CRED App Review – Earn rewards on paying credit card bill

Today I want to do the review of the CRED app. I have been using it for the last 12 months already.

CRED is an app, which gives you rewards on timely payments of your credit card payment. If you are not using this app, you may be making credit card payments anyways by other online methods. All you have to do is to make payments using the CRED app, that’s all.

It’s that simple to use!

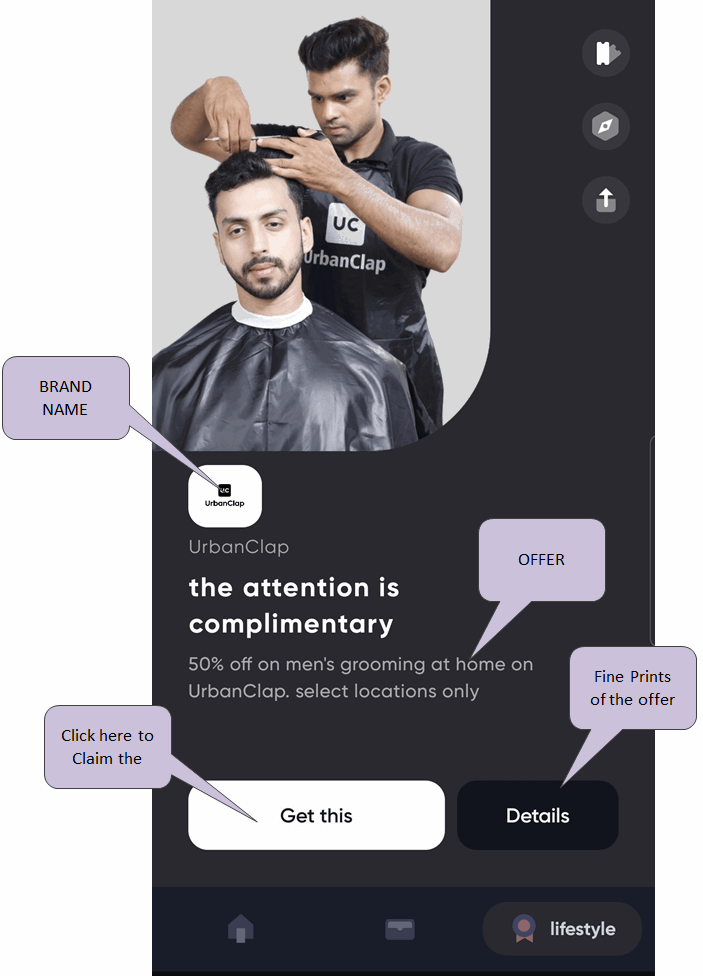

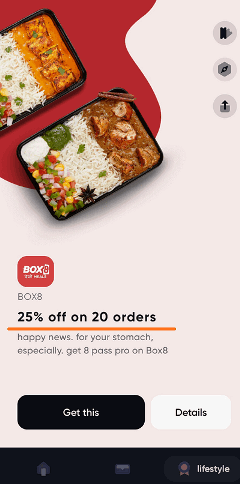

There are various brand offers and coupons from categories like dining out, food delivery apps, flight tickets, and even shopping? Here is one instance.

We get different kinds of rewards for using or raising the credit card bill amount. Like, in my case, I have a PVR credit card of Kotak bank, for every Rs. 15,000 credit card bill, I get points to redeem against 2 PVR tickets (max. Rs. 400 for 1 ticket). Because of this, I get influenced to pay my bills mostly by credit card to reach Rs.15,000 of a bill every month.

Here is how an offer looks like

This is how banks influence us to use a credit cards. But, when we pay bills of credit cards we never get any discount or reward on that amount?

However, now it is possible with the help of the CRED app. This app gives you rewards for paying your credit card dues via this app.

What is CRED App?

