3 incredible money lessons – I would like to pass on to my Kids

We have worked with more than 500 investors till date one on one and we have decent understanding of how financial lives take shape over the years.

Today I am going to share few observations out of working with clients for so many years and will share some mistakes which you should avoid in your financial life. I really wish if each parent could pass it on to their kids or their siblings when they start earning money.

Mistake #1 – Don’t go with the flow

It’s often said that in life – “Go with the flow and don’t worry”. While that’s a good advice for your life in general, but I think it’s not a good advice for your financial life.

Most of the times, if you just go with the flow, you might not get desired results. It’s a shortcut which you are always tempted to take in your financial life, but often that leads to a clumsy and bad financial life.

There is another saying that – “Only dead fish goes with the flow”.

I am sure you don’t want to be a dead fish 🙂

I have observed that most of the people, who today are having a very bad financial life, have just gone with the flow and never planning out things. Nothing in their financial life happens due to their careful planning or conscious effort. Whatever comes in front of them, they take it.

- Tax season arrives and they buy the policy because they have to submit the investment proof.

- They take loan because its a “Interest Free loan” and not because they needed it

- They want to buy a house soon, but then the next moment they upgrade their car !!

- They sign the documents where the agent asks them too and complain they were cheated

I just want to make a point. You can either choose to move with the flow and let things happen to your financial life OR take charge and make things happen in your financial life as per your plan. The biggest issue today is not just less income, but how managing the money in proper manner.

Mistake #2 – Don’t get attached with past and harm your future

Almost all the investors face this. One bad experience in some area and they carry it with them all their future.

When recently, I recommended a mutual fund from ICICI Prudential to one of our client. He was taken aback and very strongly told me that he does not want any ICICI prudential mutual fund because he has had a very bad experience with them.

On further enquiry, I realised that he was sold a ULIP by an ICICI Prudential Life Insurance agent, which he was not happy with and from that day he took a vow that never in his life, he will deal with ICICI products.

In the above example, did you see that the person had just labeled ICICI = FRAUD. There are so many good things which ICICI has to offer (and it’s true for every company) and just labeling things will only hurt your own future because you then cut down your own options.

Good and bad experience are part of life

Good and bad experience’s are part of life and it happens with everyone. You need to learn from it and move on. Take some learning’s from the incident and see how you can make your own self more strong to deal with a situation.

Like in the above example, the person could have said that – “I will now onwards read the documents and understand where I am putting my money” or “I will not buy something, which I truly don’t understand”. But instead he chose to take the extreme step.

I will give you another example

I see many people who bought a stock or mutual fund and it didn’t perform well and gave them bad returns. Now they are so scared to try out equity in their portfolio all their life, because they equate EQUITY = MONEY LOST

Note that in today’s times of high inflation and high taxes, having a good portion in equity class is not an option, but a necessity. You can’t build enough wealth without investing in equity based financial products for long term.

So coming to the conclusion, all I want to say is that don’t make mistakes of carrying a bad experience throughout your life and avoid the opportunities which exists, this is not a money lesson, but a good life lesson – which applies in all the areas of life.

If you buy a book on personal finance, and you don’t like it, it does not mean that good books on money does not exist. Or if you had a bad experience with a financial planner, it does not mean that all financial planners are bad.

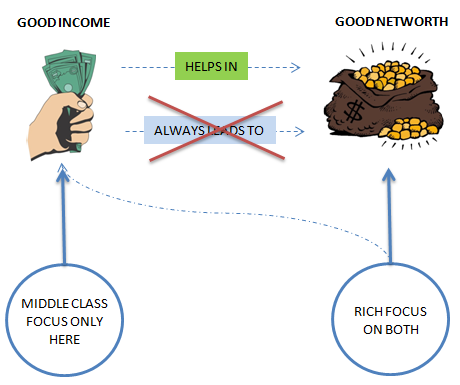

Mistake #3 – Don’t just focus on earning money, but also your networth

Do you know one big difference between RICH and Middle class ? Here it is …

“Rich talk the language of Networth and middle-class talks the language of pay-package”

What have you heard your parents ask you – “Go get a good paying job?” OR “Go and build a great networth?”

