who push for making sure the “rituals” are there and the current generation who look for speed and simplicity.

As per an Indian study, as close as 15% of all grains and vegetables in India are wasted through “extravagant and luxurious functions”.

Parents and society pressure

Most of the people who are pissed off by the idea of useless spending still have to pass through this trauma because of the parents. Parents have attended all the marriages till date in their “circle” and it was all nice and full of events and 3 days long. Now it’s their turn to show off or at least give back !

No matter how much logic you can throw at parents in doing a simple marriage with less people and a low budget, it still does not help!

Even though we are in the 21st century, the majority of parents still start saving for their daughters marriage from day 1. I say daughter’s marriage because its considered as the bigger headache and there is this ‘rule’ in our society that girls side bear the main expenses. What a cheap mentality is this !

If its going on from years, we have to change it, but lots of guys family still show as if they are bound by some imaginary forces to follow it ! Shame ! . A lot of families go into debt because of this “happy event” in their daughters life. They sell their land, houses at times, & even mortgage their assets to fund marriages.

Is this a happy event or a sad one?

Why do people spend in weddings in the first place? There is enormous pressure in the conservative society for marriage spending. These are costly social get-together’s, in this country of more than 900 million middle class and poor people. In the marriage celebrations, the hosts have to feed couple of meals to some 500 to 1000 guests.

They have to give gifts to some 50 to 100 relatives and wedding guests. The cost of lighting, flowers, decoration, booze, music, dresses and gifts to bride and groom, and travel expenses often hits the economic foundation of most families.

I personally know families, in which a man loses almost all his retirement benefits to get two of his daughters married, even when there is no dowry involved. For a middle class person, even the simplest wedding can cost rupees 5 lakhs (half a million rupees).

Does society or culture coerce people directly or indirectly to bear huge expenses during marriage of their children? Yes. People are coerced or forced by the culture to spend money to prove themselves in front of friends, relatives and neighbors. It is a social expectation imposed on people, which tramples their freedom and choice to lead a dignified life. – by Desicritics

How our Indian marriages and our customs took their shape !

Lets flashback few centuries back and understand how the procedure of marriages got to where it is today. In earlier times, it was parents who decided who the life partner would be. In most cases, the girl and boy would not have even seen each other!

Marriage was then, actually an event of getting every one familiar with each other – all the relatives, neighbors, friends, everyone came with purpose of getting along, and knowing each other. And it was an event which was “opportunity to meet!” People lived far apart, and communication & travel wasn’t as easy as it is today.

Marriages were therefore long events with series of ceremonies and rituals . A strong reason for this was that girl can spend more and more time with their future family members and get familiar with her “new” life & family. With the passage of time, the real meanings have been lost and only the rituals remain.

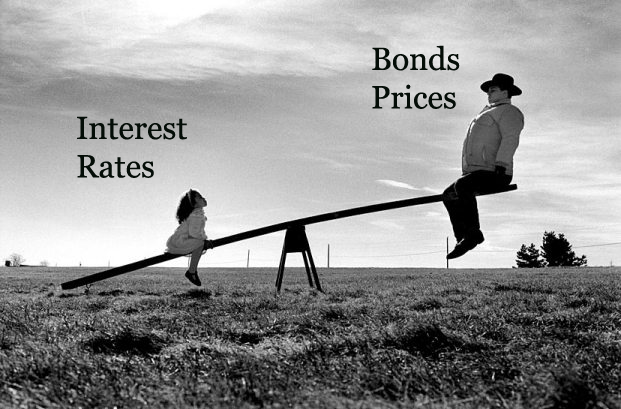

What do people think about Indian Marriages ?

