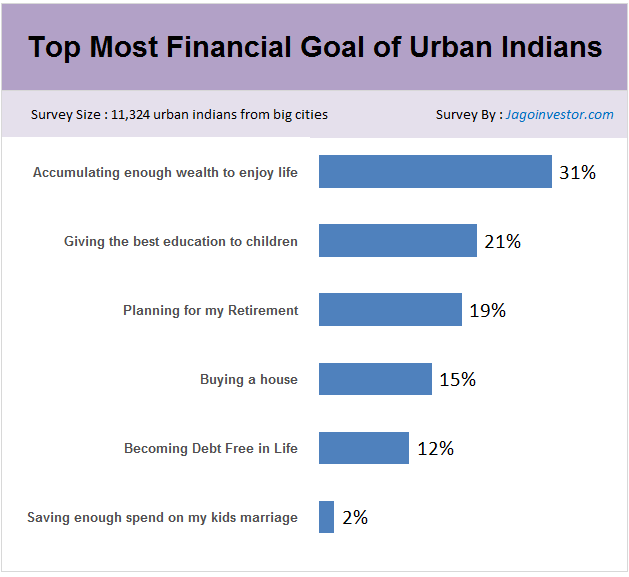

Here is what 11000+ investors told us about their top financial goal?

A few months back, I read an article that talked about the biggest financial goals of Indians. As per their survey, the biggest financial goal for 34% of the respondents was “Securing Child Future”. The only issue was that their survey size was just 150.

“Retirement” was the biggest goal for only 2% of the respondents, which means just 3 out of 150 people marked “Retirement Planning” was their biggest goal.

What is your biggest financial goal in life?

I was somehow not very convinced with their survey size of 150 because it’s not a big enough sample size to decide what most of the people feel. So I thought of conducting my own survey with a big enough sample size, and I was able to get 11,324 survey responses.

The first thing I asked was “Which is your biggest financial goal in life?”

Think about it?

What if I posed this question to you directly and asked – “Which is your biggest financial goal in life?”, what would you say?

I gave 6 options to people to choose from, and below were the results.

Goal #1 – Accumulating enough wealth in life to enjoy

“Accumulating enough wealth to enjoy life” was the topmost goal picked by the maximum people. This was very surprising for me because it was not a small sample size.

We had more than 11,000 people taking this survey and 3553 people out of that (around 31%) chose this option, which shows that somewhere priorities of people are changing these days. Now people want to accumulate wealth not just for retirement, but even to enjoy life before retirement.

They want to travel, experience new things in life, explore new hobbies and spend on themselves. In short, they want to enjoy life before retirement itself and not keep all the money only for retirement.

Goal #2 – Giving the best education to children

The next goal which was voted by maximum people was “Give the best education to their children”. Around 21% marked it as the biggest goal of their life, which confirms that still “children education” is an important and most sought after goal for investors.

It’s a given fact that giving the best education to your children is the best way to care for them and their future. Their life foundation is set by the quality of education you provide for them. It’s surely one of the most satisfying goals for a person.

Goal #3 – Planning for my retirement

I was happy to note that a big percentage (around 19%) said that planning for their retirement was their biggest financial goals. I want to reinforce the point that this survey was taken by people who are net savvy and mostly belong to big cities and earning decent money each month.

This result shows that a good number of people have realized that retirement is something they need to take seriously.

If I talk about you – Are you retirement ready? Do you feel you are doing enough for your retirement goal? If you are not sure, You can explore our pro membership program

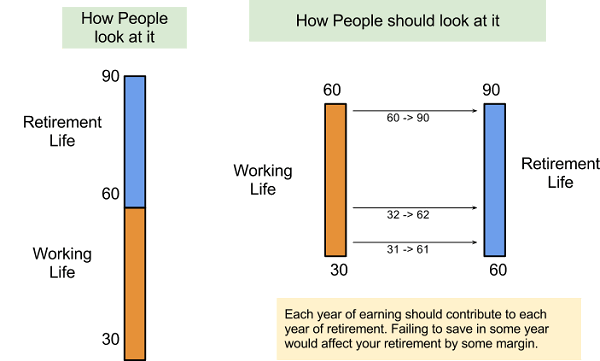

We all have 30 yrs of working life to save money for 30 yrs of retirement on an average. So look at each year of working life-saving as a fuel which will help you each year of retirement. So what you invest in the year 2016 will help you in the year 2046 (2016 + 30 yrs). This concept comes from my book – “How to be your own financial planner in 10 steps”

Goal #4 – Buying a House

15% of people said that buying a house was their biggest financial goal. Given the unaffordable housing prices and the social stigma attached to “owning a house”, I am sure a lot of people feel the “pressure” of owning a house. Only the people who still don’t own home can feel the pressure and the worry associated with it.

No matter how many articles claiming “Renting is better than buying a house in India” comes, still its an emotional decision for people. They feel pressure from family, spouse, and society to buy a house and that’s the reality.

Goal #5 – Becoming Debt-free in life

A big number of investors are getting into a debt trap and a big portion of their income goes into serving the loan or paying off some family debt. It’s surely not a very great feeling to know that a part of your income will just go away somewhere and never return back or form any capital.

A lot of people want to get rid of debt as soon as possible and the high expenses these days make it very tough for someone to close their loan by paying off the debt soon.

Goal #6 – Saving enough money for kids marriage

I am sure we all have this goal in life.

