Today I am going to talk about some mistakes which young investors make in their early life. Many experienced investors would be able to relate to it, because often we make these mistakes because there was no one to guide us when we started our journey of wealth creation.

“Young investor” here means any person who has just started their careers. Most of them would be below 30 yrs of age. I will share 7 mistakes in this article. You can consider these 7 points as the words of wisdom from experienced investors.

Mistake #1 – Not Focusing on increasing the income

Nobody became rich by only controlling their expenses!

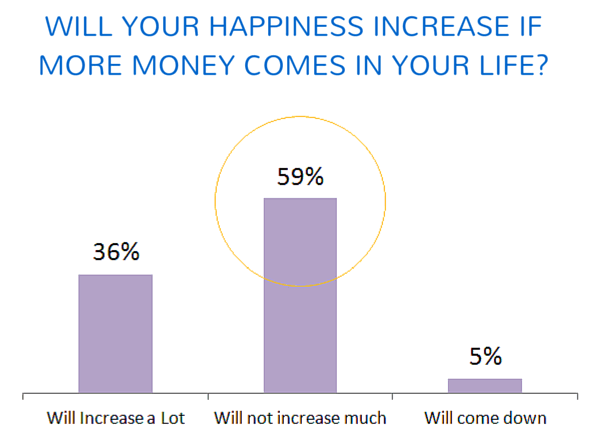

“Low income” is probably #1 reason, why most of investors are unhappy in their financial lives. Low income means low/no savings, restricted life style and constant worry about future. A small financial mistake can turn very costly if one has small income.

Imagine a guy living in Mumbai & earning just Rs 35,000 a month (or even Rs 80,000 now a days) and have to support a family of 4 people? Can you imagine how “tight” his situation is?

For most of the people, salary increment “happens” naturally and never worked on consciously. Most of the people take whatever comes their way for many years, only to realize that rather they should have come out of their comfort zone and worked “actively” on increasing their income.

They could have relocated to a new place with better opportunities, changes their jobs, asked for a salary raise, or could have worked on an alternative income, but most of the people don’t do that. They just go with the flow thinking – “I will get, what I deserve”

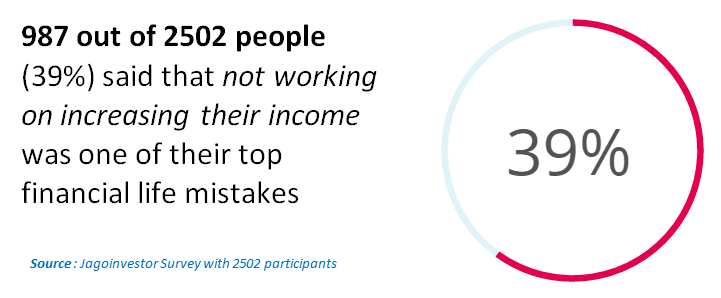

In one of the survey’s I have done recently, I asked participants to choose the top most mistake of their financial life. I gave them 8 different options to choose from and 39% of the people chose – “Never worked on increasing my income seriously”.

As a young investor, the best investment you can make it not some mutual fund, or a policy, but you yourself. Invest in yourself and develop skills which makes you “valuable”. Make yourself so employable that people run after you.

Remember, if you earn a big income, you can still make a lot of mistakes, spend like hell and choose not to control your expenses.

Mistake #2 – Getting into Debt Trap Early in Life

Don’t get me wrong!

I am not against taking debt.

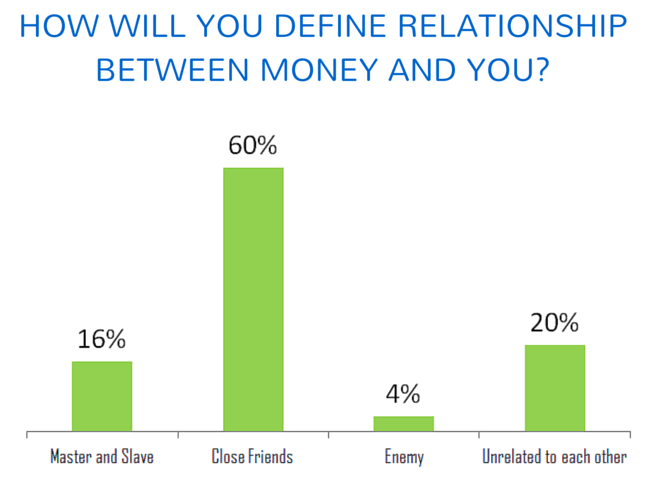

But, a large number of young kids who start their career have bad relationship with money and credit facilities.

