Want to buy health insurance with small premium? – Use super topup policies?

Do you want to know how you can take a high health insurance coverage at a cheaper premium, without compromising on the benefits and features? Today I am going to share how you can do that using top-up health insurance policies.

Gone are the day’s when Rs 2-3 lacs of health cover was considered a good cover, its not even average cover these days. With rising health care cost, a health cover below 5 lacs is just not sufficient for most of the people. I am confident on that, because in last 6 months, we have helped more than 1000+ people to take their health insurance and majority of them ended up with a coverage in range of 5-20 lacs.

I know, a lot of investors understand the importance of high health insurance cover, but they are unable to afford a high premium. So what is the alternative?

Use Super Topup Policies to increase your health cover at lower premiums

The solution is Super topup policies.

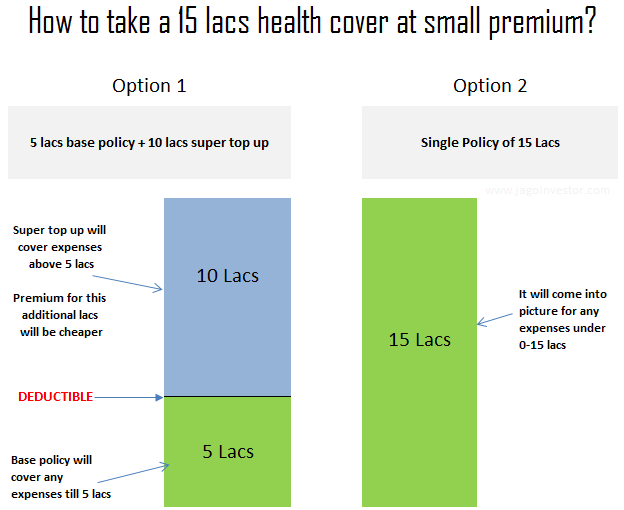

You can use Super Top-up health insurance policies to upgrade your health cover by paying a lower premium. Super Topup plans are the health insurance plans which pays only when a certain threshold is crossed.

For example, consider a super top-up plan for Rs 20 lacs with deductible of Rs 5 lacs.

In this case, the policy will pay only when the initial Rs 5 lacs is paid off and they will pay the additional amount above Rs 5 lacs. So if the claim amount is Rs 12 lacs. The policy will only pay Rs 7 lacs (over and above 5 lacs deductible. If you are new to this concept, we have already explained the topic of super top up in detail here, please read it first.

So how can you use super top up to take a higher cover?

Instead of taking a full cover of X+Y amount, you can take a base cover for Rs X and take a Super topup plan for Y amount with X as deductible. This way you will be covered upto X amount by the base policy and for any claim above Rs X, the super top-up policy will get triggered and come to your rescue.

The main benefit here is that the Super Top-up policies come very cheap and overall your premium will be small.

Example of 3 member family (2 adults below 35 yrs + 1 kid)

Suppose you want to take a high cover like 20 lacs for your family (3 member family). Here you have two choices

Choice 1 : You can take a stand-alone policy of Rs 20 lacs here. If we take an example of Optima Restore Family Floater, the yearly premium would be Rs 23,527.

Choice 2 : As 2nd choice, suppose you the same take the same Optima Restore Family Floater for Rs 5 lacs, which will cost you Rs 12,513 and on top of it, you take a 20 lacs super topup from L&T Medisure Super Top Up with 5 lacs deductible, for which the premium would be Rs 4,389. So the total premium in this choice will be 16,902.

That’s a saving of 28% in premium.

However, note that both the choices will differ with each other, because from features point of view there are a lot of differences in both the choices.

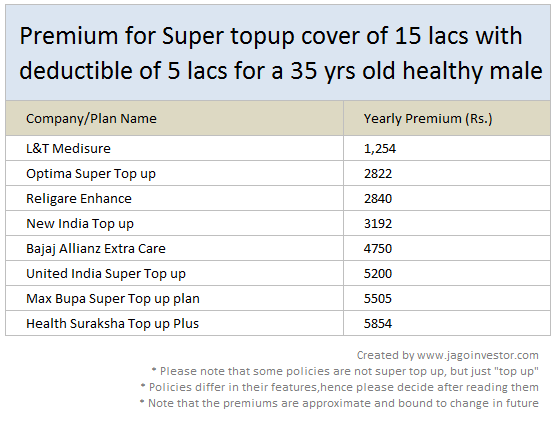

So for those who already have a 5 lacs cover already and wanting to increase their cover to 15 lacs total, below I have listed down some companies top up cover plans and the extra premiums they will have to pay.

Below is an example of how you can increase your health cover from 5 lacs to 15 lacs (or take 15 lacs cover).

Do you have a small health cover right now?

So, ask this question to yourself? Do you have a small health cover of 2 lacs, 3 lacs or max 5 lacs and you want to upgrade it to a big number like 15 lacs or 20 lacs?

For the sake of explanation, let me take an example of 5 lacs existing cover and lets see how you can increase it to 15 lacs for a small premium increase. So all you need to do is take a super top-up cover of 15 lacs with 5 lacs deductible. Below are some plans with the premium amount for a single individual of age 35 yrs.

