The secret of taking better financial decisions in your life – 4 point decision making framework

Do you know, which is the one thing – which is responsible for making financial lives complex these days?

The answer is – LACK OF CLARITY!

Most of the investors take wrong decisions in their financial lives and regret later about it. However, I want to assure you that by the time you complete reading this article, you will learn how to take better financial decisions and lead a simpler financial life.

Each financial decision you take has some pros and cos and some advantage or disadvantage. Some decisions will put pressure on your cash flow and some will make you rich in eyes of society, while some will create assets for you and some will destroy your net worth.

And finally, decisions will give you peace of mind and some make your life hell.

Some examples of decisions which investors have to make !

- Should I prepay the home loan or invest it?

- Should I buy that plot or not?

- Should I take 2nd property or put the money in mutual funds?

- Should I buy the higher end model of the car or the lower one?

- Should I change my job for higher salary or be in my comfort zone?

- Should I give 1 lac to my friend as loan or make some excuse?

- Should I buy the 2 bhk or 3 bhk?

- Should I keep so much money in FD or invest in the 2nd house?

- Should I save for my kids education right now or leave it to fate?

- Is it fine to spend money on outings so much?

- Did I make a mistake by spending so much on myself? Am I selfish?

I must acknowledge that its always going to be tough, to take a decision. But can we do something which can simplify the process of decision making and give us a framework using which we can quickly decide and take things to next level.

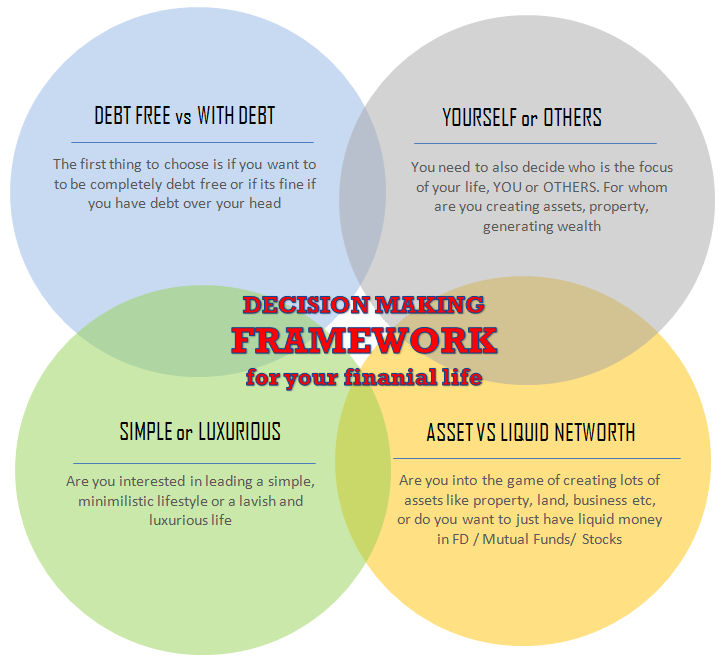

4 point Decision Making Framework

Let me introduce you to the concept of “decision-making framework”, which I recently invented and to test its effectiveness, I ran a survey which was taken by around 132+ people online. I will share the results with you below shortly.

Below are the 4 points which I have included in the decision-making framework.

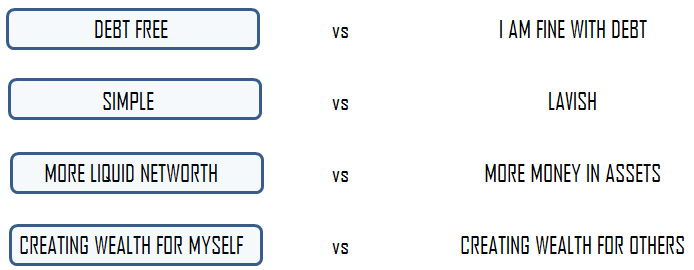

What is decision-making framework?

Like you saw above, a decision-making framework is nothing but few choices which you make before hand. So whenever you need to take some major financial decision involving money, you can check if it’s aligned with your overall decision-making framework and vision for yourself. You can check if the decision will take you closer to your goals in life or take you farther!

So now, let’s dive deeper into each point and you decide for yourself which side you fall into.

1. Debt Free or With Debt – What is your priority ?

The first point in your decision-making framework is if you want to lead a debt free life or if you are comfortable with debt and side by side you are creating your wealth.