They start using credit cards as if it’s a money toy. It all starts with a small outstanding credit card bill, and soon it starts rolling up every month and soon they find themselves paying minimum due amount and finally when things go out of control, they take a personal loan to close off the loan or convert the outstanding amount to EMI’s and starts how their debt trap starts!

Then follows car loan, home loan, another personal loan, another credit card and this way a person gets into deep debt cycle. I am sure if you look back, you will realize that the debt trap started very small.

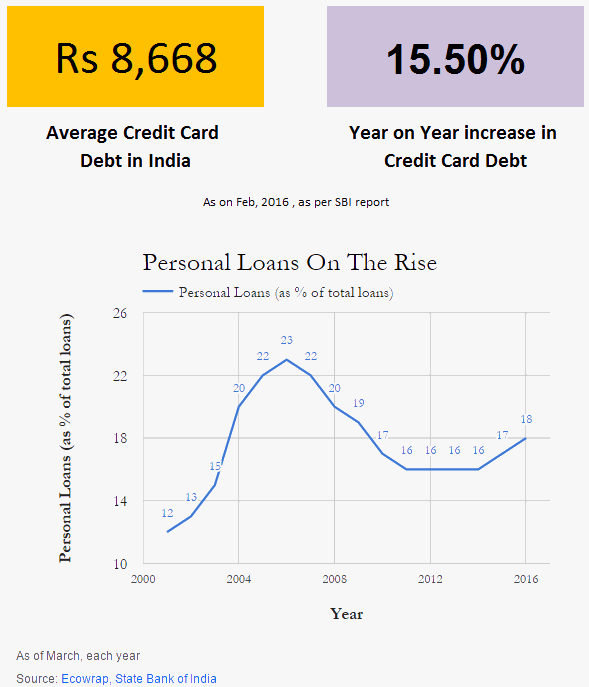

Let me share some data with you on this. As per this report, personal loans as % of loans stands around 18% as in the year 2016 (Out of every 100 loans, 18 are personal loan).

As a young investor, you can still do mindless spending, but that should happen with cash money and not credit. Because getting into debt is easy, but coming out of it is not that simple. So as a young investor try to take debt only if you don’t have any choice. As far as possible, take responsible credit which helps you in life (education loan or home loan).

Mistake #3 – Not taking risks in start of your career

I am not saying that everyone should go and start taking some risk without planning. All I am trying to convey is that its more easy to take risk when you start your career, rather than middle of your career or when you turn 40, because in your early days you have less responsibility and enough time to fix your mistakes if any.

Think of these options below!

- Want to move out of your industry and try something else?

- Want to try a start up?

- Want to try that online business idea?

- Want to change your career path because you don’t feel you belong to current job?

- Want to ask for a salary hike, but too afraid to lose the job

The above 5 things can be tried at any point of career, but practically you have more appetite to try out these things in the start of your life, when you have less responsibilities and enough time in hand to correct the mistake if any.

If you are still confused about this, you should listen to this YouTube video about best practices in Career Risk-Taking. It will help you

Once you have already spent significant number of years in your job, you will get married, have kids, get into the cycle of “life” and it will become very difficult to come out of the comfort zone. I get many mails which starts with “Had I tried it 10 yrs back … ” and I can see how people feel so stuck into their jobs and now they can’t take much risk at this point of life.

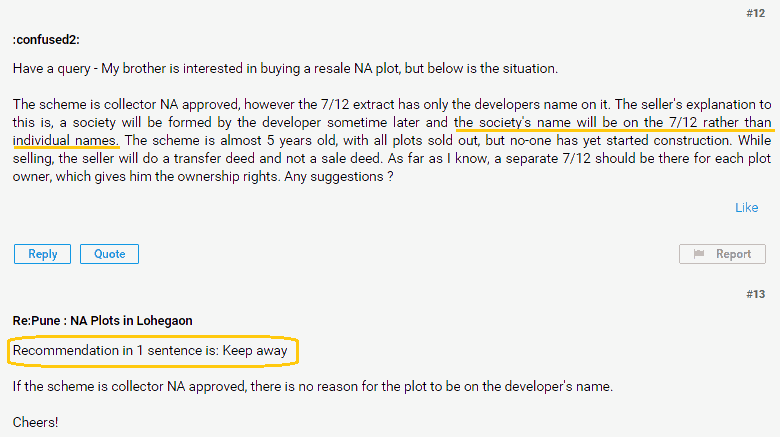

Mistake #4 – Buying policies from your relatives/friends

There are millions of investors in India, who have lost a lot of money in bad products which were sold to them by someone close to them. It was often an uncle, aunty, father’s friend, distant relatives or even your siblings at times.

