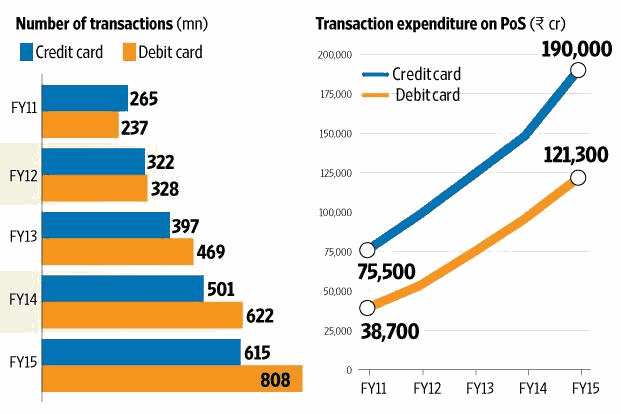

In the last 10-15 yrs, card usage has replaced cash transactions to a big level at least in urban India. We no longer go to banks to withdraw cash. Almost everyone prefers to pay by cards when we visit malls, grocery shops or when we fill petrol in our cars.

Increase in Card Frauds

While the ATM/Debit/Credit card usage has increased, so has the frauds related to the cards. Most of the time, card fraud happens due to negligence of the cardholder. In this post, I will talk about several things you should keep in mind which will safeguard you against fraud or any crime which can potentially happen. The things we talk about in this article will be for ATM cards, debit cards, credit cards, and even internet banking transactions.

1. Destroy the CVV number on the back of the card

Once you have used your ATM card several times, it’s suggested to scratch the CVV number on the back of the card. Almost everyone will memorize the 3 digit CVV number once they have used it 5-10 times. You can also write down the CVV number in your mailbox and email it to yourself if you want to record it in someplace.

While this will not make you fully protected from fraud, but it will surely reduce the chances.

2. Change the PIN as soon as you receive the card

Once you receive your card for the first time, it’s suggested that you activate it asap and then change the PIN. Try to avoid keeping the PINs that resemble your birthday, Pincode or phone numbers. Make it a random number or some combination which you can relate to.

If you do not change your default PIN which the letter contains, it might happen that someone looks at it and misuses your card, given they have access to it. That’s the reason you should also destroy the old password document.

3. Activate SMS Alerts for any amount above ZERO

It’s suggested to activate the SMS and mail alerts for all transactions.

If you do not want any SMS for a specific amount like Rs 500 or Rs 1000, then you can set up the alerts above that amount, but make sure you do it. A lot of people who come from the old generation like our parents, uncles etc are new to these card payments and do not activate these features. Please do it for them

4. Keep the customer care number saved on the phone

It’s always a good idea to store your bank/card customer care numbers on your phone so that you can inform them about any fraud or issues as soon as they happen.

Imagine you lost your card and you are thinking – “Once I am back home, I will call customer care and share about this incident so that they can block my card”. This is not a great situation, because, within a few minutes, the who has the card can swipe it and use it (given he knows other details)

Better avoid being late in informing about the incident, because once the money gets debited from your account, then matter becomes complicated and you will spend lot of times in fixing the issue and following up

Prevention is better than cure …

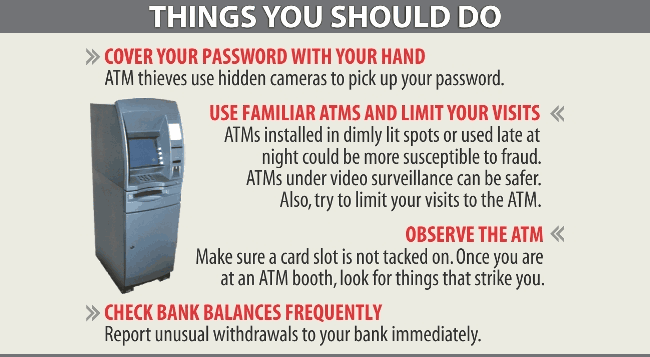

5. Avoid using the ATM in night or places which are not safe

There have been instances where I wanted to withdraw cash from ATM around night-time, and my wife always tells me that we can always do it the next day in the morning because it’s better to avoid ATMs at night especially when it’s not an emergency.

I think that makes sense.

While, out of 100 times, 99 times nothing will happen. But then that one bad incident is what you want to avoid..

RIGHT?

I am not saying that never use the ATM in the night, but as far as possible, try to refrain using your cards at night at lonely places, because you never know who is keeping an eye on you.

Here is a video from Bangalore, where a 38 yrs old lady was attacked by a guy inside the ATM. Something like this is very much possible to happen if you take things lightly at night when it’s lonely.

Hence, if are going back home in midnight and thinking of withdrawing cash from an ATM which is located on a lonely road, I suggest that you avoid it unless it’s emergency. It’s always safer to come back in the morning and withdraw the money from ATM.

6. Don’t let any once enter the ATM while you are using it

If there is only one single ATM machine inside the room, then don’t allow anyone to enter the ATM when you are using it. You can directly tell the person to enter the room once you have used it.

At times, People are not civilized enough to understand that ATM usage is a very private activity and they should not enter or look at your screen.

7. Never leave an incomplete transaction

There are many ATM frauds which have happened because the person left without completing their transaction. You should never leave the ATM screen unless the “welcome screen” appears back.

There are cases, where the computer hangs in between the transaction either because of a technical issue or because someone had done some trick to it. Always press the cancel button once you are finished or sense that there is some issue.

