List of Different Asset Classes for Investing

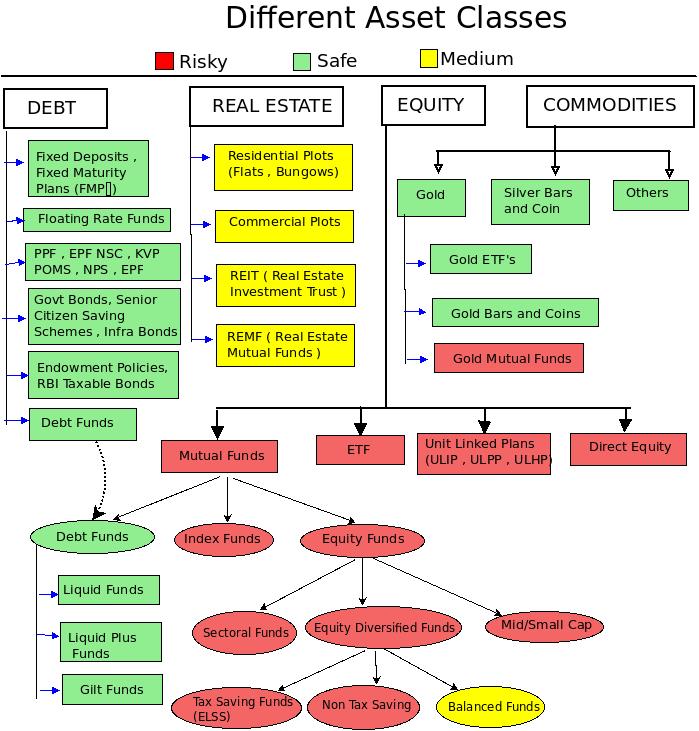

Below is the list of different Asset classes one can consider for investing in Indian markets. For building a successful balanced portfolio one has to understand different asset classes and as per their risk appetite, one has to build his/her portfolio so that it’s optimal from his risk return point of view. In this post you will look at different asset classes and their sub categories with the risk potential. This is not an exhaustive list of categories, however it covers most of them. See the Chart Below

[ad#big-banner]

Readers who are reading it in Email can see the chart here or visit blog article

Points to Remember

- The above chart does not contain exhaustive list of products and asset classes. See What is Asset Allocation

- REIT and REMF are yet to come to India, they are not there in market yet

- Mutual funds classification is not complete. There are different ways to classify mutual funds, the one I have shown is one of the way. Here is the list if good Equity Funds and Debt oriented Mutual funds

Comments! I am sure I missed out somethings in this chart, please suggest me something I can add.

January 14, 2010

January 14, 2010

Manish,

http://jagoinvestor.dev.diginnovators.site/2008/04/gold-as-investment.html link is broken

Please fix it

Good work, will be nice if you could also include Nifty Linked Debentures (Structured Products) and Portfolio Management Services (PMS) as a part of this pictorial diagram.

ashokan

thanks for suggestions 🙂 . I think that would be little more on higher side. Lets keep a list of more widely used things .

Manish

Hi Manish..

really nice effort..

the best thing about ut posts/advice/columns is that they always have an India focus and a practical approach for the common investors. Great going..

BTW, i ve been reading for the last 2-3 months, but could understand most of the instruments..speaks a lot about ur simple and practical explanations..

thanks

Rahul

thanks for your comment .

Manish

Thanks for helping us lot.We will get much benifit by using ur own idea as an expert view.

Pallavi

Nice to know that you are ready to plan things on your own . thats good . Let me know if there is any thing required .

Manish

Hi Manish,

nice to see very informative chart. i need to save 1 lac in next 6-7 months for House. Could you pls tell me where should i invest of 15k montly to get good return with moderate risk.

I am thinking of top debt MF to invest? Please advise.Thank you.

Prashant

You should not expect lots of return as the time frame is just 6-7 months . I would say anything which is very liquid and less risky should suit you .. Debt funds is good idea .

See the list of debt funds I have mentioned .

Manish

Manish,

Don’t you think commodities also shd be in yellow with Real Estate.

