Are you one of those investors who are still away from mutual funds investments because you do not have enough understanding about it or have a lot so myths about them?

Every day we get constant inquiries from several of our readers who want to invest in mutual funds and often they have myths, which make us wonder about those myths.

So in this post, I have listed down 33 various myths related to mutual funds and SIP in general. So if you are totally new to mutual funds, reading this article start to end will make you fully knowledgeable about mutual funds.

So let’s start…

Myth #1 – SIP is the name of an investment product

A lot of people think that “SIP” is the name of some investment products other than mutual funds. So they say – “I want to invest in SIP”. However, SIP means a systematic investment plan, which just means a way to regularly invest only in mutual funds. In this, a pre-fixed amount is automatically deducted from your account and gets invest in mutual funds on a pre-defined date.

For example, if you are doing an SIP of Rs 5,000 in ICICI Pru Discovery mutual fund on the 10th of every month, then on the 10th of each month, Rs 5,000 will get deducted from your bank account and will get invested automatically.

Myth #2 – I can’t stop SIP in between once I start it

Another myth that stops investors from entering mutual funds is that they think starting SIP for X yrs, is a commitment they can’t break in between and they will face some penalty if they stop their investments.

A lot of people do not want to give any PROMISE of regular payment. However, the truth is that once you start the SIP, you can anytime stop the SIP in between. So don’t worry while starting the SIP for the next 5, 10 or 30 yrs. The day you want to stop it, it can be stopped with just one notification!

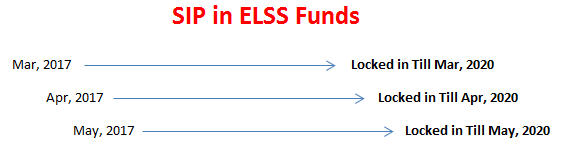

Myth #3 – All the money from ELSS can be withdrawn after 3 yrs if one is doing SIP

One of the biggest myths of investors is that if they are doing SIP in ELSS (tax saving mutual funds), then after 3 yrs, they can withdraw all their money. However, that is not true. Each investment in ELSS is locked for 36 months from the date of investments. This means that the first SIP which goes in March 2017, will be free of lock-in only in April 2020.

The same is the case with the installment which goes in Apr 2017 (will be free in May 2020)

Myth #4 – Lower NAV is cheaper than higher NAV

Most of the mutual fund’s investors think that a smaller NAV mutual fund is a better deal compared to a higher NAV mutual fund. While this may be sometimes true in case of stocks because a Rs 10 stock has the potential to grow faster than a stock with Rs 10000 stock value.

But in case of mutual funds, NAV has no significance. It’s ZERO!

Because your mutual fund’s appreciation has everything to do with the appreciation in NAV value in percentage terms and not an absolute value. I mean if you invest Rs 10 lacs in a fund with NAV of Rs 10, and if the mutual fund performs great and in the next 5 yrs it doubles in value, then the NAV will rise to Rs 20 and your fund value will rise to Rs 20 lacs.

However, if the NAV was Rs 10,000 per unit, still the effect would be the same for you. The NAV would have increased to Rs 20,000 and your value would have increased to Rs 20 lacs. No difference as such.

So stop thinking that a fund is better (especially NFO’s) just because its NAV is lower.

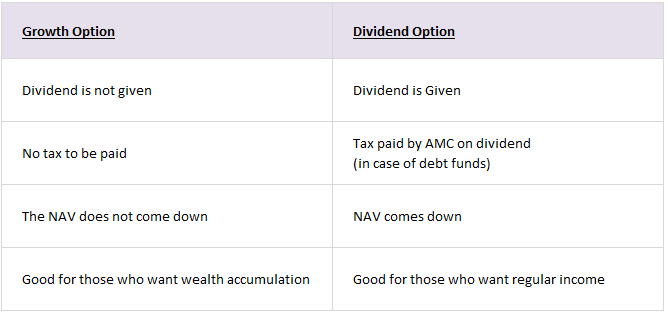

Myth #5 – Dividend in mutual funds is better than Growth option

When you choose a mutual fund to invest, you have to choose between the Dividend and Growth option. Now a lot of investors think that dividend option is better because they are getting “extra dividend” . However, it’s not true.

