Today you are going to learn how much home loan amount you are eligible for. I will show you how banks calculate your home loan eligibility and what are some of those factors which can impact your loan eligibility.

At the end, I am also going to share some tips you can take to increase your home loan eligibility.

What is Home Loan Eligibility ?

Home Loan Eligibility simply means how much loan amount you can get for buying a home. Just because you are earning Rs 1 lac a month, does not mean that you can take a Rs.50 lacs loan. Its always based on a formula and is calculated based on some formula and logic, which we are going to see today.

There are several other kind of loans like Personal loans, Car Loan, Education loans – but out of all the loans, home loan is the biggest ticket size loan and takes longer to pay off. While this article is true for all kinds of loans, still we will focus on home loan eligibility in this article.

Think from the Lender’s point of view

Before we go deeper into this article, I want you to think like a lender for some time. Think as if you are a lender and you are giving loan to someone. How will you think, how will your thought process be? Think for a minute and trust me, you will yourself realize that calculating someone’s loan eligibility can be very easy.

There are various factors one has to look at before giving a loan to someone. Just because someone is earning a lot of money, does not mean that he/she is eligible to get loan of any amount. There are various other factors which will come into picture.

I have recorded a full video on this topic which you can view below or on this direct link on youtube.

So before we look at those factors, let me quickly show you an example and explain you the simplest way of calculating the home loan eligibility

Example of Calculating Home Loan Eligibility

Lets say Ajay earns Rs 80,000 per month as a Software Engineer. Now its very obvious that he is not left with all Rs 80,000 per month as his savings. After deducting his expenses and commitments, he must be left with some amount.

As a thumb rule, banks in India assume that you are able to save anywhere from 40%-50% of your in hand income. For this example, lets say that the ratio is 50%.

So the bank will assume that the savings per month is 50% of Rs 80,000 , which is Rs 40,000. This Rs 40,000 is available for repayment of any kind of EMI’s .

Now bank will do the reverse calculation and find out how much EMI is required to pay off Rs 1 lac loan using the standard interest rate and tenure. Assuming that the bank takes 20 yrs tenure and interest rate of 10.5% , the EMI required to pay Rs 1 lac loan per month comes to Rs.998.

Now they find out how much loan Ajay can handle if he can pay Rs.32,000 EMI per month, considering Rs.998 is required to pay Rs 1 lac loan. So it would be

Rs.1 lac * 40,000/998 = Rs.40 Lacs.

So this way, Ajay’s home loan eligibility is Rs.40 Lacs.

What if there was an existing EMI of Rs 10,000 ?

Assume that Ajay had an existing personal loan for which he was paying Rs.10,000 EMI per month. In that case, his available saving would not be considered as Rs.40,000 , but 30,000 only (40,000 – 10,000)

In which case, his loan eligibility would be just Rs.30 lacs using the same technique.

Now this is the most simple way of looking at home loan eligibility calculation. There are various banks which use different formulas and calculations, but all of them will revolve around this same logic I explained about.

Important Note –

It depends on the bank on how much % saving they assume a person does. In the example above I have taken 50% as the assumption, but some banks might take it as 40% or even 35% .