This question is very important to answer because debt trap has destroyed many lives and made some really amazing people slaves in today’s world. So a person wanting to be debt free asap, keeps getting into debt because each opportunity looks so promising that they are attracted towards it and even though it does match with his vision in life, they still fall in.

Its happens because of instant gratification problem !

The first home loan is allowed!

Note that I am not taking about the first home loan you take in your life. No matter how much logic I put in, I think in today’s times, there is a very high chance that most of the people will end up with a home loan at least even if they want to be debt free. So for the sake of this 1st point in the framework, we will allow one home loan and nothing more than that.

So if you look at the other side, a lot of people after they have taken the first home loan, keep taking additional loans for 2nd house, 2nd car, plot loan, loan against property or topup loan and keep giving away their salary in EMI and keep making assets on the side.

While this is not an issue as such, but the problem happens when you realise that you wanted to debt free long back, but have spent all your life living in the pressure of EMI’s and never felt that independence of not having debt on your head.

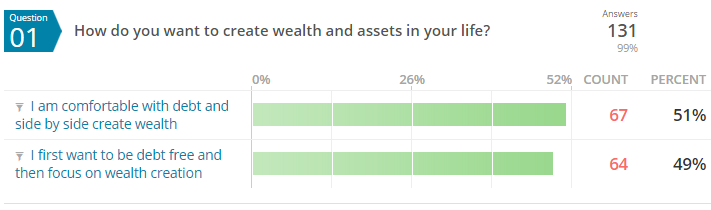

Let’s see what most of the people choose out of the two choices.

As per the survey, it was a big tie between the two choices and almost 50% people said that they want to take the route of debt free life asap, but the other half were fine with the debt in their life while they create the wealth on the side. I am sure these are the investors who have a strong predictable income structures and safe job which gives them the confidence to say that. Below are the results

Real life example when it becomes tough to choose

Imagine you have taken a home loan which is 50% complete. You are regularly taking all the efforts to prepay your loan and because of your extreme focus, the loan will soon complete (in few years). You also have few lacs in your bank account accumulated from last few years which you wanted to keep as surplus funds and are now planning to repay the home loan further and that will almost make you debt free.

BANG!

Now suddenly you come across an amazing flat/plot which sounds like an amazing opportunity and you start visualizing how this can be an amazing addition to your portfolio. How after few years you will make 100% profit on it. You visit the site, the sales guy tells you about the amenities, location, the future prospects of the property and now you don’t want to miss the offer.

Your spouse is already happy and proud of you making further real estate investment.

You were closer to get debt free, but you again get into that debt trap, because this offer comes and now you are on the way to take another loan to fund the purchase of a new property. On one side, you are so happy, but on the back of your mind, you are worried if something happens to your job, will you be able to handle the EMI for another so many years? You are worried if the new property didn’t turn out to be that great, then what?

You are worried, if it really really makes sense to buy something which you will use after many years? What if it didn’t fetch you good rent?

Truly speaking, there is no right or wrong decision of the above problem, but your decision has to align with what you wanted in your life and hence you should before hand if leading a debt free life is bigger priority or not.

2. Simple or Luxurious – What will be theme of your lifestyle?

The next thing which I feel should be part of your decision-making framework is a clear choice between what kind of lifestyle do you want to lead? Will it be simple, plain, minimilistic or a lavish and luxurious one?

I know some people will say, they want a balanced life which has a mix of simplicity and luxury both? I get that !. But there is always one of these dominating one, which will be the major part, we are talking about that here. Its totally ok to choose to live a simple life, which occasionally has luxury in it or vice versa. But the theme has to be clearly defined for you and your family.

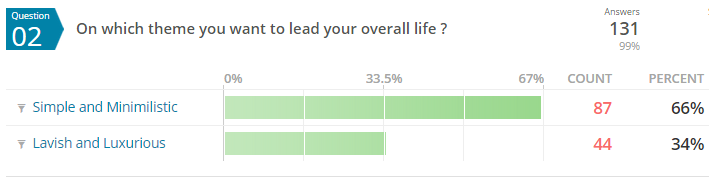

When I asked this same question in our survey, around 66% people said that their life theme has to be simple and minimalistic and 34% said they wanted it to be lavish and luxurious.

Let’s not judge people on this parameter. I am sure a lot of people who want to choose luxury theme deserve it and are working hard for it. It’s a choice of leading a life, after all it’s one life and when will you not live like a king if not right now at this moment.

On the other hand, there are people who are very uncomfortable with lavishness and want their life to be simple and plain. These people also spend a lot of money on few things they love and they become spendthrift at various points of their life. I am on of them.

