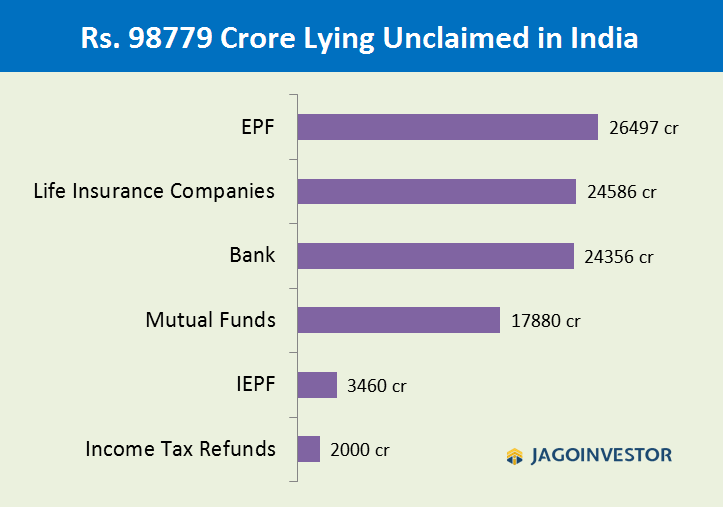

Rs 98,779 crore lying unclaimed in various accounts in India

Do you know that there is a possibility that your grandparents or someone else in the family might have some bank account or some policy that you are not aware of till today and the money is lying unclaimed for decades?

Yes, that can happen!!

Can you believe that a whopping Rs 98,779 crore is lying in various investment products in India like banks, EPF, PPF, Mutual funds, LIC, and many other entities!!

In the last 18 months, so many people lost their lives and their families had no idea of the investments made by them, or if they had any life insurance policy or not. A lot of them still don’t know and will never come to know probably.

What happens to that money? How will family members get access to them? How will they claim it?

They WON’T!

Here is the breakup of how much money is lying unclaimed at various places in India, have a look!

Let’s talk about these

Rs 24,356 in Banks

As per the RBI report, Rs 24356 crore is lying unclaimed in around 8.1 crore bank accounts as of December 31, 2020. This turns out to be close to Rs 3,000 on an average per bank account. The biggest share in this unclaimed money is in SBI bank and then other private sector banks.

Rs 26,497 crores in EPF

This is the amount of money lying unclaimed in EPF accounts across the country. Some of this money may be of those people, who have not withdrawn the money after changing or leaving jobs, but a bigger chunk is lying there for years and years and many of them may never be claimed as the families are not aware of these investments

Rs 17,880 crores in Mutual Funds

A big chunk of money is also lying in inactive folios which is close to Rs 17,880 crores. A lot of investors have invested in mutual funds in physical format decades back and many family members may not be aware of these investments after their demise. This unclaimed amount is close to a little less than 1% of the entire AUM of mutual funds.

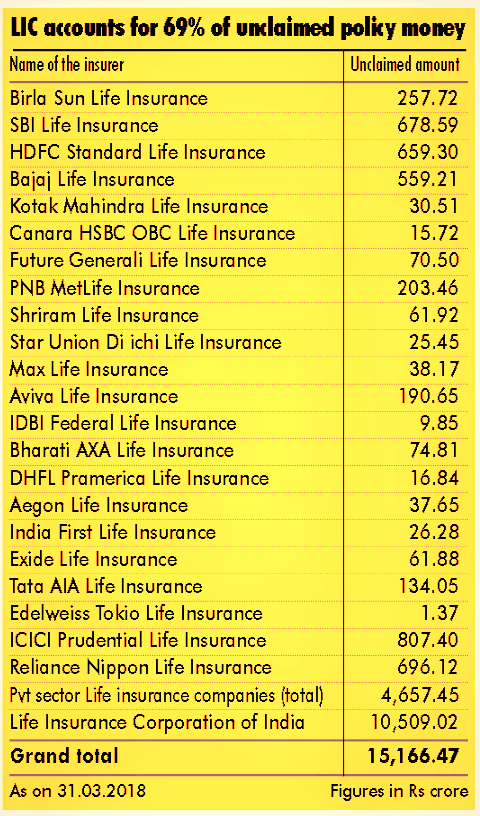

Rs 24,586 crore with Insurance Companies

LIC alone had close to 10,509 crores lying unclaimed with them as of Mar 31, 2018, and another 4,657 crore was with private insurance companies. The current figures as per IRDA is at a whopping 24,586 crore with all the insurance companies combined. Most of this is with LIC and you know there are so many policies that are never claimed after maturity due to various reasons.

Here is the old breakup of these amounts companies wise as per financial chronicle report

Rs 3,460 crores with IEPF

A big chunk of money is also lying with IEPF in form of unclaimed dividends and debentures etc., which were lying idle and no one, claimed them back on time. These amounts are transferred to something called IEPF after 7 yrs which is then used in things like investors’ awareness and protection of the interests of investors. Moneylife did an extensive story on this entire topic

Rs 2000 crore from Income Tax Refunds

As per a 2015 report by NDTV, close to Rs 2,000 crore of tax refunds were lying unclaimed with them. If a person pays the extra tax due to excess TDS deduction, one can claim the refund back by filing the returns (for the last 6 yrs). However many times investors are not even aware of these refunds or due to laziness, they don’t file the returns. Now the figures must be on the higher end.