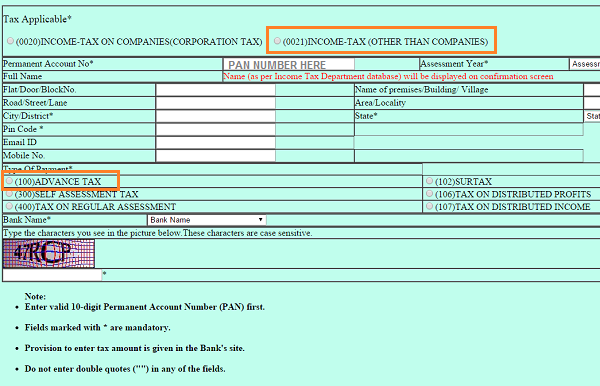

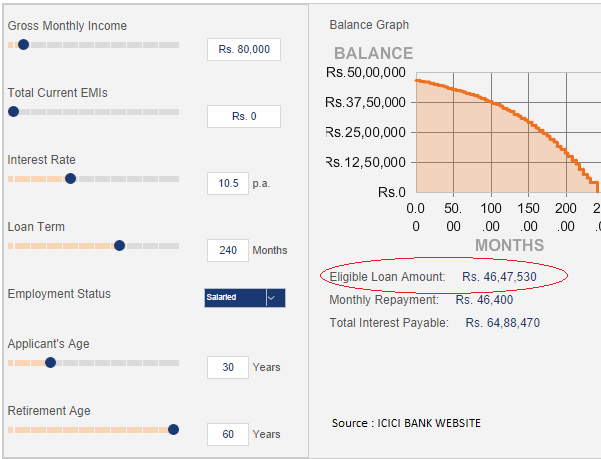

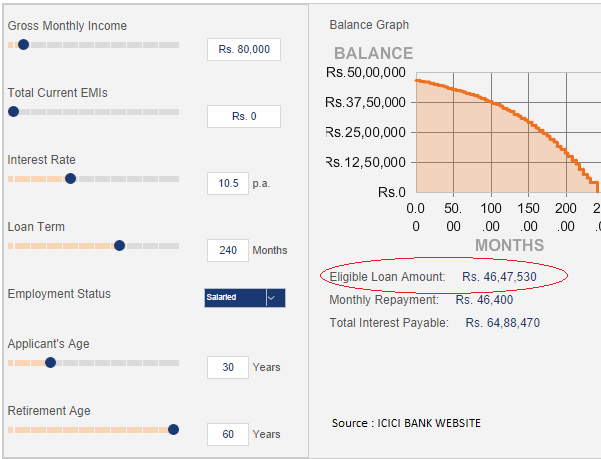

I calculated home loan eligibility on ICICI’s Home Loan EMI and Eligibility Calculator for the same example above and I got the following result

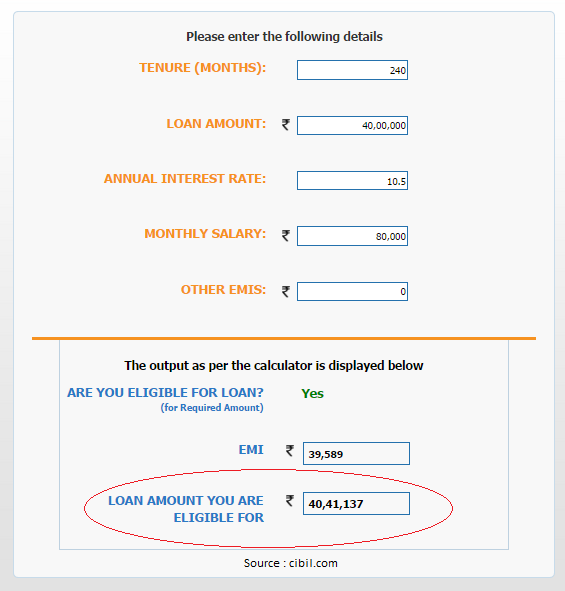

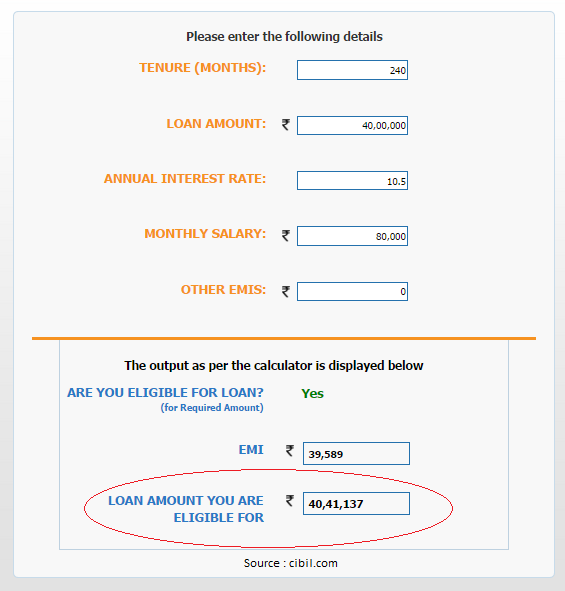

I checked the same example on CIBIL website and even there website gave me very similar result

Factors which Affect your House Loan Eligibility

Now lets look a little deeper into some of the core factors which affect your loan eligibility. Some lenders might not use all the factors, but still its a good idea to understand how its related and do something about it.

