Today I am going to review features of “Care“, one of the good health insurance policies in the market. It was launched few years back and it’s really one of the most comprehensive health insurance products available in the market as on date. So what I will do is, share with you, its features one by one, so that you can know what all it covers, along with few disadvantages in the policy

I digged deeper in its policy wordings and I will explain them in detail, so that anyone who is looking forward buy a health insurance policy can take the decision in a better way by reading this Care review. Here you go..

1. High Sum assured up to 60 lacs is allowed

The sum assured offered by the policy ranges from 3 lacs to 60 lacs. Gone are the days when 2-3 lacs of sum assured was sufficient. Now it’s very common to see people buying a cover of 10-20 lacs. Many people even want to go for a cover of 30-40 lacs also and there are very less options right now if someone wants to buy a high enough health cover. Care gives you an option to buy up to 60 lacs of health cover, and the best part is the high cover comes along with added benefits which we will look very soon

2. Single Private Room (no rent limit)

If you choose the sum insured of more than 5 lacs, then you are eligible for a single private room. The wordings in the policy is of “Single private room” and not some percentage of sum assured.

Most of the policies cap the room rent limit, however this policy caps the room type. Here, if the user takes a room higher than the type eligible he still is required to pay the difference of the room rent as well as all other expenses which increase due to choosing of a higher room type

I love this point especially because room rent limit is such a critical factor while calculation of your claim amount, you can read how room rent limit affects your claim process if you choose the room with higher rent

3. Cashless treatment in network Hospitals

Care has a network of around 4,100 hospitals around the country. If your hospitalization is planned after few days, in that case, you don’t have to shell out any money from your pocket. You can choose to take cashless treatment and the bills will be settled by the health insurance company directly to the hospital.

This is not a special feature in Care. It’s present in almost all the health insurance policies these days. But I thoughts it’s a good mention in this article as we are looking at all the features. Also, note that cashless treatment is an additional benefit which helps a customer. You can always choose to not have a cashless treatment and pay the bills yourself and settle the claim later by submitting the bills. In case of emergencies, you anyways can’t choose cashless treatment.

4. FREE Health Check each year

You also get free health checkup’s facility every year for all the adult policy holder’s lifetime!. There are no terms and conditions for this. Just that the facility is there only for sum assured of more than 5 lacs. Also, the number of health checkups depends on the sum assured amount. You get more detailed checks done when your sum assured is high.

I have realized that a lot of people do not spend their own money for regular health checkup’s, so in a way it’s a great feature in the policy, due to which one will form the habit of regular checkup’s and will be informed about their health issues.

Each year you just need to contact the company and express your desire for the health checkup and they will schedule it for you in one of the centers they have tie-up with and which is also near your house. You can choose the timings and place as per your convenience. You can collect your health reports after 24 hours of the checkups. It’s a really great thing offered by any company.

Below is the health checkup list for various kind of sum assured slabs as per their brochure.

5. Restore of sum insured up to 100% amount

The policy has a feature called restore. In this feature, if there is a large claim in the policy due to which the sum insured is exhausted or reduced substantially, in case of a subsequent unrelated claim, if the sum insured falls short to pay the claim, the policy reinstates/restores to cover to 100%. Let me explain that in detail.

Let me give an example

Suppose you have a 10 lacs sum assured. Now due to some heart-related issue, you were hospitalized and the expenses were Rs 4 lacs. So your remaining sum assured is 6 lacs. You can utilize the 6 lacs sum assured for any purpose.

But if some another hospitalization comes up for an unrelated claim, and the expenses are more than your remaining sum assured, then your sum assured will be restored to the full amount of 10 lacs. Even your other family members can avail for the full sum assured even for the same illness. Note that in case of family floater plan, it’s highly beneficial because even the other family members can take benefit of full sum assured for the same illness.

6. No claim bonus up to 50% of sum assured

No claim bonus is a very simple concept, where you get rewarded if you don’t have any claim in a year. In Care, your sum assured gets increased by 10% of the base sum assured if you do not claim in a year and keeps increasing upto 50%. Which means that if your sum assured is Rs 10 lacs, then if you do not have any claim in a year, then next year it will increase by 10% (10% of 10 lacs) , and your sum assured will become 11 lacs . Again if you do not have any claim in the next year, it will increase to 12 lacs and so on..

