Online Term Insurance Plans in India

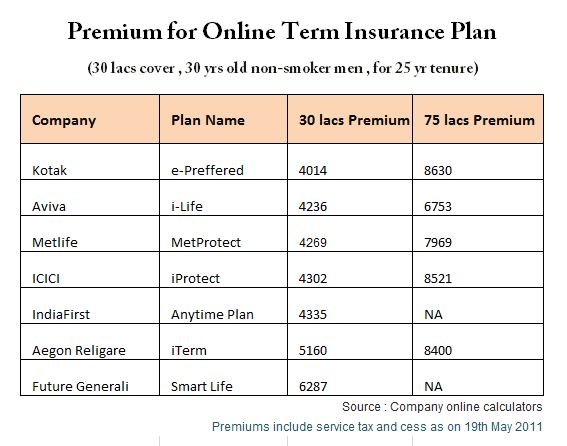

Do you have any idea how many Insurance companies are providing online term plans in India at the moment ? There are total 7 Insurance providers have launched their online term plans and the premiums are highly competitive .

Online Term insurance Plan in India

Aegon Religare was the first company to come up with their iTerm plan which was the cheapest term plan of that time , after that ICICI came up with iProtect . There was a huge response for these policies for cheaper premiums , but both the companies didn’t meet the customer service expectations of customers. A lot of readers even on this blog bought policies from Aegon Religare and ICICI , but faced horrible service when it came to getting policies on time , communication with customer care and its officials , mess of documents etc . A lot of readers suggested that they will never recommend other to go for it.

On the other hand there were customers who didnt face any issue and they got their policies on time . They are recommending others to go for it . However their numbers are smaller than those who faced bad experience. Bad customer service is not desirable by any customer , but I think we can see it improving over time with increased competition and with more better processes . Right now seven companies have come up with online term insurance plans and I am sure more companies are in process of launching it soon . I am not sure if LIC would join them in launching the online term plan , because their offline network is so big and dependent on non-term plans

How Online term insurance plan works

Step 1 : Offline

You go online and calculate your premium , then you start the process of buying the policy and submit your name, age , tenure , sum assured and medical information which affect your premium . After all this you get a premium quote and you pay it online . Most of the people take the premium amount very seriously and believe that its final premium , where as it’s not the case .

Step 2 : Online

After you have paid the premium, there are few things which are yet to be completed . You will get a mail from company or get a call from company that some representative of company will come to your residence and collect the important documents , the documents are also required for KYC . As per your age and given information , the insurer can decide if you will have to appear for medical test or not . If there is anything wrong in medical examination which can affect the premium (increase companies risk of insuring you) , then they can increase the premium (loading) . You can then decide to continue with them by paying the additional premium or cancel the policy .

Update – Apart from Kotak epreffered, Aviva ilife , Metlife metprotect, ICICI iProtect, IndiaFirst anytime Plan, Aegon Religare iTerm and Future Generali Smart Life there are 3 more online term insurance plans introdued in the market which are HDFC Click2Protect, DLF Pramerica – UProtect and Edelweiss Tokia – Life Protection

Comments ? Do you believe in online term plans ? What can motivate you to buy life term insurance online ?

June 3, 2011

June 3, 2011

Hello Manish,

I’m looking for a term insurance and cant make up my mind. I’m looking for a cover of 2 crores and have the below queries.

1. Do I take individual or family plan.

2. Will i get coverage if I become a NRI.

3. Waivers like Waiver Of Premium, Critical Illness, Terminal Illness

Do you have any policies to recommend as I did come through a couple of them but the claim settlement ratio are below 80%.