1. Your Income

The amount of loan you are eligible for depends directly on your income.This is one single factor which impacts your home loan eligibility to the greatest extent. Its very simple, higher your income, higher is the chance of you being able to pay the bigger liability.

Your actual situation might be anything, but the simple logic is that higher income person can pay more EMI and hence he/she can take higher loan.

A person earning Rs 1 lacs has higher chances of affording Rs 30,000 EMI , compared to a person who earns just Rs.40,000 .

Now if you are salaried employee, your income is assumed to be more stable than a person who is self employed or into a business. Its more easier for a salaried person to get a loan compared to a self employed person earning Rs 1 lac a month for obvious reasons.

Note:

A lot of banks will ask for your salary slips for past 1 yr and 3 yrs of IT returns, and bank statement for atleast 6 months. This is to calculate and get an idea of your overall cash flows and what are your spending patterns.

A lot of banks do not consider the LTA , HRA and medical allowances you get from the company, so they will deduct those amounts from your yearly take home.

I thought I will mention one important point here. In reality your income can be anything, but what really matters is your income on papers, which is ITR returns you have filed over last 2-3 yrs. A lot of people do not disclose their full income and pay less taxes, Its going to directly impact their loan home eligibility.

For a self Employed Professionals, along with the ITR’s for past 3 yrs, banks also require Profit and loss statement along with Balance sheet certified by a CA for last 3 yrs.

2. Age of the applicant

The age of the applicant also matters to some extent, but not significantly. Paying a home loan is a long term commitment. And banks have to ascertain how long you can pay off the EMI.

A person in his 30’s can pay the loan for next 30 yrs, but a person who is 50 yrs old will retire at 60 and has just 10 yrs in hand and in that case, he can get a loan for lower amount compared to more younger person.

3. Credit history

Your past credit history and repayment record has direct impact on your loan eligibility. If someone has a bad repayment record, then he/she might not get the loan itself. But in some cases where bank considers the application it might happen that they only approve a certain percentage of the eligibility

In our earlier example, Ajay had a loan eligibility of Rs 40 lacs in normal circumstances. Imagine that he has a bad record in past and he had not paid his past EMI’s on time and his overall credit score was bad, then it might happen that the bank agrees to only approve Rs 10-15 lacs of loan instead of his original 40 lacs loan.

4. Profession

Profession of the loan-seeker also matters a lot. Some professions are categorized as negative or risky by the lenders. People in such professions may find it difficult to get a loan sanctioned. What a lender requires is a stable income for a very long term.

So if a person is into jobs which are well paying and which are considered stable like Software Engineers, Banking jobs etc (which are white collar jobs), then the person is eligible for a higher loan amount.

However certain jobs like BPO sector jobs, running your own shop, Insurance Agent have lower loan eligibility because the income is uncertain or the chances of losing a job is higher.

5. Your Relation with the Bank in Past

A lot of banks (especially PSU and cooperative banks) still look at your past relationship very seriously. If you have an account with bank from last 10 yrs, it will matter a lot sometimes. In some cases banks directly issue a loan in multiple of your income.

6. Your Employer Category

Almost all the banks categorize various big companies into A,B,C category and offer different interest rates to their employees. so employees of Infosys, TCS, Microsoft and companies like that will be offered a better interest rates companies to smaller companies.

Check with the bank about it and you might get a slightly less interest rate, which can matter a lot on long term. You can also get processing fee waiver if special schemes are running.

