ITC – The Mega Demerger!

Over the past couple of years, ITC (read as Indian Tobacco Company) has been in the news, as it moves to demerge the hotel business from other core operations of the company. For retail investors like you and me, this is a mega event because ITC is a behemoth and when they decide to separate their businesses, we get to learn a lot more about investing by studying them rather than listening to ‘10 best investment picks this year’ from some fin-influencer.

This is a detailed account of my thoughts on the stock.

But first, an honest confession.

The first draft of this article was absolute bullshit. Since, I was more interested in drum beating about my investment prowess of buying the stock when no one wanted and keeping it in the portfolio for the last 3 years in which the stock has nearly tripled in value.

That’s where Mr Nandish Desai reminded me that I didn’t merely hold it because I didn’t have anything else to buy. I held it because I was completely sure about the value and potential of the business. And demerger was a great way to unlock it. Like an elder brother, he told me that our job is to share our learnings and not chest-thumping.

Without wasting much of your time, I will start with the article now. There are certain sections where you might feel that you already know this information, in that case, feel free to skip that section and move on to the next.

The intention of this article is to create a masterclass in understanding demergers via ITC.

ITC a Behemoth – A Brief History

The company’s roots can be traced back to the humble streets of Kolkata back in 1910. In those days, Kolkata was the hub of businesses due to its close proximity to the Bay of Bengal as it enabled overseas trade.

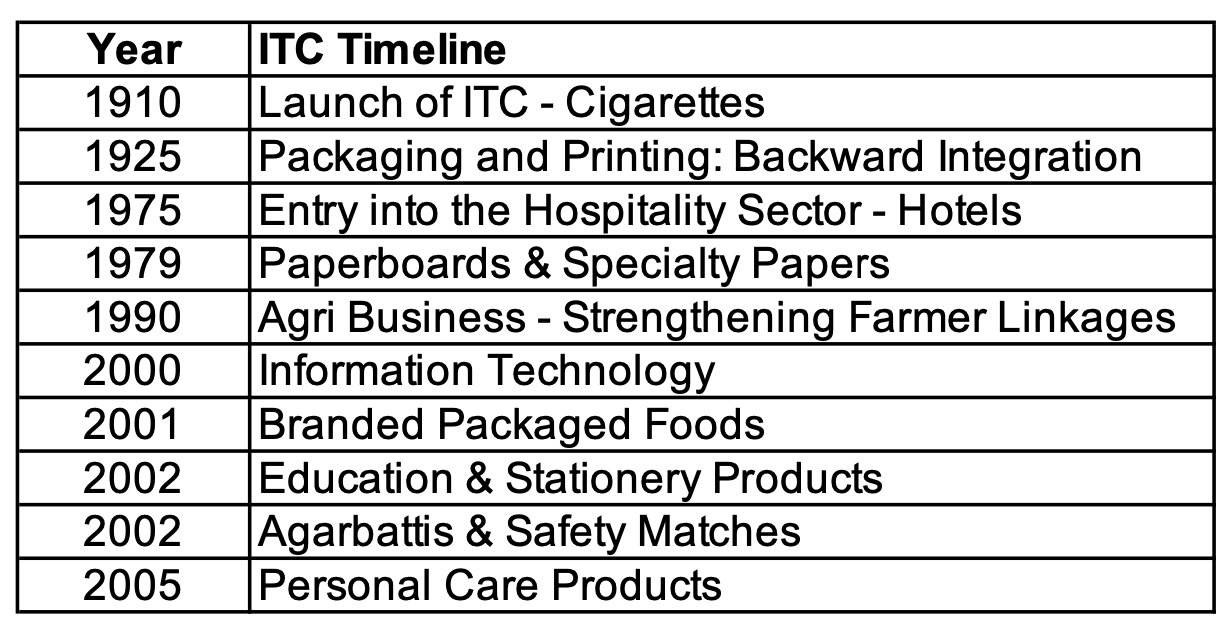

Spanning over 115 years, the company has expanded its product portfolio from cigarettes to hotels to agriculture to beauty products. The company

Source: Jagoinvestor, ITC

Very few companies can be relevant for 100+ years. This extended time period speaks a lot about the company’s management and the way it’s being run.

