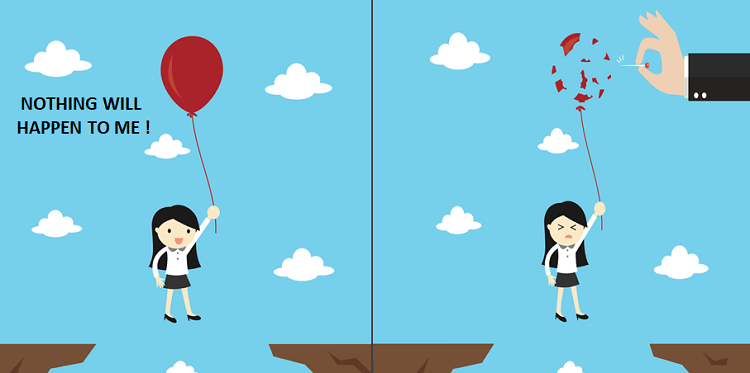

Not buying (or delaying) Term Insurance because of over-confidence

There are many investors who do not buy (or delay) term insurance plan, because they feel that nothing will happen to them.

- Some feel they can’t die due to illness, because they take care of their health.

- Some feel they will never die in an accident, because they drive their vehicles carefully.

- Some feel they will never die, because they eat healthy.

- Some feel they will not die because they keep an eye around them for all the risks.

I don’t know why people feel that they are “special” and bad things happen in only other’s life.

Do you think that those people who die suddenly because of some reason, were not confident that it will not happen to them in unexpected manner? “Accidents” are called accidents because they are unplanned and out of your control. So thinking that nothing will happen to you accidently itself is technically wrong thinking.

No one plans their death or any major accident. Life is so uncertain and external risks are so huge that statistically a certain percentage of people will die a sudden death due to various reasons.

That’s the sad truth of life.

Let me tell you two real life incidents where someone I knew personally died in an unexpected manner!

- 20 years back, we got a sad news one day that one of our relative died while taking bath. How? He suffered sudden brain hemorrhage and died. He was lying down on floor, when family broke the door. Do you think the guy in question ever thought that this can happen to him?

- 6 yrs back, someone I knew personally died because he got sucked into a daldal (mud puddle). He never realized that he is getting there as he was moving casually into that region and in no time he was stuck. He was there for taking a picture of his wife from distance & he got sucked in slowly while he was crying for help. Who can imagine or guess if something like that can ever happen?

At some point in our life, we all get casual and do things which have high risk. If we don’t do it, someone around us does not which can impact us. As humans, we have tendency to terribly under estimate the bad things which can happen to us. We feel that “accidents” and “unlucky incidents” happens in other lives.

If you really want to know how unexpected life can be, then I want you to watch out this following youtube video (just few seconds) before I start this article

https://www.youtube.com/watch?v=BxGBf6XsAio

Emotional and Financial Impact on Family

Death is not an issue for the person who dies because that person does not exist later to face the consequences. It’s the dependents, who face the heat – emotionally and financially.

Emotional suffering however huge, finally fades away over time slowly. Over years, life gets back on track. However financial impact is huge on the family, if a sufficient life insurance was not taken by the bread winner. Financial impact also completely changes the lives of family members and creates big issues.

It can leave the family with questions like

- How will we pay back the home loan?

- Will we have to sell the house?

- How will we send children to school?

- Who will give us money for many years?

- Will we have to sell house belongings?

- Will our children have to start working after their school?

- How will we take care of old parents?

- Who will earn now in family?

Think about this!

I have seen lots of investors not taking the decision of buying life insurance very seriously. They delay the decision, cut down on the sum assured feeling what’s the need to “waste” the premium and worst of all, close an existing term plan because now they feel “Nothing happened in last 6 yrs, I wasted so much of premium” ..

And then the most unexpected incidents happen ! … Sudden death due to a health issue or accident!

Rains in Pune in last 2 days

From last week, Pune is witnessing heavy rains and two days back there was an overflow in a lake within city which literally created havoc in one part of the city. One of the society wall fell and 5 people died because of that. I wonder if these 5 people ever wondered if they will die like this?

(Source : Hindustan Times)

Let me tell you another incident from Pune rains

One guy was returning late in night in his car when this over flow happened and while he was going through a tunnel, the water from the other side came because of the overflow (like you must have seen in a scene from titanic). The car got washed away and after few hours, the guy death body was recovered. He did not even get time to react and do anything as his seat belt was on and he could not do much in response of that terrible accident.

Imagine this guy, and ask yourself if he had ever thought that this could have happened to him?

We need to accept that shit happens! . Many things are beyond our control. We can only minimize the impact or risk, but can never eliminate it.

7 real life incidents which will lower your over-confidence !

Here is a small compilation of few real life incidents, where people have died because of various unexpected reasons which was beyond their control almost all the time. Please imagine yourself and ask if by any chance, it’s possible that you could have been at their place?

Pune man saw wife disappear in flooded stream (Link)

We all were trying to get out of the house when suddenly the heavy flow of water came and in that Jyotsana was washed away right in front of my eyes. I could not get hold of her or save her; afterwards, we found her body nearby.”

