This time we are going to share money story of another reader of ours (Name not disclosed as per request). This person is from Bangalore, belonging to the middle class and is now working in the US from the last 2.5 years. He is a regular reader of this blog and agreed to share his money story with a bigger audience.

Over to him…

When I was Growing Up

Born and Bought up in Bangalore, I have spent ~30 years of my life in Bangalore and 4 outside of India. Yes, I have seen Bangalore go from a quaint friendly place where I could cycle 20 km in 30 odd mins through peak traffic, be out any time of the night, ask strangers for help to the current madness on the streets.

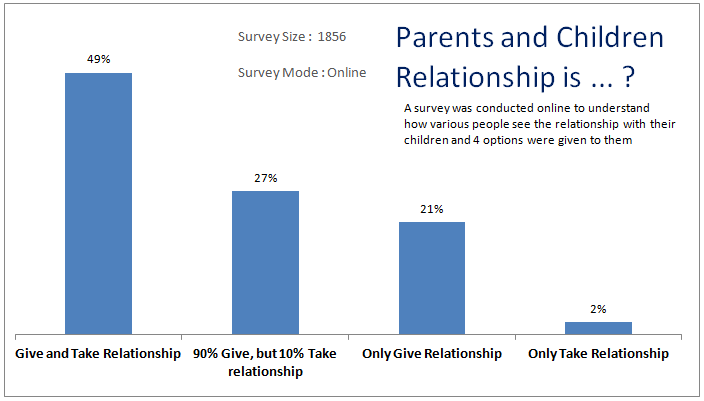

My parents were both employed in Banks. My sister and I were never left wanting for anything that would enrich our lives. Looking back; there are things that are more evident to me now with some wisdom that I have gained.

My dad standing in ration line 20 odd years ago for necessities like sugar, our first vehicle – A Luna if anyone remembers, the frown and anger (a reflection of his inability to shell out more cash ) when I asked for something by the month end.

Our Financial life improved with new Pay Scales

Things improved significantly around 10 years back when with new pay scales and an open economy, and a mortgage that was paid off, my parent had more disposable income and could get us (almost) anything we wanted – All I wanted was 500 INR per month pocket money when I was in engineering.

We did have a very sheltered life though. My parent’s primary focus was to get us educated and to ensure there are no stones unturned in giving us a quality education

I completed my BE in Computers Science and after 3 years of work experience, completed MBA from a top 3 business school in India

The Financial Struggle – Money Matters

Unfortunately, like most Indian families, this education never covered financial education. While it’s easy to now look back and fathom what my parents underwent financially when we were growing up – I still remember an incidence when I was in high school and I wanted a quiz book which costed around 5 INR (yes, 5 INR . Not a typo).

My father had told me he can only get that after a week (payday) and I had thrown a fit calling him names (I was a mean teenager). That night, when I was miserable for shouting at my father, I walked towards his bedroom to apologize and I could hear him almost apologizing (sobbing) and informing my mother that he couldn’t get what was necessary for me.

This incident for some reason stuck with me through.

I have seen poverty up close through my relatives and some of my friends (while we were relatively bit better). When I was in 5th, I realized that a friend of mine wasn’t able to pay his school fees for the month. It was Rs 30 per month (I studied in a small govt aided Kannada school) and I had asked my mom to pay his fees which she graciously did until he completed his schooling!. Experiences like these made me dread having less money than what was necessary to sustain and to some extent experience life

No money matters discussed openly!

Money matters were never openly discussed and this translated into my spending habits in my initial working years. I was making around 25k take home a month ( a princely amount on 2007 ) and I just burnt through all this – Food, gifts for friends. Zero savings except for a ULIP plan of 60k per year and a couple of LIC plans based on relatives recommendation.

Fair to say that when I wanted to complete my post-graduation, I had to borrow the ~15 lacs for my MBA from banks and relatives and also withdrew the 1 lac I had in PPF

3 years of work and negative 16 lacs to show for it!

Then my financial life took a new and positive direction

During MBA, thankfully, I ran into some good, positive money minded individuals, courses, blogs (Jago investor and Subra money for example) which opened my eyes towards my financial fallacies.