Both the themes discussed above are RIGHT, and we never know why people choose the theme they are choosing. It all depends on how they have lived their lives till date, what is their outlook towards life, their past experience with money, the struggles they have seen in their life and what kind of people they associate with. There are too many dimensions to it

Why choosing your theme is important?

So that when a big purchase comes, you can see if it fits your theme or not?

- So that you can choose which car to buy?

- So that you can choose how much furnishing to do at your newly bought home?

- So that you can decide if you want to buy a premium villa or a normal 2 bhk house.

- So that you can decide where you want to give the kids birthday party.

I am associated with both type of people in my life. One of my friends bought 70 lacs home and did a 25 lacs of interior (his house is awesome), while the other friend bought a 35 lacs home and bought minimal furniture and setup, but he has bought a high-end camera which is very very expensive.

Its not about show-off

A lot of people might feel that those who want to lead a life of luxury want to impress others and show off, but let me make it clear that it’s not like that. It is how those people want to spend their life on this planet which is anyways limited and its very natural. Just because you are not like that, does not make the other person wrong.

So, if you have made the choice of lavish living as your theme, then “to hell” with those friends who keep saying why you should save for future. Spend yourself like a king, earn more and spend more on yourself, buy awesome clothes, go on exotic tours, travel like there is no tomorrow. But be clear that you wanted it 🙂 and the best part is that you will not be guilty about it. After all, you have chosen your life to be that way.

3. Blocked Assets vs Liquid Networth – What excites you?

For those who think a lot of money will solve their struggles, you will be amazed to hear that there are many investors with net worth of 2-3 crores depend on a personal loan if they suddenly need 8 lacs of money and if they suddenly loose their job, they will panic like anyone else, because they are not sure from where the next month EMI is coming up.

Why is it so when their networth is 2-3 crores?

Because, its all blocked and locked in assets which is highly illiquid. If they want to take out the money, it will take many months and years to get the best deal. These investors choose to spread their money across various assets (especially real estate like plot and houses) and anytime they have some cash in their FD or mutual funds, they feel it should be diverted to something concrete which they can touch and feel (even gold is one asset class).

So they keep increasing their networth, but are always low on liquidity. The biggest problem which I feel with these investors is that if some great opportunity comes and knocks their doors, they are so low on liquid money that they cant take advantage of the opportunity and have to take help of loans.

The worst part is that a lot of these investors never wanted things to be like that. But because they never slowed down in their financial lives to think of how it should eventually look like, their financial life took the shape on their own based on circumstances.

Some investors like Liquid money !

Liquid money means the money which can be redeemed very soon, but with fair and decent returns. So A lot of money in mutual funds, fixed deposits and limited money in real estate is what I call as “liquid networth”. In our financial planning terms, Me and Nandish think that having 1 crore in liquid networth has to be one of the primary milestone of every investor.

You will find many investors who are having networth of a crore, but all of it will go away if you take out real estate out of the equation.

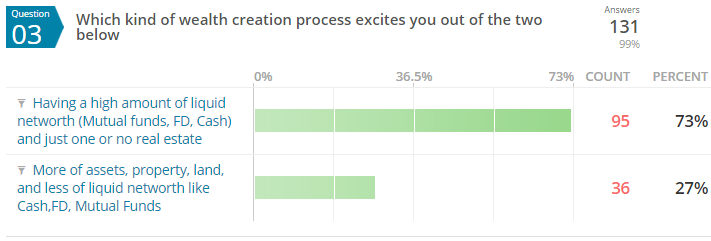

So the main question comes – “What excites you more?”

Do you want to create high networth comprising of liquid networth (stocks, mutual funds, FD,Cash + 1 real estate for living purpose) OR you want to be high on real estate, various properties, plots, businesses etc and lower on the liquid networth?

Whatever choice you make, it will help you to take further decision in life which you have to decide where should that Rs 5 lac go which you got as bonus!. I was surprised that 73% people in our survey said that they want high liquid networth (not sure if its because real estate is not doing so well from last 1-2 yrs). Below are the results.

It would be a good exercise to see if your current networth is aligned to your theme or not ?

4. Yourself vs Others – For whom are you creating wealth for?

This point if the decision-making framework can be a bit uncomfortable for many investors, because now we are going to be a bit selfish in life here. And the tough question for you all is – “For whom are you earning this money?”

