Why most investors struggle to save money every month & how to fix it?

Recently, I came across one interesting short story on quora, which I found interesting and worth sharing with all the readers. This story will help you understand why you are not able to save enough money by the end of the month. You will get to know why your hard-earned money is spent into useless things and you don’t have enough control over it.

Lady: Do you smoke?

Guy: Yes I do.

Lady: How many packs a day?

Guy: 3 packs.

Lady: How much per pack?

Guy: $10.00 per pack.

Lady: And how long have you been smoking?

Guy: 15 years

Lady: So 1 pack is $10.00 and you have been smoking 3 packs a day which puts your spending per month at $900. In 1 year, it would have been $10,800. Correct?

Guy: Correct.

Lady: If 1 year you spend $10,800, not accounting for inflation, the past 15 years puts your spending total at $162,000. Correct?

Guy: Correct.

Lady: Do you know if you hadn’t smoke, that money could have been put in a step-up interest savings account and after accounting for compound interest for the past 15 years, you could have by now bought a Ferrari?

Guy: Oh. Do you smoke?

Lady: No.

Guy: Then where’s your fucking Ferrari?

The story above sounds funny. The lady did not smoke, so that money must have got accumulated and she should have owned a Ferrari as per the logic. But that did not happen in reality.

Why?

The answer is – “Ferrari was never on her mind”

Her money was not put on the purpose of buying the Ferrari someday. She did not spend the money on a cigarette but then that same money kept getting consumed on some other things which came in small chunks.

Life kept throwing small and tempting desires and she fell for it without realizing it. And finally at the end, did neither have the money, nor the Ferrari.

You are the biggest enemy of your financial life

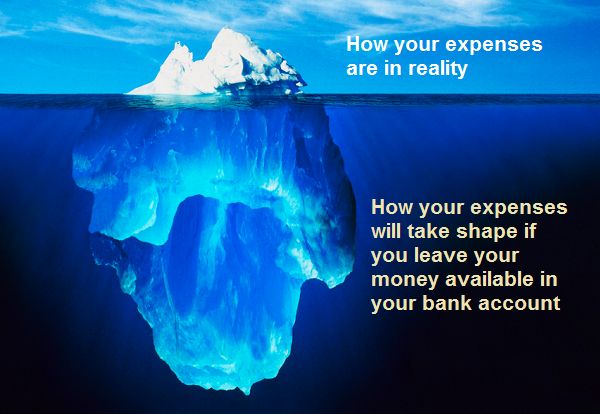

If you leave your money in the saving bank account without giving it a strong purpose. Then the lifestyle today is such that no amount of money is enough to meet your short term desires.

Life will throw all kinds of requirements and if your money is available right in front of you, you will keep trying to handle those requirements without much analysis.

Justifying the expenses becomes very easy when you have the money sitting in front of you, waiting to spend. Investors are generally over-confident about their saving abilities and there are tons of research to prove that.

Take out the manual mode of investing from your life

Here is the rule – “Lesser the money available in front of your eyes, higher the chances that you will restrict your useless spending.”.

You need to take out the manual mode of saving money out of your life and take the help of automation. There has to be some way, where some part of your salary leaves your bank account and gets invested on its own. Because the more you leave the decision making to yourself, it’s not going to happen on a consistent basis. Humans are designed to take the path of least resistance. Machines don’t make mistakes.

Let some automated way to save your money, and it will happen consistently, without fail. No one will

The best example of this is your EPF

Your employer deducts a part of your salary and that gets accumulated over months and years. That small deduction becomes a very big amount, if you leave it just like that and don’t disturb it. EPF does not earn very high interest, but still, it accumulates a decent amount.

Now just imagine this, Your employer tells you that they will not deduct that amount and you have to save money each month. It’s fully in your control now.

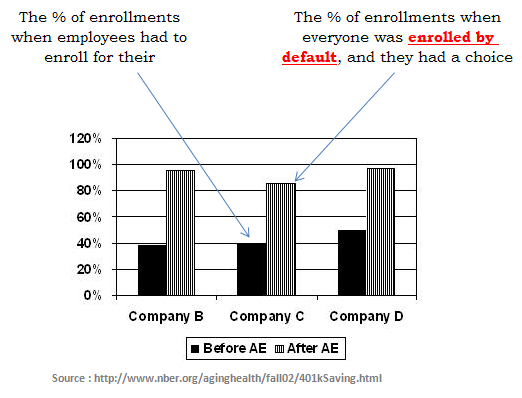

You should feel great that you have EPF and some form of automatic saving. If you were given the freedom to choose the EPF, it would be a bad thing. Because most investors won’t have chosen it. Here is a similar study from the US, where employees were asked to enroll for the 401K program (similar to EPF in India). However, the catch was that they had a choice to not opt.