27 year old, out of MBA school and 20 lacs in debt, with a salary of ~1 lac per month, I ensured that I paid off the debt in 2-2.5 years ( I had a consulting stint for 6 months in Canada that helped). My parents btw thought I had gone cuckoo in trying to repay my loans early and selling off my non-performing ULIPS and LIC plans (at a loss).

Now, 7 years later, with 7 more years of work experience, I have more than ~1.5 crores in assets. I don’t own any real estate and am looking for the best investment. I am not in love with Bangalore anymore, as I used to and the area I would like to stay is way-way-way beyond my reach.

Here is my current breakup

[su_table url=”” responsive=”no” class=””]

| My savings | Amount |

| 401(K) (retirement saving in the US) | $55000 (Rs 33 Lacs) |

| Mutual funds (in the US) | $35000 (Rs 21 Lacs) |

| Liquid cash (in the US) | $50000 (Rs 30 Lacs) |

| Mutual Funds in India | Rs 55 Lacs |

| Stocks in India | Rs 3 Lacs |

| PPF | Rs 21 Lacs |

| Fixed Deposits | Rs 10 Lacs |

| Total | Rs 1.73 Crores |

[/su_table]

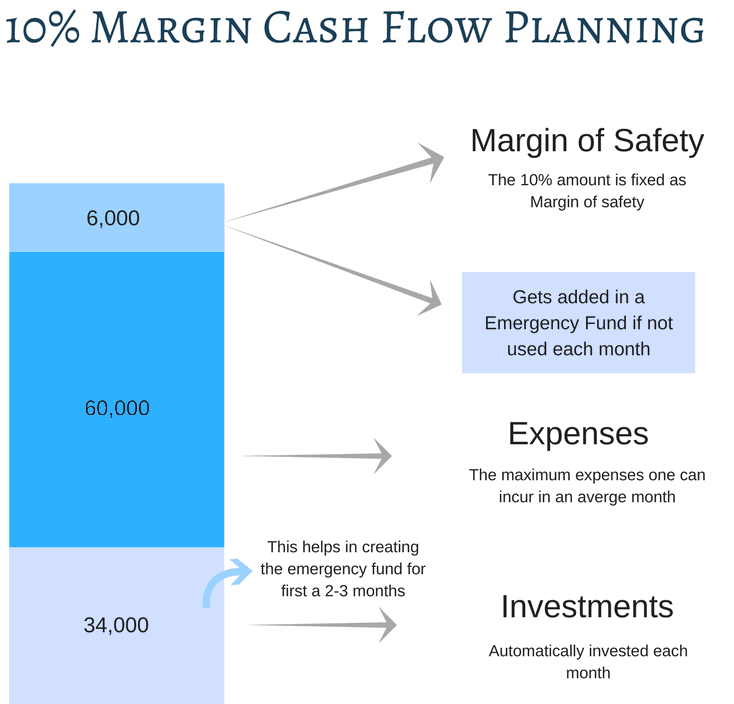

Let me share how I started my savings

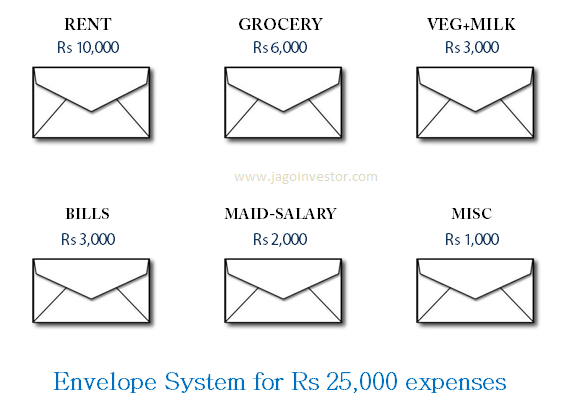

Once I started saving money, they were always in small amounts. The guideline was to keep aside 15-20 % take home income into savings right away. This was apart from the mandatory cuts like PF from pre-tax income. Just think that your take home is 15% less and stretch the rest of the money for your needs. Else, your monetary demands will always stretch to match the supply.

I was surprised at how quickly they all add up. Investing in PPF is a good example.

It’s surprising to see that I have 20 lac in that debt-like instrument. Or the mutual fund which was mainly based on small SIPs of around 20-25 k per month, to begin with. With the way markets have behaved over the past years, they quickly grew and have resulted in the current amount.

Over a long-term, a small investment on a regular basis can create huge wealth .. below is one small example of it.