So your cover of 10 lacs can go up to 15 lacs maximum if you do not claim for 5 yrs consecutive. A lot of policies (like Oriental Happy Family Floater), they reduce the premium by some percentage as no claim bonus and many people are happy about that, because that means less money going out of their pocket. But truly speaking what you need is the increase in sum assured, not a reduced premium, because every year due to inflation and rising medical costs, you need higher sum assured.

I don’t see a big benefit in saving few thousand or hundreds in premium in the name of no claim bonus.

Super No-Claim Bonus

This policy also gives an additional benefit called Super No-claim Bonus which will cost you extra premium if you wish to take it. In this super no claim bonus facility, your no claim bonus will be 50% extra each year up to the maximum of 100% of sum assured.

What that means is that if you do not have any claims, then within 1 yr, your sum assured will increase to 1.5 times and in 2 yrs, it will double. So if you have a policy of 5 lacs sum assured, then

- Sum Assured in first year – 5 lacs

- Sum Assured in 2nd year (assuming no claim made in previous year) – 7.5 lacs

- Sum Assured in 3nd year (assuming no claim made in previous 2 years) – 10 lacs

And this super no claim bonus is over and above the no claim bonus which you anyways get in the policy. So truly speaking your sum assured can increase anywhere from 60% to 150% in some years if you take super no claim bonus option while purchasing the policy. At the time of applying for the policy itself you need to mention that.

7. Around 170 Daycare Treatments covered

The policy covers around 170 day care treatments (In-patient treatments) , which are mentioned in the policy document. A lot of times you don’t need to get hospitalized for many days or even 24 hours. Some treatments can be done in just few hours. You can get admitted in morning and get things done by the evening or just few hours.

Even these kind of in-patient treatments are covered in the policy. A common myth is that you need 24 hours of hospitalization to claim your health insurance benefits, but it’s not true. Many years back when health insurance was a new thing in India, it was probably true. But not anymore.

Below is a snapshot of the policy terms and conditions pdf and you can see some of the day care treatment names mentioned. There are total of 170 treatment names listed in the document.

Please do not confuse these day care treatments with OPD. OPD treatments are not covered in any health insurance policies

8. Second Opinion and Organ Donor Cover

If there are any expenses which are incurred on the organ donor, then even those expenses (along with hospitalization expenses) will be covered in the policy. The limit for this expense ranges from Rs 50,000 to Rs 3 lacs depending on the sum assured. A lot of times, in critical cases, if there is any organ which needs to be replaced and you get any donor, then you will not have to incur the expenses from your own pocket due to this feature. While this is an extreme care, still we should appreciate that the policy takes care of this point.

Also the policy has a feature called “Second Opinion”. In this, if any of the policy-holder is diagnosed with a critical illness, then the company will arrange a free discussion with a qualified medical practitioner for you. This is great feature, because a lot of times, you want to consult another doctor before taking a big decision like surgery, operation or any hospitalization. The policy lists down the critical illnesses for which you can take second opinion. Note that the second opinion facility is only for sum assured above Rs 5 lacs.

Below are the critical illness mentioned in the policy

- Benign Brain Tumor

- Cancer

- End Stage Lung Failure

- Heart Attack

- Open Chest Coronary Artery Bypass Graft

- Heart Valve Replacement

- Coma

- End Stage Renal Failure

- Stroke

- Major Organ Transplant

- Paralysis

- Motor Neuron Disease

- Multiple Sclerosis

- Major Burns

- End Stage Liver Disease

Each member of the policy can avail the second opinion facility for each illness every year if required.

9 – Avail Medical Treatment anywhere in world

If you have opted for sum assured of 50+ lacs, in that case, you can avail the medical facilities through the world, where-ever you wish to , but it’s limited to only 5 major illnesses. Also, the benefit is available only on reimbursement basis only. Means you first have to spend the money from your pocket and then claim it back later. So I think this will mainly be helpful for the high net worth individuals and not to the middle class. Anyways a good feature, because some people might look forward to this.

