From 1st Oct, Insurance policies will be issued online (even renewal policies)

Starting 1st Oct 2016, all the insurance policies are going to be issued in electronic form.

Yes, you heard it right

Few years back IRDA had come up with the concept of 13 digit e-Insurance Account (EIA), where an investor had the option to convert their existing physical policies into demat form, but till now it was not mandatory. However now things have changed and starting 1st Oct,2016 it has become compulsory.

Now, every insurance company has to issue all kinds of insurance policies in an online format. So if you are buying any kind of insurance policies (life, health, motor, pension policies and all kind of general insurance policies too) you need to have an e-Insurance Account (EIA) and the policies will be issued in Demat form only in that account.

This will be true even for renewal policies. So even if you are not buying any fresh new policy, at the time of your policy renewal this will apply to you

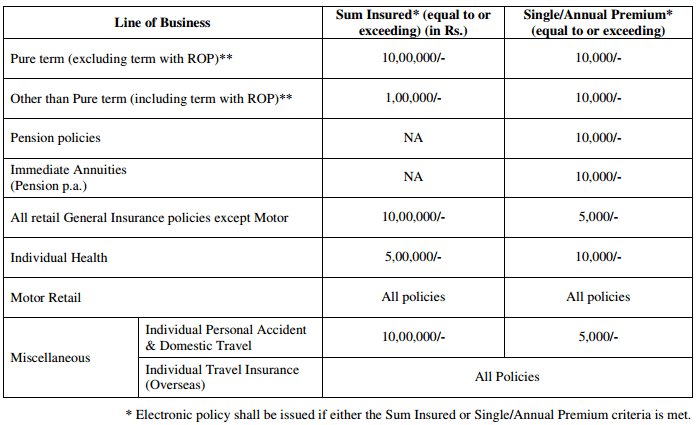

Under which cases, is this e-insurance account mandatory?

This e-account is required only if the annual premium crosses Rs 10,000 for most of the policies like term plan and health insurance or if the sum assured is above 5-10 lacs. The exact requirement is as follows for various kind of policies (source link)

How to open E-Insurance Account?

Step 1: Choose the Insurance Repository

There are 5 registered insurance repositories in the country, licensed by IRDA, out of which you need to choose one. These are …

- CAMS Repository Services

- SHCIL Projects Limited

- Central Insurance Repository

- Karvy Insurance Repository

- NSDL Database Management

Note that you can choose any one of them, and there won’t be any difference, other than level of service. At the backend, everything will be the same. Also if you are not satisfied with your insurance repository provider service, you can switch to another one later.

Step 2: Fill up the form and submit the documents

The process now is very simple, once you have decided the repository company, all you need to do is fill-up the form and attach your KYC documents and submit it to their office in your city.

CAMSrepository also has an option where you can first fill-up the form online and then download the filled form. I think it will work for most people and save time. If you want to fill the form offline, you can download e-insurance account opening form here

Following are the documents you need to submit

- e-Insurance Account form (fill by hand OR filled online one)

- Date of Birth Proof (PAN , Passport, Voter Id etc)

- Photocopy of ID proof (PAN or Aadhaar Card)

- Photocopy of Address proof (Aadhaar, Passport, Electricity or Telephone Bill etc)

- Canceled cheque

- Passport size photograph

Note that the canceled cheque is required so that the information of the bank account is captured beforehand, Any maturity proceeds or claim amount will be paid in this same account. Ideally, this should be the same one from where the insurance premium is paid, but not mandatory.

All the major insurance companies like LIC, ICICI, HDFC, and others have already joined hands with this facility.

Check out this short video created by CAMS team

Once you submit the documents, it will just take a few days to open the account.

If you need the detailed list of the documents required, you can view this PDF document (2nd page)

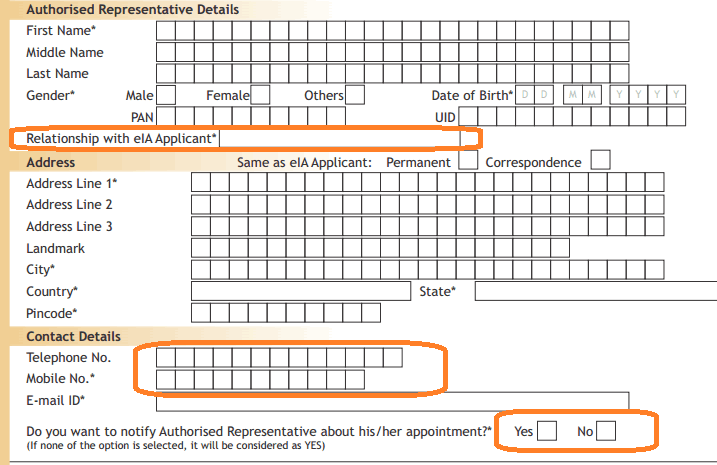

The concept of Authorized Representative

A special feature called “Authorized Representative” is introduced in this e-insurance account where an investor can assign someone trustworthy or close to being AI (authorized representative) who will be able to access the details of the account in case of death of the policyholder. This is different than the nominee.

For example, I can give my close friend name and details in the AI section ask him to have a look at all my details in case I am dead and ask him to communicate things to my family as per my plan.

