X+Y theory – A simple theory explaining, why its important to invest money for future

Today’s article is going to be very very basic. It’s one of the lessons which we should teach our kids when are growing up. The question is “Why Invest money at all?”

A lot of investors are not very serious when it comes to save enough money and invest it properly so that it grows well. A lot of investors are quite consumed in their life and don’t deal with this conversation fully. Only after years of working they realise that they have done a very bad job when it comes to investing their money.

I thank Mandar Rane to raise this question in Ashal Jauhari facebook group and shared what he faces with his siblings and many connected to him

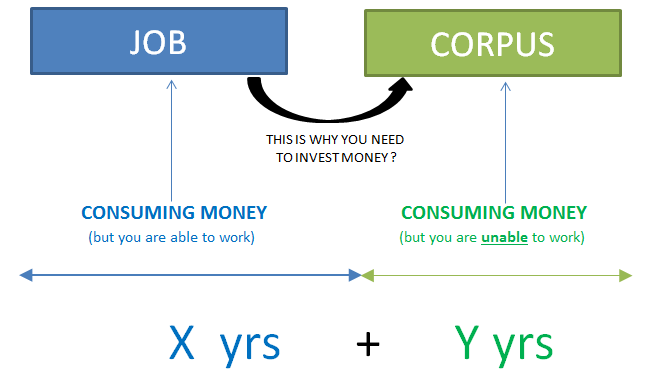

X+Y years theory – Why you should invest money at all ?

There is a simple conversation which I think everyone should go through once. I call it as X+Y theory. Its very simple.

Every person will be living for X+Y years in total.

X is the number of years when they will go to work and bring back money to pay their bills and acquire all they want to enjoy (movies, clothes, eating out, travel, food, fees). This is mostly ACTIVE income and money will come only when you work.

Y is the number of years, which we will spend without earning. We will still need food, clothes, travel, eating out and various other things, but the problem is we will not be working in those years, either by choice or mostly because we are unable to. Now where will the money come in that phase? The money has to come from somewhere?

Right?

So you mainly invest so that you create enough wealth which can last your Y years. I know I am making retirement planning very jazzy at this moment, But NO, this is just going one level deeper and answering the basic question of “Why should I invest at all?”

Note that when we are in X yrs phase, we are not too much concerned about the Y yrs, because the X yrs phase itself has many issues. Kids , House, job, health, parents, relationships and many issues which keeps us occupied enough and only when we approach the Y phase, we are bit scared and tensed, but then it gets too late.

3 basic level reasons you should invest your money?

Below I will talk of primary level issues why one should invest their money to grow in future. And when I say grow your money, I am not talking about saving it in bank account, I mean talking about really letting it grow beyond inflation.

1. Because of Inflation

The most basic reason to invest your money is to protect it from Inflation. Your money will decrease after many years in its purchasing power. A Rs 100 note will not be able to buy the same thing in future, what it can buy today. So you need to invest money properly so that you are able to at least buy the same quantity tomorrow or preferably a larger quantity.

2. Financial Independence

This is exactly what I was talking above. I am sure everyone want to work, but not becoming money slave’s. If you do not invest your money, you will never be able to create a corpus of money you can rely on, and will never be able to get free from your work. If you want to make sure your reason to go to job should be “because I love my job” and not “I need to pay my bills, I am helpless”, then start building that corpus as soon as possible.

And I am not talking about cutting down your desires and entertainment. Do all that, but also start creating that corpus. Keep a balance.

3. Reach your life goals

If you earn Rs 100 per month, and you need Rs 50 for some purpose suddenly you can surely handle is somehow. But what if you need Rs 5000, but you earn only Rs 100? In that case, you need to make sure you have accumulated that amount before hand, slowly and steadily.

We all know some of our financial responsibilities will be coming up in distant future and they would need a big amount. Things like house downpayment, children college education, marriage and many other things like that. If you do not invest, how will you fund those goals? It’s as simple as that.

You are sum of your experiences in life

A lot of youngsters have seen their parents struggle for money and their mindset is already set in a way that they understand the importance of saving properly and growing their money. However a big number of people have had a bad relationship with money. They live paycheck to paycheck, splurge beyond the limit and are careless enough when it comes to money.

A lot of people might say that they are just stupid to act like that and are highly careless and irresponsible. But I think its just a matter of lack of financial literacy or their way of looking at life is different. Everyone is raised differently in their lives and we all have difference experiences. We become what we experience at some level. If you save enough or do not save enough, at the end its just has an outcome which you need to be aware about. That’s all.