When the enrollment was made a compulsory thing as a default choice, with an option to opt-out if one wants, the enrollments more than doubled. Why did it happen? Because enrollment happened automatic!

So coming back to EPF example, Will you save money equal to your EPF each month if it were not taken out of your salary automatically?

Are you really confident that you have the determination and commitment and control over yourself to save that money month after month, year after year without fail?

Are you understanding what I am trying to tell you here? The point is, YOU are your own enemy when it comes to saving. Take your manual judgment and your decision making out of saving each month. Let it happen on its own, automatic.

My personal Experience

Around 6 months back, my wife wanted to start a recurring deposit.

She started a recurring deposit of Rs 15,000 per month for 1 yr period. After 8 months, when she checked the bank accounts, she could see the 1.2 lacs in the deposit account. Suddenly she felt – “How this money did came there?”.

The point is – it was automatic saving. It all happened in the background and didn’t give her any scope of judging the decision again and again. She always saw her salary minus 15k in her bank account.

All her expenses, shoppings, indulges, bills had to happen out of the money which she saw in her account and it happened. The expenses fit themselves in the amount available. It’s the nature of money, and I will share more about it in some time.

Don’t trust yourself for saving money

Don’t trust yourself, when it comes to systematic saving. Your intelligence can be your big enemy. If you decided that each month you will carefully set aside some part of your money yourself, after all the expenses are done, then it’s going to be a tough time for you.

Do this simple exercise

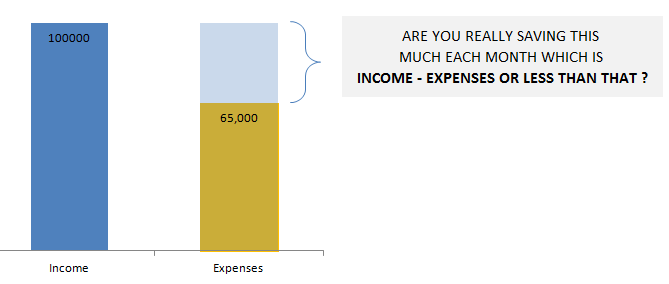

Take a sheet of paper (or open an excel sheet). One the left side write down your income each month and one the right side, write down all the expenses per month.

Now subtract your expenses out of your income, and you get your monthly surplus. So each month after all your expenses are made, you should be saving that surplus amount. Correct?

Is that happening? Did I hear NO

Why does it happen? Why are you not able to save the money equivalent to your surplus each month?

MONEY is like flowing WATER

Have you ever wondered why you are not able to save enough money, even though your salary has kept increasing in the last many years? Your expenses keep on matching with your expenses.

Even if you are saving some money, are you reaching your full potential? I guess NO

Why?

It’s because money is like flowing water. If you do not give it some direction, then it will find out its own direction.

When you do not automate saving money, then all the money will get consumed into “something”. Life will keep throwing various kind of expenses, desires and requirements, and if money is easily available in your bank account, then trust me, you will always come up with strong reasons why you can’t avoid those expenses.

Some of our clients get shocked when they fill up the datasheet we send them. The most common complain is – “I am not saving anywhere close to what my income – expenses is showing up”, where is it all going?

The answer is – “Its getting consumed into things which looks important and urgent in short term, but in reality, they are not”

My friend real life case

Few months back, I was talking to one of my close friends. He told me how he is not able to save anything by the end of the month. He was very confident that it’s very tough for him to save anything. After all, if he had any surplus, why it’s not there at the end of the month?

I asked him a simple question – “If his income increases by Rs 1,000 per month. Will it remain in the bank account after all his expenses?”

This one single question was a game changer.

He told me that he is very sure that even if his income increases by Rs 1,000 per month. His life would be same, it will surely get consumed somewhere.

I told him – “In that case, if your income drops by Rs 1,000, your situation will be same”

So why not set aside that Rs 1,000 in the starting of the month itself, and see fewer months in the bank account. Trust me, your financial life will figure out something, it will adjust. It will surely try to fit it.

And that’s exactly what happened. I helped him in starting his first SIP of Rs 5,000 per month.

Just a few days back, the first auto debit happened. I can almost guarantee that by the end of the year, these Rs 60,000 which was getting consumed somewhere, will “automatically” get saved in mutual funds.

So what is the worst case?

Ok fine, your financial life is really in bad shape & you can’t save even a penny. Let’s say, you show some courage and start a recurring deposit of Rs 1,000 per month, even though you know you will need that 1k later.

What is the worst case?

You would need that money back in some time again? Right?

Solution – It that happens, then break the Recurring deposit and use the money …

Or you could start a SIP of Rs 1,000 and incase you needed it, you can always redeem it and take back your money.