Sometimes as investors, we get completely blindsided with the kind of work it takes to keep such a large company moving. We are always interested in our money growing and there’s nothing wrong with it. It’s our expectations that are completely incorrect to such a degree that we expect a large cap to move like a small cap.

We look for 30% to 40% growth in such companies year on year. Well, let me be honest with you, it’s not possible at all. Regardless of which fin-fluencer says, it’s simply not possible.

Visionary companies don’t just stick to one product line along the way, they diversify. There’s a school of thought in many seasoned investors that diversification should be in related industries only. Else, it becomes a cash guzzler of sorts.

But here’s the difference.

India’s economy opened up in 1992. That means, Indian companies had to be under License Raj from 1947 to 1992. Those were tough times. Unlike today, when any founder from the Rural parts of India can challenge a large institution based on his or her own merits. We don’t need family names anymore in order to move ahead.

You don’t need to be an Ambani or Birla to disrupt any particular sector anymore. Look at how Mr Deepinder Goyal of Zomato has disrupted how we experience food and grocery delivery. Same goes for Mr Bhavish Agarwal who is redefining Ola from a transport company to an auto manufacturer and slowly putting his feet into the evolving semiconductor industry.

It’s funny how Mr Rajiv Bajaj of Bajaj Auto isn’t able to reconcile with this change, since they are the businesses of a generation that thrived when there was simply zero competition.

ITC in its own way is in a very long battle. Right from hotels and agriculture to IT and personal care products, this company is facing a massive amount of competition.