- Mainly Yourself + a bit for others in your life (kids, parents, others in life)

- OR Mainly Others + a bit for yourself

Our parents created wealth primarily for us – their kids. They earned all their live, but never enjoyed the fruits of their labour. They never gave priority to their desires in life. They never owned a car, so that we can have a bike. They never created their retirement fund, because they were busy funding our post-graduation. They never went for any lavish vacations despite having money because their daughter’s wedding had to be planned years before and the money was to be accumulated.

But this story is taking a new shape in last many years.

I am constantly seeing the shift in mindset. From last 10-15 yrs, the mindset has shifted on “them” to “Me”. from “their needs” to “my wants”. The aspirations have gone 10X high and we want to consume, spend, enjoy, live life in a very different way compared to our past generations.

We have seen many of our clients focusing more on their “Retirement goal” rather their “kids education” or “kids marriage” and to some level I think they are going right.

Kids Education and Retirement

In old days “Kids Education” means “Retirement goal”

You will find various parents today who have hit retirement, have nothing great in networth to talk about and don’t have a penny to feed themselves and there is no help coming from their kids as well for whom they spend all their wealth till date. A lot of parents secretly wonder, if they did the right thing to over think about their kids and others and never thought about their own retirement or aspirations.

But things are changing !

Today, you have to plan both the goals separately and for most of the people its not possible to reach both the goals easily. Kids today have many options like taking education loan (if they are highly smart and crack good institute) or first take a basic job go for higher education few years later using their own money. In fact, many parents are now taking the route of education loan (they help taking it), but finally ask the kids to repay it themselves.

Already a lot of kids are guilty these days that their parents have to spend on their weddings and they want to arrange it all themselves. I know this is a sensitive topic, but this always keeps hiding in every investors mind and no one talks about it.

Spending culture in increasing

These days more and more people are going on exotic vacations abroad and within India, spending more and more money on entertainment, eating out, having great experiences, and spending on possessions. But some people are not able to do that because they are not yet clear if its morally right to do it or not.

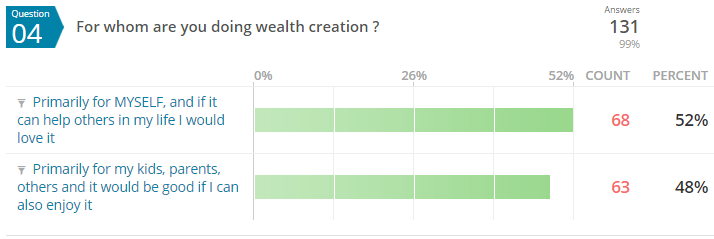

Here comes the biggest surprise. Almost half number of people who took the survey chose themselves over others and the other half choose others over themselves.

You have to complete your responsibilities in life

In no way, I mean to say that someone who is choosing themselves as the primary beneficiary of their wealth are running away from their responsibility. You still have to pay your kids school fees, clothes, your parents health expenses. Do all that!, but when you have to choice do a SIP for your retirement and another option is to pay EMI of a second house which you think will help you kids in future, you have to make a clear choice on who will get a bigger pie.

Will this decision-making framework help you ?

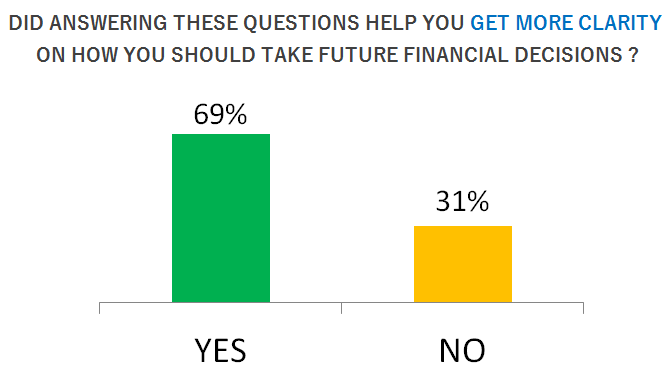

Truly speaking, YES and NO both are the answers. This whole exercise is nothing but bringing out your subconscious mindset on paper and make it clear to yourself on what you want your future to be like and how you would like to lead your financial life. You will not get robotic about your decisions, and obviously deviate from these points which you decide by yourself, but at least this will give you a structure to think and act.

At least 69% people who took the survey said that just by answering these 4 questions and choosing their answers helped them realise what really they wanted in life and how they should take their future decisions.

I also now realize, that why we should not think why others don’t act like us and why some are materialistic and others don’t, why some people spend too much on their comfort and some live frugally. Why some people buy too much of real estate and others don’t. Why some people are in rush to close their loans while you might be thinking that they are not taking right decisions.