How to teach this lesson to your kids (and some adults)?

The simplest way to teach this lesson to small children is to tell them the Ant and Grasshopper story. It’s one of the most simple and powerful stories.

Here is the story for those who can’t see the video

In a field one summer’s day a Grasshopper was hopping about, chirping and singing to its heart’s content. An Ant passed by, bearing along with great toil an ear of corn he was taking to the nest.

“Why not come and chat with me,” said the Grasshopper, “instead of toiling and moiling in that way?”

“I am helping to lay up food for the winter,” said the Ant, “and recommend you to do the same.”“Why bother about winter?” said the Grasshopper; we have got plenty of food at present.” But the Ant went on its way and continued its toil.

When the winter came the Grasshopper found itself dying of hunger, while it saw the ants distributing, every day, corn and grain from the stores they had collected in the summer.

Then the Grasshopper knew… It is best to prepare for the days of necessity.

Invest early and with discipline

To get the maximum benefit, make sure you start your investments as early as possible. Even if it’s small in the start, that’s ok. At least you will prepare yourself to invest bigger amount in future if you at least invest small amounts in the start. You will build some wealth (even though its small) and build your mindset to invest regularly.

July 6, 2015

July 6, 2015

This is exactly what I keep advising my friend who belongs to Muslim community. He has strict no to invest in any kind of mutual funds or stocks which is the most preferred option in terms of returns. Ultimately he ends up creating FDs having no option apart from buying insurance policies. The experts like Manish can suggest some alternatives, at the same time following the ethical laws of particular religion. I’ve done enough study and found some ethical funds which are also not supposed to be purchased for investment purpose according to him. Is it like he can invest only in FDs.

Hmm. thats a belief issue . How will you change that ?

I think that Muslim friend of yours is ill-informed about his own religion. in Islam, riba,i.e.,usuary or interest is prohibited and moreover something which assures ONLY Profit but no-loss is prohibited too…so going by that rule in FD, the sum deposited would only increase with the interest being added to it. Therefore it isnt allowed if one adheres to strict Islamic laws….Please google if anyone wants to know in detail as to why Riba is haraam in Islam.

Thanks and Regards,

Tabish

Hi Tabish

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

This is not totally correct. Muslims are forbidden from investing in companies which are not ethical(as per islamic laws). eg : They cant invest in companies selling alchohol.

Muslims can invest only in shariah compliant mutual funds.

Also a lot of muslims are following laws when gold was the standard and there was no paper currency inflation. These need to be adjusted else they lose money due it inflation if they dont take interest. They should only not take inflation adjusted interest.

Amit.

Thanks for your comment Amit

An unrelated but very important question: Why is the jagoinvestor forum now read-only? That discussion forum was a very lively platform for me to ask my questions and answer a few. Has the forum been made inactive?

Thanks,

Sambaran

Hi Sambaran

Lately from last few months, the forum questions are not getting answered by any member. So most of the threads were just piling up and no answers . Also questions were getting repeated beyond the tolerance limit. Hence now its in read only mode.

Manish

Sigh! I used to get a lot of help from the forum.

Anyways, I now got hold of Pattu’s forum called diy.freefincal.com

Let me use that.

Hi Sir,

Your articles are always informative for beginners like me.

I am considering an investment into shares.

On fb i read that wealth i n stocks grows linearly without compounding.

Is it true?

Regards,

Raj, thats not correct !

This was a great read! Thank you so much. I am definitely going to show that video to my kids.

Great !

Very Good Article. Even many of this generation has no awareness regarding retirement part. Good and simple article

Thanks for your comment ashok

this is the most simple and no fluff article. Excellent. I have been trying to make my friend(s), Cousins ( who just started earning and in early 20s) for about 3 months now. I sent this article and it hit something for them because of its simplicity and now they are asking me on how to proceed and more about it. so Thanks for an article which made ignorant,/apathetic people in my life …to listen and take a look about investing and need for it.

Glad to know that Prasanna ..

