Today I am going to share with you an amazing journey of one of our readers who was deep into debt many years back and how they finally broke that unending cycle debt trap and came out clean after a lot of hardship and courageous decisions he took in his financial life. This is the story of Pranay Kumar who is from a rural town of Maharastra.

The town had small local banks (one room banks / 2 branches banks) from which his family had taken loans and the life took turns in manner that he was soon into a debt trap. His story is inspiring and nerve wrenching at the same time. We had changed the name of the reader due to his request and shared his story in his own language which we received over email with minor grammatical corrections.

Background

I had a total 11 loan accounts when I entered into IT field as a software engineer in the year 2004.

All these loans were in existence because of my ancestors and relatives. We had. We had some family business in town in the year 1998 which my uncle took over. My father was jobless and with no motivation (bad mindset), he tried to make a business run again, but it failed. Along with that failure, there were my engineering expenses (fees + hostel from 2000 to 2004) for four years and BAD friends of my father – all this contributed to our growing debt over time.

Lesson from my father – “Make poor but wise friends rather than rich but mean”

To run the business, my father took an initial loan of Rs 2 lakh for the construction of a site and material. Then somehow it failed, so he got another Rs 50,000 back in yr 2001, along with another Rs 15,000 of personal loan for my engineering fee for the first year in the year 2000.

So by the end of 2001 financial year, we had Rs 2.65k loan and there was no source of income!.

At this point in time, we had no relatives who came close to help except my mother’s father and brother. My father had zero sources of income at this point. So my mother started a coffee shop near a school. Just to earn enough for food.

At this point, we lost help from most of our relatives. Interest rates in small towns are different when it comes to personal banking. Rates were starting from 18% to 25%.

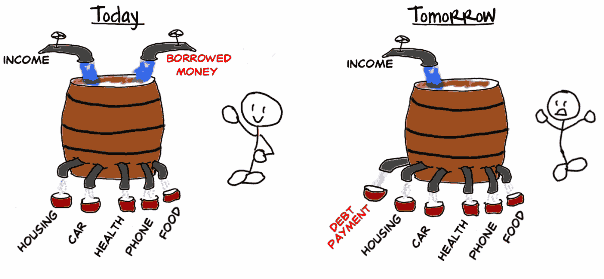

In yr 2002, the 2 lakh account got in trouble as interest was high. So my father opted one brand new loan from another small institution, worth rupees Rs 1.5 lakh. He divided this money and cleared up the interest of all other 3 loan accounts, so we had like 4 accounts with all principal due, which is like Rs 3.7 lakhs.

Also one interesting point we learned that my father was borrowing additional money from his friends which were supposed to be repaid. It seems that this 4th loan was used for some reason.

My Education Loan

Later I opted for an education loan of 45,000 for my engineering. This was the 5th loan.

Every month of march – there was a rush. Father didn’t do work, the mother ran a shop which was just sufficient enough for 1-time food.

Father stopped sending money in my engineering, as the fees were covered by education loans. So at this particular point in yr 2003, I had to take some sharp moves in so-called cutting expenses.

- I dropped a one-time mess

- My friend from a native place used to bring food from their home.

- I dropped using bus/rickshaw.

- With my engineering, I started working at a place in Sangli, for a salary of 800 rupees per month.

- Used to ride 16 km per day using a bicycle.

All this helped me with rent + one-time food. Father didn’t have to send money but it was a tough time for me. I didn’t have enough money for books. During this time, Guthka was banned in Maharashtra, but Karnataka had the shops. So, I went to the Karnataka border, which was some 40 odd kilometers away and with my monthly salary, I bought 2 big packets of it and gave it to our librarian, who in return gave me 6-8 books.

I came 3rd rank in that year. Now I feel bad about such a deal but times make a man do miserable things.

Bank misguided us to renew the loans

So no EMI was paid till this point of time and on top of it, the local banks misguided us and asked us to renew our loans.

Out of five loan accounts, four accounts got renewed. Education loan wasn’t kicked off until I finished my education.