Dividends are not extra!, The NAV comes down by that margin after the dividend is paid, on top of it, if the fund is not an equity fund, a dividend distribution tax is first paid by AMC, which lowers the return of the investor. However, in the case of growth option, the money remains in the fund itself.

For example, imagine a fund XYZ with NAV of Rs 100 and a dividend declaration of Rs 10

- Now in case of dividend option, Rs 10 will be paid to investors and NAV will come down to Rs 90.

- However in the case of the Growth option, nothing is paid to the investor, but the NAV is Rs 100.

Myth #6 – Mutual funds means Stock Market

One of the most common myths is that mutual funds are highly risky because they invest in stocks. However, this is half true. Only equity mutual funds invest in stocks and are risky (in fact volatile is the right word, not risky)

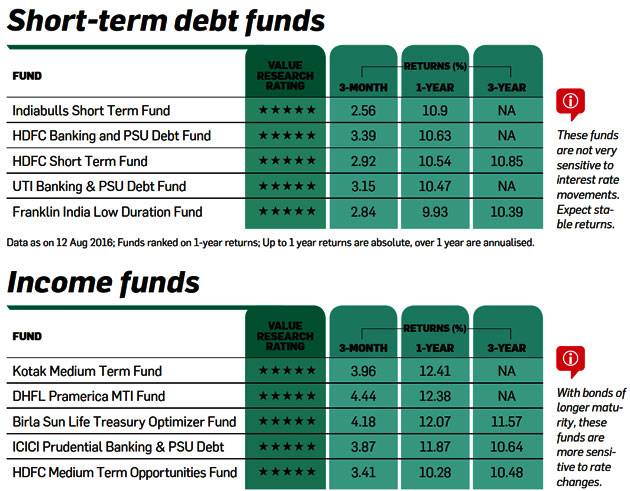

There are other categories of mutual funds called debt mutual funds, which do not invest in equities. They invest in bonds, govt securities, and other secured investments. While debt funds have their own risks and even their returns are not 100% stable, still, debt funds are highly stable when it comes to returns and often provide better tax-adjusted returns then most of the bank fixed deposits.

Myth #7 – You have to invest big amounts in mutual funds

Many small investors stay away from mutual funds and stick to recurring deposits and other products because they think that mutual funds are for big investors and one has to invest big money in it. However, you can start a monthly investment of even Rs 1,000 per month in most of the funds. If you want to invest on the onetime basis, the limit is Rs 5,000.

So someone who is just earning Rs 10,000 per month and wanted to invest 10% of his income, can also start mutual funds SIP.

Myth #8 – Mutual funds are always for long term

Mutual funds are marketing as long term investments most of the time. However, it’s not always the case. There are mutual funds called liquid mutual funds and even short term debt funds which can be used for short term investment horizon like 6 months or 2 yrs.

This article from Economic times talks about some of these funds

Only in case of equity mutual funds, it’s suggested that one should invest from a long term perspective to reap the maximum benefits.

Myth #9 – Mutual funds offer guaranteed returns

No, Not always.

Actually never!

Mutual funds never offer a guaranteed return like a fixed deposit. This is one reason why many investors who are totally in love with “assurity” shy away from investing in mutual funds.

Various categories of mutual funds offer various return range. An equity mutual funds can offer return anywhere from -50% to 100% return in a year (just a high level estimate). Whereas a debt fund can also deliver a return ranging from 5% to 15%. And a liquid fund will mostly give a return in range of 6-8%

So the returns are not guaranteed, but highly probably within a range depending on its category.

Also note that as the investment horizon shifts from 1 yr to 10-20 yrs, the probability of getting a stable return within a range increases.

Myth #10 – I will lose my money if the mutual fund’s company goes bankrupt

This is common thinking, but not true

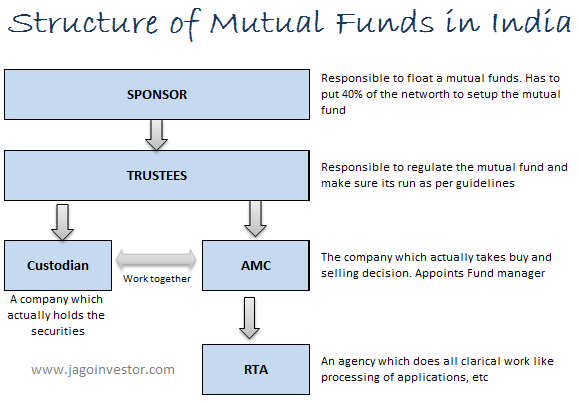

Mutual funds are highly secured in terms of structure. The way it’s designed and regulated by SEBI, it’s almost impossible for investors to lose money due to a scam or AMC going bankrupt. Your mutual fund’s units does not lie with AMC (it just takes the decision of buying and selling). Units and all the money lies with the custodian and highly secure.