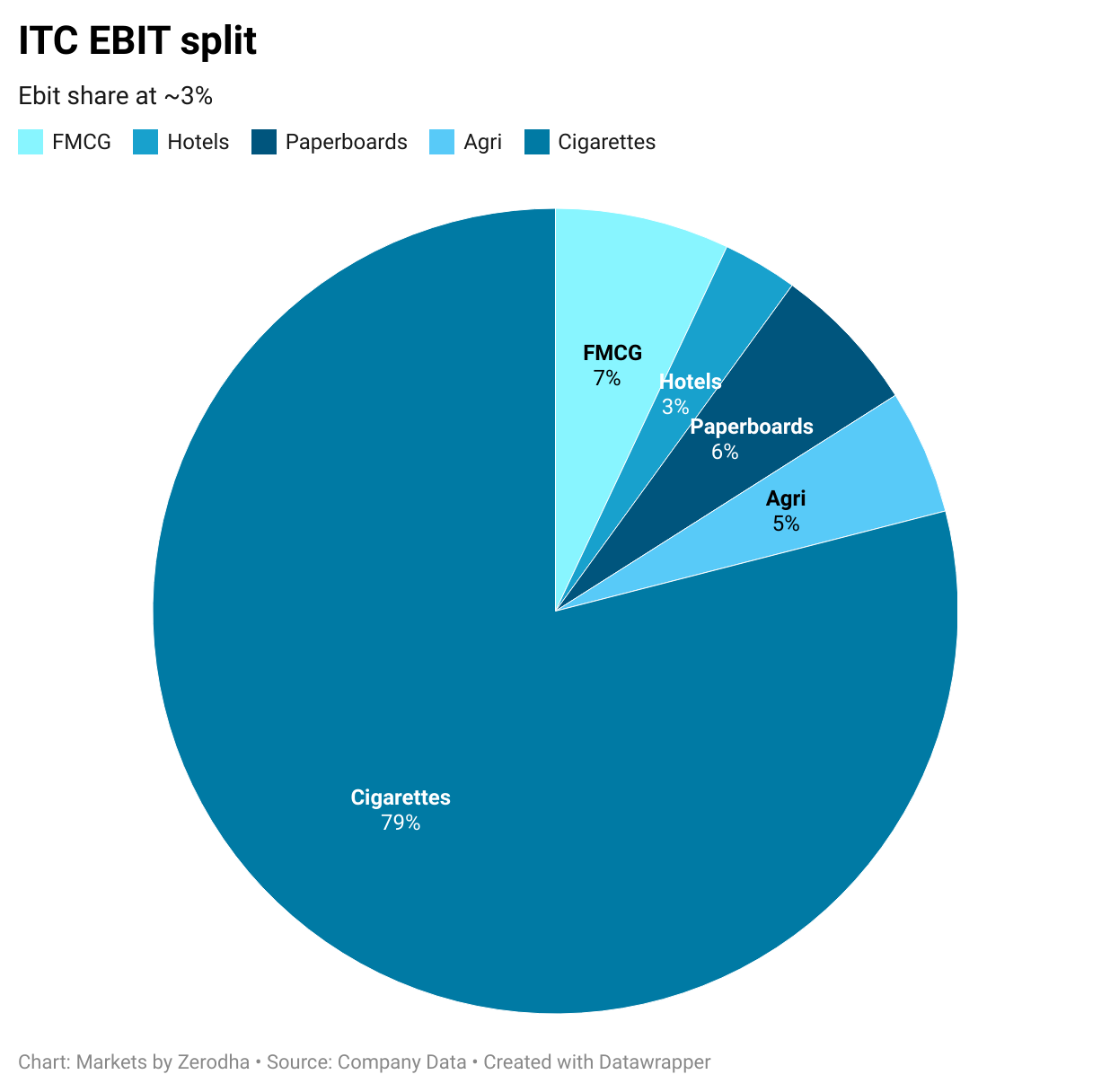

It’s the Cigarettes business which is the cash cow of the company that is helping to fight these battles on multiple fronts.