SO what works for you might not be others priority and does not fit others life. Its important to understand this point and brings maturity in your thinking.

So what is my personal answers for my decision-making framework ?

I thought I will share with you all about my personal answers for these questions above and how I think about my own financial life. Below they are

Understand that the above points are my personal points based on my life experiences and my mindset, you should think that they are better than yours or anyone else. Because of my clarity on above 4 points, I will decide in following manner.

I would like to hear what do you think about this idea and does it make sense to you. Do you feel something like this simplifies the decision making or not? Also please share your personal decision-making framework. What are your answers on these 4 points?

October 4, 2015

October 4, 2015

Dear Manish,

I would like to have your suggestion. I will be retiring in 2022 and currently do not have my own home. I would like to build a home so that there is no burden of rent after my retirement. From many years, I have also been investing in PPF and have accumulated some money in it. Please suggest, whether should I take home loan or take out the money from my PPF and us it for building my home? My feeling was to take 50% loan and 50% use it from the PPF for the total cost of building the house. This will give some tax benefit and also will not put me into heavy load burden. Kindly suggest.

Yes, I think your idea of taking 50% loan is good. Dont use the full PPF amount as it will help you in your retirement

Thanks for supporting my idea. This idea I got it only after reading your article.

It was a value read Manish. I, while reading, also answered the 4 q’s and did changes to my excel plan which i maintain to track and plan my personal finances. I have also sent the q’s to my list of clients(I advise on personal finance in my own little way). Thank you for doing such work and enriching people like us through ur passion and work.

you are good manish !! no wonder why your site is rated among top five blogs

Thanks for your comment gunjan

Great Article ! After reading Your Article i feel i have to add one more point towards this article will help your reader to get more information in this article

Time value of money.

According to this principle, a money you receive today is worth more than a money you’ll get tomorrow. You’ll have opportunity to invest that money immediately and begin earning more revenue from it (and also avoid losing value because of inflation).

Again, this helps you make certain calls about your purchases — and your income. It’s the old “a bird in the hand” theory in action for your wallet.

These point help me in my whole life.

Thanks for sharing that Decisionmaker

Very insightful article. Articles like these help a great deal for people who don’t have a lot of knowledge or are confused as in what to do. I am a Tata AIA Life policy holder and suggest Tata AIA life’s Smart growth plus plan which seems a very good plan and, it offers flexibility in choosing policy term, has good policy returns and tax benefits u/s 80C & 10(10D).https://www.youtube.com/watch?v=p6taJlYgVgY

Thanks for your comment Naveen

Hi Manish

Thanks for a wonderful and insightful article!

These are definitely some of the important factors to consider, but these situations could also be alleviated if you have a sound financial adviser in place.

Secondly, the question of debt-free vs debt ridden is really a matter of personal perspective as it depends a lot on risk appetite and age-profiling of investors. I believe investors who have just started their careers should not really be debt-averse (for the right spirit 🙂 ) and should have tangible asset/wealth creation as one of their foremost priorities.

Just to quote an example, I have been in a situation where i took my first loan to buy a house; once i was on the verge of repaying the home loan, i really got attracted to a second property investment(RTM) and took on debt to fund it. (however the debt is being serviced through rentals which take care of approx 60% of the EMI). So in a way i feel that at the end of the day, the decision would have made sense.

Regards

Sreekanth

Hi Sreekanth

True , ultimately one has to take their own pick between these choices 🙂

Dear Manish,

These four questions are relevant to every reader here. I am close to paying off most of my debts and believe me its a great feeling. Thanks to you since I have been an ardent reader of this site and took a difficult step of cutting costs and spending only on basic needs to close all my small time loans. I wish I had found this site earlier. Anyways. I also took a decision of holding my temptation of moving into a brand new flat. Instead we wish to renovate our existing though an older flat with few lacs. I am scared to block my salary for next 30 years.

Financial stress can be fatal. Thanks for all the information here.

Thanks for your comment jhuma tiwade

Hi Manish,

I have been following this site for a while now. I have been able to relate myself to many of the articles that you have written. The X-factor that differentiates this site from others is its simplicity and the appeal to the general public. It has been a privilege to come across these articles that have been an eye opener to a part of our life (financial life) for which formal education is not readily available. Keep the good work going !!!

Rahul

Thanks Rahul !

please help me .i am salesman in demat account opening in chandigarh. how i will get data of already demat account holders and also how i will find more leads

Hi kanwar

Thanks for asking your question. However we do not have answer to your question.