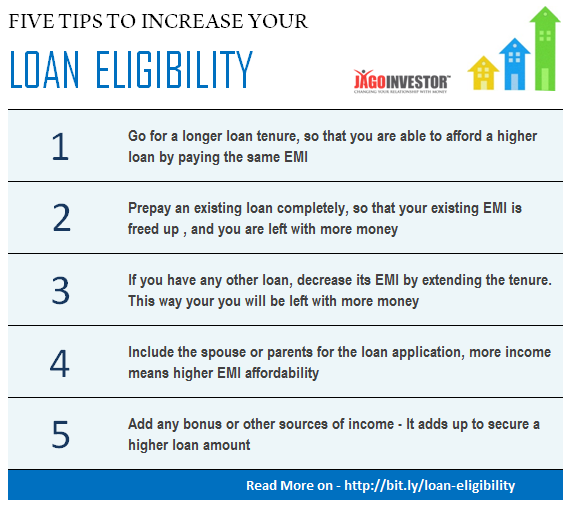

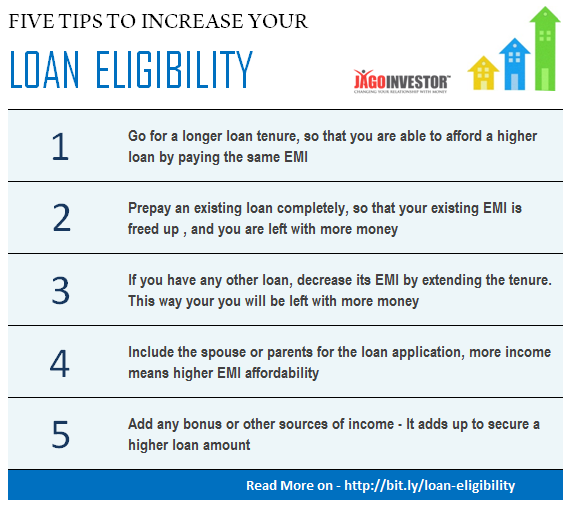

5 tips to increase your loan eligibility ?

So you understood how the loan eligibility is calculated and some factors which impact it, so now lets see some of the actions you can take to increase your loan eligibility.

1. Go for a longer loan tenure

your EMI depends on the tenure of the loan, so if you increase the loan tenure, you might get a higher loan eligibility.

So if you were planning to take a loan for 10 yrs, and assume that your loan eligibility came to Rs 20 lacs, if might happen that it goes up to 30 lacs if you are ready to take a 20 yrs loan. Its as simple as that. This is because you are committing to pay over a higher time frame.

2. Prepay an existing loan completely

If you have any existing loan which is about to complete, then better pay it off completely. This is because in that case, your monthly savings will go up and that will increase your loan eligibility .

For example – imagine you are able to save Rs 40,000 per month. But you have an existing personal loan for which you are paying Rs 15,000 per month EMI and that leaves you with remaining Rs 25,000 only. Now imagine that you have Rs 1 lac in outstanding for that personal loan and its going to complete in next 8 months, after which you will have full 40,000 with you for paying home loan EMI .

But right now your bank will see that you just have Rs 25,000 in hand to afford additional EMI , and you will have a loan eligibility of only Rs 25-30 lacs, where as in reality you know personally that you can afford much more EMI given a chance.

So in this case, its always a better idea to arrange for money from somewhere else and pay off the personal loan fully and that will free your EMI there, and you will be left with full Rs 40,000 in your hand. This simple action will increase your home loan eligibility by a big margin

3. Extend your other loan tenure and decrease the EMI for the other loan

Now this is just an extension of the above trick . You have to think about how you can show the bank that you have a higher amount available with you.

So if you have any other EMI going on and you cant prepay it fully, then at least you can increase the tenure of that other loan, which will decrease the EMI part and that would leave you with more money in your hand each month.

For example, imagine you have another home loan for which your tenure left is 4 yrs and your EMI is 15,000. Now if you cant prepay it fully, what if you can increase the tenure to 10 yrs, may be the EMI comes down to Rs 9,000? That would mean extra Rs 6,000 with you. That can show the bank that you can pay more EMI on the other loan now …

Check this point with the bank when you need the loan. In some banks this thing might not be of any use if they do their calculation on outstanding loan.

4. Include the spouse or parents for the loan application

This is pretty clear. If you include your spouse or parents as additional loan applicants, then your overall loan eligibility will go up because now there is more income to support that loan.

The person you are including should have all the documents and ITR as proof for their income and its stability

5. Add any bonus you are liable of

You should also mention to the banks if you get additional bonus or perks from your employer or if you have any other source of income like rental income, interest from deposits or some other business income apart from your regular income.

Even if you mention that your spouse also earns some additional income which can be used later, then it might help sometimes. This particular point is not going to increase your loan eligibility, but at times this can help you get your loan approved.

Conclusion

The simple point of this article is that banks look at your potential to repay the future loan and there are factors which affect that and you can take some actions to improve your chances of securing the loan or increasing your loan eligibility

Let us know about any questions you have or some thoughts you want to share ?