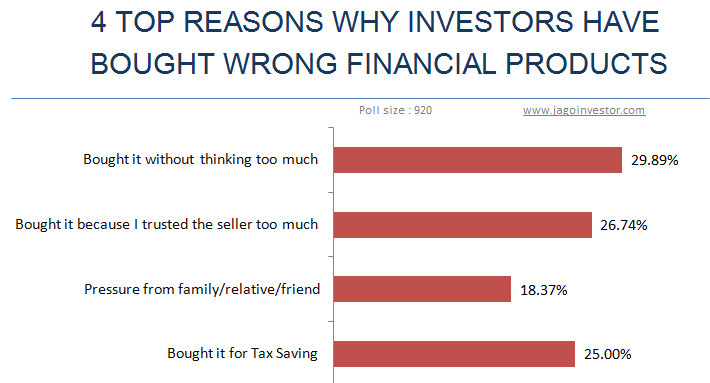

A lot of products are bought in India based on trust and goodwill. Often relatives pressurize you to take a policy.

This is particularly true for Endowments policies, ULIP’s and other insurance products. You will often find someone in your close circle who is an agent and your parents trust them like anything and force you to buy a policy from them.

Years later you realize that you have burnt your fingers and can’t express your dissatisfaction openly. So what is the way out? Either research on things on your own or directly buy form the companies or if you need external help, better hire an advisor or an external agent, but not a relative

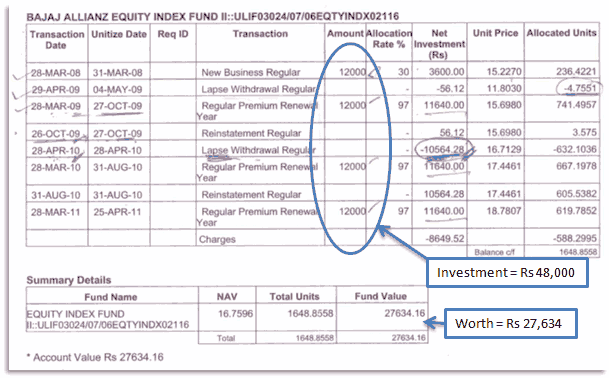

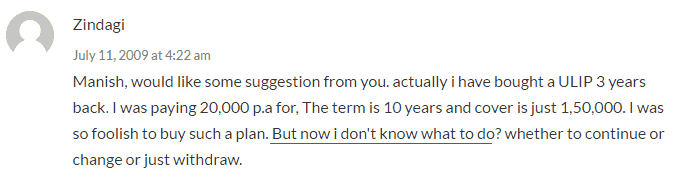

Mistake #5 – Investing in a product you don’t understand yourself

On an average, 90% of the investors can’t explain what exactly they have bought. I was once talking to an investor in our workshops (the upcoming one is in Pune on 22nd May, 2016) and the guy said he has few policies. When I asked how many? He had no idea

When I asked what are the names of the policy, he didn’t even know that.

He said that he had bought them few year back for tax saving and does not exactly know what they are !

The problem is that investing in products, which you don’t understand blocks your financial energy. Your money is stuck in a rotten product and takes away a lot of time.

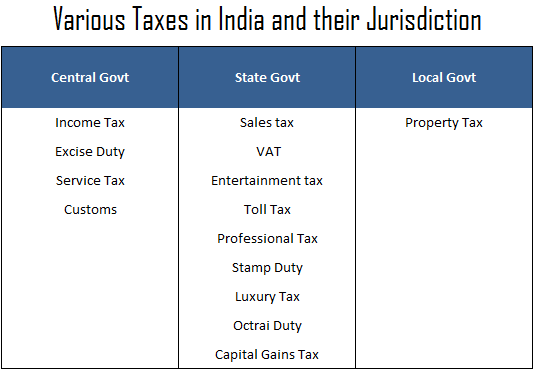

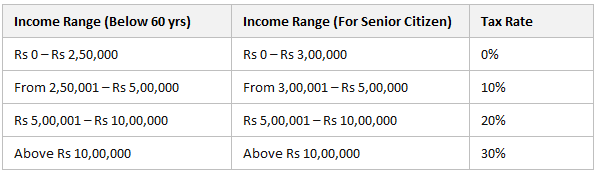

So if you are buying a financial product, please learn how it works and how it’s going to benefit you at the end of the day . Find out everything about return, risk, liquidity and taxation. If possible, better know which financial goal it’s going to fund.