Reg’s

Rahul

Looks like you are considering “Commodities” as “commodity trading” . thats not the case . we are considering investment options like GOLD , Silver etc only and that too for long term , and in that case they have proved to be safer investments .

Am i Correct ?

Manish

HI Manish,

Another one more excellent informative article from you. Thank you very much for that.

These days I used to heard about “ETF-Gold Funds/Investments”. If you could put some light on that topic or share some resources that would be great.

Thank Again.

Rajesh

Rajesh

nice to hear from you in the first comment . Keep commenting 🙂

ETF are the new type of instrument which are very effective and should be used by everyone . they are popular in US but gaining popularity in India now , see : http://jagoinvestor.dev.diginnovators.site/2008/08/what-are-etfs-etfs-are-basket-of.html

Gold Funds are mutual funds which invest in gold mining companies , Its different then investing in GOLD : http://jagoinvestor.dev.diginnovators.site/2008/09/gold-funds-what-are-alternatives-to.html

We also have GOLD ETF’s as investment option in GOLD .

Manish

Thanks Manish for sharing these links which are very much informative.

Rajesh

You can invest in Gold ETF’s using your Demat account only . Make sure you have a demat account if you want to invest .

Manish

Okay. Got it 🙂

Hi manish,

Very nice chart, but what is reason of gold coming under category of “Safe”?

Marshal

Marshal

We have considerd all the investment from historical return point of view . Generally people buy GOLD for long term and gold is considered safe from that point . Dont look at the returns from last 4-5 yrs .

manish

it should branch from under Mutual funds. Ofcourse they would be debt as well as equity under the category. Index funds shouls be under Mfs,

Sunil

Index funds are already under MF .

Manish

hi manish

can i purchase foreign mutual funds, if yes ..then how. please elaborate

I am not sure on this . Will check out

Manish

Maybe to the Mutual funds u can sub categorize as Indian and foreign also.

Sunil

But that would be a different kind of classification . Can you tell me where should I branch that out from ?

Manish

Manish,

Excellent overview of the complete list of investment avenues. Amazing as usual your articles. Hope you will be writing dedicated articles on few asset classes in the list which are not more familiar to us.

Regards, Mahesh

Mahesh

Thanks a lot . Which one of those you dont understand ? let me know

Manish

Hi Manish,

I am holding NRI status. Looking forward to invest some amount in bonds issued by GOI with locking period more than 3 years. Can you help in sharing the list of bonds issued by GOI for which NRIs are elegible ?

And what should be the procedure for this investment.

Thanks a lot in advance, Mahesh

Mahesh

https://secure.icicidirect.com/trading/rrb/RRB_FAQ.asp#a2

Manish

Hi,

If I may, I would like to mention something. under equity head, Mutual funds and direct equities are depicted with same level of risk. I think we need to differentiate between these 2 (probably with different shades of same color). This would further justify your post about risk level in different asset classes.

These are my 2 cents of course.

Thanks

Anand

Anand

I accept that you are correct. I thought about this my self but then we have to include lot of shades for different funds because all the invesment options have different risk return profile . So what i did was categorise them with very broad categories .

Manish

Hi Manish, Where and how can I get gold ETFs? What is the minimum investment?is it like SIP(means monthly or yearly)?

.-= Mukul´s last blog ..Decade recap =-.

Mukul

You can trade in Gold ETF from your demat account only . Minimum amount is mostly 1 gm of gold price because 1 unit if that much priced . We dont have SIP in that. you have to do it monthly .

manish

Thank you for such a nice details 🙂

Balbir

Thanks for the comment . Did you see any new product on the chart which you were not aware of ?

Do you have idea about REIT and REMF ?

Manish

This is an excellent diagram i can say, Thanks for this, I am regular visitors of your blog and really enjoy reading your article.

Thanks Dhiraj

Nice to hear from you for the first time in comments . How old reader are you ?

Do you understand all the product discussed on the charts ?

Manish

I am just a 7 month old reader but swear I didn’t miss a single post….

As far as product is concern I understand the most of the product but one more help needed from you that if you elaborate Debt fund & Index fund little more with an examples.

Thanks

Dear Manish,

Nice List for investments in Indian market. I think you included all corners of the investment world.

Thanks for sharing.