Over the years, the income level has risen many folds and today its not uncommon to see income levels of 10/15/20 lacs per annum and the society label them as “doing well”. But the ground reality is very different many a times. The net worth of these high earners is still not upto the mark.

When we do workshops in various cities, we often see people who are earning 10-20 lacs per year who have spend years in their job, but they don’t have enough to show off as their networth. Many of them are empty pots whose size if big enough.

Its because they have focused and worked on their income’s, but never focused properly on building networth. Just because you earn good, does not mean you will have a lot wealth, because that needs conscious effort and mindset to build wealth. It needs actions, adoption of structures in your life which many don’t act upon.

Good Income is very Important

Don’t get me wrong. I am not saying don’t try for good income. In fact, if you focus on good income, you can build wealth more easily and faster, because more income generally leads to good wealth. But often its not true and it can happen only if you choose to consciously work on it.

It might happen that a person earning less than you build;s higher networth then you because he was fanatically working towards it.

We once came across a couple in Mumbai who was collectively earning around 35-40 lacs each year. I know the moment you read this, you must have thought – “Wow .. that’s a lot of money. I want to get there”

But reality is different

But their lifestyle never allowed them to save enough. Their expenses list was so huge that I was almost numb, when I saw their datasheet.

Here was a couple who was doing extremely well from “society standards”, but still their networth was pathetic compared to their income because they just focused on consumption and only consumption. Their were so many leakages in their financial life, that money never stayed in their financial life.

They could not even arrange for 10 lacs cash in emergency situation. So poor was their allocation and planning, that it was a height of mismanagement. We then worked with them for few months and redesigned their overall financial life which they approved.

We set their financial goals, helped them to define things and systematically save for each of them and suggested them how they can improve. We put right structures in their financial life, which forced then to save first and only then spend. They are doing better now.

I know this is an extreme example, but many people can relate to it at some level.

As an investor your main focus has to be on your networth and a good income is a tool for it. A higher income which does not lead to a good networth is only a short term success story.

What I have seen in last 7 yrs ?

Today’s generation is into a deep financial depression. You meet a guy, he is going to a swanky office, his package is bloody 16 lacs per annum, you envy him and you hear this guy has just bought a house (on loan). You feel you want to be like him, what an awesome feat he has achieved.

But the reality is very different. While this all looks great from a distance, deep down a big number of investors are facing a very tough situation, which is only known to them.

They are hell scared of future. Even though they are doing well today, they are still not sure what future has for them, they are depressed and fearful of expenses lined up for future. It has destroyed their peace of mind. They have good money coming into their bank accounts, but peace of mind is missing.

I am sure many readers who are reading this can relate it to their lives. What kind of suggestion would you like to give to a new investor who has just started their financial life?

April 7, 2015

April 7, 2015

Manish You approach is very simple and easy to follow. I would like to invest around 25 lakhs which I have as NRE FD.

Can i leave it as it is or invest in someother instrument?

I am planning to settle down in India. What type of whole life insurance do you advise?

Thanks

Mani

I waa always reading your articles from a distance !. I thought it is time to join the club. Keep up your good karma.

Welcome !

Very good arcticle sir, this is really happing with many people.

Welcome .. Glad to know that Ravi ..

Very good article…

But I expected the “How to overcome part” for each mistakes and examples you mentioned….

Karthik

Thanks for sharing your views. I think the how to part is obvious once we define the problem , is it not ?

Hi Manish,

I agree with you. The comment was before reading your book… Now I am inline with you. 🙂

Karthik

Welcome

Hi,

Very well written you have been able to gather your experiences and you have made it into a very relevant story of present times,its an eye opener for many who really want to awake and start looking at a wealthy financial future.

Pl keep writing.

Best Wishes

Thanks for your comment anil kale

Nice article Manish.

This article reminded me of the book Rich Dad Poor Dad which says –

The rich first save and then spend, the poor (even some of the super educated ones) spend as they earn, and are left with nothing in the end.