Let me share how this renewal scheme works in case of loans. It works like this – Suppose I have a loan account with due outstanding of 75k, then it was asked to split in two accounts like 35k in one account and 40k in one account, as money was now spread across two accounts. So instead of one, charges would be applied to two bank accounts (e.g. – postal charges: Rs 200 per account, maintenance: Rs 200 per account, legal case: Rs 1000 per account). So we had the following list of accounts

- Bank 1 – 3 accounts

- Bank 2 – 3 accounts

- Bank 3 – 2 accounts

- Bank 4 – 2 accounts

So in total, there were 10 loan accounts at that point in time.

Every March was disastrous. My father had to go to court, police n all. Bank people used to fight, as they used to come to my house, they used to mark the furniture so that it can be decided which bank will take which one. My mother used to have Bentex Gold jewellery, they even took that.

Note that we are talking about very small rural banks and not the big banks here. You will not even hear some of these banks names.

The first Job started with 10 loans

So there were 10 loan accounts when I got into my first job in Bangalore with a salary of Rs 15,000 per month in Nov 2004.

Later after 3 months, the salary came down to just Rs 5,000 per month. I used to stay in a Dharamshala where people can sleep in the night for Rs 35 rupees per stay, day time it was not allowed to be there. I spent many months there.

My father was doing the same thing even then. He used to renew the loan (principal + interest = new principal amount). My mother was running a shop for food. So in 2005, it was almost impossible to even think of repaying the loan, as I had just Rs 5,000 salary.

I shifted to Noida with a new job which paid me 16,000 per month. My own expenses were around Rs 3,000. I was sharing a room with ex-colleagues of my first job, which helped me a lot.

There was no PF or tax-saving from my side.

I started giving a 90% salary for clearing loans

From that point onwards, I went to an extreme end.

I started giving 90% of my salary to banks in clearing loans. 10% was for my survival. Believe me, this couldn’t take down a single bank, as interests were very high. Because of the legal cases, the father was about to go to jail. So I went to ICICI bank as I needed urgent money and took another loan of Rs 1 lakh to just to pay the interest – the interest rate was 21% interest!

I gave it to my parents to just pay the interest. Legal case was withdrawn for some time and parents renewed the loan, Again.

At this point, the total loan count was 11

I had to do something extraordinary to get out of my debt trap. I opted for another job, outside India and tried to make up more money. In just 7 months, I made around Rs 5 lakhs in Japan/US.

But when I landed back, my sister’s marriage was fixed :), so half went into her marriage. The other half was supposed to go to a bank, but my father paid only interest. This was the time where I almost gave up in life. But somehow I got another job, back in Bangalore, double than what I was earning.

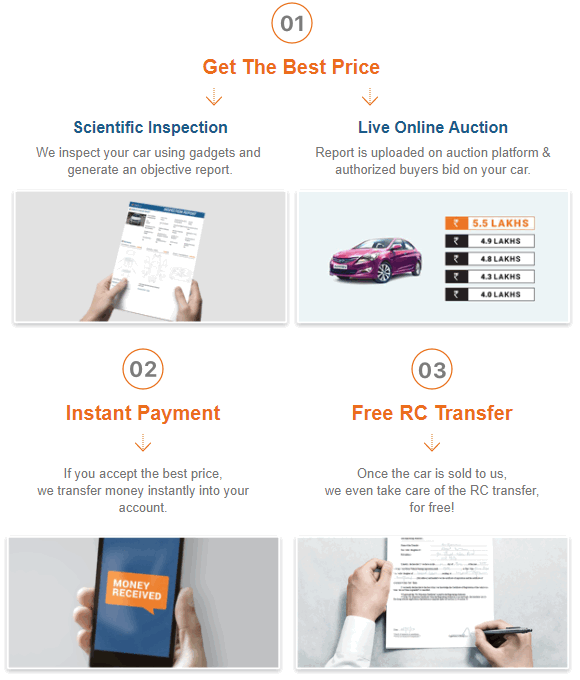

Tracking all the Loans

I created a document, excel sheet document, to track all my loan accounts.

My per month my take-home was Rs 50,000 at this point in time, so I was paying Rs 40,000 to banks and Rs 10,000 was for my and family survival.

