iCare : new online term plan from ICICI Pru

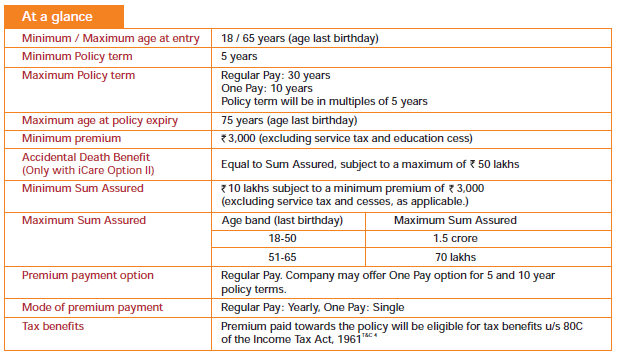

ICICI Prudential has launched their new online term plan called “I-Care”, which will replace its old term plan called the “i-Protect” (read iprotect review). This new i-Care term plan has some interesting features like no medical examination till the age of 50 and up to 1.5 crores of sum assured can be taken.

Features of I-Care Term plan

The biggest surprising feature of i-care term plan is that there is no medical examination for customers who are up to 50 yrs old. For all the health related information the company will depend on the declaration made by the customer as there won’t be medical tests applicable. This will make sure that the policy is accepted as soon as possible as there is no medical examination in between. Also there is something called “Policy acceptance” in i-care, which means that once you submit the application online and make the payment, it will be reviewed and finally it will be accepted, after which your insurance coverage will start. Some other features of i-care policy are as follows.

Additional features

- There will be high cover available to those people who have active home loan in their name.

- The premiums once declared will not be increased later, as there is no medical exam later.

Riders in i-care term plan

There is only one rider in i-care term plan just like iProtect had and its accidental death rider. So here are two options one can go for while buying i-care term plan.

iCare Option 1 – Sum Assured

If you take option 1, then you just have a basic sum assured cover which will be paid in case of death. Even if you die in accident you will still get the basic sum assured.

iCare Option 2 – Sum Assured + Accidental Death Benefit

In this option, if one dies due to accident, then the nominee receives extra money equal to sum assured (subject to maximum Rs 50 lacs). This means that; if a person has taken second option with sum assured of 80 lacs, then he will get 80 lacs on death if the death is due to anything other than by way of accident. But if the death is due to accident, then nominee will get Rs 1.3 crores (80 + 50)

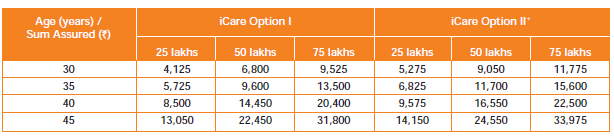

Below are the indicative premiums for both the options.

Note : Please make sure you read the terms and conditions properly (mentioned in the 5th and 6th page of the embedded doc above).

October 7, 2011

October 7, 2011

Hello sir,

I am 49 year old govt officer. I want to take online term plan. No medical issues. Which policies can be bought without medical test. Is there any amount upto that no tests are required. I have one LIC term plan. Please advise.

Once you cross a certain age limit like 40 or something , the medicals are always there. What you can do is leave your details with us and we will help you on this . http://jagoinvestor.dev.diginnovators.site/solutions/buy-life-insurance-plan

Hello Manish, I am 38 years old and have hypertension, however all other tests (including Renal doppler, Echo Cardiogram and Tread Mill test) have confirmed that there is no other problem. I am taking medication and also changed my lifestyle completely so I am healthy now. Is it okay for me to go for a non-medical online policy? If so, which one would you suggest – my thought was HDFC online policy. Your advice would be great. Thank you.

Hi bala

I can see that you are thinking of buying a term plan. ALl you need to do is leave your details at http://jagoinvestor.dev.diginnovators.site/solutions/buy-life-insurance-plan

Our team will get in touch with you

Manish

I am 45 years old. I applied for ICICI Pru IProtect Smart Term Plan for 1cr. Initially the premium was Rs. 31500. They had a medical test. Now they have enhanced the premium to Rs.45000, with the reason that elevated enzyme levels reported in my medical test. please suggest me what should I do now, bcz since last 25-30 yrs I never admitted for any medical treatment. I am surprised to see all these. Please suggest what should I do now.