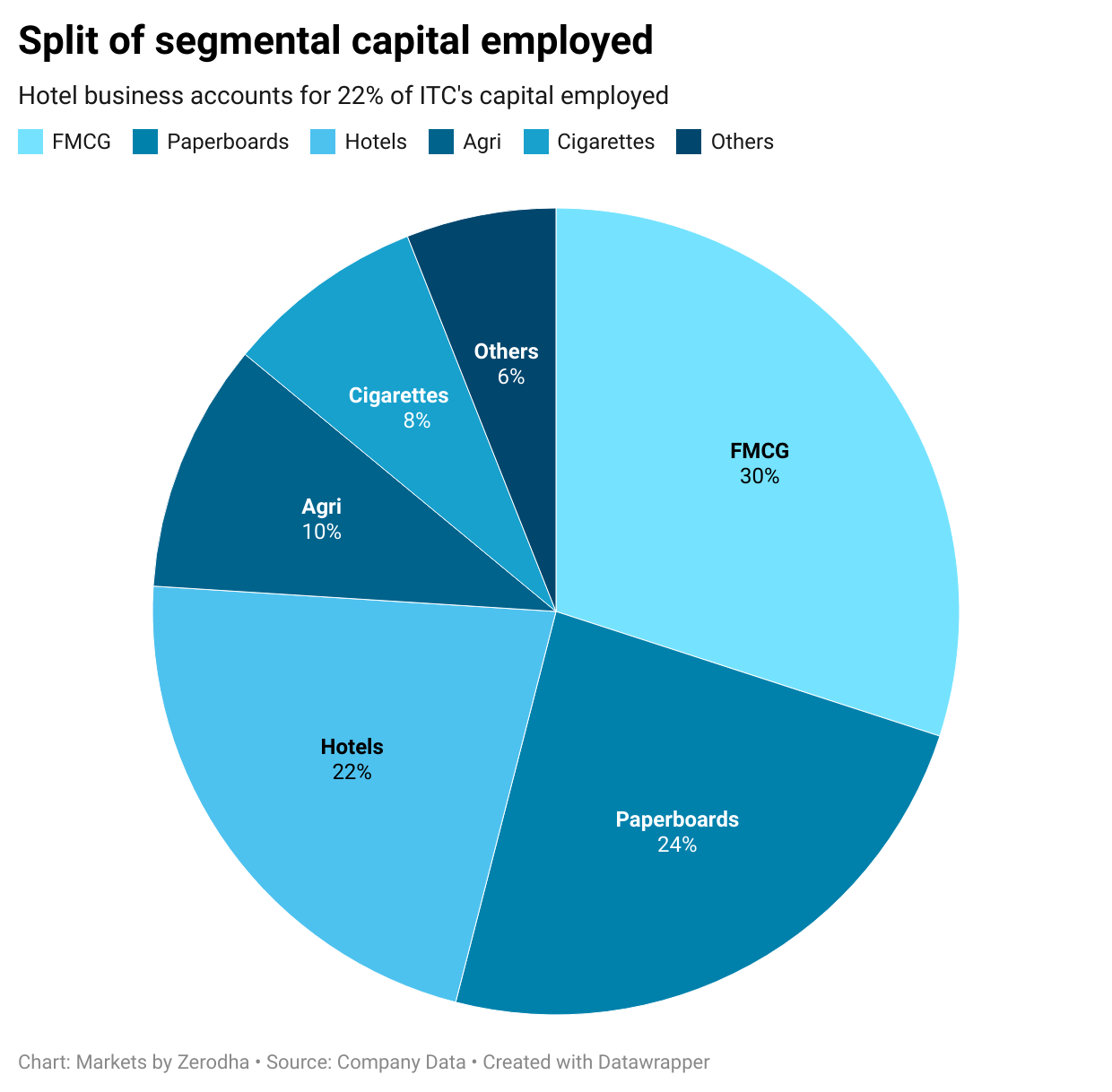

Think about it – the cigarette business is responsible for close to 80% of operating profits (or EBIT) of the company. And yet, it needs just 8% of capital every year to keep it going.

Suppose this year the company did a sale of Rs 10 lakhs. Out of this Rs 8 lakhs comes from cigarettes business alone. And how much does this business division require to run itself?

Just Rs 80 thousand only.

With Rs 80 thousand or as I wrote earlier – 8% of capital, the company is able to operate its plant, supply its products to the end consumers, pay for their salaries and everything.

But here’s an interesting take in this – Hotels business

In similar light, Hotels consume close to 22% of capital every year but only contribute 3% of operating profits (or EBIT) for the company.

These are not just numbers, it’s a point at which an investor’s blood should boil.

