6 facts to know before you apply for credit card in India

So you want to apply for credit card? That’s great, but are you well versed with the world of credit card? Do you know how does bank evaluate its potential credit card customers? Are you clear about your requirements and why are you so eager to get a credit card?

Most of the people do not spend much time to check which credit card is best for their requirement, but just grab the one that is offered to them for the first time. So today, I want to make sure I give you a sneak 360 view of the world of credit card and what all things one should be looking at before they apply for a credit card in India.

1. Your Income is important parameter for Credit Card Eligibility

When you fill in the application form while applying for a credit card, the lender asks you for various information like your age, city, take home income per month and type of your employment, which all is required to decide if you qualify for getting a credit card or not.

But out of those, your income is a very important parameter because that’s the main thing which determines your repayment capacity of your dues each month.

Someone earning Rs 50,000 per month is generally more eligible than someone who earns Rs 25,000 per month, because higher income is an indication that you will be able to pay your bills on time and on a consistent basis.

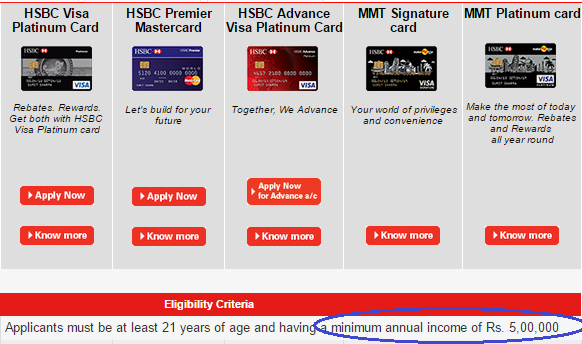

You income is also an important information for bank to set your credit limit at the time of issuing the credit card to you. You can see below a snapshot of HSBC credit card page and they have mentioned that the minimum annual income of a person has to be Rs 5,00,000 to apply for these credit cards.

So if you are earning good enough money, only then banks will be interested to give you a credit card. Make sure you do not apply for credit card just for the sake of it without a minimum threshold income. Also, note that you would need to submit your latest ITR copy for income proof.

2. Existing relationship with bank fastens the process

If you already have a salary account or saving account with some bank, it is relatively easier to get a credit card, especially when you have handled your accounts properly, I mean not have too many overdrafts, maintaining your minimum balance over the years and having a consistent flow of money in your account.

This is because the bank can easily verify your income details and see your activity and how responsible you have been over the years.

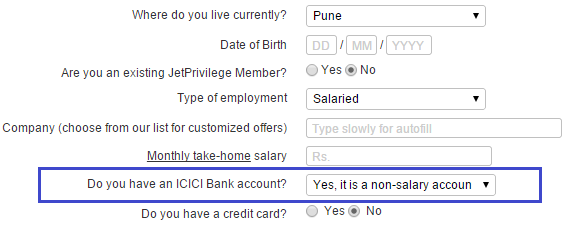

So for example, if you want a HDFC credit card, but you have salary account in ICICI bank, it would be recommended that you apply for ICICI credit card first (assuming it does not matter much to you). You can easily apply for the card online on bank website, and even bank will ask if you are an existing account holder in the bank or not. To which you can choose YES

If you do not want to apply online for your card, then you can also visit the branch and meet the representative face-to-face. Bankbazaar is a good portal to compare and apply for credit cards or any other kind of loans.

3. Your past credit history matters

It also matters how was your past credit history, if you are looking for credit card. If you have taken some personal loan, education loan or home loan and now applying for credit card (generally a second credit card), your CIBIL report will be checked by the company to find out how was your credit history.

Did you make your payments on time? Did you close all your loans and outstanding without any balance or not?

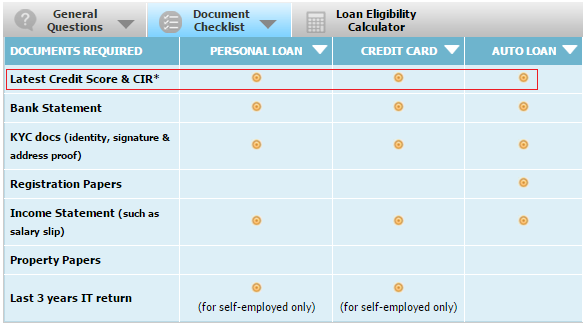

You can see a snapshot by cibil.com below which shows you what all documents are required by the lender before issuing various kinds of loans and it shows that the latest credit score and CIR is mandatory.

In fact the CIBIL report is now mandatory check for any kind of loan. Make sure you surely check your credit report once before you apply for your card.

4. Be clear about the purpose of credit card

There are various kinds of credit cards available with bank. You need to understand very clearly what is the main reason you want the credit card?

If you want to use the credit card primarily for dining and shopping, then you can choose the card which gives more benefit for that. If your main spending is on fuel, then there are cards which cater to that requirement. There are tons of ways you can get rewards and cash back on credit cards. It’s important to do a bit of research on this.