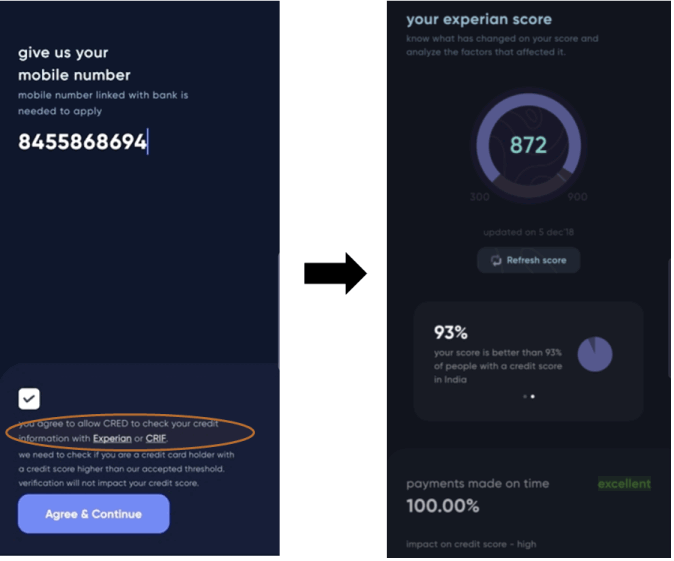

CRED is an app on which you add your multiple credit cards and make payments by the app itself, which gets credited to your bank in few hours. The app is exclusively for those people who have a good credit score (checked automatically from Experian or CRIF) and have some history of credit card payment. This is checked when you register for the app for the first time.

It is also equipped with the cred to protect feature which is an AI (Artificial Intelligence) backed system, that keeps track of every single nuance of a credit card payment journey – right from due date reminders, spending patterns and other card usage statistics.

There are two things you can earn on CRED App

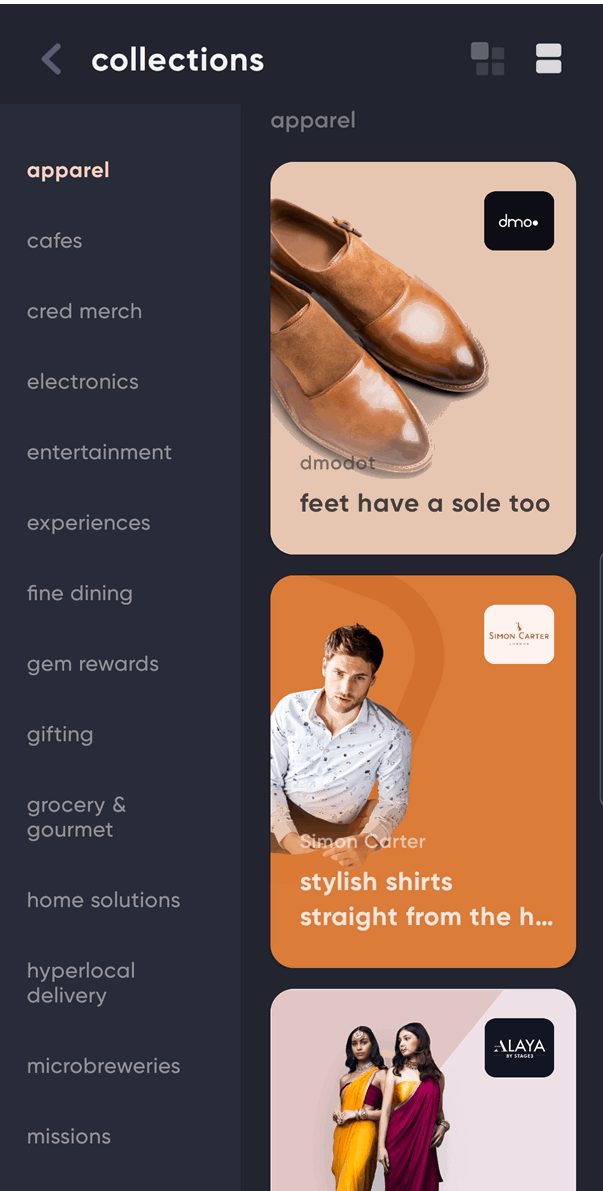

Coins – You will earn coins equivalent to your credit card bill amount every time you pay the credit card bill. So if you pay the credit card bill of Rs 40,000, you will get 40,000 coins. The coins will keep accumulating month after month. So you can keep collecting coins and later redeem it in any manner. There are some offers and benefits which requires a very large amount of coins, so it’s beneficial to collect lots of coins. I currently have around 3,50,000+ coins in my own account.