Hi Sunil

I can see that you are thinking of buying a term plan. ALl you need to do is leave your details at http://jagoinvestor.dev.diginnovators.site/solutions/buy-life-insurance-plan

Our team will get in touch with you

Manish

Manish, Thanks for giving many suggestion on insurance. I am going through policy bazaar. Found two policies Religae and PNB metlife, both cover till the age of 75, I selected PNB metlife and added accidental and illness, it routed me to PNBmetlife site. after entering all detail i see 1cr is split in to two portion one lumsum and another monthly.. so i am confused. Also i noticed accidental and illness add on was not there. I stopped there the premium was coming around 22k as i included my wife too.

Can you suggest based on the claim rate, coverage and till whatever maximum age should i go with Metlife? I am now 37 years old.

You can go with them if you trust the name. I would be able to help you with HDFC if you want it, see our service on that http://jagoinvestor.dev.diginnovators.site/services/life-insurance

Hello Manish,

I need answer on following:

1.What should be my anual salary -CTC or Taxable income.

2.For existing any insurence detail which kind of insurence should be considered :

a)Insured for death benifit for Dhanraksha Policy taken with Home Loan :current death cover is 16 lacs .do I need to consider exact figure like 1620550.

b)LIC jeevan anand where death cover is 5 lacs

c)Oriental Health Ins policy -2 Lacs cover for Family

d)Death cover in Car insurence Policy

e)death cover in two wheeler Ins Policy

3.Is it Mandatory my nominee should be dependent on me ?If my wife is earning ,can I show her as nominee?

4.”medical test is mandatory over 50 Lacs ” is this IRDA gudelines or Insurence company specific ?HDFC is giving term insurence of 75 Lacs without medical Insurence?Is it under IRDA norms?

5.Is it good to have riders in term Insurence policy ?If yes then which rider like accidental ,Critical illnes etc?

6.If today I am earning and based on that I can buy a term insurence for a limited sum assured .Like if earning 5 Lacs annual then can take max 60 Lacs term Insurence .Right ?If after buying trm policy ,next year I became job less then do I need to inform Insurence company ?

7.I bought term insurence from Bharti .Now next year I am buying another term plan from HDFC .Do I need to infrom Bharti about this?

Thanks,

1. Taxable income would be a good thing

2. all the policies which has LIFE INSURANCE element

3. yes you can show her as nominee

4. this is company specific, but all companies do this now

5. Your choice purely

6. no you dont need to communicate anything to company

7. No

I am looking for term plan for 30 yrs, 50lc amount for y current age 30 yrs.

I checked quotes from different companies and found that Aviva has 94% good claim settlement ratio, lowest premium, long policy period, good customer service before policy buying.

Compare to that I found HDFC is also second good and it has strong fundamentals in the market but only case is that its premium is approx. 6770 compare to Aviva is 4750.

Manish, Can you please guide me should I go for Aviva or HDFC? I am thinking to go with Aviva. Is it stable and trustable company.

And also Thank you very much for sharing such useful information and also your view points for many users. I have also shares your post to my friends so that they can aware about term plan.

Tushar Patel.

If you ask me, I personally have no issues going with AVIVA , however if you have trust issues, better go with HDFC

I have found claim settlement figures from web for year 2011-12. When 2012-13 data would be released any idea?

I want to go with Max life instead of Aviva and HDFC and thinking to have SA of 50lc for now and in future will take another policy based on requirement with another company. Do I think correct or any suggestion?

You can still go with them. Just make sure that the data given by you to them is 100% correct and no hiding !

Claim settlement numbers will come on IRDA , but you never know the dates , It should arrive after the year ending for sure !

sir,

main ek term plan lena chata hun

mere pariwar main 5 member hain.

mata-pita, wife(private job) or 1-1/2 saal ki ladki.

main uttarakhand main state gov. ka employe hun

meri annual income 450000/- ha

mare gov ka health insurance ha jisme puri family cover ha.

sath hi mere pass 54000/- annual ki lic ha

to mujhe kitne ka or kis company ka term plan lena chahiye.