7 school children die in Kenya as school building collapses (link)

“We were in class reading and we heard pupils and teachers screaming, and the class started collapsing and then a stone hit me on the mouth,” 10-year-old survivor Tracy Oduor told the AP. “When we got out of the gate, we heard that pupils were dead. I feel so sad.”

Spine surgeon & driver killed in accident on Mumbai-Pune Expressway (Link)

The car had stopped on the roadside to get a punctured tyre changed. When the driver was changing the tyre of the car a speeding private bus coming from Mumbai rammed into the driver and Dr Khurjekar, killing them on the spot.

A person died while taking selfie with elephant (Link)

A 30-year-old man was trampled to death by an elephant at the Bannerghatta Biological Park on Tuesday, after he and his friends sneaked into the park to take selfies with the elephant.

14 dead, several injured in massive fire at Mumbai’s Kamala Mills (Link)

The fire broke out shortly after midnight on the third floor of the four-storied building on Senapati Bapat Marg. The majority of those killed were women attending a birthday party at a rooftop restaurant.

Illegal banner claims another life, 23-year-old dies after hoarding falls on her (Link)

An illegal banner which was installed by an AIADMK functionary for a family function fell on Subhashree, making her fall to the road. Meanwhile, a lorry which right behind her on the road ran over her.

28-yr-old engineer dies after sharp kite string slits his throat in Delhi (Link)

A 28-year-old civil engineer was killed and at least half a dozen others, including a retired defence forces officer, were injured after being allegedly hit by sharp kite strings (manjha) in separate incidents during Independence Day and Raksha Bandhan celebrations on Thursday.

Please take Life Insurance

So the point is clear!

In case your family members are financially dependent on you, and you do not have sufficient assets with you, please buy sufficient life insurance (only a term plan) as soon as possible and secure their future. Do not over estimate your ability to avoid accidents. You have far less control over these things than you think.

If you are confused on which term plan to buy, I can help you along with my team. We will connect you to right platform to buy the term plan which will also give your family claim support in future. Just email us at [email protected] and we will get back to you!

Do share any incident or real life story related to this topic in comments section below.

September 27, 2019

September 27, 2019

Hello!!

Just wanted to check that can a non-earning female (single mother) is eligible to take term plan? If yes then which insurance company is giving the same??

Hi A

Non-earning person is not eligible for buying term insurance, because he /she is not the bread earner so their demise won’t affect the financial health of family.

Vandana

Hi,

Love your articles, Can you also please suggest the financial decisions to be made by younsters who are just got the job to build the good corpus and if term insurance have to be taken the factors which should be considered? Expecting your reply and keep up the good work.

Thanks

Hi Pavan,

For a person who has just started a carrier, I would suggest to start with a SIP of easily manageable small amount say 3K to 5K for retirement. And next is to get health insurance of at least Rs. 5 lac (if not provided by employer) so sudden medical expenses will not hammer his long term financial goals.

For the sum assured of term insurance, we suggest nearly 300 times of current monthly expense to make it simple and not going in too many calculations.

Thanks

Vandana

नमस्कार

मेरा नाम संदीप है मै crpf मे हूं… क्या मुझे कोई टर्म पालिसी बताएँगे जिसमे किरीटिकल illness and accidental provide होता हो? और जिसे on ड्यूटी या ऑफ ड्यूटी जैसे छुट्टी, within कैंप, एजुकेशन courses आदि i.e peace posting मे क्लेम मिलना चाहिए..

या Govt से मिल रही benefits पर depend.

संदीप त्रिखा

7983449297 व्हाट्सप्प

Hi Sandeep,

Someone from our team will get back to you on this.

Thank you

Vandana

In India, lot of people don’t listen to Term Plans as they are confident nothing happens to them.

Not only that, they avoid the term insurance, they think its like an outcast, not for them

In the western world its the exact opposite, they understand the importance of insurance and opt for it.

Lets hope the ideology of the Indian crowd also changes.

Yea … very correct observations ..

In general we have become a very reactive society in general compared to a preemptive society. We take actions only when event happens, and not before that!

Should someone need to take life insurance in his early 20s if he doesn’t have any liabilities or anyone depending on him or he should take it only when he gets married and have a dependent family mostly in his 30s? Given that life insurance premium costs less when he takes it early on.

Hi Bittu,

Term insurance is for those who are bread earners of the family and are having dependents. It is for those, whose death will affect the financial life of members of the family.

Vandana

What about people not having dependents? Not married/no home loans?

Hi Nikhil,

Term insurance is suggested only for bread earners, who are having dependents.

Thanks

Vandana

Please write an article on Accidents ( MOTOR / TRAIN ) and how the compensation can be claimed and on what basis ie. as per Income Tax filing.

Hi vipin

Thanks for your suggestion. We will try to write an article on this.

Vandana

Can you write a post for those who are moving outside of India temporarily say 3 years? What should they need to manage in personal finance and how do they invest from outside of India?

Good point Satya .. I will write on that asap !

Hi Satya

I just wrote an article on what you suggested for NRI investments .. here it is

http://jagoinvestor.dev.diginnovators.site/2019/09/nri-investments-guide.html

Manish

Nice article…but really 20 decades back? 🙂

Sorry it was 2 DECADES ? … I changed it to 20 yrs !