Regards

Hi DrMKVerma

You should accept the proposal and go with it, atleast you are getting the policy !

Manish

Dear manish

Can hiv positive take this policy

Hi Rajveer

Thanks for asking your question. However, I dont think I am eligible to answer your query as its either out of scope of my knowledge or its not related to money matter directly

Manish

I purchased ICICI pru I protect smart term plan 50 Lk SA. Company issue me policy without medical , is it OK with out medical

Yes, its ok . If you are young enough and have good health, then not having medicals is fine

Thanks for reply, my age39 is this plan is good & not worry company not medical tests

Yes, you can just go ahead with this. Why are you not opting for HDFC ? We suggst that policy and we can also help you schedule a call with their team as we have special tie up for our readers.

Manish

Dear Mr.manish,

I am meganathan.working in Saudi Arabia,

1) I am planning to buy 3cr term plan insurance. Unfortunately I cannot come for medical.

Is there any term plan with out medical in any insurance company?

2) if medical I can do in Saudi Arabia some insurance company(like Bajaj Insurance) but the mention tests are not available in Saudi(computerized treadmill test) .

Please advize me.

Note: I approached by policy bazaar and I paid premium in HDFC. Now they are telling medical can done in india only. Now they cancelled my insurance two days before. Return pay not yet received).

Please advise me…If min amount insurance I can select (like 2cr or 1 cr)

No , without medicals you wont get it

A Tip who want to Buy ICICI iProtect Smart Plan

I am a 36 year Smoker and when I calculate my premium on ICICIPrulife.com for 75 Lakh for 31 year policy it was around 21000/-

Now Tip time for those having bank account in ICICI

if you have account in ICICI

click on the link which is there in ICICI bank account after login screen ( Insure Online)

Click on the banner iprotect plan

Calculate your premium now.. for mine it came down to 15000 from 21000

I bought the policy (Smoker) for 31 year with 75Lakh Sum Insured buy paying premium 15K

Now Surprise time….. I got smoker policy issued with No Medical Test required in 13.5 K and 1500 is showing as Advance premium.

Saving of almost 6.5 K annually.

Glad to know that ali ..

Hi Manish,

I have a question here…After new rule Section 45 companies are doing Medical Test as mandatory for all even though for 50 Lakhs Premium amount(Earlier there was no medical test for 50 Lakh)

But in my case they issued policy without any Medical Test…will it put any negative effect in future at the time of claim(In case of death) ?

No it will not have any impact on you

Hi Manish,

I am 32yr old, living in UAE, want to know if this plan (icici pru smartlife – all in one option) is available for NRIs.

I am unable to get any clarity from the website.

Kindly assist.

Its available for everyone !

Hi Manish thanks for provide imp. l information. I already have a ICICpru Icare term plan with option 1 with 75 lac sum assured, & premium of 11543, now I find that for the same sum assured icicipru iprotect is having premium of 8332 with additional benefit of terminal illness, & waiver of premium on disability. I am thinking to shift to this new plan , since it will save money in premium & 30yrs coverge will start afresh. What is your suggestion. please reply

Yes, I think you should shift !

Hi..Subbu..i was trying to buy icicipru I protect too but I faced two hurdles.. One is icici is not providing defined space to answer all questions in health questionare .2nd they had removed old policy details column from application form..&been advised me to write a mail with all details to icici but that mail won’t be part of policy document..i also got multiple lipoma condition..So I ask you to reply me with your experience with me on manish [email protected]..also to manish for help in deciding to purchase or not. Thanks

HI

i am planning to take I care II.i was therein dubai for 5 years.Now i am working in chennai.Iam planning to take a policy in within few weeks.in future if i got a job again in overseas i will move.Whether policy is active when iam moving to some other country for work.if any thing happens outside india, whether policy will cover, nominee will get full amount.please clarify

Yes, nominee will get full amount

Dear Manish,

There is one query, would really appreciate if you can throw some light in context of ICICI Pru iProtect plan (it would require a medical test before policy issuance):

The health questionnaire asks for cancer/tumor/cyst or any kind of growth the applicant is aware of. If for a person the answer is YES –not due to cancer or tumor, but because of Lipoma (deposit of fat under the skin, which is non-malignant and non-cancerous and doesn’t require any treatment), then will the application will be simply rejected? or they would first conduct a medical test and then take the decision?