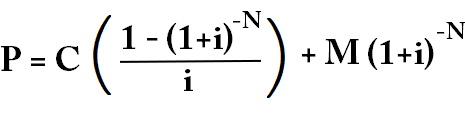

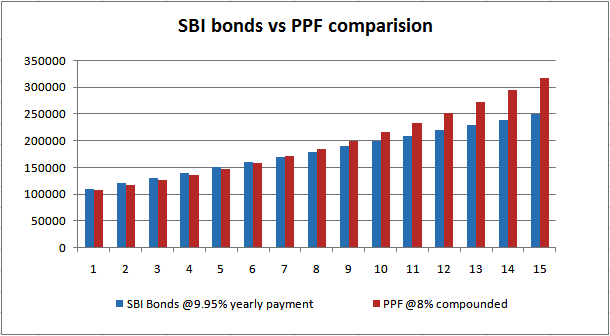

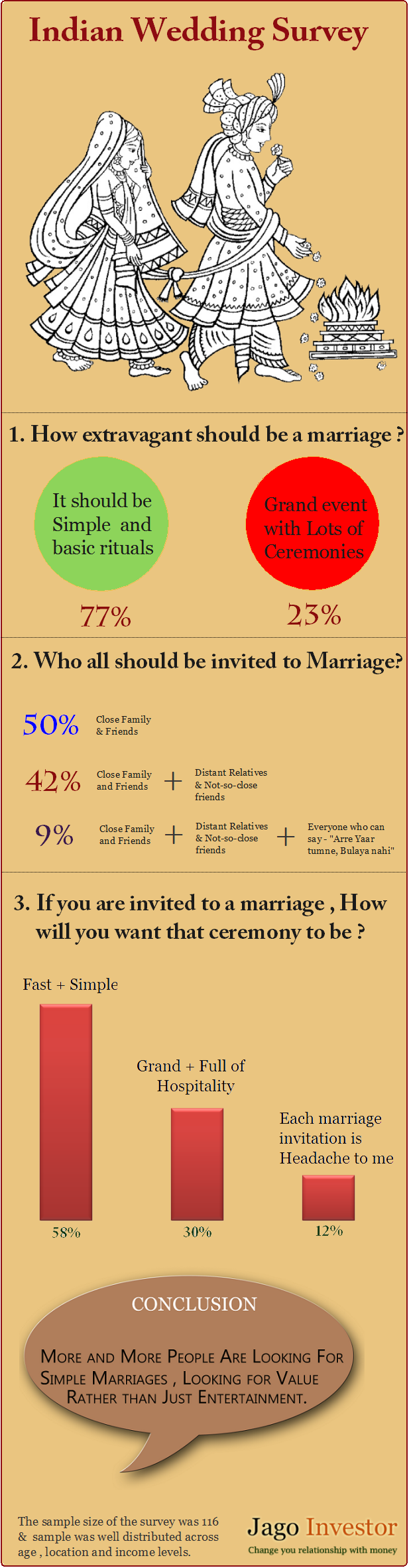

I conducted a survey few days back and there was a great response . I came to know what urban Indian (mostly metro’s) thinks about Indian marriages and some interesting results came out . See the survey report which I have created out of it .

Most of the people participating in the survey said that they feel marriages should be simple and fast, which indirectly tells that there should be less spending on marriages. However still a quarter of the participants said that it should be a grand event as its once in a lifetime event and hence deserving of expenditure!

There was also a interesting pattern seen on what people think about who should be part of a marriage. There were equal number of people who opted for “close family and friends” as well as “All the family, relatives and all kind of friends.”

Some even went ahead to say that they would like to call everyone who can embarrass them later saying “Arre yaar, tumne bulaya nahi” .. Believe me whoever says that kind of sentence never actually comes anyway! You can safely request him to come and then forget about him/her 😉 .

This clearly shows that while most of the people would like to spend less on their marriages, they still feel the pressure of society and therefore would would like to invite people. This is very obvious, given the way our society is shaped.

While a person attends many marriages in a year, only 1-2 of those marriages are the one which he actually cares about. Most of the others are just a formality. Imagine, while just inviting others is a headache, even the person whom you invite, also gets a headache of attending it!

Attending marriage is also becoming like actually getting organizing a marriage! No one wants to do it, but everyone has to do it!

As many as 58% of the survey participants said that if they attend a marriage, it has to be fast and simple as its just another formality for them, 12% even went ahead and declared those events to be a headache for them. Only 30% participants said that they would love to attend marriages which are grand, after all they are guest ! .

All ceremonies are driven by “Looking Good” factor

We live an ordinary life but our eyes would like to capture things in movies or television shows which are larger than life. Most Indian weddings shown in Indian movies and television shows are larger than life. They are shown as if our entire life is about spending on weddings and nothing else.

While watching movies we forget that everything is fake, it is not a real wedding happening on screen. The scene is created where everything shown is picture perfect. ‘Everything is created so that it LOOKS GOOD’.

When we have a family function each person wants to look good or wants to avoid looking bad in the eyes of relatives. They want the event to be the best, they want it to be different, they want people to say “kya kharcha kiya hai, kya baaat hai”.