Gems – You can also earn “gems” in the CRED app. These are different kinds of currency that are required by some offers. Right now one earns 10 gems on each referral. So if your referral signs up on the CRED app, then you will earn 10 gems. If you like Jagoinvestor, please help us earn some coins by registering on the CRED app using this link.

Here is a sample of some of the offers on the CRED app

- iXigo flight bookings – Rs. 1000 off on using 5,000 coins

- Flo Mattress – Rs. 5,000 off on using 20,000 coins

- Swiggy – Free delivery for 3 months on using 5000 coins

- UrbanClap – Flat 50% off on man grooming using 25000 coins

- Flea Bazaar cafe – Flat 20% off on total bill using 5000 coins

- Cashback – Get Rs 1,000 cashback for 30 gems

- Flipkart – Rs 500 gift card for 20 gems

There are various kinds of coupons and offers available under the CRED app under different categories. Depending on what offer you want, you can go into that category and explore the offers available in your city.

3 steps to register for CRED App

You can avail of the benefits of this app only if you meet the eligibility criteria defined by the app. Which is – to have a good credit score. Following is the step-by-step process for this –

Step 1 – Download the Cred App from here

Step 2 – Register to cred using your phone number

- Login to cred using your name and phone number registered with a credit card.

- The app will prompt you to grant permission for phone access to verify the number and SMS (which is needed to send a reminder on your due credit card bills), just grant the permissions.

- Cred will process this data and check your eligibility, on the basis of your credit history. Cred has a tie-up with credit bureaus like Experian and CRIF.

- If your credit score meets the standards of cred then you will receive an OTP to proceed further

If your membership is rejected, improve your credit score and apply after a few months again. It may also happen that you are using multiple mobile numbers for banking, so try again using another number. So, if you have just got your credit card some weeks back, please wait for a couple of months before you apply.

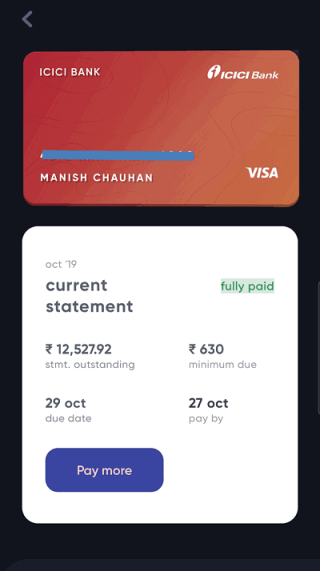

Step 3 – Add your credit cards

Once registration is successful on the CRED app home page all your Credit Cards would be displayed. You just need to verify these cards by entering the last 4 digits of the card. To ensure the active status of these cards, cred will instantly deposit Rs. 1 to each of the cards.

You will not be asked to enter an expiry date or CVV of your cards which ensures the safety of this app.

Once successfully getting your card verified, you can exclusively earn rewards and scratch cards on every bill payment. Master card, American Express, Diners Club, and VISA cards are presently being handled by the CRED app.

5 benefits you get in the CRED app

Coming to the main point of getting rewards and benefits from the CRED app, below are the following things