Mistake #6 – Not saving early in life

After spending many years in your job, you will realize as an investor that “I will save when I will have more money” is an illusion.

When you start earning money, your income is less and you are not able to save money at all because you are hardly left with anything at the end of the month.

However note that this is going to be true always. While your income will rise in future, so will your expenses. You will get married, have kids, your lifestyle will improve. You will get a car, buy a house and what not. You will enough feel that you have enough to save.

The graph for expenses is set to rise and this feeling of “I will save in future, when I earn more money” will be intact. This is the reason a lot of investor never save enough money which they deserve.

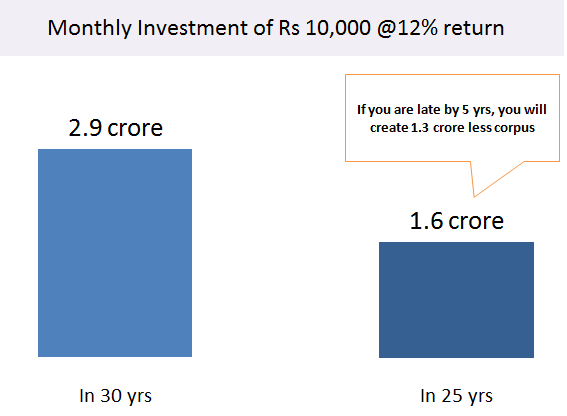

The graph below shows you if a person starts investing Rs 10,000 a month, they can accumulate around 2.9 crores in 30 yrs. However if they delay it for 5 yrs, and then start the same thing. They will accumulate only 1.6 crore by the same time. That’s a big difference because of the delay.

As a young investor, you need to understand that habit of “saving money” is more important than how much do you save. If you can’t save anything, start with Rs 100 per month.

I know it sounds like a joke. But once you do it for 5-6 months, you at east know that you can save Rs 100.

Then upgrade the number!

Upgrade to Rs 500 or Rs 1000 a month. Continue for another 6 month.

Soon, you will realize that you have reached Rs 5,000 or Rs 10,000 because you are just increasing the number, the “habit” was already in background.

Mistake #7 – They neglect their health

If you do not have good health, it will not matter how much money you have earned, because you won’t be able to enjoy that money at all. It does not make sense to lie down on a bed made of gold in your retirement.