Also, if a company rejects the application, then can it affect chances of getting insurance from other companies as well, since various company ask the question about rejection of the application and the reasons?

Thanks in advance.

Every company will ask for the same thing and yes, if rejected, it will become a blocking for getting it from other companies also . Regarding the question you have asked, I think its more of a underwriting level question and I am not qualified to comment on it . Try customer care of the ICICI and they will help you on that

Manish

Thanks for your advice Manish. I went ahead an applied for the policy and ICICI has asked me to get a test done, which requires a small surgery. This looks too much of an effort for purchasing a policy. Is it possible that to circumvent this test I propose to get some cooling period clause included in the policy? Is it a practice to get some clauses included in such cases when applicant is not willing to go through such tests?

Please provide your kind advice. Thank you very much.

What about the icici pru iProtect plan? Does it still exist? what about medical test in that case?

Yes iProtect plan still exists and medical tests are necessary!

Dear Sir,

I had proposed for ICICI Prulife II online policy for which i paid the premium and undergone the full medical. But now they have said that my policy is not accepted and can apply again after 6 months. No other reason is mentioned.

1. Can I apply for another policy through other company

2. what are the chances of getting rejected again

3. Can i avail any offline policy.

Worst part is that the doctor who conducted the medical test was a fresher Homoeopathic Doctor. An error probably in taking my BP has probably cost me a lot. Because I have declared that I have BP and I am on medication. Unfortunately I was as truthful as possible.

I suggest you apply only after 6 months now . You can look at HDFC as an option . Talk to us if you want that in future, we can connect you to our HDFC contacts !

Thanks a lot sir. Pl Let me know the details of the HDFC plan and connect me to to the relevent person if any.

Hi Manish,

I have some queries arising in my mind which is stopping me to go further for taking Term Insurance from any company…

If you can give answers with (Yes or No) also it will be very helpful to me.. and They are :

1) Claim Settlement can be happen for this below kind of Deaths :

If insurer died due to any of these Viruses such as : Flu, Swine, Corona, Ebola, chicken guniya, etc… any new dangerous virus/Flu comes after policy taken…

2) While taking policy Insurer is Non Smoker, No Alcohol Drinker & No tobacco addicted; if later on he started and died…

based on medical reports during death time and company found that he is smoker or Drinker or Tobacco addicted, so claim settlement will happen or rejected..

3) While taking policy Insurer is with NO disease or illness :

If any disease or illnes happens later on after 1 or 2 yrs, and insurer died with the disease, so claim will be settled or rejected

Will Term Insurance cover all this below kind of deaths :

– If insurer died due to any of the disease such as : Diabetes, Cancer, Heart attack, etc..

– If insurer died due to Body Organ failure or Non Proper Functionality such as : Lungs, Heart, Kidney, Brain, Intestines, Spinal cord, etc…

– If insurer died due to Illness such as : Blood Pressure (High or Low), Hyper Tension, Obesity, diabetes, kidneys, heart, etc..

– If insurer died due to accident Illness before or after 6 months..

– If insurer died due to Suicide after 2-3 yrs after policy..

– If insurer died due to accident while driving a car and later police or court stated that its driver mistake ??

– If insurer died while swimming in Lake, River or Sea…??

– If insurer died due to any type of Murder ?

– If insurer died due to some one pushed him from height ?

– If insurer died after having continious illness for more than 6 months, 1 yr or 2 yr…

– If insurer died being hospitalized for some months due to any of the disease, surgery, etc… claim will be settled or rejected ??