- Cashbacks on paying bills

- Discounts

- Free gifts and offers

- Spending Analysis

- Credit Score tracking

Let’s look at each of them

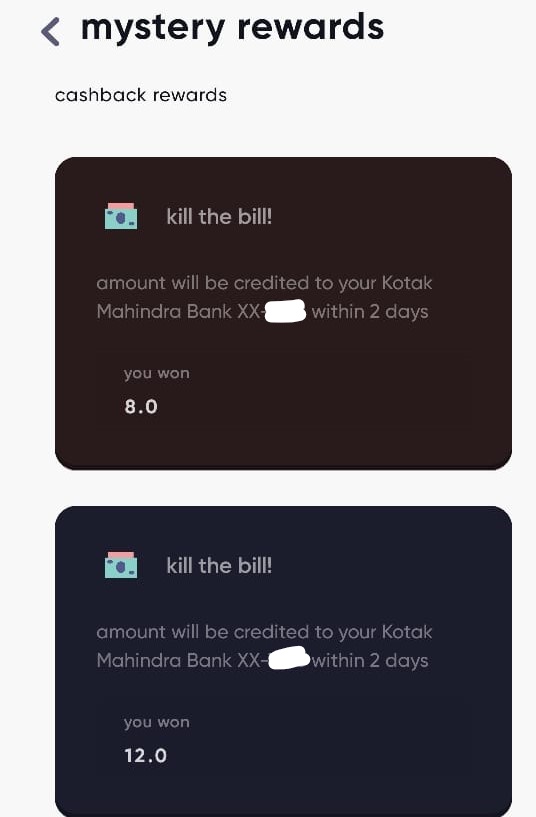

Benefit #1 – Cashback on paying bills

You may earn cash back (all called #killthebill) on every transaction. At the time of payment of more than Rs. 1000, you may be notified that you have won a scratch card and you might earn some amount which will be credited back to your credit card.

Benefit #2 – Discount Offers

Now, this is the major part of the benefits. CRED app has associated with various brands and it offers you some discount (cash discount or percentage discount) when spending a particular amount.

For example one of the offers is a “20% discount on the next 20 orders from BOX8”, so you can see that you will get 20% on the Box8 for a long time, but you still have to pay the rest amount. So even if you are getting a discount, you need to SPEND on it. So these discount offers are truly good only when you are anyways going to spend money on these brands.

Sometimes, it may happen that these offers also give you a chance to experience things which you might not have done without a discount, so technically it’s beneficial in that manner, but still, spending has to be done.

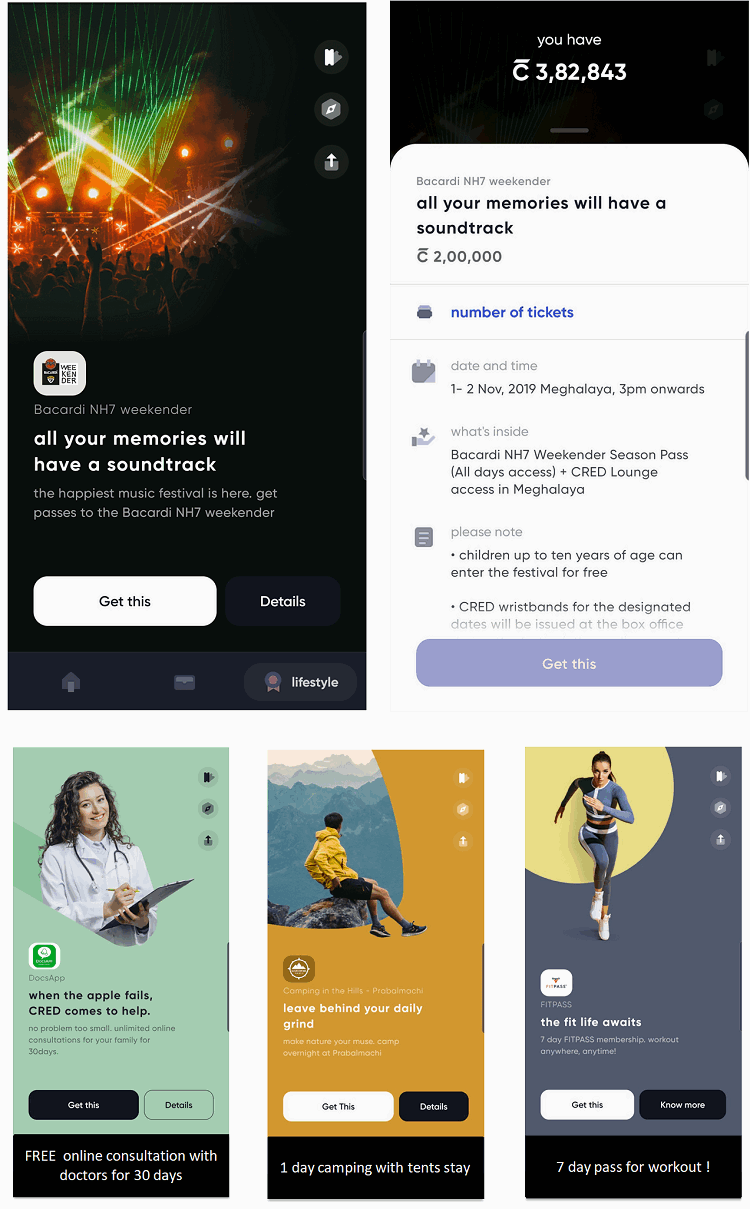

Benefit #3 – Free Gifts and benefits

There are some rewards that are truly free for you by burning some coins or gems. You don’t have to pay anything to get the benefits. These I personally think are the real benefits in a way, because you are not spending anything out of pocket, but just availing an offer.