.-= khalid´s last blog ..Infosys Q3 FY10 : Net up 2.8% =-.

Thanks Khalid

Do you have any other things to add ? Do you think Derivatives (futures and options) should be added here from retail investors point of view ?

Manish

I have provided some thoughts on asset allocation on my website:

It also has a blog on industry trends

Thanks for the Links 🙂

What are your views on portfolio rebalancing ?

Manish

Dear Manish

I have already made portfolio rebalancing – Calculation Excel Sheet ……if you interested pl write…

Pl note my e-mail Id :

[email protected]

[email protected]

Nikhil Shah

NIkhil

send me the excel ..

Manish

hi nikhil

please send ur excel sheet to my id:

[email protected]

thanx

Dear Manish

WOW …Excellent diagrom. Can you add the following products in the diagrom

1). Whole Life Insurance policies …

2). Govt.Bonds / RBI Taxable Bonds..

3). Deep Discount Bonds / Fixed Deposit..

all above mentioned items Should include In Debt Part Only…

Good Job…

Nikhil

Nikhil

Thanks for suggestions .

1. Lets consider it as Endowment policies only .

2. I have added “RBI Taxable Bonds”

3. FD was already there .

Can you throw some light on “Deep discount bonds” ? What are they ?

Manish

Dear Manish,

Here I am sending some basic information about Deep Discount Bonds…

Typically, a deep-discount bond will have a market price of 20% or more below its face value. These bonds are perceived to be riskier than similar bonds and are thus priced accordingly.

These low-coupon bonds are typically long term and issued with call provisions. Investors are attracted to these discounted bonds because of their high return or minimal chance of being called before maturity.

I am also sending URL

http://www.raagvamdatt.com/Understanding-Deep-Discount-Bonds/229/

Thanks

Nikhil Shah

Thanks Nikhil

As we are mainly discussing Indian markets . Do we have or plans to have deep discount funds in india ? Do you know of any such fund ?

Manish

Dear Manish

I have invested for my son in ICICI Bank – Deep discount bond for a long term period …This bonds are tradeable in nse – Debt market…with thin volume..it should be invested in to vary financially sound companies only…At present this plans is not available….may come in future..

Nikhil

Nikhil

can we buy those deep discount bonds through Demat account as its tradable ?

Manish

Manish

Yes ..You can buy those deep discount bonds through Demat account as its tradable From NSE Or BSE Stock Exchange…Debt Market module…

Nikhil

Ok . let me try that .. I mean i have ICICI demat ,

Manish

My first impression on seeing the chart was WOW! A well thought off thing.

I guess it covers most of assets for common man.

You can have a miscellaneous High risk category which would have Forex, Structured Products etc. which are usually invested in by HNI.

As far as Silver is concerned I think its going to give better returns than gold because gold to me seems already overbought commodity while we are still to see ETFs & other such convenient products for Silver. Moreover Silver has a lot more industrial use than Gold.

.-= Amit Kumar´s last blog ..How to keep track of Mutual Fund Investments? =-.

Amit

Thanks for the wonderful comment and your views on Silver . I never knew that Silver has so much to offer from Industrial point .

Regarding Forex and Structured products . I am not sure how much will it be understood by common man . Even I dont understand structured products 🙂 . Most of the items on charts are common man products which they can invest in and even heard about at some point in time (not all , but most of them) . I would appreciate if you can talk more about how retail participation can happen in Forex and Structured products ?

and by the way , Silver ETF’s was something I heard last year . I guess it will be coming soon 🙂

Manish

Yeh there were talks of launching Silver ETF by Benchmark MF, but I don’t know why its delayed. About structured products last year ICICI Pru came with debt investment option – SMART Fund – whose returns were linked to NIFTY performance, but I am not sure how was it received by Retail Investors. You can find some details about the same here – http://www.moneycontrol.com/news/mf-interview/will-icici-pru-smart-fund-appeal-to-retail-investors_353397.html

But then its a complex thing!

.-= Amit Kumar´s last blog ..Invest Rs 63,000 and save full Income Tax on Rs 1,00,000 under Sec 80C! =-.

NIce link . let me see if I can write something on that front sometime 🙂

Manish