Where does all this unclaimed money go?

The question is – If all this money is unclaimed, who exactly gets benefitted? Does the bank or insurance company keep all this money and just use it for their own benefit unless someone does not claim it back?

The answer to that is that govt has formed some of the FUNDS where these amounts shall get transferred after some number of years and that fund will be used for some purpose. Here are those funds

1. Senior Citizen Welfare Fund (SCWF)

All the unclaimed money from EPF, PPF, Insurance companies and postal deposits go to Senior Citizen Welfare Scheme which works for the betterment of senior citizens who are below poverty line in the country. I am really not clear which are the schemes or ways they do it.

2. Depositor Education and Awareness Fund (DEAF)

All the money which is lying claimed in the banks like saving bank account, fixed and recurring deposits, demand drafts etc. is transferred to this fund called DEAF and it’s used for depositor’s awareness and protection.. Which I really don’t understand what it means !

3. Investor Education Protection Fund Authority (IEPF)

IEPF is another fund which is created for investor protection and financial awareness and it gets all the unclaimed dividends, shares, matured unclaimed dividends etc. I have already written about how to claim refund from IEPF here

Make sure your money does not become part of unclaimed money in future

The learning from this is that you shall make sure that all your investments details etc. are shared with your family properly and they shall be aware of it.

August 3, 2021

August 3, 2021

Periodical updating of change of address with banks, post offices,employers etc will enable the survivors to get information about money saved with these establishments. Also the breadwinner should maintain a record of all his savings, assets and liabilities and update the spouse, adult children about these investments.this will to a great extent solve the problem of unclaimed money.

Great point

IT IS AN WONDERFUL ARTICLE TO READ, IN THE VERY NEXT DAY OF THIS ANNOUNCEMENT CAME IN THE NEWS, OUR FINANCE MINISTER SAID, IN THE MEDIA THAT, INDIAN CREDIT GUARANTEE CORPORATION IS THERE TO TAKE CARE OF THIS MONEY, THOUGH CGCI, INDIAN GOVERNMENT WILL ENSURE THAT, THE PEOPLE WHO HAVE INVESTED WILL GET THEIR QUANTUM, OR THEIR KIT AND KINS.

Link?

I cant find anything on this?

even if any of elders money are stuck in the funds stated by you , how to identify and claim the same.

You cant identify unless you have some info.. You need to have some thing like PAN , DOB or an identifier…

i still have many physical share certificates . i was told those cannot be converted to dmat now and hence are nothing bust waste paper . is it so. pl confirm . is there a way to get it converted to dmat on payament of any penalty ………………..

I dont think its true

Who told you this?

You can surely convert the shares in demat, the only requirement is that company shall be in active state.. Else what will you do even if its in demat?

Manish

IS THERE ANY WAY OR SITE OR SOMETHING LIKE THAT, WHICH MAKES IT POSSIBLE TO TRACE FORGOTTEN INVESTMENTS OF US AND OUR FAMILY ? AT LEAST ALL INVESTMENTS VIA PAN NUMBER BE MADE AVAILABLE, HOW ?

No .. nothing is that simple.

Banks give a list of all people who have old unclaimed amount on their site but just name and address is there

Manish

Good Information. Even today, I am unable to track the stock investment made via paper format 12 or 14 years ago. Even If I have the old document, not sure how to proceed to claim it 🙂

You didnt use PAN while buying them? YOu must be aware of the company atleast? You can mail the company to get this much info I guess.

Also if you have the documents with you, there are many advisors who will help you to remat back the stocks for a fee

Manish

Article missed one important aspect, over savings. People saves money even they don’t need that money or no one have to inherit that money.

So everyone should save amount which they need rather than than keep on working and saving till last breathe.

Thats an issue from a different angle 🙂

Some of this could be because people are denied withdrawal facility. I will give two examples:

1 – Banks. My wife (or her relatives) had created bank account for her when she was a child and had regularly put money in it. She told this to me after our marriage. So, when we went to her hometown to withdraw it, they asked for all sorts of proof that it is her and not someone else. It was bit difficult as she had changed name and didn’t have any ID with old name. The Bank manager happily told us that there are many such child accounts unclaimed because people cannot give ID proof and they migrate to other cities after marriage.

2 – EPF – After my retirement, I had sent application (through my employer) to get my EPF pension certificate. It took multiple back and forth communication over 3 years to finally get it. I do not know how many people have that stamina to fight so long. To be honest, I don’t know how much fight I have to go through to convert this certificate to real pension when I turn 56.

Thanks for sharing this Bhushan.. I agree that complex claim process makes it tough to claim things

However in the 1st example you gave, I think its not really the bank issue. What they are saying is really a cause of concern. If someone cant prove that its their account, they shall not be able to get it.. Otherwise so many frauds will start happening

I will say that its investor who has to think a little ahead and keep all the proofs at old PAN or some proof which can establish the relationship

Manish