Thanks Manish for the wonderful article..Nice explanation with the Ant and Grasshopper Video

Regards

sathya

Welcome 🙂

This is one of the most well written blog explaining the importance of thinking ahead in terms of finances. I also like this one which has a similar subject. http://bit.ly/1fk31Yl

Thanks for your comment juthika

Definitely agree, the story Mike Tyson bears testimony to frittering away a fortune so much that today he is more or less bankrupt. Compare this to Mark Anderson who was a corporate executive whose maximum income never touched more than 14000$ pa but could donate 36 million $s to charity !!

http://teamaag.com/how-ted-johnson-ex-ups-banked-70-million/

Hi shankar

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Sir,

I’m an avid reader of your blog and books and I agree with most of your Financial Planning concepts and theories. But can you please Write an article on how a lower mid class family can apply financial planning efficiently. These concepts are easy to follow for a upper mid class family but not for someone with just 10k to 15k per month. How an Individual of low earnings and saving of just 2k to 4k can have a good portfolio. What should he consider among various financial planning option such as secure future, health, insurance, retirement etc. How can someone with little earning can create goal based Financial Planning when an Individual have just about 2k to 4k savings. He can go for just one thing I guess. Please guide me on this issue.

Thanks!

Hi Anil,

This question is addressed to Manish , but the point you have raised is very close to my heart. I would like to share my thoughts with you . If you don’t mind .

First of all concepts are concepts , middle class , upper middle class , high class or whatever does not matter. Application of concept matters. For example , If a person learn addition , the concept remains the same whether its adding a 2 digit number or a 10 digit number .

Secondly , What you are referring to is that even after the application of the concept the rise is not noteworthy. Its physiological …. but in the world of the finance percentage matters .

Eg . Which do you consider better a stock of Rs1000/- going up to Rs1100/- or a stock of Rs10/- going up to Rs15/- . If you had a certain amount of capital on which would you bet your money on .

When you have X amount of money and you spend Y amount you are left with Z .

X-Y=Z

Now X , Y and Z are different for different people . Many times people who have same X have different Z . Figure out why ?

Jagoinvestor is about concepts , learning and believing.

The game of finance is to have patience , apply concepts , trust in God and all above in your self.

Regards

Dear Sir,

Thanks for the great reply and motivation. I guess along with concepts I really just need what you mentioned, patience and trust.

Thanks!

Glad to know that Anil ..

Your expenses are less than your income and you save consistently your creating wealth….it doesn’t matter whether you save millions or you save few 100 point is u must save….

Good point !

Hi Santanu…what you mentioned is correct. Today, we are absolutely in a state of flux…there are choices to be made everyday and the chance of making a incorrect decision is higher than ever. One thing I have learnt from Manish is to keep aside an amount (come what may) before you spend. Its really not that difficult but the results are amazing. The other thing is not to get swayed by peer pressure…the money we spend today on schools, colleges, weddings, movies, hotels …everything is so insane! We should realistically put down in a sheet of paper all available alternatives and see if our decisions were correct…if not, make course corrections. Look for bargains and exercise our loyalty points…nothing wrong in that. Its equally important to keep our kids grounded…give them the necessities and not go overboard. There are external influences that you cannot avoid but you have control over your decision. Using public transport wherever possible reduces the dent on the wallet and I am sure it doesnt reduce our status in society because people globally use public transport. Finally, I concur that a lot needs to be done in the space of personal finance…even the high paying execs today fail miserably in this area because they are not aware.

Keep up the good work , Manish!

Very nice Manishji. Request you to start a you tube channel giving financial lessons.

Hi Paritosh

We already have it https://www.youtube.com/user/jagoinvestor

Very True Manish. The way our life’s expenditure is increasing, it is really tough to decide how much money will be enough to live a life when there will be no income. In fact the concept of retirement is also going to change day by day, I am not sure how many people of my age will be able to retire at the age of 60.

Recently I have approached to my kids school admission in DPS. During this research, I have discovered the cost of education has become too much for a pre-primary kid. I have to spend around 1.2 lakh including admission fee & miscellaneous.

But, if I share my college education fee, people will not believe at all. In 4 years, I have spend 13,000 / semester only. I have completed my graduation with the fee I have spend for my kids admission fee only and that is also for UKG. Just can’t imagine how will be the cost till he reach college. 🙂

Anyway, I think besides investing we should also try to think about to find out some alternative way or passive income source, which one can continue till he/she die, if possible.

Hi Santanu

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Hi Manish,

This article talks about basic thing about finance management but message is very deep.

You have explained very well the importance of building corpus that can last life long. I remember the story of grasshopper and ant, best way to explain how hardwork pays back in future.

Thanks for writing such a nice post.

Thanks for your comment PardeepGoyal