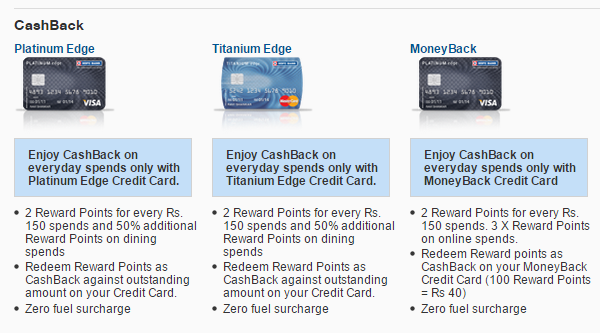

Below you can see some HDFC cards examples .

Most of the credit card companies offer cards under categories like Silver, Gold, Platinum, and Titanium and then as per categories like Diners card, Fuel Card, Cashback cards. If you look at HDFC credit card page, you can see categories and various kinds of features as below

5. FREE vs. Annual Fee credit card

There are credit cards which are totally FREE for lifetime and then there are cards which come with annual fees ranging from Rs 99 to few thousands per year. Most of the people want a lifetime free credit card, which is totally fine if your credit card usage is basic in nature.

But if you have very heavy card usage and 40-50% of your spending happens on credit card itself, then it makes sense to go for premium credit cards, which have some annual fees, because those cards offer you awesome benefits and various ways to save money.

You get higher reward points and cash back in those cards. Also, they have special tie ups with airlines, hotels, shopping stores, fuel companies etc and you get maximum benefits by being a premium member.

For example: Those who travel a lot by airlines can look at Signature Credit Card from HSBC which has special tie up with Makemytrip and comes with annual fees of Rs.3,500, but gives lots of discounts and vouchers which can be used by the cardholder. You will not get these offers if you have a normal credit card.

If you want to learn how can you use your credit card in more efficient way, a good resource is this article written by Shabbir.

6. You can also get credit card against a fixed Deposit

Do you know that you can also get credit card against fixed deposit open with a bank ? Yes – That’s possible . There are many banks, which will offer you a credit card, if you open a fixed deposit and want a card against it as security (These are also called Instant Credit Card).

This is very much beneficial for those people who are not able to get credit card due to low credit score and banks are rejecting their credit card application. So you can apply for a credit card if you are ready to open a fixed deposit and its also one of the good ways to start improving your credit score, if its messed up.

Below is a snapshot of ICICI Bank credit card page about instant credit card

Most of the banks have a minimum threshold of Rs 20,000 fixed deposit to be opened with them and your credit limit is always below that FD amount.

So if you open a Rs 40,000 FD with bank and take a credit card against that FD, then your card limit might be 20-25k per month and if you default of payments for a long time, bank will break the FD and take their dues from it, so there is no risk for bank.

This is the reason that it’s much faster to get a credit card against a fixed deposit and there is no income proof required to get credit card against a FD .

Get set Ready

I hope you are now clear on various things before you apply for credit card from any bank. It’s very important to be very clear on your expectations from the card and for what purpose why you need it.

I would be happy to know your views on this and if you can give some tips to a beginner who is looking for cards for the first time

January 22, 2015

January 22, 2015

Credit card

Hi,

Great article. I also want to get a credit card but cibil score scares me. This is because I have heard that non payment in credit cards due to any reason also lowers down your cibil score. Is that true?

Yes, that is true! . Take card, but dont use it to that level which you cant pay

Thanks Manish. I am constantly reading about cibil score because increasing it is has become immensely important for me. I read many blogs and found http://www.loankuber.com/content/cibil-score/ to be very beneficial. It has a section just dedicated to cibil score. Thought it would help other people like me too. 🙂

I am salaried with monthly 40k. My basic requirement is flight booking, hotel booking. Which credit card will be suitable for me ? Kindly suggest.

Hi Shikha

You need to compare products in the market and choose according to your needs .

Hello

my monthly take home salary is approx 33k i m using HDFC credit card from last six month but it is not beneficiary so i want to make another credit card that is beneficiary for me so suggest me is i m eligible for any bank card 1 more thing 1 month earlier i applied for credit card that was rejected due to previous card is not 6 months older so now i am eligible or not

You can apply for one and see if you are getting it or not !

if again i will apply it will affect on my cibil score or not? because this time i m going to apply for CITI bank.if it will affect my cibil score than i will not apply for any card so suggest me.

Hi manoj

One instance of non approval does not mean that you have poor CIBIL score.Have you checked your CIBIL score?

If you are paying loan in timely manner with no issues of default. You will most likely have a fair score in CIBIL. Though, The more we apply for loan or loan products it does have an adverse effect on our CIBIL score .Credit card is a debt product and thus has an impact on CIBIL.

In case you have not checked it yet . My suggestion would be to better make a decision based on the need rather then getting scared of CIBIL score.

Hi Manish,

I’ve a salary account with IndusInd bank with more than 15k pm. Can I get a credit card on this salary. If yes then suggest me one.