Below you can see an example, where you can burn 2,00,000 coins and get a pass for 2 people Bacardi NH7 weekender event and even lounge access. Apart from that, I have shown 3 more offers for complimentary benefits without paying any extra from your own pocket.

So you can keep collecting the coins and wait for the right offer or reward to arrive which is useful for you.

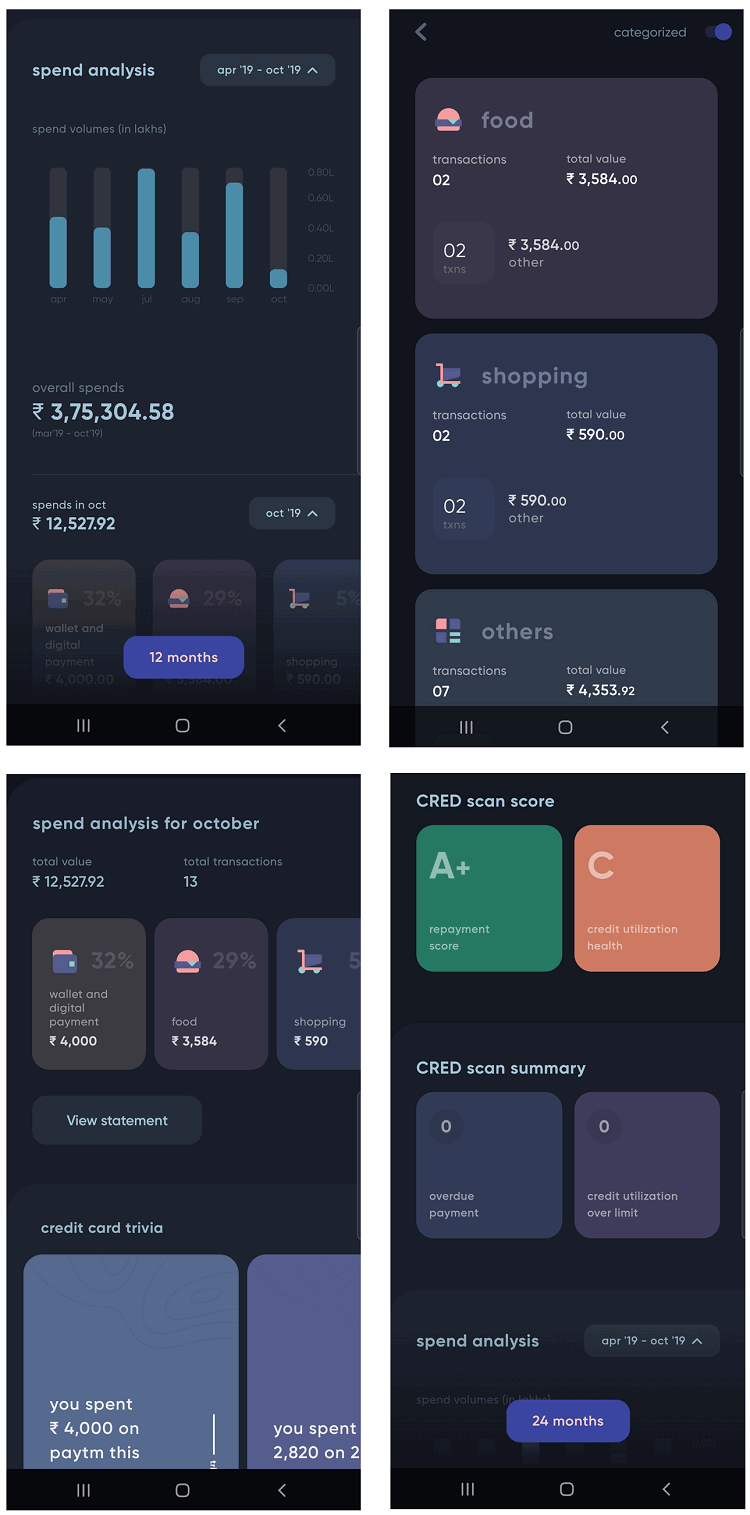

Benefit #4 – Spending Analysis

One small benefit of the CRED app is that you get some insights into your spending pattern and the history of your credit card payments in one single place. This is good for those who have multiple credit cards and want some visibility on how their spending is happening.