We all want to save some money (or a little) for our kid’s marriage, but 2% of people marked it as their biggest goal in life. I am not sure if they have achieved rest other goals already or not. I do not have much comment on this point, because I don’t want to say if this is wrong or right. Maybe you can share what you feel about it?

So what is your biggest financial goal?

We saw all these 6 goals and how people responded to them. Would like to know what is your biggest financial goal in life and what do you think about this?

October 17, 2016

October 17, 2016

Great article manish !! But do you think there is a need to accumulate wealth to travel ? people travel on shoe string budgets, if they really want to , I myself have travelled across the country on very low budgets

No , I dont think that. But “travel” is very different for various people . Those who want to do explorative travel , they dont need a lot of money, but what will you do for those who want comfortable travel 🙂 .

IS TERM PLAN BUY FOR UP TO AGE 65 YEARS OR 70 YEARS

Some policies give it till 70 yrs also , Do you need help on that ?

A good visual inside the retirement planning

Thanks for your comment bhupendra

Thanks for your comment Ritesh

Nice work as usual Manish!!! Keep rocking

Thanks for your comment Arun

Thank you for the interesting survey. If I may provide a feedback, it could be made even more insightful if the results are categorised by age. Eg: Financial Goals of 20-30 yrs old maybe very different from 40-50 yr old people. Perhaps the majority of the survey was taken by a particular age demography and the results are skewed towards their preferences.

Perhaps, people would be more interested to see the goals of other people of their particular age bracket than a commutative picture.

Anyways, thank you for all your insightful surveys. Hope to read many more in future.

Yes Parijat

I understand that more details would have helped 🙂 . I will try to include more points in future ! . THanks for your constructive feedback

I feel there should be a row as others, so that individuals can fill in there own respective financial goals over and above the ones mentioned in the excel shared….like i want to study more and there’s no option to select that

Thanks for sharing that concern. I know we can have those options, but I wanted to keep it simple . Anyways its now done !

Child’s marriage used to be a big financial goal for our previous generation. Now children are getting independent and they start earning by age of 24 (boys & girls). So people are focused more on enjoying their own life and least concerned about the marriage of their children.

I am also one of those 🙂

Yup .. I think thats the main reason !

Hi, very informative article.

I am a prospective investor and was looking for profitable options to invest. I wanted your views about Peer to peer lending and is it a viable option to invest?

Vikas

Its not a way to “invest” . Its a new concept of lending money and is a risky thing. YOu can only put a very small part of your money in that

Very insightful article Manish!

I do agree with your observations. An individual should have financial goals as goal-based Investing always ensures that the money is allocated to relevant and prioritised havens. Moreover, financial planning is about taking holistic view of life i.e. enjoying the present and simultaneously providing for the future. In the initial years of one’s career, one needs to accumulate wealth that can be used to develop one’s skills to enhance one’s earning capacity. In addition to that retirement planning needs to take centre stage. Retirement planning is undoubtedly one of the important personal financial goals of an individual. It needs to be given a serious thought and should be started as early as possible.

Hi Kishorkumar Balpalli

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

One question – what does it mean by saying “Accumulate wealth and enjoy life”? Is one supposed to stash it away first, and then use it for enjoyment, is that what it means? Does life work like that – delayed gratification…

I think whoever chose this option is either looking for financial independence (i.e. live off investments style). Or has tried to state their goal as LARGE INCOME (perhaps larger than what they could spend)

It does not mean delayed gratification. It might mean that poeople want to enjoy right now also (when income is actively coming) and also save money for future (to enjoy when the income stops) . ITs not that they will first deprive themselves for 10-15 yrs and then enjoy later. That I think it not a very intelligent way of saving for future joy !

I agree is not an intelligent way.. I just meant to ask – how can Accumulate wealth and enjoy life co-exist? I mean this is an ideal balance, so if in a survey this option is there, it’s the obvious choice (as it states both – you save wealth + you enjoy life currently too)

Hmm.. yea may be I should have kept it more clear . But I dont think most of the people misunderstood this.

My biggest financial goal is to become financially independent so I don’t have to work but can work if I want to. This would mean I have enough money to pay off all my debt and to earn enough passive income from my investments to cover the living expenses of me and my family. I’m tracking my progress to my net worth goal every month! Interesting Survey – thanks!

Nice article. My financial goals are to earn 5% returns on investment monthly basis. Happy to be on track now to become financially independent.

5% on monthly basis? Is that not very high and unreasonable expectation from a long term point of view ?

yeah! i want to know what he is doing, and then cut-copy-paste (even half of it, i.e. 2.5% will be great enough!)

5% per month is impossible from a long term perspective. No one till date is known to have successfully have done that. 1% is reasonable expectation !

Good article as usual.

as this article talks about biggest financial goal of person,surveyor has to choose only one option.

instead, It would be interesting to see how people arrange their goals in priority .

Yea .. But I did not do it that way !

Good topic. I have not set any goal seriously. I shall be happy being debt free, particularly be away from the bad loans. Also l need sufficient wealth on retirement, for which am investng a portion of salary in stock sip ppf gpf fd etc. But not targetted any amount. I haveno dream for a car or second house or celebrating kids marrage.

Thanks for your comment SANJAY LAHA

Hi Manish,

Nice evaluation!. I think age should also be considered here, as financial goals tend to change depending on age.

My top financial goals when I started of my career was more to do with tax saving and lifestyle goals…now few years after the goals have definitely changed and are more to do with investments and planning for future. Now that I am married and have dependents, my upmost important goals are child education and long-term wealth creation

Thanks for sharing that. I agree that it would depend on the age.