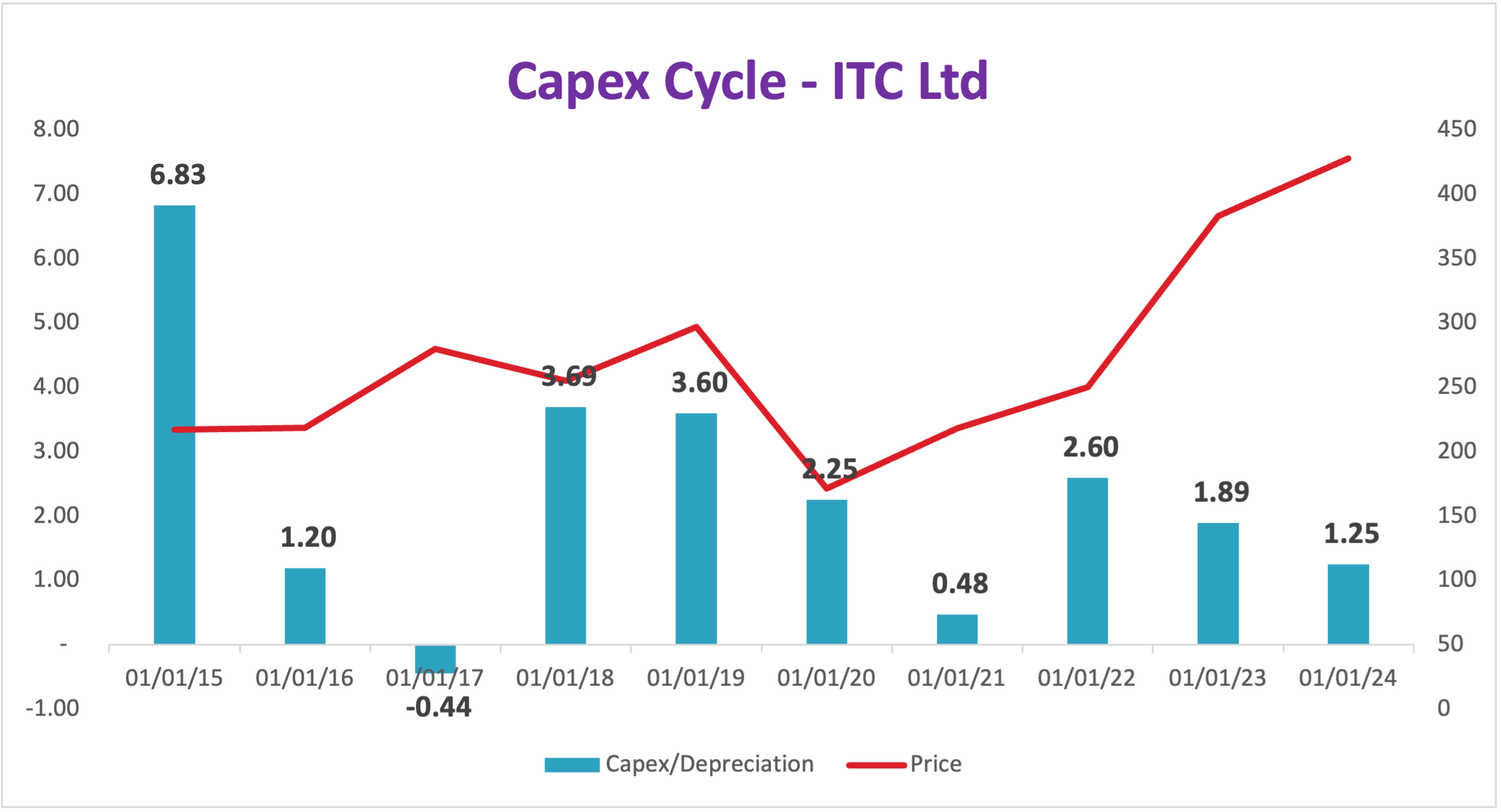

Because ITC has been doing massive capital expansion (‘capex’) for the last 10 years. Here’s a chart for you to look at.

Source: Jagoinvestor, screener.in

This is a bit technical, if you don’t wish to read it – please skip to the next section.

In Capex we define money that is left after for buying and selling of fixed assets such as land, building, plant & machinery, acquiring new businesses and some other selected investing items from the Balance Sheet.

So every year, the money that is used for expansion of business is taken into account and divided by ‘depreciation’ which is wear and tear on these assets.

If this capex / depreciation = 1, then every new addition is equal to the one that is replaced.

When it’s around 2, then it means some real capacities are being added.

But first, a quick word on ‘depreciation’.

When you buy yourself a nice car, you will not sell it for the same price right. Suppose you bought a Maruti car for Rs 10 lakhs and after 3 years of driving it for 50,000 odd kms, you will sell it for Rs 6 lakhs.

Simple math tells you that the car lost Rs 4 lakhs in value.

NO.

Simple math doesn’t apply here. In the accounting framework, we get the invisible hand of depreciation that accounts for your use of the car, repair and maintenance work, etc – in short wear and tear.

So, after 3 years, after depreciation when your car’s value is Rs 5 lakhs, then you have made a gain of Rs 1 lakh on the sale of your car. Truth be told, you will be TAXED!!

Now back to ITC’s chart.

In the last 10 years, ITC has been on a capital expansion spree. And most of this money has gone into building its world class hotels which has resulted in very little revenue growth for the company.

Pouring too much money to earn very little is the reason why most Institutional Investors stayed away from the stock.

