List of Best Debt Oriented Mutual Funds for 2009-2010

If you don’t like Equity because you have a lesser risk appetite and still you want to make better returns , where do you invest ?

The answer is Debt Oriented Mutual funds , In this article we will see What are Debt Oriented Mutual funds , A list of Good mutual funds and what are the returns you should expect from them .

Have a look at List of Best Equity Diversified Mutual Funds. These funds are getting very popular these days as people are not ready to put their money in market for long term because of Market Uncertainty and decreased risk appetite after the recent fall in 2008-2009 .

Hence these Debt Oriented Mutual Funds have become very popular , Read This Article

What are Debt Oriented Mutual Funds ?

Debt Oriented Mutual Funds are those Mutual funds which Invest primarily in Debt products like Debentures , Certificates of deposits from Corporates , Govt Bonds etc , They put a small portion in Equity also (10-40% max) . These funds generally return in range of 10-20% in long term and the downside is limited in these Mutual funds as Debt Component is High.

Please note that even these Funds can give Negative Returns but that happens in Extreme fall downs or very bad times. You should not assume these will always give positive returns. Also You should also concentrate on Long term returns, Dont judge a Mutual fund by Its Short term Returns

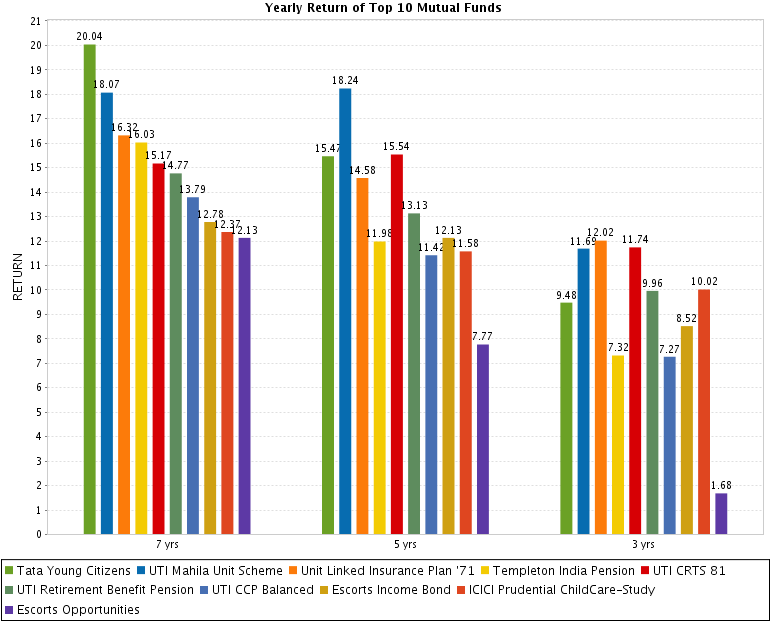

Let us see some Stats which will give you more idea about these .

- In 7 yr time frame Best return is 20%and worst return is 8.09% .

- In 3 yr time frame Best return is 12.09% and Worst return is -5.87% .

- 5 funds are more than 10 yrs old .

- Most of the Funds do not have an Entry load, but can have exit loads if exited before 2-3 yrs . Some have locking period also , but no tax benefit .

Below is the Chart I created which Shows CAGR return of Top 10 Debt Oriented Mutual Funds (Click to Enlarge)

Source : ValueResearchOnline.com

List of Best Debt Oriented Mutual Funds

UTI Mahila Unit Scheme

- 16%+ return Since Launch, 8 yrs old Fund , Excellent Track Record .

- This is my Favorite Mutual Fund . Amazing one .. Read a complete review for this Mutual Fund Here

Tata Young Citizens

- 14 yrs old Fund, Excellent Returns , This is extremely Risky Fund .. Don’t consider this as a Debt Oriented Fund

- Equity Component is very high at 50% . So I am not sure if this will suit as Debt Oriented Fund .. only people with strong heart should take this .

UTI CRTS 81

- One of the Best Funds , 28 yrs old fund , Lambi Race ka Ghoda , 13%+ return CAGR which is amazing for any debt oriented fund .

- Equity Exposure of less than 30% and the worst return ever in 1 time period is -14% , the best is 35-40% in a year .

- 4 yrs old fund , Extremely low Equity Exposure of less than 15% , Average return

- Looks great for Future performance .

Other Good Funds

- Birla Sun Life Asset Allocation Conservative

- Templeton India Pension

- Unit Linked Insurance Plan ’71

Note : please make sure you read all the other details yourself before you decide on buying , These are just my personal opinion and make sure you are your own decision maker 😉 .

Last year when markets were doing bad , Debt Funds were the best choice of the Investors , However Its not the best time to Invest in pure Debt Funds , but rather invest in Debt Oriented Funds if you are not ready to take high risk.

Look at the following Video which Is not a recent one, but talks about How investors were eager to invest in Debt Funds Last year .

Conclusion

If you don’t have very high Risk Appetite , you can look for alternatives to Debt Oriented Mutual Funds , Its always better to park your funds with these if you want more than 10% return with some amount of Risk .

Please note that These are not equity Diversified funds and hence you should not expect very high returns from these .. If you get around 10-12% from these funds that is more than good . Anything more is wonderful .

Please share your comments. Do you think you will invest in these funds, Are the returns from these Mutual funds are worth looking at them? Any do you know of any other fund which is not covered here? Please leave your comments.

November 18, 2009

November 18, 2009

Sir good afternoon,

I want to invest lampsum amt 8 – 10 lakhs in flexi stp debt fund . After 15 years 2 daughters marriage & my son edn. I want return corpus 1 crore . So plz suggest good stp debt fund otherwise suggest a good way .

