Travel Insurance in trains in India by IRCTC has became mandatory

In next 7 min, you will read how you can secure your family with just Rs 1. I am going to teach you that. IRCTC has made it compulsory for every train traveler to take a Personal Accident Insurance Policy which has been applied from September 2016.

Railway minister Mr. Suresh Prabhakar Prabhu had announced in his speech that from the month of September 2016, railways will provide an optional travel insurance of Rs.10 Lakh to the passengers while booking tickets from its website, which can be opted by paying an extra 92 paisa.

UPDATE: Now while booking for train ticket you will see the prize “Rs.0 per person” in the option of insurance. So there is a possibility that the insurance amount have been added with the ticket fare.

Travel insurance policy by IRCTC is now mandatory

Earlier this accidental insurance policy was optional but now IRCTC i.e. Indian Railway and Catering Tourism Corporation Ltd. has decided to make it mandatory for the safety purpose of the passengers. Now if you book your tickets, you will not get an option to choose if you want the insurance or not. It has recently become mandatory as it was hinted some time back as per this article.

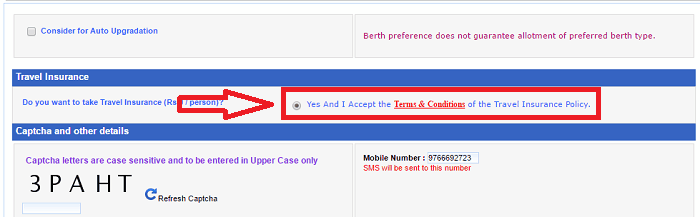

You can see the snapshot below

This policy is just like a travel insurance policy where a train traveler or passenger who books a train ticket from IRCTC’s website will get the insurance up to Rs.10 Lakh by paying an amount of less than Rs.1 extra while confirming the ticket. This amount will be provided to the family/nominee/heir of the person if he/she gets injured or dies in train accident.

3 companies which provide IRCTC policy

IRCTC has a tie up with 3 insurance companies which are providing this policy. These insurers are Shriram General, Royal Sundaram and ICICI Lombard. We recently tested it to see which company is providing the insurance and we got a message with Royal Sundaram. It might be different in your case.

Initially this scheme was introduced on a trial basis, but now it’s compulsory. The passengers having confirmed tickets, RAC (Reserved Against Cancellation) or are on waiting list can have benefit if this insurance.

This facility is not available for the sub-urban trains. Only Indians can get this policy. Children and Foreigners are not eligible for this policy. The insurance will be valid in cases like train accident, riots, terrorist attacks, shoot-out or arson in train, on platform or on the route to its destination.

What is covered under IRCTC Travel Insurance policy

Unlike common belief, the travel insurance with IRCTC goes beyond cover on death and provides various other benefits like disability insurance in various conditions.

Below are the details

- 10 lacs for death

- 10 lacs for permanent disability

- 7.5 lacs for partial disability

- Upto 2 lacs for hospital expenses

- Upto 1 lacs for transportation of mortal events

Who can claim compensation of accidental insurance policy by IRCTC?

If the deceased is married then his wife, son or daughter can claim for the compensation. The daughter or son should not be minor if they are claiming. If the deceased is not married then his or her parents can apply for compensation. In other case, if the deceased has nominated someone else like other relative or any friend then he/she can also claim for the compensation.

In short we can say that the person whose name and details have been filled in the application by the deceased while booking the ticket can claim the compensation. The only thing is that he/she should have ID proof.

As per rules, within 4 months the insurance claim has to be filed from the date of insured event. All the terms & conditions, benefits and exceptions of this policy are mentioned in this pdf, download it and read it in detail.

Please watch the video below to learn about this topic ..

How to apply for the compensation of IRCTC accident insurance policy?

The nominee or the claimant can apply for the compensation to the nearby office of the insurer company which the deceased had selected at the time of booking ticket. You has to visit the insurance office and fill the compensation form and attach all the documents essential for the claim.

Why this Policy is Important?

In last 6 years around 800 train accident cases were registered in India in which near about 600-620 people died and 1850 were injured. More than 15000 people are killed in railway accidents per year as per some reports

Just imagine, you could have been one of those. What financial impact it can have on your family?

But many people just ignore the travel insurance thinking that it can never happen to them, as if they are GOD. Anyways the irctc insurance charge is just Rs. 92 paisa, which is nothing compared to the benefits it provides.

Disability in case of train accidents

For an ordinary person, if such accidental case happens then it will be too much difficult to arrange money for hospitalization. And the cost of this policy i.e. 92 paisa is negligible as compared to the total train fair and the compensation.

The big reason to worry is many times these accidental victims die just because they couldn’t get proper medical treatment or even immediate help also.

May 2, 2017

May 2, 2017

Insurance premium charged by IRCTC is very negligible considering that bus and flight services charge about Rs. 15 and Rs. 150 respectively for every ticket booked. Its a great move all the same. The general public who use internet to book tickets through IRCTC can be assumed to be middle class and hence the premium will not hurt them a bit.

Absolutely. This message should reach more and more people

What about those who travel in the unreserved coaches of the same train, having booked general tickets at railway reservation counters? Do they have any insurance cover?

I think the insurance facility only for those who have reservation

INSTEAD OF FILLING AN EXTRA FORM,PERHAPS IT MA YB ADVISABLE TO KEEP A LINE FREE IN THE RESERVATION SLIP ” NAME, AGE,RELATIONSHIP AND ADDRESS OFTHE NEXT OF KIN/ email/mob No..

Hi anand

It’s a good suggestion. Thanks for sharing.

‘Route’ to its destination – in place of ‘root’ to its destination…

Thanks for correction Sandip Mukherjee. I have updated it.

Nice initiative by the Railways.

Thanks for your comment Anand

Great move by the Indian Railways. Such a minuscule amount can be easily paid by everyone and in return the benefit is immense. Infact I would say the Railways can easily increase the premium to Rs. 5 and proportionately increase the compensation by 5 times too. Even for regular travelers, it’s not a huge amount.

Hi Anjan

Its a very good suggestion, but there can be a section of people who are very poor might feel that even Rs 5 or 10 is a big amount for this.

Priyanka

Thanks for giving such Important and useful Information….

Thanks for your comment Navnath Pawar

Interesting.

This seems to be one way of reducing loss due to accident, for railways. Aggregating 1 rupee per ticket, to pay accident victims. However, it OK considering state railways is in. They are finding ways to reduce their costs keeping rates very low.

However, many times the issue is not with the policy or scheme but the execution. Like many other compensation schemes, this also should not become lame when servicing claims.

Thanks for sharing that Srinivas

Great Job Di…..

Thanks for your comment Pawankumar Satav

If a family ticket say of 5 people are travelling then the person on whose name the ticket obtained is covered under the travel insurance of RS.10 lak

What about the remaining 4 people.

Hi T.Radhakrishnan

As we check for this, you have to mention each travelers name there. So everyone is covered under this policy.