Initial 4 months, one bank loan closed down, the other 10 still running. I approached each bank at a time and told them that I am working on repaying them back soon(legal case, bank control over house furniture and property was done, so nobody would have done any more harm to us, except killing us).

A Big Shocker! – Messy bank statements

I started digging into documentation and then a big shocker came. Every bank, almost every bank had problems in their bank statements. I thought my parents are taking care of the documentation part, but there was a MESS.

I started asking for printouts from these banks. They were saying – each printout would cost you Rs 25. I knew there is something fishy there, hence I paid and got the statements.

Kudos ! – miscalculation worth 30,000-40,000 was there ! . From then, every month I had to fight with banks in recalculation. Later took help of a govt officer and told them that I am complaining to some bank authority about this loot.

Finally, I was left with a minimum 8 big loans and 3 minor loans. At this particular time, I had to make tough choices. I created an excel sheet for all these loans, utilized my bonus+awards in office, wiped out loans which were less than Rs 50,000. I targeted one loan every month. The main reason was – all loans were in a default state, so I didn’t have one important aspect called ‘Breathing Period’ .

First Loan wiped out

With my first wipe-out, I took down the first Bank loan. Here, my mother diagnosed the balance sheet/loan details, found out a missing calculation worth 20,000-25,000. We asked bank guys to reduce that loan amount, saying I would pay in one shot. The amount was around 50k.

90% of the salary was gone in one month. I managed to take the loan count down, but due to all this, I had to drop my MS plan.

In start of 2010, I took down my education loan and personal loan of Rs 90,000 in two installments, for which I borrowed money from friends.

In March 2010, I cleared another Bank loan of 3 lacs. Then I took down one more big loan amount of 2 lacs. At this point – my other sister came home for her childbirth :), so I had one more responsibility.

So I decided to pull down loan in three attempts. Went to the bank owner – He was the same guy who offered us loans like offering tea, now when we asked him to reduce the loan, they said NO.

Interestingly, my father had kept house papers as liability – so there was no chance to get amount reduced. So I approached for EMI payment papers. They took one week to give it to us and later it was a big shocker – postal charges of Rs 900 for one time , admin charges 750 rupees +, etc.

At the same time, I was also paying Rs 2500 for ULIPs and Rs 42000 per annum for LIC Jeevan Anand and also had to pay back the money taken from friends.

I raised my bar of payments, I paid more than 2 lakhs in 2 months (my plan was simple – make huge payments around the salary date.

Some improvement after many years

So as these three months went by, another bank came down and finally 2 loans got completed. The moment I pay off a loan, I asked my parents to take a letter on bond paper stating this:

- No legal cases pending on this person – name, address

- No Loans due for this person – name address.

- All legal cases are withdrawn and charges payable by the bank.

I have a nice collection of such letters today! . Then as time passed I completed more and more loans slowly. My take-home salary was around Rs 55k at that time. So I decided to pay Rs 40k to default bank per month but that couldn’t help me serve other roles.

Slowing Down

I had slowed down, kind of worn out. I suffered a serious depression at that time. I was earning much but didn’t have money to satisfy myself.

It was cut-to-cut life.

I didn’t know what to do. One of the urban bank due was around Rs 3 lakhs. I managed to arrange Rs 1.5 lakhs over 4 months and paid it, but still it was short of 1.5 lacs, so again I had to run for friends for money, somehow by end of 2010 I was able to clean that loan.

At this particular point, my father made a mistake. Even I made a mistake. I asked my father to go and collect the papers of closure details, he refused to go for some time. After 3-4 months or so, my mum went to the bank (again !) and bank guys said – one more loan pending (which my father didn’t tell me about) + interest of old loan worth 42k !!!!!

Why? Because we changed our bank software and with this new software – a different way of calculating the interests – your due is still 42k !

Freak – one small mistake – refusal to take ownership – cost me 42k !. So back to square one. 3 loan accounts + 1 BRAND NEW loan account from an urban bank and accumulated interest of 42k of old account – this new interest mechanism caused severe attacks on bank guys from villagers nearby as they didn’t understand new interest mechanism and issues with old software – it was kind of news in our region.