For more on this, you should read this article

Myth #11 – Past returns in mutual funds indicate future returns

Not correct.

While past returns can surely tell you that the fund did very well in the past and there is some probability due to legacy that it will perform well. But it’s not written on stone.

How the fund will perform in future is totally a function of what decisions fund manager takes in future. HDFC Top 200 is a classic example, where the fund who ruled the mutual fund world is now not one of the top 10 funds.

Another example is the SBI Maxgain tax saver which was one of the best ELSS funds some years back but is now replaced by many others.

Here is a study by Yahoo Finance on this topic with respect to funds in the US, which tells that around 92% of top performers do not remain top performers after two years.

Myth #12 – More mutual funds means Diversification

Diversification is an abused word, at least in mutual funds.

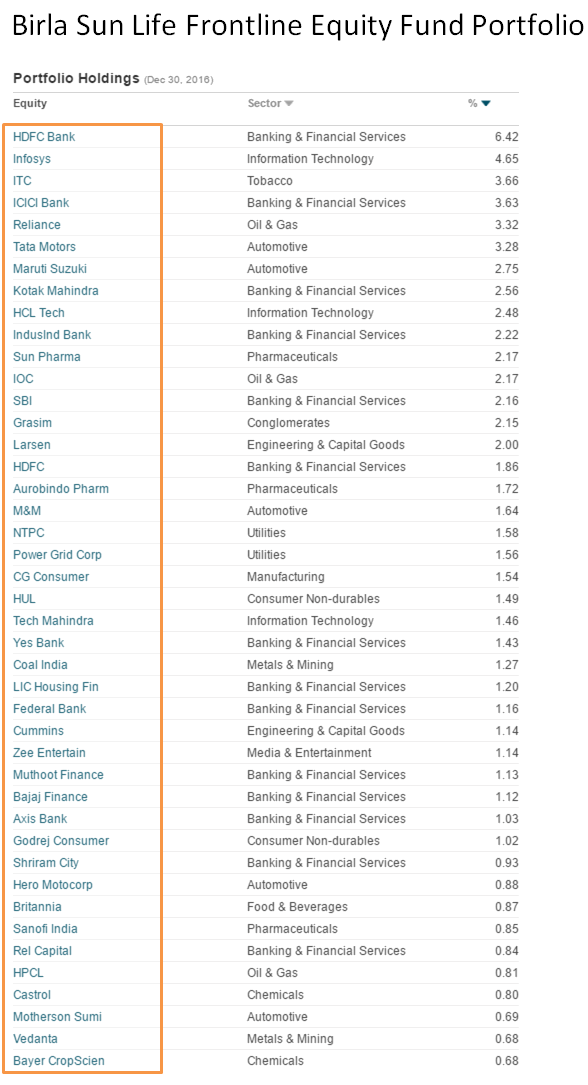

Just because you invest in more mutual funds does not always mean that you have achieved diversification. The reason is simple. A mutual fund invests in close to 50-100 stocks. So when you invest in an equity mutual fund, your money is already well diversified across sectors, types of companies, etc.

When you add another mutual fund, most of the stocks might be the same and also in the same proportion, giving you very little extra diversification. When you add 3rd fund and 4th fund, almost no diversification happens. Below is the portfolio of one mutual fund and you can see how much they have diversified already.

This is one reason why it’s of no use to invest in 10-20 mutual funds of the same category. 2-4 funds of a similar category are the maximum one should invest into. You should add more SIP amount or lump sum in the same fund once you have chosen 2-4 funds.

Myth #13 – I need Demat account to invest in mutual funds

No, it was never the case.

A lot of people think that unless they have a Demat Account, they can’t invest in mutual funds. You can invest in mutual funds from your Demat provider also, but it’s not mandatory.