It will be tough to get it at this salary level !

http://www.allonmoney.com/credit-cards/low-monthly-income-in-india/

Hi I want to apply for a credit card.and my take home is 11000 I want to apply for a credit card.can u suggest is it possible to apply and which bank.

I dont think it will be possible with this salary. Banks generally need 25k+ per month atleast !

http://www.allonmoney.com/credit-cards/low-monthly-income-in-india/

hello sir first time i am planning to apply credit card….i am eligible in major criterias…actually i havent taken any bank lone during entire life…..as far as itr is concerned what eles i can show as i am paying my taxes…i have retail pharmacy at my place my earning is good requesting kindely help is about my question i desperately need credit card…semd your valueable advice to make it happen..waiting for positive reply

regards

Rohan Patil

Hi Rohan

You can apply and choose the best option for credit card here http://jagoinvestor.dev.diginnovators.site/solutions/apply-credit-card

Dear manish,

i am planing to apply for epf, i resigned on 2nd oct 2015 and i joined some other company on 1 st nov 2015. is it possible to apply next month? pls help me i am very new for this process.

Thanks,

vijay

Yes, you can apply for next month

dear sir, m buisnessman. i’v wholesale buisness. where m earning 33000 inr as per itr.. And I have a current and saving account in andhra bank. And I want to know in which bank I have to apply…. Recently I also get call from ICICI bank representative. So which is better ICICI or andhra bank. My itr for a. y 15-16 filed on 10th Oct 2015. I want my first credit card with higher limit for future prospects so I m in confusion. I had also taken personal loan and auto loan and making timely payment of all. So which bank can give me higher limit

I suggest go for ICICI . Its better..

Hello Sir

I’m 27 and my take-home income is 88k. My savings account is with ICICI and Home Loan account is with SBI. I’m more interested in CITI bank credit cards as I often see their name being appeared in all the offers in e-retailers Advts in newspaper for heavy cashbacks.

ICICI, HDFC etc. appear rarely. Would you please suggest a good credit card if it is not to be CITI only?

Go for CITI card if you are doing too many shopping online

SBI rejected my credit card application as I do not have sufficient credit history

What does that mean , I never took any loan in my life, first time applying for card.

Thats the issue , now a days banks are looking at the history of loans taken .. Subscribe for a secured credit card and start using it

Hi Manish

My take home is 30k per month . i have salary account in ICICI bank. Can u suggest me order of preference from the below cards.

ICICI , HDFC and CITI

ICICI

Why saying ICICI? Most suggests CITI or HDFC than ICICI..Can u explain?

Because I have personal experience with ICICI , thats why

hi I am From USA I live In Vizag India as a Tourist i have a 5 year visa I have a fixed income of 80,000 Rp from the USA can i get a credit card in India

Hi Bill, It think its going to be tough , but I cant comment on it . Why not visit some bank and talk to them directly .

Hi Manish ,

After doing a lot of research , I am going with ICICI Platinum chip card. Correct me if I am wrong.

I am planning to apply for ICICI Platinum Chip credit card , but I don’t see it under the offer section of bookmyshow movie tickets. But I heard , it gives good movie offers , please confirm if you can.

And also do provide any suggestions between ICICI Coral credit card and ICICI Platinum chip card.

Highly appreciated.

Looking forward to your reply.

Plus , I also applied for one HDFC Times card , but some glitch in their network or something they said they are processing a moneyback card for me. So , should I cancel that and get a times card?

I suggest Coral card or Rubyx . I have the Rubyx and it gives me good discounts on movie tickets from time to time 🙂

Hai Manish, my takehome comes around 70k per month. My salary will be credited to that account in narketpally(where I work )which is 50 km away from my residing place hyderabad. Many banks are rejecting me application based on this point concluding that the distance should be with in 30 km from residing area.can you please suggest me any bank providing credit card in my situation???

Why dont you apply for credit card from a bank which is near by .. open a new bank account if required

My salary is 55000 pm……I m planning to get a credit card for online shopping, daily shopping, dining, movies and travel……which one should I go for

ICICI is good one !

My salary is 25K take home. i cannot buy home appliances in that salary.. whichcredit card can i prefer?

ICICI is good

Dear Manish!

I was told that spending more than Rs 2,00,000 in a given tax year on credit card has to be informed to Income tax deptt. Is it so?

If yes, then what is the procedure to be followed? Please enlighten me!

No , you dont have to do it yourself,but the banks etc will do it from their end

dear sir, m buisnessman. i’v small buisness. where m earning 20 to 30000 inr..bt i v not file ITR.. how i apply credit card nd which bank???

It would be tough if you have not filed ITR

Manish,

Can you suggest me a HDFC credit card. I already have a salary account with them

1. Overseas travel purchases (hotels, food and other airport charges)

2. Domestic rare payments – Flight ticket / train ticket bookings, Salon services

Hi Atidevin

Your cases is a bit complex and I think we are not the right people to comment on it.

My suggestion would be hire someone who is professional in this area and consult them

Manish