I approached the bank and said, I can wipe out quickly if you give me concession (I didn’t have to bother about CIBIL as a loan was on my father’s name). So I convinced them saying I will open FD if you minimize the amount. I paid Rs 2.25 lakhs in several months and took off that bank as well!

This time I collected those wonderful letters saying no legal case, no loan pending etc. This took time till mid of 2011.

At this time I was taking a breather! I thought only one big loan account worth Rs 3+ lakhs is remaining which I can wipe out in 6-7 months minimum. So I buckled up but again unforeseen events occurred around Jan 2011.

My house flooring went down by a few inches, as the house was 27 years old. So I had to spend some Rs 40k to repair it. I thought I will do it later but my sister came for childbirth at our home !!! So Rs 40k for house repair and close to 20k per month for sister’s health n stuff + household. Plan to wipe out the last loan was in vain!

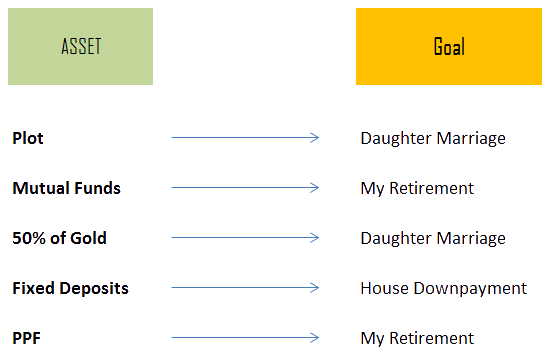

I had to draft something new which would take care of such things (which my insurance doesn’t cover) on run-time. So one day I sat and thought about what all am I supposed to do in the future?

- List came out

- my sister’s delivery charges

- naming ceremony expenses

- future marriage of my other sister and gold expenses

- payout these 2 last loan accounts worth 3+ lakhs

- run my house in hometown

- health expenses.

Clearing Off some loans

So first thing I did was – Rs Arranged 1.5 lakhs cash and paid to one of the bank – that was completely from my salary savings for my MS.

Rs 1 lakh was pending and the interest rate was 17% + many ‘so-called-mistakes’ in statement (EXTRA 5K charges for something, 5k entry by MISTAKE).

I had to stop this payment and make it more worth- traceable- tractable- manageable. I went to HDFC , I have salary account with them – took loan of Rs 1 lakhs with 14% interest (had to fight to reduce that 0.5% – referred them to their own site) and added another Rs 50k into it and wiped out 17% bank and made my loan more manageable.

After so many years I was in control of my salary – but still, two things were worrying me – ULIP and Jeevan Anand . I asked my questions on Jagoinvestor and got clarity on what to do with them and I finally I decided to close them down very soon.

Finally, I was left with a much cleaner state. I had one loan of 2.5 lacs left, which I planned to clear off by paying Rs 40,000 for the next 5 months and also planned to pay 5,000 per month to HDFC for the next few months.

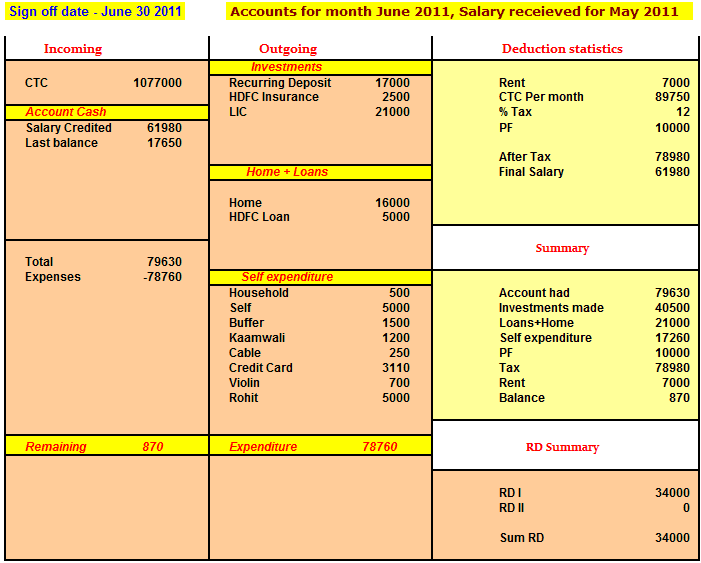

But during this time, my sister’s due date came close and boom ! dangled plan. I realized this would go on and on . I had to make savings for my other sister marriage too. So after thoughtful analysis of one week, many permutation – combinations – opened an RD account – one for sister marriage with 17k per month for 12 months period. Below is a snapshot of how my excel sheet plan looked like