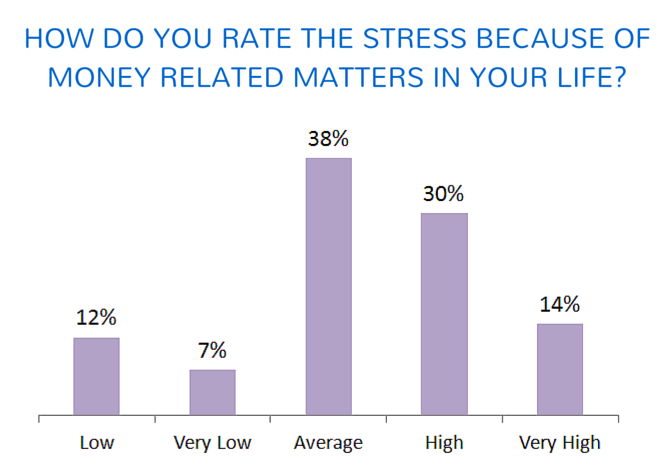

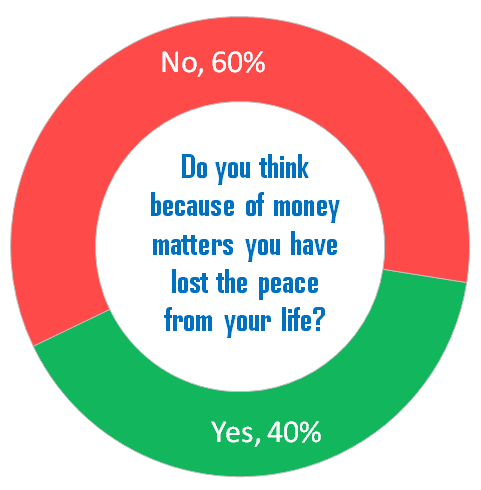

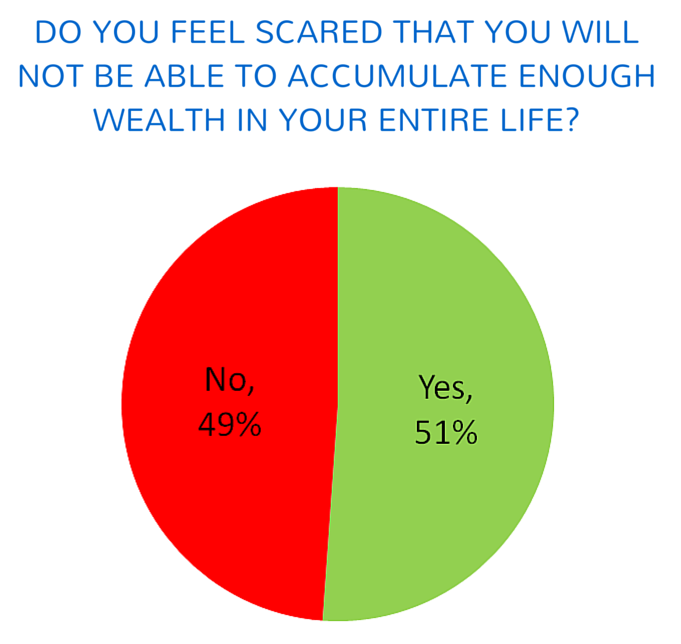

While earning money is important and required, make sure you also pay attention to your physical and mental health. These days, the jobs are too demanding and there are many money matters which will take the peace out of your life. You might get lost in the rat race and forget that you have a body to take care for years.

Only years later you will realize that it would have been better to earn a bit less and have a healthy body, rather than having bad health with money.

The quote from Dalai Lama is worth reading

Learn from others mistake

At this point of time, internet is flooded with the mistakes other investors have done. It’s a wise thing to learn from those mistakes and not repeat them.

A good and healthy start of one’s financial life helps a lot and if you are a starter, I strongly suggest you take a note of the points above and implement them.

Please share your views on the points above. Were they helpful to you as a new investor?

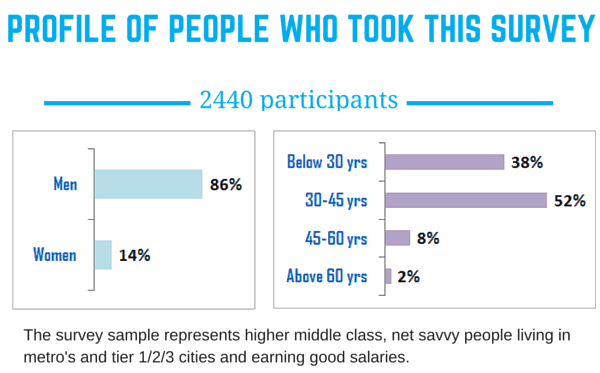

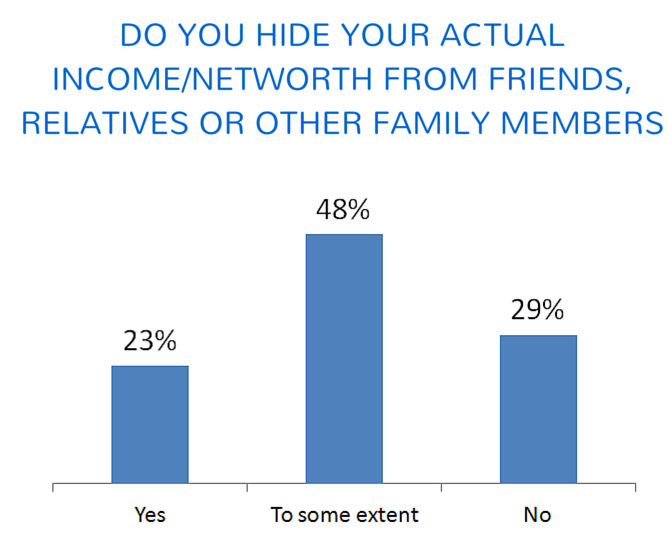

Below you can find the profile of the people who took the survey. Around 90% of survey takers were below the age of 45 and only 2% were senior citizens. Around 14% of survey takers were women, which is low in a way and should improve.

Below you can find the profile of the people who took the survey. Around 90% of survey takers were below the age of 45 and only 2% were senior citizens. Around 14% of survey takers were women, which is low in a way and should improve.