So when you invest from ICICIDirect or HDFC Securities, you are actually investing via a Demat account and the units you get sit in your Demat account.

So if you want to invest in mutual funds, you can invest directly from the fund house or through an advisor.

Myth #14 – I can start SIP and forget it for long term

A lot of investors think that once they have started a SIP investment or even lump sum investment they can just sit back and relax for next 10-20 yrs. This is not suggested.

Mutual funds need constant review every year. So you should at least keep an eye on your fund performance. Do not overdo it and start looking at weekly and monthly returns, but do that in 1-2 yrs.

Invest in Mutual funds with Jagoinvestor for FREE

Myth #15 – You can’t save tax under 80C in mutual funds

Many people who regularly save income tax through PPF or life insurance policies, do not know that even mutual funds have 80C benefits. ELSS or Equity linked saving scheme is the category of mutual funds which gives you 80C benefits up to Rs 1.5 lacs.

Myth #16 – SIP can be done only on a monthly basis

No, An SIP can be done even on a weekly or quarterly basis. While monthly SIP is the most suitable for all (we all get monthly income), but at times if you want to invest on a quarterly basis or weekly basis, even that can be done.

However, note that it depends on a mutual fund if it gives you the facility of weekly/quarterly SIP or not. Most of them do, but at times, some mutual funds might choose to not have that option.

Myth #17 – Mutual funds investments are complicated

While investing in mutual funds is definitely as simple as creating a fixed deposit. But it’s not too complicated. You need to do one-time documentation to start with and once it’s done, After that you can buy/redeem mutual funds online.

One place where you might feel complication is while choosing the funds out of the big pool, but with your own research or with guidance from someone else (like Jagoinvestor), you can get a set of mutual funds to invest in.

Here is a good mutual funds tutorial for beginners by Deepak Shenoy

Myth #18 – I can’t add more lump sum amount in my fund where I do SIP

A lot of investors feel that if they have started a SIP in a fund XYZ, then they can’t add additional money in the same fund under the same folio. It is not true.

When you invest in a fund (either SIP or one time), you get a folio number. This is like an account number. You can anytime add any amount of fund to the same folio. So if you are doing a SIP of Rs 10,000 in Birla Balanced Advantage fund, and now if you want to add another Rs 1,00,000 suddenly, you can do that.

Myth #19 – You need documentation every time you want to invest in mutual funds

Again a big myth.

Once you are done with the first time documentation, after that every time you want to invest and redeem or switch, you can do it online. The documentation comes into picture only when you want to do changes like your email id, phone or address etc.

Myth #20 – Mutual Funds are not for retired investors

This is entirely false.

There are various kind of mutual funds which are suitable for retirement needs. You can invest your hard-earned money in debt funds and keep them secure while it’s growing at a decent return. One can choose an option for a monthly dividend and get an income.

One can also SWP from a fund, and withdraw a fixed amount each month. One can invest in debt-oriented mutual funds, which can have some equity component for some return kick!.

We have helped many clients to plan for their parent’s retirement money deployment.

Myth #21 – I can’t invest in mutual funds because I need high liquidity

Again a myth.

Mutual funds are highly liquid and you can get your money ranging from instant redemption to 3-4 days depending on the fund type. If you want very high liquidity, then you can invest money in liquid funds, from where you can redeem in 24 hours.

Myth #22 – Mutual funds are not that famous among investors

This may be news to many, but the Mutual Fund’s industry will overtake Deposits in Banks very soon (maybe a decade). Right now at the time of writing this article, the money in India mutual funds was around 18 lacs crore, It has doubled in the last 4 yrs, and set to grow very fast in the next decade.

In the US, mutual funds are already several times bigger than Fixed deposits and it’s going to happen in India too over the long term. So if you still think that mutual funds are some alien concept, then you are wrong. It’s very popular now in India and one of the standard investments products.

Myth #23 – Mutual fund redemption needs the permission of a broker or advisor

Your broker or advisor has no control over your mutual funds. You can do redemption on your own by either installing the app of the fund house or through the portal where you have access to.

In the worst case, you can anytime go to the fund house office or CAMS/KARVY office and apply for redemption. This does not need any approval from anyone.

Myth #24 – I can’t skip an SIP payment once started

A lot of people are worried about what will happen if they skip the SIP in a particular month when they are low on funds?