10 – Pre and post hospitalization expenses

The policy also pays for any medical expenses related to the claim before and after getting admitted to the hospital. It covers 30 days of pre-hospitalization expenses and 60 days of post-hospitalization expenses. A lot of times a big amount is spent before and after the hospitalization in medicines, checkup’s and other things. It’s very important that a policy takes care of these facts. However, note that this is a basic feature, and almost all the policies in market gives this benefit.

11 – Domiciliary Expenses Covered

The policy covers the medical expenses incurred on the home treatment. A lot of times a patient is not in the condition to the hospital, in which case the treatment can be done at home. The policy will pay upto 10% of the sum assured in this case. The condition to avail this offer is that

- The patient is no in condition to be moved to hospital

- OR, there is non-availability of the room in hospital

Note that there are many illness for which the domiciliary expenses cannot be claimed, please check that list in the brochure of the policy.

12 – Lifetime renewal and no restriction on entry age

Once you buy the Care policy, you can then renew it lifetime. This is one of the most important points one should remember while buying any health insurance policy, because you buy the policy looking at a very long-term and not just for next few years. The policy should be able to help you when you are in your late years, because that’s when you really need it badly.

Also, there is no limit on the maximum age by when you can renew it. On top of it, even the entry is not restricted due to age factor, a person can buy the policy at any age, provided they fulfill the health checkups and the restrictions by the company.

Waiting period of 4 yrs for pre-existing illness

Under this policy, any pre-existing illness will be covered only after 4 yrs of taking the policy. This is a common exclusion in almost all the policies. However if you are a senior citizen, then the coverage for that particular illness might be excluded permanently, because once you cross the age of 60, the chances of you getting hospitalized due to that particular illness is high and it does not make any business sense to cover it.

This is precisely the reason why one should take their parents cover as soon as possible, especially before they cross the age of 60 yrs. Apart from the pre-existing illness, a lot of illness have their own waiting periods from 1-4 yrs, which is a standard thing in any kind of health insurance policies. Also nothing other than accidental hospitalization is covered for the first 30 days of taking the policy. I suggest you read this article which talks about exclusions in mediclaim policies in detail.

Other Points

Below are some other important points one should be aware about

- If your sum assured is more than 5 lacs, then there is no sub-limit on the ICU charges, Doctors fees and Medical fees.

- The policy provides ambulance expenses ranging from 1,000 to 3,000 depending on the sum assured

- There is no age limit of buying a new policy. Anyone can buy the policy at any age, just the minimum age requirement is 91 days for family floater and 5 yrs for an individual policy.

- Maximum 6 people can be covered in a single family floater plan

- The policy like every other policies in market does not offer any dental care treatments

- This plan does not cover maternity expenses, but that’s ok. Don’t over focus on this point, as it’s something you can take after yourself

- You get 7.5% discount if you renew/buy the policy for 2 years and 10% discount of payment of 3 yrs in one-shot.

Disadvantage of Care Policy

Let me mention some the problem and disadvantages of the policy.

1. Average policy, if sum assured is less than 5 lacs

A lot of features are applicable in the policy only when the sum assured is more than 5 lacs, if you want to take a lower cover like 3 lacs or 4 lacs, in that case, Care is an average policy and not the best.

2. Room type capping

You already know that the policy caps the Room type instead of room rent. This was a good advantage also, but at the same time, this can be a disadvantage also. In this case, suppose the room type which your policy allows is unavailable, then you will have to go for some other type of room and in that case you might have to suffer the reduced claim amount. You are tied-up with a particular room type only.

Suppose there is some other policy, which caps the room rent limit at 1% of sum assured and imagine that your sum assured is 10 lacs, then you are eligible for any room with rent of up to 10,000 per day. In that case, you can choose either a single room without AC, with AC or a premium room. It’s totally your wish as far as the room rent is below 10,000. But in case of Care, if suppose you are eligible for a single private room whose rent is 6,000, and the next category of room costs Rs 9,000, then you can’t go for the Rs 9,000 room . You can surely take it, but then your claim amount will get affected. So make sure you think on this point properly before you buy the policy.

