CIBIL to provide 1 free credit report a year – Says RBI Governor

CIBIL will soon be providing 1 free credit report a year to every person starting Jan 1, 2017 as per RBI directions . This was said by RBI governor Raghuram rajan at a seminar on ‘Transforming Rural India through Financial Inclusion’.

This is great news for investors because right now one has to pay Rs 550 for getting a onetime credit score and report from CIBIL. While Rs 550 is not a very big amount for many people, for a majority it’s quite a good amount and most of the people are not in agreement to pay for a PDF report, as they think that it should be freely available.

How the FREE credit report will help investors?

A lot of investors have till date not checked their credit report and hence they are not aware of any issues which might be present in their report. Not everyone is ready to pay Rs 550 for their report and even that’s the reason why many people are not aware of their credit score.

With this free credit report, I think a lot of people will start looking at their report and start working on improving their score and take measures to remove the bad remarks from their report. Investors will also be able to find out if there are any fraud loans on their name taken by others if any.

Seems like RBI has really pushed on this matter of free credit report. The reason why I say this is because around a month back in June, 2016 , there news channels had reported that RBI has suggested CIBIL and other credit bureau to provide a one free report. You can check out this youtube video.

What is Credit Report?

In case you are not aware, Credit report is a comprehensive report which is prepared by CIBIL or other credit bureau from the data they get from various banks and lending institutions. The report contains your credit history and all the details about our past loan payments (including credit card). Every lender uses this report to understand how trustworthy you are and if you should be given a loan or not.

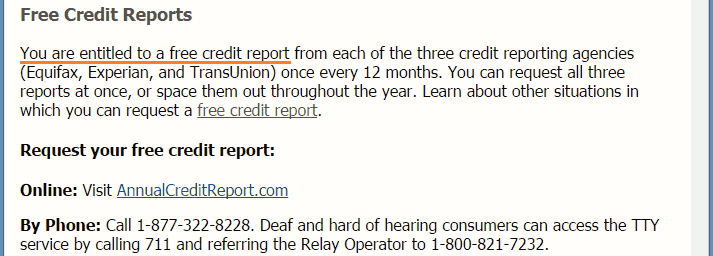

In a lot countries consumers are entitled for one free credit report a year and now it’s going to be a reality in India too. I went to https://www.usa.gov/credit-reports to understand how it works in US and found out that Americans are entitled to get 1 free credit report from all the three credit bureau there. See the snapshot mentioning that below

In India apart from CIBIL, we have Experian and Equifax as other two credit bureau, but at this moment RBI governor has only announced that one will get a free report from CIBIL. He has not mentioned about the other two.

However, I think over time even they will start providing a free credit report to catch up with the rules.

What you think about this news? Do you think it’s fair for CIBIL to charge people for providing the credit report or it should always be FREE?

July 20, 2016

July 20, 2016

Really like your site. But please put a date of posting for each article at the top. We can find out from the URL and the comments, but it would be nice to have it next to the author’s name.

Thanks for sharing that feedback. Will think about it

Does anyone know from when will CIBIL start providing free report?

Next year. No exact date though !

There is a fourth credit bureau in India – CRIF High Mark. It will indeed help customers if they get one free credit report every year from each of the bureau. While currently CIBIL is a dominant bureau, over the time other bureaus may gain importance in case banks start using their data in decision making. It is a good practice to check your bureau report a couple of months in advance before you apply for a home loan, so that you have enough time to get the issues corrected.

Hi Avinash

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Hi my cibil score is 550 I want my score to improve. How it can be done quickly.

Read this http://jagoinvestor.dev.diginnovators.site/2012/04/tips-to-improve-cibil-credit-score.html

This is a great news. I would go a step further that once I paid 550/- I should be entitled to get 3 reports in next three quarters each to check that steps I am taking to improve credit score or how loan enquiry I am making are impacting my credit score. Mostly when people request CIBIL score they end up requesting another one in next few months to see how things have improved or went down, while I understood it does not changes on the positive side that quickly but negative impacts happen very quickly.

It’s after all my data and CIBIL have no moral reason in business to make money out of it.

Thanks for your comment Harsh

Moneylife Foundation’s recommendation that at least one free credit information report should be provided free of cost to borrowers seems to have been accepted by the Reserve Bank of India.Please check below link for more information.

http://moneylife.in/article/moneylife-impact-rbi-governor-says-cibil-to-provide-one-free-credit-report-a-year-and-mdash-fate-of-many-other-pro-consumer-recommendations-unclear/47585.html

Thanks Venket for sharing this information.

Hi Manish ,

Thanks for sharing this wonder full article , could you please share the steps of get the credit score .

Just go to CIBIL.com and buy it there !

Hello Manish,

Since when is this effective and how to go about applying for one.

Best,

Kiran

Its effective from next year.. there is still time for this to get started !

Thanks to RBI governor Sri Raghuram rajan. It can help many a middle class people a lot.

Thanks for your comment GNANESWARI

Hi Manish,

Thanks for sharing this latest news. I personally think its a good move to provide one free credit report from CIBIL. But can you please explain whats the procedure to get this, How CIBIL will deliver it to customers? Can you please focus on this.

that process has not come yet !

Thanks Manish.

Please inform us once process has declared.

Sure

Good news. But viewing a self credit score should be free always. As CIBIL is Govt institute it should provide scope without charges. After awareness people can take precautions themselves to have good score.

Also earlier even after paying charges or for loan application CIBIL use to decrease the score by few points which is wrong. It is just enquiry not loan default.

CIBIL is not a govt institute

Good that now individuals can a free credit report.

Can you share more details about the schedule of free credit report and how it is to be obtained.

That details will come in future !

What if lending institutions utilise this opportunity during any loan processing with the unaware consumers? Still there is a lot of possibility of misuse by banks and other institutions as most indians are still financially illiterate….

Yes, thats the problem . If one is not literate enough in financial matters, companies can take them for a toss!

CREDIT report shuould always be FREE

Thanks for your comment SUNIL KUMAR

This is really good. As you mentioned in your article, it’ll help people incline more towards financial aspects than where they stand today. The report could be eye opening for some. I personally have checked it twice till date in 8 years..500 seemed too much ..

Thanks for your comment Prem

It’s a gr8 news!!!!!!

Hello Manish,

I recently paid 550 Rupees and requested for my credit score. This was the first time I requested for my score and also found some discrepancies in them. I raised a dispute to correct them. However I go the following response “No change Please get in touch with your credit institutions for the required correction”. Do you know how we can contact the concerned credit institution requesting them a change?

Regards,

Gautham

Yes, please contact each lender and then ask them to update the changes

This is with effect from which date ?

Next year onwards !

Great news of vital importance for all the persons holding the account with the bank. I understand, the functioning of CIBIL is still weak because of certain discrepancies appearing in the score sheet not related to the person concerned. All information of banks is also not on record due to time lag. Will you please take up the matter with RBI for this?

Only a person suffering from that can complain !

Wow! That’s great news!

Certainly a wise announcement by RBI to make people literate about their credit history and take credit decision more cautiously.

Thanks for your comment Abhay