I have learned that the difficult part is to start and I maintain disciple in investing systematically. Once you do that, they give you some surprising results.

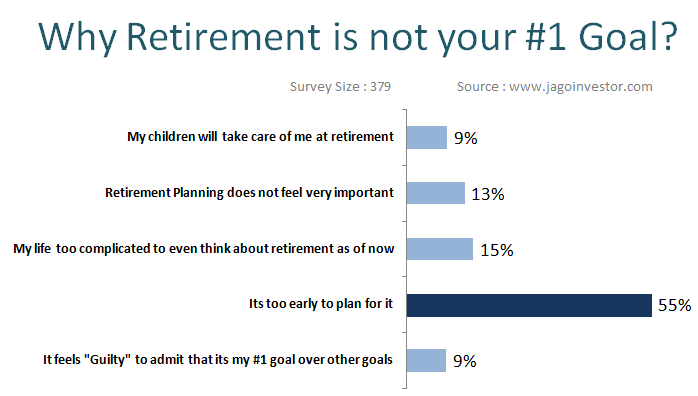

My next 6 yrs plan

I intend to not touch my Indian mutual funds, invest another 50 lacs there over the next 6 years and just let it marinate and grow over the next 20-25 years when I retire.

These numbers indicate that I am potentially ahead of some peers in the income and asset curve in the same age range

Money for me now is a means of where I want to be in 20 years from now while enjoying life on the way and being able to help everyone who matters to me. I hope I am able to use money as a tool to enrich not just my life but many others – Next stop, for now, is a small home of my own.

How important is money in life?

Currently, Money is a contributing factor for peace of mind.

I’m glad that I can provide for my family, spend some good amount, have a security blanket in case of emergencies, help my family and potentially don’t have to worry about money when I retire.

It’s not the end at all but is a means to achieve my goals. I know people romanticize having less money, but having stared at poverty up close in many cases, I can tell for sure that it’s always better to have enough money to ensure peace of mind. At the same time, the definition of “enough money” keeps changing. In college, 500 INR per month was enough money.

First job – 7000 per month for the first 6 months was enough for me to live like a king. My salary jumped to 25k per month and 3 years later and I thought I ruled the world. This is how I felt!

Now, with 15x – 20x that income, I am still not sure if it’s enough money (especially as I plan my retirement and my child’s education 15 years from now). I am still trying to find my answers there. My wife calls me a compulsive worrier and over thinker and maybe that’s true.

I started educating others on money

When I meet my friends with less money than me or family members with less money, my first thought is how to help – not necessarily financially, but in terms of education. But it’s not always easy. I tried educating my uncle on how his LIC policies are a bad investment and he can look at markets and MFs as he’s retiring 20 years from now and I was snubbed as a know it all in some circles.

I also donate at least 10k a month or two into micro ventures such as https://www.rangde.org/ to ensure I can contribute some way and make a difference in some small way. One of my goal, when I retire, is to ensure I have enough money to generously help those in real need

Don’t make stupid mistakes when it comes to money

When I see my cousins burning through their money in their 20s with no investment or investing in something just for the sake of 80C, friends buying the latest gadget (iPhone upgrades every year ! ), spending insane money on cars, to me it looks like people are finding happiness through small things which is never-ending.

There will always be the next thing that money can buy. I don’t want to judge anyone. Maybe they know something I don’t. But I find this very running after materialist things/brands and spending without a thought about the future very concerning

My younger cousins make fun of me (all in good humor) for not wearing branded clothes. But I am glad in the “cheaper” clothes that keep me comfortable and have never understood why I should pay 5k for a pair of Nike floaters

I am glad to share my story

After I shared my story with all readers on Jagoinvestor platform, it bought back so many memories – I’m literally in tears thinking about what our parents had to go through to get us this life that we now take for granted. I feel lucky to have such parents and in general to have been bought up in an environment that could get me to where currently I am.

Thank you for giving me an opportunity to share my experience with you ! and I request all readers to share their own money stories with all of us, there is so much to learn and know how others have lived their financial life and think about money matters.

What is your money story?

If you want to write your money story, Leave your details here and Jagoinvestor team will get in touch with you with next actions.

What do you think about my money story? Did you enjoy it? Can you share your views about money and how it changed over the years?