Last night, it was a historic moment when our Prime Minister informed the whole nation that Rs 500 and Rs 1000 notes will not be eligible currency notes from midnight at the end of 8th Nov, 2016. Here is the RBI notification

PM Modi had also explained all the points very well in his speech and shared how people should not worry about this if they have money with them and it can be exchanged with new notes in next 50 days, however seems like a lot of confusion is there around this topic and many myths are floating around.

5 important facts about the old notes bank

Below are some of the most important facts which you should know after this Rs 500 and Rs 1000 notes bank. There are lots of myths around and I wanted to clear them. These points which I have mentioned below are taken out of the RBI notification itself.

Fact #1 – You can deposit any amount of old notes in your bank/Post Office account

You can “deposit” your old currency in your bank account till 30st Dec, 2016. There is no limit on this amount and if you have Rs 50 lacs with you in Cash, you can just walk into your bank branch (expect a lot of rush) and just deposit the amount in your bank account. The limit which is there is on the “exchange” which is the next point. Please find below the exact wording from the RBI notification.

Also note that there is no limit of deposit for account whose KYC is complete. If KYC is not yet complete, the limit is Rs 50,000.

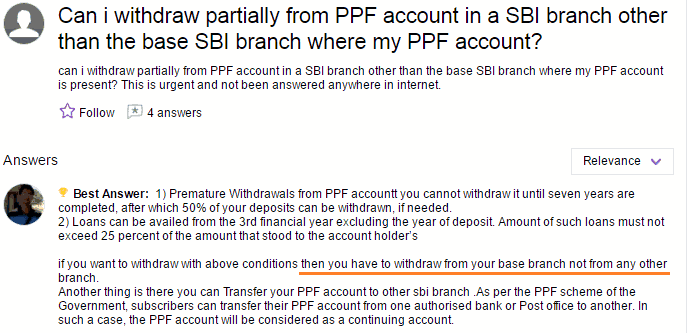

#2 – You can exchange up to Rs 4,000 notes in ANY bank branch in first 15 days

You can walk to ANY bank branch and exchange up to Rs 4,000 of old notes along with your identity proof (PAN, Aadhaar card, Passport etc). You don’t need a bank account in the same bank. After 15 days, this limit of Rs 4,000 will be reviewed and raised. I am sure this small limit is kept so that most of the middle class and poor people are handled before other privileged class 🙂 . Apart from the bank branches, you can also visit RBI centers for this exchange.

#3 – You can deposit the money in 3rd party account also

It is also possible to deposit the money to 3rd party account also if you follow the full procedure and produce a valid ID proof (your own)

#4 – Cash withdrawal Limit from ATM and Bank Branch

There is following withdrawal limit set by the govt.

- ATM – Withdrawal from ATMs would be restricted to Rs.2,000 per day per card up

to November 18, 2016. The limit will be raised to Rs.4,000 per day per card

from November 19, 2016 onwards. - Bank Branch – Till 24th Nov, 2016, you can walk to your bank branch and withdraw up to Rs 10,000 in a go, but the overall limit is Rs 20,000 per week.

You can walk to ANY bank branch and exchange up to Rs 4,000 of old notes along with your identity proof (PAN, Aadhaar card, Passport etc). You don’t need a bank account in the same bank. After 15 days, this limit of Rs 4,000 will be reviewed and raised. I am sure this small limit is kept so that most of the middle class and poor people are handled before other privileged class 🙂 . Apart from the bank branches, you can also visit RBI centers for this exchange.

#5 – You can deposit the old notes till 31st Mar, 2017 in worst case

In worst case, if you are not able to deposit the cash in your bank account or exchange those till 30st Dec, 2016, Still you will get another change to deposit the amount at RBI designated branched till 31st Mar, 2017 with proper documentation. One of my close friend parents are coming back to India from US after Jan, and they were worried after this news. I told them about this 31st Mar, 2017 deadline which calmed them!

Below is the speech by our Prime minister in case you want to hear it.

The big confusion and the Panic

This whole news which came out last night has created a big confusion among people and I can see many of them in panic situation. A lot of people who know clearly that their money is still safe and can be deposited back in bank account are also acting like the world has come to the end.

On the lighter note, social media went crazy and there were some really hilarious tweets which started circulating across various platforms.

There was news of people rushing to buying gold, doing shopping last night (till midnight) and what not. Understand that if your money is legally earned and you are paying the taxes, you need not panic and just keep calm, you can deposit it with bank and your money is 100% safe.

Only those who have black money will be facing problem as now all the money they have is worthless.

Discomfort because of the BAN

While there is surely some level of discomfort, but that’s very obvious and it’s bound to happen when things change at this level. This bank of old bank notes is for good and our countries future. This will really help curb black money and corruption in a big way.

Will update more on this topic in coming days. New notes of Rs 500, and Rs 2,000 will get started from Nov 11th .

Let us know your views around this topic in comments section below