Below is an excerpt from a report from Indian express which shares more details about keypad jamming fraud in ATMs.

Keypad jamming fraud

The risk department of the banks have termed it so because the modus operandi of defrauder involves jamming both the ‘Enter’ and ‘Cancel’ buttons on the ATM machine by applying glue or by inserting a pin or blade at the edge of the button. So when the customer tries to press the ‘Enter/OK’ button after entering his ATM PIN, the key does not function and the customer can’t proceed with his transaction. At this juncture the customer thinks that the machine is not working and tries to cancel the transaction, which also does not go through as that button is also jammed. Thinking that the transaction is cancelled, he leaves the ATM machine.

As soon as the customer leaves or is prompted to visit the nearby ATM machine, the fraudster takes over the machine and since the transaction is active for around 30 seconds in most cases (some banks have reduced it to 20 seconds), he keeps the transaction active by pressing some functional buttons and in the meantime removes the glue or pin from the ‘Enter’ button to go ahead with the transaction. The fraudster then withdraws the cash from the customer’s account, leaving the customer unaware of the fraud till he checks the message from the bank.

If your ATM screen is hanged or incase of any issues, make sure you contact the security guard or at least call the customer care while you are inside the ATM.

All ATMs have a CCTV machine and it will record your activity which will help you later in case of any problem or dispute. Here is a real-life case of how ATM fraud can happen from a fellow blogger BasuNivesh.

8. Never share your debit card PIN when you shop

When you go to Petrol Pumps to fill your car or while you are dining at restaurants, try to avoid sharing the ATM PIN while making the payments. A lot of people let others enter their PIN because they don’t want to walk all the way to the swipe machine.

I prefer to walk down and enter the PIN myself or ask them to bring the swipe machine near me.

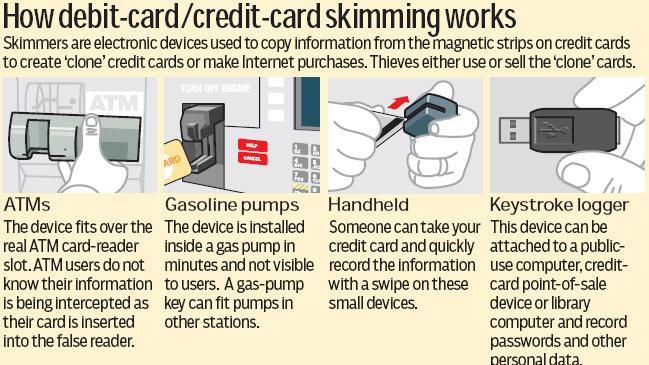

While it surely adds to convenience by sharing the PIN, but it also exposes you to the risk of debit/credit card fraud. No one is stopping the person who has your card to note down your card number, expiry date, CVV number (most of the people don’t scratch it) and write down the PIN you shared with them. In some extreme cases, your card can be swiped to the skimming machine to steal the information and duplicate the card.

A lot of people think that just because someone has their card details, they are still secured because the OTP comes to their mobile or the 6 digits extra password is asked while doing a transaction online. However, they are mistaken.

While one will surely fail while doing the transactions in Indian websites, they will succeed while using the card on international websites, because OTP is not sent there. Also, that extra layer of 6 digit password is not asked while doing transactions at many websites outside India.

9. Never share your PIN, OTP, CVV and other sensitive details

My father in law is a senior citizen and despite being a bank employee for many years – I can clearly tell you that even he might fall prey to many online frauds related to banks because he is very new to these card payments and internet banking. He belongs to that old era and his banking is very different than today’s banking.

Like him, your parents, and grandparents and in-laws will surely be from the generation who does not understand very well how these online things work.

When they get a call from someone who says – “I am calling from Bank and …”, for them it’s a genuine call and they can’t tell a difference between fake call and a genuine one. And they are always on the list of fraudsters.

There are various online frauds going on these days, where a person poses as a bank employee and then scares the person on other end saying things like

- “This is a verification call from the bank, please share the OTP which has just come on your mobile”

- “You will now get a new card because the old one is canceled, please share the 3 digits on the back of the card to approve this”

- “We notice that a 20,000 transaction has happened just now, did you do it? Please share an OTP which has come to your mobile to verify that you are the cardholder”

Listen to this YouTube conversation, where a girl is posing as SBI staff and trying to get information. Imagine if your parents or some senior citizen gets this kind of call, how will they react?

Here is a good FAQ related to fraud protection related to cards from ICICI bank

10. Don’t expose the cash withdrawn from ATM

I have done it a few times, and I now understand that it was a mistake.

When you take out cash from ATM, if it’s a big amount – many times a few people come out of ATM holding the bundle of cash without realizing that someone might be watching them.

It’s always suggested to keep a bag with you and put the cash inside it or at least keep the cash in your wallet or pocket till you reach your car or home. There might be many bad elements nearby and they will keep an eye on you. They might be behind you and later they may attack you. What they show in CRIME PETROL actually happens in real life too 🙂

Don’t Get Paranoid

While it’s suggested that you should be alert and careful while using your cards or internet banking, but I would like to also add that you should not become paranoid and start behaving like a maniac :). You should judge the situation and use your presence of mind when someone is really being helpful and when someone is trying to trick you.

Please share any other tips or suggestions which I have not added above.

![asset class-] comparison](https://www.jagoinvestor.com/wp-content/uploads/files/asset-class-comparision.png)