Manish

As usual perfect article and clearly explained all things. Manish, I am reading your blog since long and learnt lot of things about investments.

I can clearly and confidently say that, this article is very very relevant to me as I am already thinking from this perspective only. It’s only ourselves who will decide what type of lifestyle we need to live on this planet. We should neither complaint about other lives and their lifestyle nor follow their lifestyle blindly.

Its all depends on the persona whether he/she should live simple or luxury life, whether want debt or want debt free life, whether need only 1 flat or more than one.

ITS ONLY WE WHO DECIDE WHAT WE WANT IN OUR LIFE.

Thanks for such great article and now I am more confident on my thoughts. 🙂

Great to know that Happyinvest007 🙂

Please share it with more and more people

Manish, this is arguably one of your best articles in recent times. It’s been a while coming though. I think some of the questions you have posed are very impertinent to what we ask ourselves at different points in our lives and that’s why this is such a thought provoking article on many levels.

I for one feel very strongly about the debt issue and hence will comment here. I don’t think I can ever live with debt on my shoulders. It’s like an axe hanging over your head 24×7 and that’s just too unnerving to me. My father has taught me to never borrow money and live on credit no matter what the circumstances and I have taken his advise to heart. I am not in a government job, hence no matter I well I perform, I can never be comfortable about the security of my job. To take on a 10 year or 20 year loan for me would be too much of a sacrifice in terms of the freedom & flexibility in life that I value so dearly. It would cut short too many options in my life at an age when I should actually be at an exploratory mood and be prepared to take my chances.

I have been working for 3 years now and have already realized the importance of financial independence. I have personally experienced how private companies can exploit the hell out of you and make you work like a slave. Unfortunately when you have no other options, you feel compelled to put your head down and do whatever is asked off you. There is no worse feeling than not being able to stand up against abuse. A secondary source of income can be like a lifeline for many of us whose primary job is stressful and even abusive to a certain extent. This is what I am working towards at the moment.

Hi Anjan

Thanks for sharing your views. Every person mindset gets shaped because of their experience and what they have seen in life, so its perfectly fine if you think that way. However, you should know that its very personal to you and many others might differ 🙂 .

Thanks for sharing your views on this topic.

Manish

Very clear cut financial decisions making process.

If anyone still confused, may stay confused forever!!!

Thanks for your comment Nilesh

The questions are too broad and it is easy to say I want debt free, simple life & liquid networth. Obviously 66% of people think they live a simple life. What each of it means and entails is something which needs to be discussed.

Ask them these and you would know if they are ready for it or not?

1. When was the last time you went thru delaying your purchase for lack of resources and how long did you wait out?

2. When was the last time you have cut your monthly expenses by 10%? and what did you compromise?

3. Have you lived your life debt-free? If not, how fast have you cut down your loan duration?

Collect these answers it will show the results of your survey are what they want to achieve but they are never willing to do it.

Hi Santy

Thanks for your comment and points. I agree that points are high level, but then the framework is suppose to be high level. In reality a person will look at other angles also and then take the decision, These points are just for directions , not the address of destination

Dear manish

thanks a lot. its an awesome article.

Thanks for your comment Tejaswi

very very good article . its clear so many thing .which we actually know but confused . even we rarely think like this way .

Glad to know that preeya ..

A very outstanding article. This framework can definitely helps to take important financial decisions with crystal clear mind.

Thanks a lot for sharing your thoughts !

Glad to know that Santosh ..

Indeed a very good article, especially when I was in a dilemma of whether to go for new house(2nd house) or keep investing in equities.

Glad to know that Rahul ..

Hi I am not getting articles via RSS feed. is it blocked?

Hi Giri

Use this link http://jagoinvestor.dev.diginnovators.site/feed

Great article, Manish.. Being a beginner in investment cycle, the article taught me how broad I should keep my investments so that they are both liquid and grow time-to-time.

Glad to know that Aravind ..

Manish

It was an Excellent Article….In Fact this article is BESTarticle till date since last 3-4 years from when i started reading your blog. The problem that u touched in this article is very common for me…..Many times in life this decision making was very confusing for me….BUT from now onwards….i have got parameters based on which i can decide………Thanks Manish…you have really solved a biggest confusion of my life

Dear Manishji

Its an eye opener for all

Thank God i explored your site

Thanks a ton for your most valuable sights that you deliver to people like us.

Glad to know that SRRK ..

Glad to know that Sushil ..