Plz give information types stp debt funds . Im new in mutual fund and shares .

Hi Abdul Raheem

We think our pro membership will help you as it fits in your requirement. We have various benefits under it like life insurance, health insurance, mutual funds and your financial analysis too..

Just check out our Pro membership once and schedule a FREE call with us to know more – http://jagoinvestor.dev.diginnovators.site/pro

Hi Manish

I have invested around 4.5 lakhs in MFs over a period of 4 years through SIP. Now I would like to invest around 4 lakhs in debt fund for 6-8 years, which can give me better returns than FD. Shall I invest as lump sum or through SIP. Kindly suggest good fund

Regards

Hi Umesh

ICICI MIP 25 is a good debt fund if you want to beat FD by taking a very small risk !

@Jagoinvestor

Sir I am 22 yes old..I dnt have any knowledge about investments,I went around all Blogs & other sites.I concluded that all the FD ,MIP etc range form 8-12% of growth..

My question is If i invest 50000 Per month what are the methods from which i can get assured returns in range of 3000 -5000 Rs monthly.

Thank you!!

I am not clear of your question

[…] List of Best Debt Oriented Mutual Funds in India to Invest – @sunil . Well.. these are good Funds .. No Doubt . the only thing is they are MIP’s , They are not in the category of Debt Oriented Funds … When we say Debt …… […]

Hi Manish,

I have bought a Kotak Smart advantage plan in Nov 2008 where annual premium is 36000. Now i have complied 4.5 year. the plan says you have to continue for 20 years otherwise you will loss your first year premium. as of now i seen only 4 to 5 % return. can you suggest me what should i do with this policy(surrender,partial withdraw or ACM mode)

Surrender it !

Hi

Pleases help me in Investment plan…

My take home is 40000

Think I have 20 thousand for savings per month after all expenditures.

1).I am investing Rs 1 lac in PPF every year.I started it 2 years back.though it will be useful for children education after 15 years.I want whether is it good option or not keeping inflation in mind?

2).I want to take Debt Funds and Gold ETF to beat the inflation .So please suggest me some good funds and how much i have to invest to get 4lacs/5 lacs every 4 years or 5 years like.

Please do respond

Thanks

KC

I think you are over investing in PPF , not having a equity component is going to hurt you in long run

i invested 1.25 lacs in ulip , icic pru life time super , now the fund value is 85000/- should i continue??

Better you dont . Surrender now !

thanks sir, but will you advice me which one will be a good one for me.

You can go for HDFC equity and DSPBR top 100

i CAN INVEST 10k PER MONTH .

Risk – 50 % i can take.

Advice

Invest 5k in equity mutual funds and rest in a RD !

Hi,

I want to invest in debt fund approx 60,000 and i want to start SIP monthly in equity with Debt fund . Please suggest how is the plan.

Also suggest best debt fund and best equity fund to invest.

It would be STP from debt fund to equity fund , how good it is , can be only said if your objective is clear, what do you want to achieve ?

VERENDRA

I want to invest upto 5lac in mutual fund, which one is better for me as i am totally new about MF.which MF will gives me more intrest with security upto 2-3 years period of time ,as i am getting 8% from bank by FD.

pleas suggest some good MF names which gives good intrest with security..

verendra

there is no mutual fund like that .. mutual funds will not come with security , it will come with risk , only then it has potential to give more returns

Manish

i want to invest 4000 per month for 1year which scheme wil give me gud return

Praveen

What is your risk appetite ?

Hi, Manish, I am looking for Debt market investment where it should earn more than bank interest and no risk

Pls. suggest for 1year time and also i am looking for the high liquidity option too.

Rgds

SK patil

SK Patil

There is nothing like that ., if you want more than bank FD ,then you need to take more risk that a bank FD , simple

Manish

Hi,

This is a good article. Do you have any analysis or article done on which funds are good to use as an emergency fund parking place? Money which I may need after 3 months or 5 years, but is just parked there better than a bank FD for more than about 8% return.

Saurabh

You can then look at debt oriented funds only ,otherwise there is no way to get better than FD returns with liquidity as good as liquid funds.

Manish

Are returns in Debt funds taxable on maturity? If yes then whats the rule?

Saurav

Yes they are taxable . for any gain within one year, its added to your salary and taxed .

For anything above 1 yrs , Indexation applies and then you can pay tax @20% , If you dont want to apply indexation , you can pay tax at 10%

See : http://jagoinvestor.dev.diginnovators.site/2009/05/how-to-calculate-capital-gains-and-what_7801.

Manish

could u please suggest me the portfolio ofbest mutual funds for the coming year, my risk appetite is moderate, planning to do SIP…. thanks manish.

Great tp maintain 80:20 ratio in portfolio…we can either invest in Balanced fund or debt oriented fund and stii get more than 8% return..:)

Sir

What are the Debt Funds you are going to invest you personal money. Please suggest me i have at present 14 lacs in my hand and iam a private employee with a lot of job risk.

http://jagoinvestor.dev.diginnovators.site/2009/11/list-of-best-debt-oriented-mutual-funds-for-2009-2010.html

Manish

Can SIP be brought in debt oreinted fund No knowledge about debt So asking……

Manish

Yes , SIP is a concept for mutual funds and not about equity or debt. however there can be some funds which might not allow SIP , also SIP in debt funds does not make much sense , as SIP is a concept which is used to capture volatility .

Manish

I want to invest Rs.500 p.m. Debt oriented SIP, Which one the best and safest ?

Sudip

You should be able to find this information on blog itself , have a look at the “how to use this blog” video in the sidebar .

Manish