But you know what, you will not take it back. You will not redeem it. Because like most of the investors, you are lazy when it comes to money. It’s easier to adjust rather than take that pain to go to the bank and sign that paper for redemption.

We humans take the path of least resistance. You don’t know how amazing human laziness can be for your financial life. Ask those who bought IT stocks and never cared to think about what to do with it. Its only their laziness, which has made them millionaires, because they still hold the stocks

Most of the people are living with this myth that they will not be able to save even a penny by the end of the month. It’s not true. For 95% of investors, it’s a self-created illusion.

They have just not tried enough in the right manner. Let me share with you this in detail

Income – Expenses = Saving

For most of the investors, the default equation each month is “Income – Expenses = Saving” . This equation looks very natural and logical. First, you take care of expenses because they need to be handled NOW, and then if something if left, you will save it. This is how any normal person will think like. But that’s the root of the problem.

If you are not able to save enough money each month, I am ready to bet that this is the equation that is destroying your financial life. Let me guess how it looks like.

Each month, you must be earning some money, then you take care of various expenses, some fixed and some random surprises and if you get lucky, you must be having some surplus money in a bank account each month.

But wait, The money is still in your bank account. It’s still “easily available”. You decide that you will do something about it very soon. You decide that once it becomes a big amount, you will create an FD out of it.

Next month, again you have some surplus and more money got accumulated in your saving bank account. Suddenly in the third month, your spouse tells you that she wants to upgrade the washing machine. After all, anyways its Diwali time and she deserves it.

And why not? After all, you have the money available in your bank account. What’s the problem then?

Your timing is also perfect, the thought of upgrading the washing machine has come up just when Flipkart sale is round the corner. I am sure it’s a coincidence.

No , it’s no coincidence.

The point is – the money found its own direction and that’s because you didn’t gave it any direction beforehand.

For a moment, think what would have happened if the additional surplus was not available easily. It was there in a recurring account or was into SIP in some mutual fund or ELSS (locked for 3 yrs). It’s hard to imagine that you would have said – “Let’s stop our RD or SIP in mutual funds and upgrade the Washing Machine”.

Can you see how everything changed in both the situation?

Or imagine you would have created an FD out of that money before hand for paying the school fees for your kid at the of the year. Would you break your kid’s related FD to upgrade the washing machine? Generally not.

I am not against the expenses

Trust me, In no way, I am judging the urgency of your needs or desires. They might be genuine and very much reasonable. Please go and upgrade your washing machine, if it’s really needed. I am not even against taking a loan for that, but just assure that your requirement is genuine and not a made up one.

Just 1 yr back, I bought a sports cycle out of impulse and you should have met me just before I purchased it. I would have convinced you that I need the cycle more than I need oxygen. Plus, I had the money with me at that time. Today I am not using it enough to justify my buying decision.

I can tell you – this false belief of “I need it so much” and the availability of money in your bank account is such a deadly combination.

So what do you do ?

Change the equation to “Income – Saving = Expenses”

Few changes in life give a new direction to life. Everything changes.

Trust me, this is one such change if you really understand it well. If you decide to change your saving equation to “Income – Saving = Expenses”, it can drastically impact your financial life in positive way.

Here is now you implement it.

- Find out what is the minimum amount you think can save each month. Is it 10%, 20% or 30%. Take a lower amount at the start, else it won’t be sustainable in the long run.

- If your salary arrives in your saving bank account on date X, then, setup a recurring deposit or a SIP in mutual funds on date X+2 or X+3

- Trust automation, it will do wonders for you

- And in the worst case, if you really need the money, you can redeem it back and use it or stop the RD or SIP.

If you can take this first step, then you have already won the big part of the battle. Other things like great returns, advice, controlling risk, finding the best financial product and all that will be taken care of later. But the first step it this – changing the equation

If you can spare 20 min, you should watch this amazing video by Shlomo Benartzi, on the topic of Saving for tomorrow, tomorrow. You will understand the impact of automatic saving in a better way in this video

And you don’t have to compromise

Don’t confuse automatic saving with compromising on your expenses and fun. We are not asking to stop eating out or cut on your entertainment in life. A lot of investors live in this myth that financial planning is all about compromising your desires and spendings. No, it’s not.

It’s all about giving a meaningful structure to your financial life and exploring various possibilities to make your financial life awesome. That all.

I would love to hear what you think about this idea of changing the equation. Do you think that this single thing is really a very important parameter to live a good financial life? Please share your own saving habit in the comments section

November 22, 2015

November 22, 2015

As usual very helpful article.