I implemented this advise in my financial life before a year (after carelessly spending all my earning for over 5 years, including buying a house on loan) and now the future looks much more comfortable 🙂

Hey Akshay

Thanks for sharing your experience with all of us. It was a great learning.

Manish

Extremely informative article. I believe each and everyone of us have our own priorities and some advice that has passed down by our parents , so we try to incorporate a lot of those things and invest accordingly. But now with Indian economy things are not the same as they used to be 20 to 30 yrs back. So we need to guide our children differently, most importantly they need to understand the importance to money and how to spend money not to waste it. I have invested in tata aia life’s policy they have recently launched Smart growth plus plan which offers flexibility in choosing policy term, has good policy returns and tax benefits u/s 80C & 10(10D).

Hey Kabir

Thanks for sharing your experience with all of us. It was a great learning.

Manish

Nice article Manish.

Thanks.

Welcome .. Glad to know that Jeevan Singh ..

Hi Manish,

Another good article!!

I think one needs to learn to look at his financial life from a distance as a third person…your experience helps us to exactly do that and take some concrete steps to make one’s financial health better…this is my feeling…Abhay

Welcome .. Glad to know that Abhay ..

Hi Manish,

Awesome article as usual crisp and informative. This article is not only to be passed to kids also for us to implement. I believe for many of us it would be an eye opener.To mention i liked your quote

“Rich talk the language of Networth and middle-class talks the language of pay-package”

Keep Sharing..

Welcome .. Glad to know that Chandrashekar Iyer ..

Superb article.

Thanks Moneypurse

Nice Article Manish.

One more nice article Manish , keep up nice work.

ex-yahoo colleague,

Bangalore

Welcome .. Glad to know that Vikram VI ..

Another brillient article by Maneesh.

Thanks Maneesh for being an indirect part of my good financial life. I have been your reader since I came across this site & never miss an article, not a single.

Thank you again.

-Niranjan

Welcome .. Glad to know that Niranjan ..

Title is thought provoking.

It is indeed required to educate our kids in the field of finance. Generally children learn by observing adults. When adults do not care about their finances and neglect planning, it is highly likely that the children also follow suit.

Hence it is required to discuss financial aspects of life with children(appropriately) and introduce them to various aspects of financial instruments as children age. In the process, parents can also explain various financial mistakes they did and how they impacted them adversely. This not only educate children on financial aspects but also makes the bond stronger.

Thus one can teach children to be frugal by demonstrating the same at home. We can use many things till their useful life is over. One can also demonstrate the bargaining process and getting some object at a competitive price

To sum up, every one should try to pass on one’s financial knowledge to friends and relatives specially to children. This will help children develop a balanced view of life.

Hi Srinivas

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Hi,

You will be surprised to know that there are people who own a car costing Rs 10 lakh, but stay in rented house. Instead, focus on owning a house first whether through loan or not. One can buy car only if required. The equation to buy a car is < 60% of one's annual income. With Ola cabs, one need not buy car. The money earned can be invested in Equity funds through SIPs. Make sure your SIP payment is done in the first week, same with insurance or loan payment, so that you get to spend only after what's left.

Any couple with good income should buy 2 houses, 1 2BHK and 1 3 or 4 BHK. Before starting family, a 2BHK is just right. As income levels increase, and kids are born, they can buy a larger house. The 2BHK can be given on rent to generate another source of income. As the kids grow and are married, the couple can stay in the 2BHK house and the 3/4 BHK house can be given on rent.

Hi Ashwin

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Super article..

Thanks for your comment ashok

My suggestion is always go for forced savings, ie arrange for transfer of fund to insurance, nps, ppf, mutual fund via electronic fund transfer. So that money is transfered without fail.

Hi kankuppi sadashivappa

Thanks for your sharing your valuable comment on this topic. Please keep sharing your views in future also

Manish

Very good article..the only problem with this article (and most financial articles) is that people who know and apply all this will read it..but the ones who really ought to read it..WONT.

Hi Anshuman Kumar

I dont think so . There are enough people here reading this, who needs it badly.

Indeed a very good article by Manish, as always, followed by a lively discussion by all the participants. My compliments.

Thanks for your comment J K MATHUR