To claim settlement :

– With Normal dead, weather dead body has to go through with “Post Martum” mandatory ??

– Natural Death or due to illness death, in both of the conditions weather dead body has to go through with “Post Martum” mandatory .. and needs report for claim ??

Informing to Insurance Company :

– Weather Nominee need to inform Company immediately as and when insurer died, for future claim settlement ??

– Nominee or his dependents were not in a position to inform Insurance company immediately after insurer death..for atleast a month, what is the maximum time to inform company ?? to claim insurance..

Its important that Nominee need to inform Insurance company before funeral of insurer for future claim settlement ??

– Insurance company investigation team need to be available or presence before funeral of insurer, to stat that nothing hidden with his death ?

Accidential Death : AD means what kind of Deaths comes under this category..can you list down some of them…

I will be very happy if you clear some of this above questions…

1. You will still be covered

2. You can start drinking/smoking later . No issues

3. All kind of deaths are covered .

Please Help

age 25, smoking drinking occasional, please suggest

1) what if rather than 1 Cr. i take a term policy for 50 lacs each from 2 diff companies/same company?

2) Some companies provide upto gaining 75 year of age or for 30 years, in general sense which is more appropriate for a person of my age?

3)I am into adventure sports like skydiving, scuba diving etc does the policies generally cover death due to these activities and /or any change in premium?

4)The claim settlement ratio till what extent is it relevant because if i m looking at a long term plan the companies who are new in market and providing good options but not great claim settlement ratio as of now but well known world wide,dnt you think with time their statics will eventually improve? so investing in these is more beneficial?

I am targeting Aegon religare i Term plan in general any reviews and feedback will be highly appreciated ! Thanks .

1. You can look at HDFC aviva ..

2. It does not make sense to go for that tenure . Take till 60 yrs

3. If you are TOO MUCH into it, then its better you disclose it !

4. Claim settlement ratio does not matter !

Manish

Can you please help / guide me to built my finance portfolio.

My age is 32, Married, 1 year child.

My Salary : 15 lac per annum ( including tax)

Current investment :

1) Apart from company PF : I add 50K to PPF annually Since last years.

2) 40 thousand EMI – home loan

3) Invested in HDFC life progrowth plus (ULIP) couple of month back for 15 years ( basically for child plan)

4) Currently have LIC policy – Jeevan Saral but I am planning to surrender next years since it will complete 5 years and I should get 100% paid premimum amount back.

5) Planning to buy life insurance term plan and accidental riders policy.

Can you please suggest if I am missing anything or need to add/remove from my profile.

Thanks

Rohan

I think you need to look at things goals wise, is your life goals properly addressed ? List down them and then assign your investments to them .

You can take our support to take health and life insurance if you want –

http://www.jagoinvestor.com/services/health-insurance

http://jagoinvestor.dev.diginnovators.site/services/life-insurance

Hi Manish,

I want to know whether death happened due to AIDS is covered in term plan or not?

Hi Himanshu

I am actually not very sure on this . If you already have a term plan, then its better to talk to company and ask for it

Manish

Hello Manish,

very good efforts for this blog.

I am 33yr old, non-smoker, social drinker, and working in Finland since last 5 years. I would like to get a life insurance policy for myself (1 Cr, 30 yrs long). I would like to stick to the reputable ones.

Is there any Pure Term insurance policy for NRI offered by LIC, HDFC, ICICI or SBI? I checked about HDFC click2protect policy, and there is no information if NRI can purchase that or not. Also, no information about LIC online-term insurance plans? do you have any suggestions

Thanks,

Pradeep

LIC has no term plan at the moment. there was news of one coming up some time soon, but you cant just wait for it .

Coming to next, SBI offline term plan is given to NRI’s , even HDFC might give it to you . The best thing you can do is enquire with all these companies customer care on their website and tell them you will visit INdia some time soon . See what is the response from their end !

Can I take icare in the name of my father who is wholely dependent on me (i.e., he doesnt have any source of income and I alone support my family)

I am not sure you will be able to take very high sum assured for your father. Company will deny it