It’s totally your wish as far as the room rent is below 10,000. But in case of Care, if suppose you are eligible for a single private room whose rent is 6,000, and the next category of room costs Rs 9,000, then you can’t go for the Rs 9,000 room . You can surely take it, but then your claim amount will get affected. So make sure you think on this point properly before you buy the policy.

I suggest that you also compare Care policy with some other policies like Max bupa plans or Apollo Munich Optima Restore and then take a final decision.

3. Co-payment of 20%, if policy taken after 60 yrs of age

If at the time of entering the policy, the age of the policyholder is more than 60 yrs, then a 20% co-payment will apply. Which means that the policy holder will have to bear the 20% bill amount and only 80% will be paid by the company. But if you enter the policy before 60 yrs, its not the case.

Hence the policy becomes unattractive to senior citizens who are looking for health insurance. In comparision a policy from L&T insurance is better where 10% co-payment applies after the age of 80 yrs. The policy from Max Bupa called Heartbeat, does not even have the concept of co-payment. So the policy from Care scores low on this point.

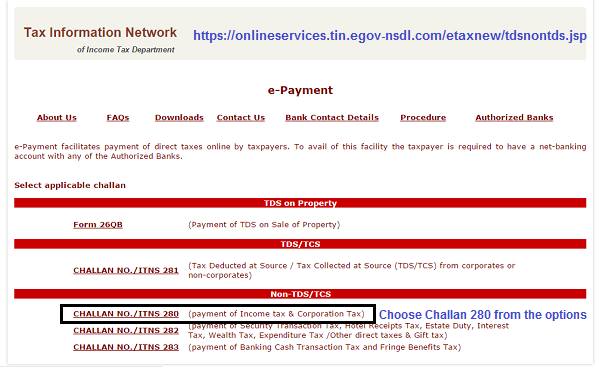

Premium Chart for Care

Below I have listed down the premium amount 5 lacs sum assured, for various age range with two cases of a single person insurance, and another one is a family floater policy with 2 adults and 1 kid. You can check how the premiums will rise over the years when the policyholder will move to various age slabs. Note that now there is no claim based loading in the premium. Now as per new guidelines of IRDA, a policy premium increases when the policyholder moves in a different age range.

An important point to note in the premium chart about is how the premium is very less in the initial years, when you are below 60 yrs and how it increases when you become a senior citizen :), which is quite natural and explanatory. Also you should not be shocked to see these high premium values in today’s time, because these are all future values, and even though today these premium values might look big to you, but when you turn 60 or 70 yrs, at that time these premium values will look very normal to you.

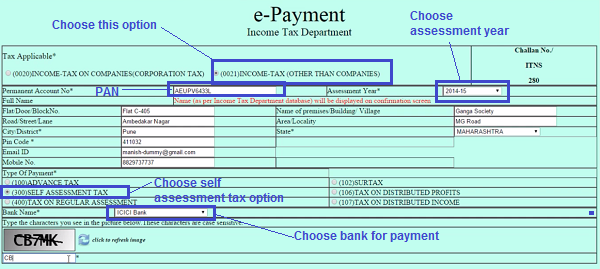

Snapshot of the Care benefits

Do you want to buy the Care policy?

If you want to buy the policy or want to enquire about it, then just fill up the form below and you will get a dedicated phone call to help you choose the policy and explain you.

I hope you have got a fair idea about the policy. Note that this Care health insurance review is mainly for educating you on various features of the policy. Please check other policies details and make sure you choose the policy which suits your requirements.

Let us know what are the points you liked best about Care and which point you didn’t like ?

EDIT : This is not a paid review. We have started d0ing review’s of various policies and we will do review other products as well. This is just a point by point explanation of each important point in the policy. Also, we have added the disadvantages of the policies, not just positive’s. Care is definitely not the best in market in all respect, but a very good policy considering most of the profiles. Please see the article more as an attempt to help a person understand what all policy provide’s its customer.