If your bank account does not have sufficient money for a month, then on the SIP date the SIP will not get processed, but from next month it will go fine again. Mutual funds company does not charge any fine or penalty for this, but your bank can levy a small charge for this like Rs 200/300.

I think it’s good, because that way you will be disciplined enough to make sure that your SIP’s go on time, but also does not hurt you too badly in case of emergency

Myth #25 – I should stop my SIP when markets are down

Unless you are an expert in understanding markets and how they will behave (which I think no one knows), it does not make a lot of sense to time your SIP’s. Just let them run in all kinds of markets and focus on your long term goals.

Most of the investors make this mistake that they stop their SIP’s when markets tank. In fact, this is the best time when you should accumulate more Mutual funds units in your portfolio so that when markets are up, you will reap the benefits.

Myth #26 – TDS is applicable when mutual funds are sold and redeemed

Mutual funds are not like Fixed Deposits or Recurring Deposits.

When you sell your mutual funds, there is no TDS which is deducted. You get the full amount in your bank account and then you need to figure out the tax amount and pay it later.

However there is no exception to this. In the case of NRIs, if they redeem their debt funds, then TDS is applicable.

Myth #27 – My money will be locked in mutual funds like other products

Many investors think that in mutual funds their money is locked for a specific period. in case of mutual funds, most of the funds are open-ended funds, which means that you can invest any time and redeem anytime.

There is no lock-in except in ELSS funds (which comes under 80C) and close-ended funds (which specifically tell you the duration for lock-in)

Myth #28 – SIP should not be started when stock markets are very high

Yes, this is actually not a myth, but truth.

But only if you know that stock markets are high. If you are very sure you can figure that out then Yes, it’s better to wait for markets to tank down, and then start SIP. But 95% of the people don’t have time and energy and even expertise to read these signals.

So that’s the reason, why you should not think much when you are starting the SIP. Start your SIP’s irrespective of market conditions. And when markets do down, it’s time to increase your SIP amount

Myth #29 – SIP is always better than Lump sum investments

None of them are better than the other.

SIP’s will outperform the onetime investments in certain conditions and vice versa. SIP’s, however, are more suitable for a common man as it’s a monthly commitment and averages the risk of market volatility.

Here is a good discussion on SIP vs Lumpsum Investments by Monika Halan and Vivek Law in a show called Smart Money

Myth #30 – I can’t switch from one mutual fund to another fund

Many people do not know that it’s possible to move from one fund to another fund across the same fund house. You don’t need to sell the fund, get the money in your account and then again invest in another fund of the same fund house.

So if you have a mutual fund from Birla AMC, you can switch it to another Birla fund without redemption.

Myth #31 – Mutual funds of bigger and trusted brands are always better

Do you know that LIC also has mutual funds business?

However, LIC mutual funds are one of the worst-performing funds across the whole MF industry. LIC mutual funds is not same as LIC insurance.

In the same way, SBI mutual funds should not be confused with SBI bank. A lot of first-time investors in mutual funds investors want to go with trusted brands like LIC, SBI, or HDFC.

Not that mutual funds is a different business, and you need asset management expertise. A small fund house like Motilal Oswal or even Quantum or PPFAS has high-quality funds and should be explored.

Myth #32 – I can’t partially withdraw from mutual funds

Yes, you can. Mutual funds can be redeemed in parts. You just have to choose the number of units you want to redeem or the amount you want to redeem (it will calculate the units required). So that way, it’s a great product. Because in case of deposits it’s either the full amount or none (which is one positive thing also)

Myth #33 – Only humans can invest in mutual funds

Even companies and partnerships can invest in mutual funds. It’s not limited to just humans. So if you are a business owner, you can also go for your business KYC, and then start invest in mutual funds. If you have money lying in current accounts, you can park your excess money in liquid or debt funds and redeem them anytime you want with a single click.

Let us know if you have any more myths or queries related to mutual funds or SIP.

Are you ready to invest in mutual funds?

Are you still waiting to start your mutual fund’s journey? If Yes, then our team at Jagoinvestor can help you start your mutual fund’s journey.

Invest in Mutual funds with Jagoinvestor for FREE

We help our clients to set their financial goals, do all the documentation, and give a free portfolio tracker along with mobile apps to check your portfolio.