Many people asked me about why Rs 17k, but I had planned for entire one year that what would I do with my money. So I started executing my plan. So took one more risk of saving money when one leg was in fire, other on ice.

Sister got a baby girl

May 2011 – My sister got a baby girl, that role was seeking more money from my salary – medicines, naming ceremony and to end it – awesome fight from my sister’s husband which was leading to divorce – my sister gave birth to a baby child (I named her Maithili – named after Seeta – Seeta’s premarriage name was Maithili).

So one thing goes down other pops up, keeping my toes burning. So I had to concentrate on this thing as well. It cost me hell of money man. The naming ceremony was like Rs 50k – in cash – didn’t opt for loan – I was saving money for my MS, which I gave up. So after this, there was high drama in the family, it kind of slowed me down.

I finally was LOAN FREE

End of 2011, I went ahead, closed my ULIP, Jeevan Anand payments and used that money to close my HDFC – paid preclosure charges, took on loss by ULIP as I couldn’t bear this loan tension anymore.

1st January 2012, as planned, I was loan free.

You won’t believe, I became sick in the first week of Jan – still went to HDFC bank for a preclosure statement – took it by hand as I couldn’t wait for another week. 2012 might be the end of the world for many, for me it was freedom.

Started some Saving!

From Feb 2012 onwards, I started buying 10 grams of gold, saving money into various RD accounts – May 2012, I got engaged by my own expenses – Nov 2012 is marriage. I hold NO LOAN on my head and this is the greatest feeling I ever had.

Now I am using all this experience and helping my other friends who have many loans.

The current situation

Thanks for listening to my debt trap story and how I came out of it. Talking to the current situation today in 2015. Now I am living loan-free, credit-card-free life. I didn’t buy a flat/apartment yet, instead, I saved money and constructed a big house in native. As my job needs relocation, I really didn’t want to get stuck with a property. Also, I worked upon many RD/FD formulas to generate parallel income which can take care of my quarterly needs. Working every month on a savings plan. I have got couple of SIPs recently but apart from this, I am trying to save my 50-60% of salary.

With this my story is complete. I hope others can take some learning’s from my experience.

Important Lessons learned from this debt trap story

Based on this debt trap story, I came up with few learning’s which I could draw for all readers

- If you are deep into the debt trap, don’t randomly start clearing it off, but make a solid plan on paper and try to follow it

- Do not deal with small local banks that are owned by one person or a small local body, there are very high chances of errors and intentional cheating. You might get the loan fast, but the interest rates are very high

- Don’t underestimate the power of interest rates. a 15% or 20% interest rate has a lot of power to keep you in debt for a long period.

- You need to take extreme and bold steps when you are in deep shit. Unless you will take very bold actions, it will become very tough to come out of debt trap

- Focus on increasing your income over time. No matter how much you try to cut down on costs, the real lifesaver will be your increase in income.

- Short cut often leads to long cut when it comes to debt. Almost everyone who is in a big debt trap today started with a small debt at some point of time thinking that it’s manageable, but it’s not the case. As far as you can, try to avoid taking debt for trivial things

- Life will keep surprising you with sudden unexpected events that will keep disturbing your original plans, so better you account for them.

- Social events related expenses can really be a pain if you are already struggling in your financial life, especially if you are dealing with debt. You need to take some tough stand on those expenses if you want a smooth ride

- If you are into a deep debt trap, be mentally ready to see few years fly while you are dealing with it. Plan your future, marriage, education plans keeping that in mind. It will mentally help you to deal with it.

Please share your thoughts after reading this debt trap story!