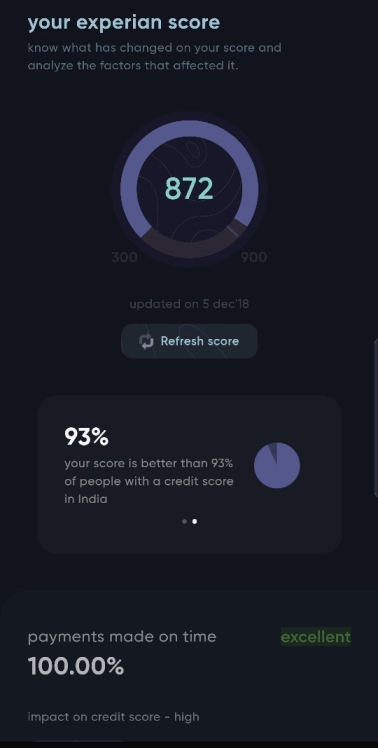

Benefit #5 – Credit Score Tracking

CRED app will keep showing your credit score from time to time, so this will help you to stay motivated to make timely credit card payments and you can also keep a track of how your credit score is moving over time. Right now CRED has done a tie-up with Experian and CRIF and pulls your credit score from both places.

How to make payment in the Cred app?

Paying credit card bills via the CRED app is very easy, just click on pay now, enter the amount and click proceed. Nowadays the bill amount along with the minimum due amount automatically gets pre-populated. You can make payment via debit card/net banking (NEFT/IMPS) or UPI. It may take some time to reflect on the money credited to your credit card account.

On Completion of Bill Payment of your Credit Card, you will be rewarded with CRED Coins and Kill Bill Scratch Card which you will have to redeem.

Is the CRED app safe?

I am sure that you must be having this question about the safety of this app because you are putting your credit card details and authorizing the app with all details.

First, this is this app is founded by Kunal Shah, the person who started Freecharge and the startup is heavily funded. The past record of the founder is intact so you can trust the company.

Next point is that the CRED app never asks you to provide the date of expiry or CVV on your credit cards, hence you are not giving any critical information to this app.

Then, you should know that when you install any other app, those apps also get various permissions like reading your SMS, making calls on your behalf, tracking your activity etc, and this app is nothing different from others.

If you want, you can deny access to emails and messages then you won’t be able to receive a notification on due dates and also you won’t get any expense analysis.

Nothing is FREE in this world

While it feels great to get great offers and benefits and freebies, remember that nothing is FREE in this world. Behind everything which looks amazing, there is a business model and the reason why you get those free rewards and offers.

You should be aware that CRED or any other coupon company does various tie-ups and associations with brands and companies and acts as a lead generation company. You are nothing but a lead to some other company and CRED is helping in growing sales for the other party.

They will mostly get something back in return and that’s the business model. Nothing wrong with it, but you as an investor should be aware of what you are getting into.

The discounts and awesome benefits you get from CRED or any other similar app are basically tempting you to spend on the pretext of a “great deal”. If you spend on something which you originally did not intend to buy then it’s an extra expense for you at the end of the day. The coupons are pure rewards only when you were anyways going to spend on something and if you get an additional discount on the deal.

So, we need to be conscious while spending and getting discounts by using CRED coins, it should not happen that you are spending on some unwanted stuff to just redeem Cred coins.

Let’s take my example, I attended two live concerts in Pune, VIP pass of Rs. 5,000 each. No doubt I just paid Rs. 4,000 (Rs. 2,000 each) instead of paying Rs. 10,000. But, if this reward would not be in the pictures so, I would have never gone to that concert and saved Rs. 4,000.