This is what it’s LOOKING GOOD, nothing else.

The spirit of celebration is quietly taken over by the looking good factor. Most people don’t know this, they are not present to how the looking good factor is running their financial life. They simply want to look good and inside of that they over shoot budget, invite more people to the event and will try his level best to impress the guests.

Looking good element is not only present in the Host , please don’t be mistaken. It is fully present in the guests who are invited. When we receive an invitation to attend any marriage or function we attend the event just to look good.

We go to the functions thinking “Nahi gaye toh aache nahi lagega”. Even the gifts we give on each wedding or occasion is decided by the looking good factor inside us. (Think about it). By the way where is all this coming from.

It is either to look good or you want to avoid looking bad when it comes to attending functions, giving gifts, organizing events. Some say it is my first son getting married so I will spend, some say it is my last son getting married so I will spend.

NO BOSS it is simply the looking good factor running the financial show of your life.

The point is you can go beyond “The looking good factor” you can get in touch with your true self-expression and focus on celebration rather than burning your hard earned money just to look good.

We have served dozens of our clients and almost all of them have been victim of this “Looking good” and messed up their financial life. however we have been successful in coaching them on how they should come out of this “looking good” and concentrate on a bigger goal in life , which is attaining financial freedom. I am sharing this with you, because I don’t want you to be one more victim of looking good factor. If you can get this lesson, you can design and live a simple yet extraordinary financial life.

But marriage is a one time event and to be remembered !

I agree !

Who’s stopping you from making it memorable and enjoyable? Life is to make each moment memorable and marriage is an event which has to be memorable. However do it in your capacity, thinking past and future and what impact it can have on you , not others.

If you want to spend 20 lacs on marriage, and you can afford it, then damn it all & just go do it! But shower it all on your family and people who matter, do it on people for whom you will be happy with, do it for everyone whom you will miss if they are not part of the marriage.

Instead of wasting it all on 750 people, of whom 600 are just weird acquaintances, better spend all 20 lacs on just 150 who are close to you and you would not regret spending it all on them. I would suggest, spend 15 lacs on marriage and go for a amazing honeymoon with those 5 Lacs!

Your spouse will love you for at least next 2 years for sure! Guaranteed! 😉

However if you spend 20 lacs on those 750 bums and are irritated at each moment, and then complain that real estate prices are high, paisa nahi hai, kaisa karenge, and all, then God help you! You choose your path and boy, please work on your emotional quotient! 🙂

Marriage’s in future

Now coming back to the point, If this is the condition today, in 2011, you can only imagine the scenario after 20-30 years. In this new India, more and more people are travelling to other parts of country, settling in other states, mingling with other communities and end up marrying with other castes.

This will only rise in future , not come down. Which means marriages will have to be more simpler. People will have much lesser time than today for “external” events .

With everyone busy in the rat race of life, and with new breed of individuals who will be “us”,everyone who will be part of your children marriage would be your friends and relatives who are almost of same age, and hopefully think alike and will be wise enough to accept that “uske ghar ki shaadi bade sidhe sade tarike se who rahi hai”.

We would not mind attending faster and simpler marriages.

So I want to give you no suggestions today; just food for thought. If you have a goal of your children marriage, discuss with yourself, rethink stuff…

It might happen that in future you might not have to spend so much money on marriages because the situation and those environment might not demand it. It may be they don’t even care for it! You might be losing on some other goal or some sleep over night on these points!

Experiences of Readers about Indian marriages

You can skip this part now if you wish to, I am just sharing some of the experiences of readers who have taken the survey and shared their personal views on Indian marriages .

Reader 1

Today people spend so lavishly on their son/daughter’s wedding like never before, even when they have to take personal loan for it. I really don’t understand the reason behind all this, I guess this is to do with their social/personal image.

Who dont want their daughter to be happy and not to face any taunt from future in-laws because uski baap ne uski shaadi acche se ni ki?? Maybe this fear makes them spend so much..!! For these people, I have a question, does spending so lavishly on their son/daughter’s wedding boost their social image and stop the taunt from in-laws family (PRACTICALLY)?

Did they work hard and save whole life to spend like this? Why not spend it on their own vacation, son/daughter’s honeymoon, things they desire most in their life etc? Why not buy a home they desire for (if they don’t have one), why not plan for retirement?