Abhijit

You can take a term plan for 50 lacs or 1 crore from HDFC

Hi Manish,

Help me to understand if there are difference in exclusions with different Insurance Provider’s

I was told that company charging less premium may have more exclusions compare to other charging higher premiums

regards,

Anil

No , generally its not like that . They might have less riders than others, but in general all term plans cover exactly same things . Read this article to understand why their premiums are different from each other – http://jagoinvestor.dev.diginnovators.site/2013/05/how-insurance-companies-work-and-the-business-model-behind.html

hey Manish,

I am around 26 years old now (1986 born). I have LIC Anand and LIC Amrit of 5lacs SA. I am planning for Online term insurance now for cover of 50 or 75 lakhs.

1) should i go for reliagare considering its service and do u think its worth trusting them for next 30 yrs

2) should i go for aviva i term instead?

I will nominate my mom as of now as i am unmarried still.. planning to add my wife in future as extra nominee.

plz suggest if this ok.

I would vote for Aviva !

I went for Bharti Axa eProtect policy for 50 lakhs SA and 25 years tenure. Actually I went through policybazaar. They suggested choosing between Axa and Aviva, though they pushed a bit more for Axa. I agreed because the premium was the lowest as per my independent research too. Also thought if I went by all reviews I would never end up buying any policy!

They were there on phone to help while filling up the online Bharti Axa form. After paying the calculated premium online, I had to upload a few docs as id, address and salary proof, etc. After that, within 1 or 2 days, I got a call from Bharti Axa that a medical was scheduled for me and that would be done through a home visit.

Got a phone call from the health check up provider for the test and scheduled the check up. They came promptly and finished the test in 15 mins. Ten days after that, I received the policy and with no change in premium.

All in all, had a smooth experience and got the policy in two weeks after the online payment. Now all that remains to test is a smooth claim process, but I won’t be around to post my review on that 🙂

Great .. thanks for sharing your views on Bharti Axa !

Hi Manish,

I am 31 years old and planning to buy my first Term Insurance policy.

Please suggest and clarify my few doubts:

1. Which company shall I go with?

2. What is the difference in bying policy online or from agent, I mean, is there any drawback bying policy online?

3. Do we have LIC term policy available online? if yes, what is the plan name?

Thanks in advance.

Regards,

Bhaskar

1. Aviva or HDFC

2. from agent it will be of high premium, as their commission is to be given

3. NO

Thanks for answering my questons Manish..

So, I should go with HDFC online plan first and LIC online plan later once it’s available. is it correct?

But,I was reading about LIC online term plan in an article published long back in 2011. Is it still not launched?

Thanks & regards,

Bhaskar

Yes , online plan from LIC will not come it seems

With the recent announcement on Aviva selling its stake, does it make sense to go for Aviva?

It will be bought by someone else. If you are fine with it . then please go for it , else someone else !

Hello Manish,

My age is 28 and i need health insurance for me and my MOM(52) & DAD(57) can you please suggest which plan is better.

For you , Religare Care and Oriental for Mother

Hi Manish,

I have recently bought ur 2 books “16 personal finance principles every investor should know” and “How to be your own Financial Planner in 10 steps”. I have never read such type of good explanation with example. If i read it 5 yrs back then now i could be a good investor. Thanks Manish.

I have one question about term insurance. I want to take term insurance of 1 cr so please advice which company is better to go for this. i am 33 old. i have family of 5 member and only i am the source of money. I was suggested from one executed that go for Bharti AXA…. is it good?

I also want to by one health policy for my entire family so please advice for that also.

please advice….

Jatin

Good to know that Jatin

YOu can go with Aviva Term plan ..

Thank for your reply….

But shall i know why only Aviva? is there any strong reason behind this?

Why not other? is it secure?

Please advice…

Jatin

there are other options as well . HDFC , KOtak , ICICI .. but I give you 3-4 other names, you will still ask which one is the best, which is not the way you have to look at it . Just go with anyone you TRUST .

Hi Manish,

I am planning to take online term insurance. I am 24 Yrs old.