Here’s the proof.

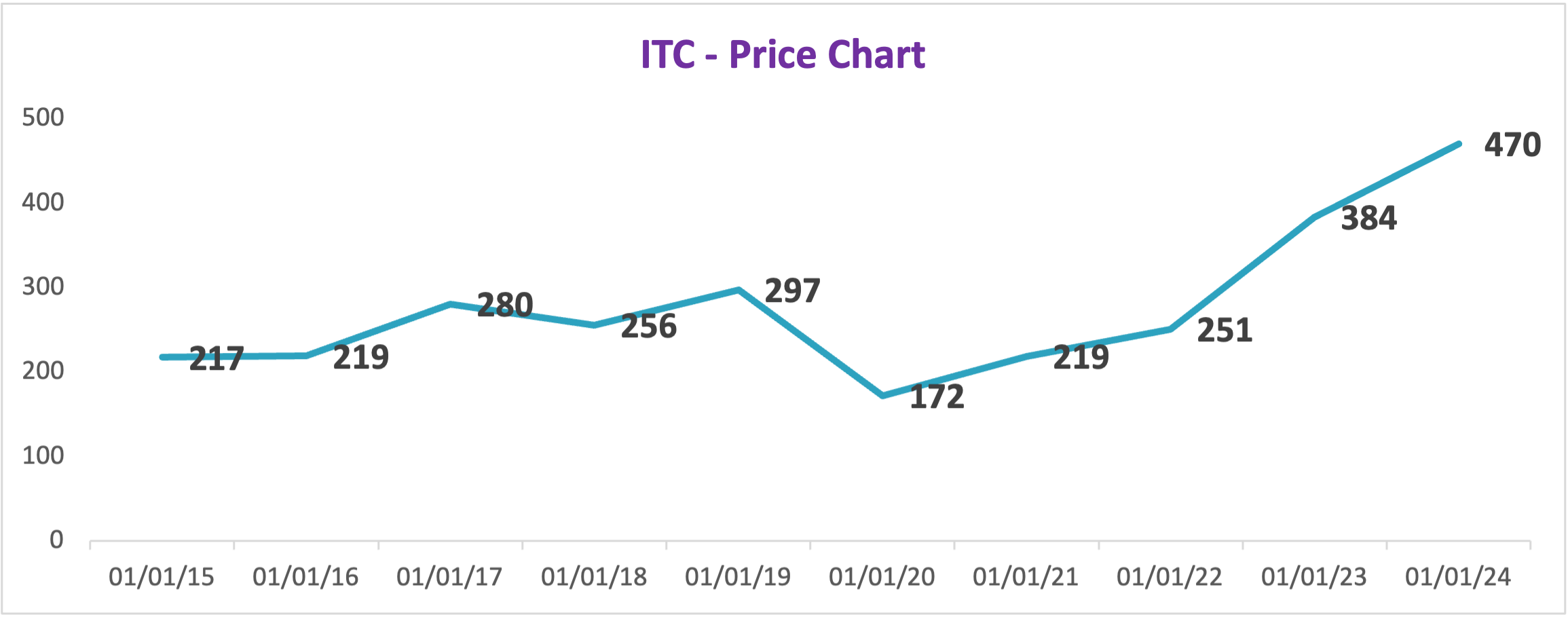

From 2015 to 2021-22, return on the stock was 0. 7 years and the stock price return = 0.

And then something happened!

The rumours of demerger began. The Hotels business was going to now be separated from the other businesses of the company.

The stock price slowly started moving up.