Why not use the money they want to spend to fund poor & needy child’s education than to spend on decoration & food at the marriage on rich & well settled family and friends (read everyone) who can say “arrey yaar, tumne bulaya nahin!”..

I am sure, the marriage can happen in small banquet hall (lawn) with only close friends and relatives invited, sharing the happiness immensely than to manage large crowds seeing your hard earned money flowing like daru from the bottle forming the ocean.. Shadi 3 crore ki can become shadi 3-5 lakh ki with happiness multiplied many times!

Reader 2

Today’s marriages are more of a show – “my cousin had a grand wedding, I will show them what a ‘grand’ wedding is next month when my son gets married.” It’s more like the Onida advertisement – neighbours envy sort of thing.

One who has attended a relatives wedding feels he can do a better show of it , like ‘people will forget that wedding, they will remember my wedding for a long time to come. All show. I say go feed or look after some really needy people in that money spent on the lavishes of the wedding. Keep the wedding simple with minimum rites as required.

Reader 3

Few thoughts on the way today’s marriages are conducted these days in our country ( I may be little over the top being a bania 🙂 . First about the marriage ceremony itself – they are all the same.

A large glittering hall with a huge gathering of unrecognized people and a very few close friends / relatives. What’s the point of such expense ?

I’d think couple may be better off performing a simple marriage ceremony & utilize the money saved for themselves – expense on close friends / Honeymoon / Car purchase / House purchase etc.

Second, the marriage invitations have become much more transactional than an emotional invite. Your option of “Anyone who can say tumne bulaya nahin” captures that (wonder how many people will select it 🙂 ).

People invite everyone they can remotely relate to (it’s high fixed cost anyways as per grand arrangements – adding few people doesn’t matter).

If the ceremony were to be conducted in simpler manner, a much better & thoughtful function / reception party can be arranged for fewer people with lots of personal attention & hospitality that makes the event memorable for all rather than “aaj phir ek shaddi mein jana hai…dinner karke zaldi aa jayenge” 🙂 .

Ofcourse our parents generation for whom shaddi is an event to call upon the whole society would disagree. It ‘ll be nothing less than a crime not to call upon all and spend it all on a marriage.

I ‘d think as the current generation takes over the role of parents and arranging for child’s marriages (hopefully they will let us :P), we might move towards simpler marriages and grand functions for a lesser number of people.

Reader 4

Marriage used to be a divine affair, 2 people getting together and taking oath to live together until death, through thick and thin. Today some of the marriages I visit are more of wealth show and ego pumping affair for the couple and their parents.

Sure, those with hidden black money would want to spend it all here (visit a marriage of a real estate developers son/daughter, you will know).

I am a South Indian, and had visited a north Indian friends marriage in UP. It was an high expenditure marriage, with great food and gifts to all attendees.

Everybody enjoyed the food and drinks, and by the time the mooharat, started (midnight), there were hardly a handful of close relatives left to witness the rituals. It made me realize how fake and shallow Indian marriages have become.

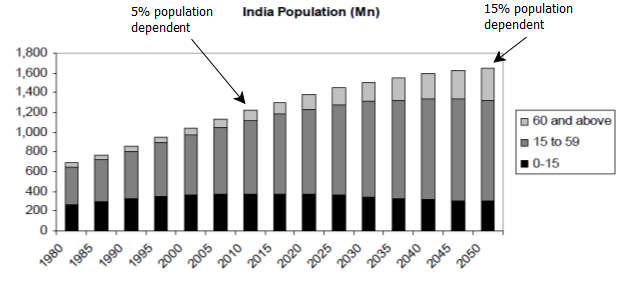

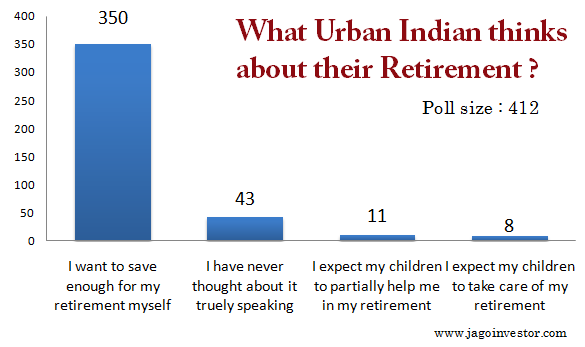

Best Investment for your Retirement ?

Best Investment for your Retirement ?