Download the Cred App from here

Who should use this app?

The app is more suitable for the below-given categories of credit card users –

- High credit card bill payers

- People living in metro cities/tier 1 or 2 cities (most of the rewards are dining out or live concerts)

- People who pay credit card bills before the due date (no reward on late payments)

Do let us know if you have any comments or questions regarding the app?

October 14, 2019

October 14, 2019

Cred Customer Care Number 835OO77O1O

Payment service is available using apps

Credit card bill payment send money rent payment

Another fraud tech start-up with loads of funds to steal our data and read profits in future. Disgusting! Avoid such frauds! Stealing data to make money is not a sustainable business model. People are frustrated globally even with Google GB and others where YOU are the revenue source. Spending millions advertising to get some gullible customers is not sustainable. Avoid at all costs. Even this article is part of the marketing strategy. Avoid Investors! Jago Jago Gadhedo

I have just started to use this app and i have done couple of transactions..It is awesome..i have to say it..i would strongly recommend this app to everyone

Thanks for sharing

Am using this app from few months, recently i met with issue with payment. While i was paying credit card bill through UPI app, transaction was successes but not added my RBL Credit Card dated 05-02-2020 lots of email send but I do not know where is my money.

Hello Mr. Sahim,

You can contact the customer care of Cred, they can tell you what is the problem. In the meantime, you can also and meet the concerned person of your bank and ask them as well.

Thank You

Anuradha

Am using this app from few months, recently i met with issue with payment. While i was paying credit card bill through UPI app, transaction was not successes but fund debited from my bank accounts.

What i have to do, is that amount credited to my bank account or credit account.

What will be credit card bill pay time.

It will come back.. issues like these happens all the time for various apps.. Nothing to worry !

I have been using this app from last one year and all i can say is “go for it” !

Thanks

The app gets access to money free of interest for 48 hours. Uses it. Makes gokd profit and gives you peanuts in name of fraudulent offers. If you pay on time, it could always delay payment for more than 2 days with zero accountability. Penal action for delayed payment by CC is on your account including risk of damaging your credit ratings. All CCs provide UPIs for payment. Cred is just adding one more later with zero value addition. Most offers available on Cred are otherwise available or are exclusive only on app embedded link. In short you can avoid this app if you don’t want your personal financial information going out for sale with zero accountability.

Thanks for your views Ankit on this app..

what if payment done through netbanking and status shows successful and not credited in credit card account. and they are not willing to help by throwing ball in the bank court by giving utr no. worst service in case of payment stuck…..

Hi Ashutosh,

Cred app is tried and trusted credit card payment facility, so I don’t feel this type of extreme scene can happen.

Vandana

Nowadays CRED is not giving Killthebill for all transactions and they set upper limit for this. Does any one knows what is the criteria to get the Killthebill?

I saw that few days back and also redeemed it for a small amount. But I don’t have details !

Such a post on Jagoinvestor?

Hi Venki

Whats the problem in this article? Its about informing about an app which has now a days become an integral part of investors life. Every other investor has started using it and it has many benefits.

Can you share why you feel it should not be on this website. We want to cover all kind of concepts, products, topics related to personal finance here. As far as the content is valuable to some section in any way, we can do it .

Manish

Thanks Manish for the article. I installed this app a referral but didn’t know how to use it .

Just register your number and credit card and make account .. then start paying your credit card bills from there

Manish

I have heard that we should not always check the credit score. That reduces your credit score in return. So how does this app gets our credit score? Is it a good thing to constantly check your credit score?

Hello Harsh, there is no harm in checking your credit score. You can do it whenever you want, be rest assured your credit score will not decrease.

Thank You

Anuradha

Hi Manish,

the link gives is only available for IOS devices.

AL

Hello, If you click the link from your android phone then you will be able to register. Please click the link from your android phone.

Thank You

Anuradha

Manish, Is this a paid (or any other benefit) advertisment article OR a genuine review?

Its a genuine review Harshdeep. Why do you get a feeling that it is a PAID review? Note that we get almost daily requests for paid posts and sponsored posts with a link back, but we do not do biased reviews.