Features and Benefits of e-Insurance Account (EIA)

Let me know to share some benefits and key points of this e-insurance account and how it will benefit the overall insurance industry as well as the investor, even though it may look like another hassle to you right now

- FREE account – This account will be 100% FREE account for investors, there are no charges or maintenance fees to be paid by anyone. One person will have only a single account (like PAN)

- All policies at one place – This will be the single point of contact for investors to view, download and manage their insurance policies, be it life, health, motor or any travel insurance policy.

- No KYC repetition while buying new policies – After doing the KYC first time, you won’t have to do it again and again when you buy new policies. All you would need to do is mention your EIA number and buy the policy.

- Get reminders – You will get reminders for your policy maturity, payment reminders and any other important updates.

- Single place to update your KYC – IF you want to update your mobile, address or other details, you will just have to update it in e-insurance account and not in each policy individually.

Understand that with this initiative, the insurance companies will simplify their process and a good amount will be saved as there won’t be a lot of paperwork involved (printing of documents, courier etc) and that’s why insurance companies will fund this initiative and will keep it FREE for investors.

Converting your existing physical Policy in Electronic form

I know you must be thinking about what will happen to my existing policies which I have bought till date? So, there is a simple process to convert them online.

Once you open the e-insurance account, you can apply for conversion of your existing policies into the online form (its good that you do it beforehand, because at the time of renewal it’s going to happen anyways going forward)

As per Cam’s repository FAQ point 18, you can just mention your policy number and it will be converted into an online format

18. How do I convert my existing paper policy into electronic form?

If you already have eInsurance account, log in to your eInsurance account, click on “ePolicy conversion” and enter your policy number, name of Insurance company that needs to be converted into ePolicy. In the next few days, your policy will be converted into ePolicy.

You can also download the policy conversion form and submit it for offline -> online conversion of policies

Please share what do you think about this new rule? Do you think it will help investors and the insurance industry?

September 17, 2016

September 17, 2016

Manish,

SHCIL Projects Limited has surrendered its license for IR this year, you may want to update your article to include this.

Thanks for sharing that Mangesh Tambe

Hi sir

I hv a query

Does the premium of term insurance Inc every year

I hv term insurance with premium 10186

This year premium paid 10270

Wn askd they said service tax has increased

Sir is this ok

Or premium shd hv been the same

What if service tax decrease

Thanks

Vishal

No ,it does not increase every year !

How to Switch the Service Provider ?. I am not able to find any information about this

I think it’s not implemented yet, and may require some more time. Many people even don’t know about insurance repository services. But, you have written a well-illustrated article about e-insurance.

Thanks for your comment Pawan

Sir your articles are great help for us . kindly do one more thing , mention print icon on the top of the article . So that we can take print easily.

Hi kamalpassi

Thanks for the suggestion. Sure , We will try to add that in near future.

For the last 2 years CAMS is unable to convert my LIC policy. LIC also refuses to convert the policy. And CAMS has stopped responding to complaints or queries.

I think you should go to CAMS office now and handle this offline !

Religare insurance is still not mapped.

I have eCAMs account, I used the same process mentioned above to open it. the account opening is a smooth process, the problem is that the account is not that great. The policy addition process isn’t great. LIC policies are not being added online. The compliant is responded very late and there is no way to get to know if the issue is resolved without trying again and again. Would recommend to try other e-insurance companies and avoid eCAMs

hi Manish,

Many Insurance Companies are not listed in the CAMS online form like Religare, Oriental, ICICI Lombard etc.

Would it be worth filling up the form offline? Will CAMS be able to process policies from these unlisted companies?

Its an excellent move. Most of us generally forget share all the insurance details with family and its whereabouts or yet time the family is not aware of the policy or the procedure for claiming the money when there is death of the insurer. The option of “authorised representative” will be very helpful

Hi Anand

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

I have opened the account few months back.

Few of my policies are reflected there but the website/system has many bugs. Details are incorrect, not shown properly and no way to edit them.

I am surprised to hear that they will be making it mandatory!!!

LIC is still not listed.

Indeed a very good move…even LIC agents can also help the clients in assisting and making awareness as how its going to be useful and also for the common crowd who have less knowledge in computer online operation…

Very important information

As much as it’s a great step I feel that instead of having another number, they should just link it to Aadhar or PAN.. Do not understand why can’t all accounts be linked to one number? Some will argue it’s security but still I feel it will be much more convenient that way. . Thoughts?

A very interesting move indeed. This helps to avoid loss of papers and hassle free operations.

If I register my self here and put existing paper policy details for conversion do I need still keep the papers with me or can throw them away. Actually I lost papers for one of my very old LIC (endowment) policy. I was thinking of applying for papers at branch. Is it required now ?

Any Idea – Suppose I open at CAMS Rep, will this information get reflected in the NSDL Consolidated Statement being sent every month. This is a good consolidated info of all investments in Stocks and MF. In this Stmt, there is a line for the NIR related info but question is whether it would fetch details from all the IR’s ?

Hi Manish,

Could please confirm, that the form has to be submitted to whom and where…

This is really good initiative by Modi Government. However, we know that Indian population is 130 Crore and around 3-5% is covered by insurance. Insurance Companies must tap the rural area for their growth. Simultaneously awareness camp must be run by the insurance companies to educate the rural people for technology of such e-policies from the funds which they have saved from physical policies in paper form.

LIC doesn’t seem to have tied up with NSDL?