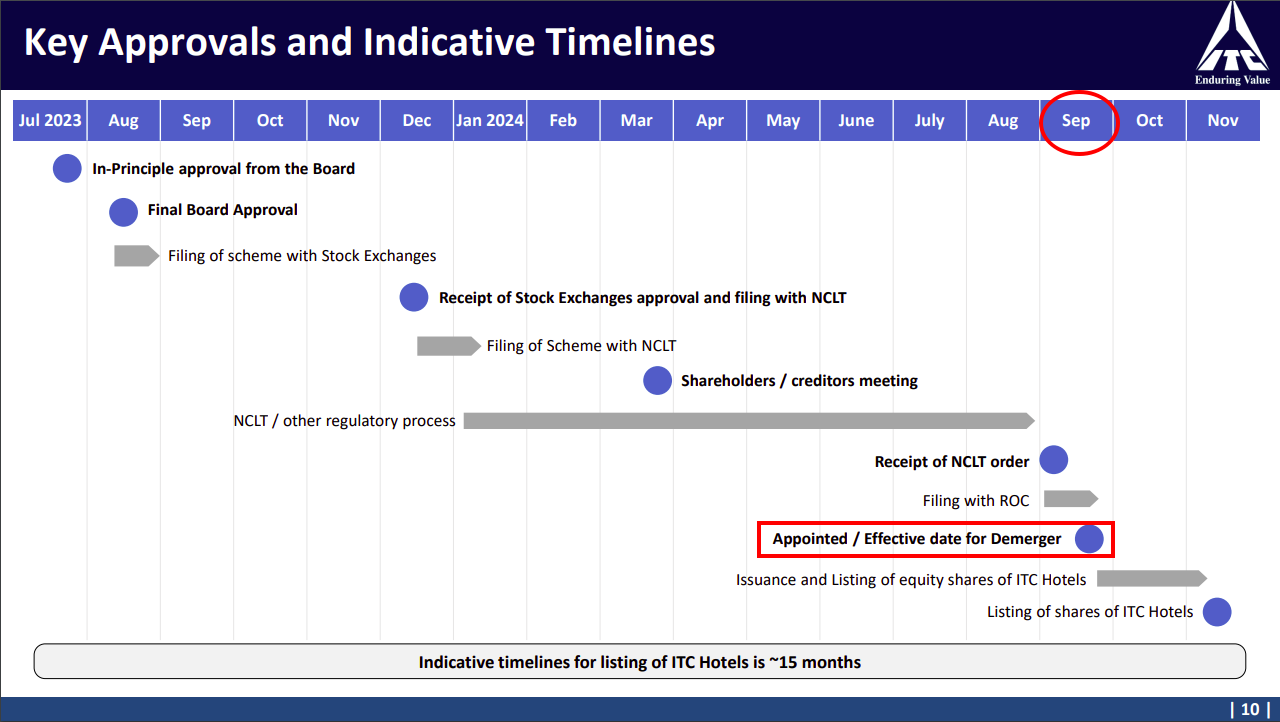

In July 2023, Board of Directors of ITC Ltd, approved of this demerger. And this was a mega event. Something that everyone was waiting for.

Source: Jagoinvestor, ITC Presentation

Following this news something else too changed. Let’s take a look.