Which plan should I go for?

Which types of deaths are covered in online term insurance plan as there are no riders?

Thanks,

Vikram

All deaths are covered in term plan .. go for Aviva or HDFC

Dear Manish,

I am 34 year old and planning to take term plan. i have gone through your site and it’s really help full. I have some question. Can you please help me to get the answer these questions?

1. which online term plan is good? As we are in 2013, do you still think offline term plan is better than online term plan policy?

2. I was smoker earlier and stopped smoking for almost 3 months, still i will be consider as smoker?

3. As per guide line they required Age proof, Address proof and Salary Proof. But From last year i came to South Korea on employment contract for 2 years. Will my salary proof be sufficient? As its Korean company’s salary proof. Do i need to notarize something? I am little bit confused in this point.

Please let me know, if you need any more information or clarification.

Mayukh

1. It can be especially for NRI who dont get online plans

2. Yes, you are a smoker .. once smoker , always a smoker is the funda for insurance companies

3. that will be told to you by insurance company

will it matter if a person moves out of country for long term after taking online policy i.e. at the time purchasing the policy person is in India.

No , not much .. but there is a question while taking the policy that are you having any plans to travel in immediate future, if you are sure about it, then better tell them …

Manish,

last week I purchased “how to be your own financial planner in 10 steps” book, and working on step#1 🙂

now I’m looking for increasing life insurance, age of 39yrs for self with “online term insurance”, can you please suggest 1 or 2 with following my expectations;

1. lowest online insurance premium for 1 cr SA

2. trustworthy insurer / high claim settlement ratio

3. easy / painless claim settlement process for dependents

thanks for your active blogs and book, which is easy to read and understand the personal finance nuisance 🙂

Jay

Thanks Jay .. you can go for Aviva or HDFC Click2Protect !

Hello Manish,

My age is 28 i want to buy Term Plan and i need 750000 lacks cover so please can you suggest which plan is best for me.

Aviva iLife

I read your suggestions and impressed,

Well i just want to know is there any minima criteria of income on papers for term plans and if yes where i can get that?

2. we do business and in that we don’t show more income on papers for tax saving purpose and its also cash business thats why so what should i do to buy 1 cr policy?

waiting for your answer

Rohit.

Sadly

You need to give proof about you income level , only based on that you get term plan for high cover. Ideally you get around 20 times your annual income on max side. So if you have atleast 5-6 lacs of income on papers, then only you will get 1 crore of term plan

Hi Manish,

Thanks for your articles and comments. I am already having a term plan from Kotak & Metlife. I a planning to take another from Tata AIA, new online plan. What are your views regarding this.

Why so many ?

I want to increase my coverage amount.

Hi. I’m planning to take Aviva Term Insurance but I’m confused which particular plan to take??There is Aviva LifeShield Plus, Aviva LifeShield, Aviva LifeShield Advantage, Aviva LifeShield Platinum, Aviva i-Life. Which one should I go for?? I’m looking for 50 Lacs SA for 35 years.

Aviva iLife

Hi Manish,

First of all thank you very much for providing such useful information.

I have taken LIC-Jeevan Anand and already paid 4 premiums in 2 years (15412 Rs quarterly). But the premium is very high. The policy lock period is 3 years so I will

surrender this policy after 1 year.

Now I am planning to buy term insurance. My DOB is 13-Apr-1985, non-smoker.

is it best time for me to buy term plan? Because I have LIC policy now.

Please suggest me good plans.

Thanks

Yes .. go for term plan .. the best time if when you are NOT SUFFICIENT COVERED , which is true right now !

Dear Manish,

Presently I am living at Renwal , 70 K.M. far from capital of Rajasthan(jaipur). If there is any company which offer online term plan at Renwal. I mean any company which offer term plan all over India.

Bharti Axa Life, HDFC and ICICI pru, and maybe SBI LIfe