Always enjoy reading jagoinvestor articles because you talk of real life issues of regular people. The language is not fancy and your content is better for it. You talk like a friend would. In simple terms bit about very relevant topics and giving good advice. Thanks foṛ that

Thanks for sharing that Gaurang .. please share the content to your friends and all so that more and more people can read it

.. please share the content to your friends and all so that more and more people can read it

Very interesting and thoughtfully articulated article Manish.

Thanks for your comment Sandeep

Very good article manish

Thanks for your comment Rohan

Good article Manish.

Thanks for your comment Jackson

Found your article informative. Thanks for sharing.

Thanks for your comment Rohit

Very informative post from Mohit Chauhan sir. Sir, Do Jago investor allows guest posting? If yes, then I would like to contribute articles here. Thank You

Yes you can contribute articles to Jagoinvestor ..

Just make sure its a high quality content and something new to community. Send it to me on manish@jagoinvestor.com

Manish, as you have rightly pointed out, it is indeed a good and practical idea to get into passive or automated mode of investment, whether through SIP or RD.

Even within SIP, it is a good idea to give a long term SIP in good equity funds or even ETF – say 3 years (or even perpetual) rather than 6 months once funds are finalised for investment. If the fund performance deteriorates, one can always stop the SIP.

However it ensures that you keep on investing regularly, without bringing emotions in the investment process, something that behavioural finance recommends.

Yes, I fully support that ! . It will help to save money in long run !

Hi manish,

Good to know one more interesting lesson from you.

One suggestion required from your side that where some body need to invest if he has some spare money in hand by looking today’s market scenario. either PPF, SIP or RD..

SIP is the better choice. In case you are interested in that, let us know and my team can help you in setting up the SIP and doing all the things – http://www.jagoinvestor.com/start-sip

Hi Manish,

As always great blog . Automation has done wonders for me .I am able to save about 55 % of my income due to Automation via SIPs in equity and debt funds / RDs .

Believe me , It feels awesome after you see a hugh amount in your savings / investments at year end .

Hey Minu

Thanks for sharing your experience with all of us. It was a great learning.

Manish

Hello sir

i am really glad to be part of this. rally appreciate you for aware people. it is a useful method no doubt.

Thanks for your comment swati

very well written article with interesting points…although i am already doing some points that are mentioned, will try the income – saving’s formula.

Glad to know that Rabiya ..

Hi Manish,

Wonderful Article. Completed relating to it.

I very pathetically managed my finances and almost 90% of my salary goes on loans (this happened also due to genuine reasons). I will clear of 1 credit card of mine this month with the bonus and I will be left with about 10K excess in hand. Do you suggest that I pay that excess 10K also into another CC and try to clear that faster or should I save that money. Pleas suggest.

Very good post…!

I tried this way by saving 5K in RD and today i saved almost 2.50 Lacs.

Glad to know that !

nice post

This is a great article for folks finding it tough to save money. I have been following this strategy as well and I can say without a doubt that this works wonders. The first thing that I do when my salary gets credited is to move a certain % to a flexi-RD, per a budget. I make do with whatever else remains.

A year ago I did not have any savings at all. I found myself put up against a heath emergency which had me borrowing money from friends and colleagues. The health insurance claim didn’t come through either. But come one year later, I have a substantial amount saved up and I feel I’m better prepared for unforeseen situations. I find myself more attuned to cutting costs wherever I can to save up more.

This idea of automated savings has you adopting a more frugal lifestyle as well. It may seem a little odd when you start out but eventually you’ll find yourself getting more and more accustomed to it and that big number in your savings would definitely put your mind more at ease than any other material item ever could.

True ! .. thanks for sharing your story and how this is working for you !

Dear Manish,

I just finished all my car/home loans 1 year ago . I have rebuilt my contigency fund for 1 year. Now i want to invest upto 50% of my salary of 1 lac, for my family. This is all i have. Please advise what is the best way to start forward again :). I am 41 years old. and looking forward to your ideas

and looking forward to your ideas

Thanks

Rakesh

Hi Rakesh

I suggest you should invest in equity mutual funds with a proper plan for your financial goals. We can help you in choosing the right funds for your goals . Do explore our financial planning once. Its affordable and will give you a good roadmap.

http://jagoinvestor.dev.diginnovators.site/services/financial-planning

Manish

Hi Manish,

Great article!

I want to which are the best automated saving options to save for short tem goals e.g. a financial target in 06 months.

Thanks in advance.

RD is the best thing

Thanks, nice one

Hi Manish,

Its a great article indeed. I too realised that equation should be income-savings=Expenses recently and have started moving part of my salary to another savings account which is not used.

However I know it is not great idea. So started RD.

I really liked the idea of automating the savings I will try to implement it in coming months.

Glad to know that SriharshaKaragodu ..