We do very less reviews and only for the things which are of any use to investors and also which is something we can use in day to day life or in short, something which is really worth writing about.

The only small benefit which I am trying to extract is to provide my personal referral link in the article, so that if someone registers from the link, I can earn some gems. The screenshots you see in the article are from my personal CRED account and 1-2 screenshots are my teammate accounts screenshot.

Also, I don’t know if you have read the whole article till end. I have also talked about CRED business model and how it tempts you to spend and you need to be careful about it. Here is a snapshot below of what I have written in the article

—

The disounts and awesome benefits you get from CRED or any other similar app is basically tempting you to spend on the pretext of “great deal”. If you spend on something which you originally did not intend to buy then its an extra expense for you at the end of the day. The coupons are pure rewards only when you were anyways going to spend on something and if you get additional discount of deal.

So, we need to be conscious while spending and getting discounts by using CRED coins, it should not happen that you are spending on some unwanted stuff to just redeem Cred coins.

—

I really wonder if any company would love to pay to someone who is also critical towards the end of their product and gives a message like that.

I am not saying that paid posts or sponsored posts should be done or not. At times, they might make sense and also act as a revenue model for bloggers. But as of now we have never done it and don’t feel we will do it in near future at least.

Thanks for asking and sharing your concern. I hope I was able to answer

Manish

I was ok with Paying through the CRED app, spending analysis (which is basicaly giving data to them for mining), however, the app also asks me to give GMAIL permissions for it to automatically get the credit statement. Nope. Sorry. They may start mining the whole email account data, who knows!

Yes, that may happen provided you are giving the access. However you can always forward the credit card statement to a dummy account and just give access to that dummy account. Should work I guess!

Manish

Cred is asking for your credit score which I’m not comfortable with. I’ve had a dispute with Freecharge over a payment refund and they never choose to respond and rectify it, worst customer support. My request to delete my account with them was also not responded back. I’d stay away from both companies, more so due to the reasons mentioned under “Nothing is FREE in this world”. Your personal data would be used and sold to third parties and in a way you are giving consent towards it.

Well, that’s always the possibility. and that’s why we are getting all those awesome deals .. the customer is the PRODUCT when one does not pay..

If you are not comfortable, then please do not install it. I think that’s the right thing so do !

Is it safe or not.?

Hello Ms. Rim, Yes this app is safe due to the following reasons –

1)The founder of this app is Kunal Shah, who also started Freecharge. This startup is heavily funded. The past record of the founder is intact so you can trust the company.

2) The CRED app never asks you to provide the date of expiry or CVV on your credit cards, hence you are not giving any critical information to this app.

3) You must be knowing that when you install any other app, those apps also seek your permissions on various things like reading your SMS, making calls on your behalf, tracking your activity etc, and this app is nothing different than others.

4) If you want, you can deny access to emails and messages then you won’t be able to receive any notification on due dates and also you won’t get any expense analysis.

I hope you got answer to your query. If you still have any confusion, please get back to us.

Thank You

Anuradha

How long does it take to credited the payment towards the due account after making payment through cred app

When I made last payment for myself on CRED, it happened in 1 hour . But always take 2-3 days in consideration

I think apps like this only incentivize people to spend more. Many banks offer rewards like this for using their credit card but in the end, they are all just discounts/gift vouchers on restaurants, bars, concerts, giant retail chains etc. Most of the time I would have never spent money at those places but I went ahead and did just that to avail of the discounts or gift vouchers. The gift vouchers are also of low amount and you can rarely buy anything with just that amount. So more often than not, you have to add some money of your own to complete the purchase and therein lies the great trick.

These are new tricks which businesses are using to make you spend more. The discounts don’t really affect them since their products are already overpriced to begin with. My point is that one should be very careful with these offers as they lure you into the trap of consumerism. If you wish to live the simple and frugal life, it’s best to not get distracted by these offers.

Right point ..

But incase of CRED, there are many offers where you no not pay anything, you just redeem points and get some benefit ..

Also, as I said, someone who can not control their temptation, for them these apps will work in negative way. But at times, when you want to anyways buy something and if some coupon is available, you can surely use it.

So I think one can decide how they want to exploit the apps benefits by controlling themselves.

Manish