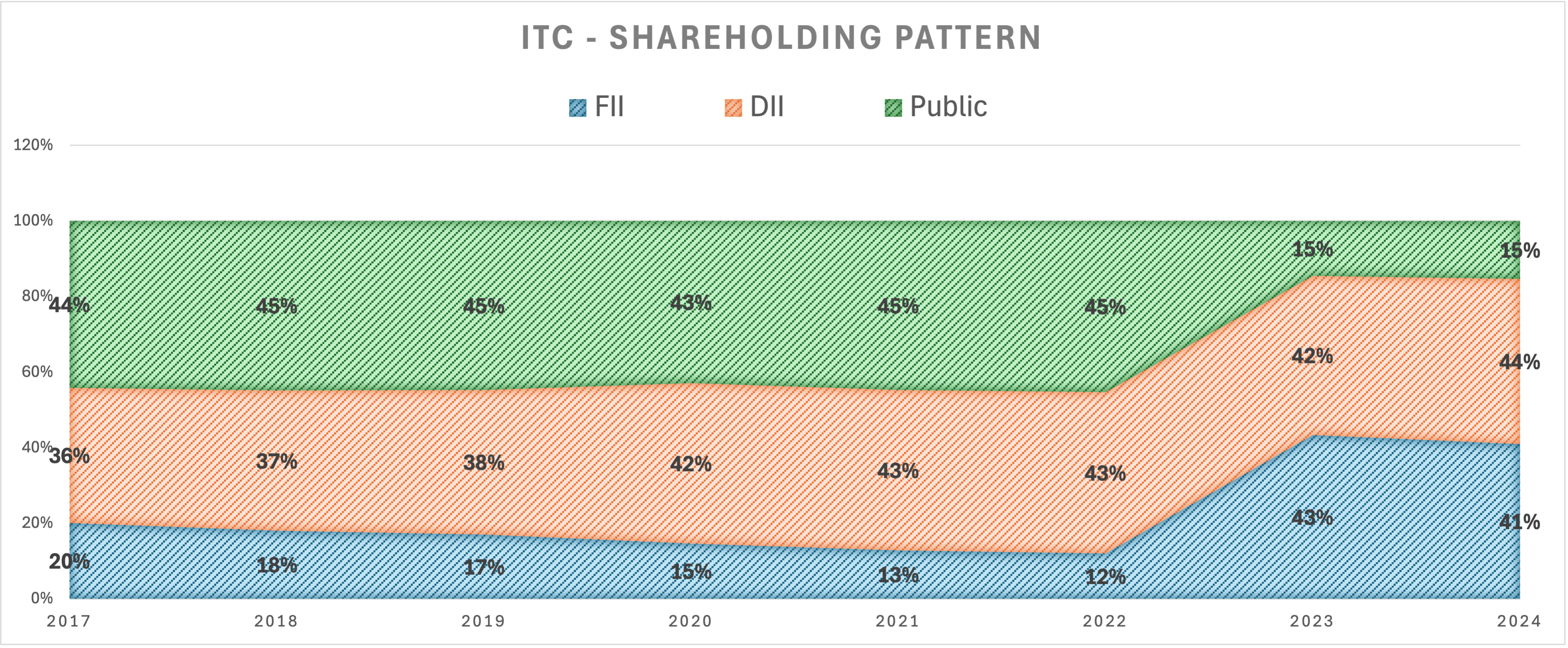

Foreign (FII) and Domestic (DII) Institutional Investors jumped at this opportunity. The stock began its movement after 7 years of stagnation.

It caused many retail investors to just sell the stock and exit. Because they were not tired and bored of holding this stock in their portfolio. For them, it was a permanent value trap. Hence, as soon as they got some good gain, they exited.

At this time, the Indian equity market was in the middle of a small and mid-cap boom. So retail investors were more interested in cashing that opportunity out and as a result their shareholding which was 45% before the announcement dropped to a mere 15%. While FII went up from 12% to 43%. DII largely remained the same.

The stock price jumped from Rs 200 to nearly touching Rs 500 in a matter of 2 years.

The reason why FII bought the stock is because Demerger unlocks Value.

ITC’s non-hotels business consists of Cigarettes, FMCG such as Ashirvaad Atta, etc., paper industry, agriculture and IT are tremendous cash generating machines. When they will be accounted for separately, they will dish out good profits that will benefit the shareholders over the long term.

Hotels business on the other hand will now be subjected to a litmus test of performance. So the management will now have to be very careful about how much money they are investing and to what extent they are making profits.

The real test for Hotels will begin now. While the other businesses will be free from having to carry the burden on their shoulders.

Conclusion

As retail shareholders, we often miss the point of demergers. Maybe because we don’t fully understand the kind of stock price return it can generate for us.

Plus, demergers are long drawn corporate actions that take a couple of years to fructify. In such a time, it’s our impatience that tends to get in the way. Something else is always going up and someone is always making more money. We just miss out on our portfolio that can compound massively.

As retail investors, we should always check for these special situations and look for an incremental institutional ownership. If that happens, they all we need to do is fasten our seat belts and enjoy the ride!

Jinay Savla, Jagoinvestor

January 14, 2025

January 14, 2025