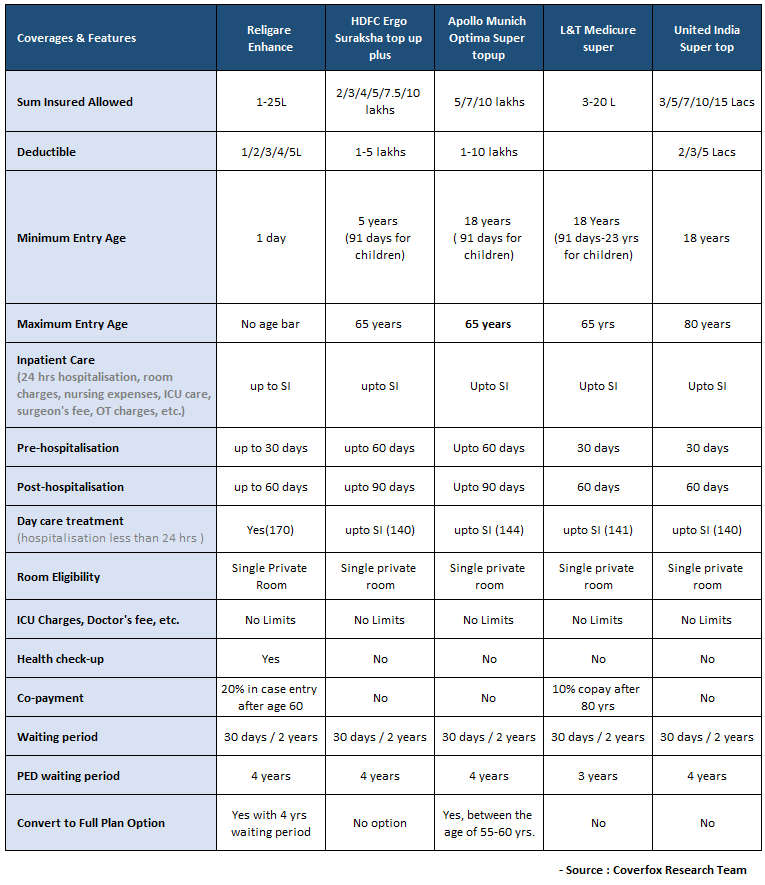

Comparison of Super Top-up Plans in Market?

Below I am sharing the comparison of various super top up plans in the market and how they differ from each other on various parameters.

Why Super top up premium is less?

I am sure many investors will have this question in mind that “Why is the premium for a super top up plan so less?“. The answer is that the probability of a super top up getting triggerred is statistically very less and hence the risk for the insurer is not that high.

Think about it this way. If you have a large cover of 15 lacs right now, what would be the hospital bill on an average? Most of the times, it would be in range of 50,000 to 1 lacs if you get hospitalized for a minor case and few lacs if there is some accident or some major issue.

Only in a very very fatal case or if you are highly unlucky, your bills will run over in the range of 10-15 lacs and thats going to happen once or twice in your lifetime. So the chances for a company paying for a claim above a certain threshold is very less. That’s the reason the premium for a top up plan is less. Higher the deductible, lower the premium.

Is it advisable to buy the base plan and super top-up from the same company ?

The answer is YES. If your base plan and the super top up plans are from the same company, it would surely help because you have to deal with the same company for both the claims. The documentation process is more simple and the communication is smooth. The company will not find any issues because it has all the records with them.

However note that even if you have it from different companies, it’s ok. You ultimately have to look at the features and what combination works best for you and if the total premium is affordable to you or not.

What are Convertible Top-up plans ?

Lately, a new kind of top up called as convertible topup plans are coming up in market.

“Some companies offer Super Topup plans with an additional feature that allows the plan to be converted into a base plan. This is done by buying out the Deductible in the plan.

For instance, if you have your company health insurance for Rs. 3 Lakhs you could buy a Topup of Rs. 15 Lakhs with a deductible of Rs. 3 Lakhs. In case you leave this employer, and/or are without cover, you can apply for buying out the deductible at the time of renewal by paying additional premium. There are certain conditions/triggers based on which this feature gets activated into the plan.

This is an excellent feature for people who feel that they would be working with employers who will provide health insurance cover all their working life, without any break.

For instance,

In case of Religare Enhance – The convertible feature gets activated after 4 continuous renewals. The plan has a waiting period of 1 year for Pre-existing diseases

In case of Apollo Optima Super – The option is available for customers who have bought the policy before crossing the age of 50 years. The option can be opted between the age of 55 and 60 years at the time of renewal by paying additional premium, if the policy has been renewed continuously without break. “

Who all should buy a super top up plan ?

- Those who are having a small cover by themselves or a group cover through their employer and want to increase their cover (ideally you should have a base policy for a minimum amount)

- Those who are right now having a small cover and want to upgrade it

- Those who can take care of small medical bills themselves (like up to 2-3 lacs) and only want help in case of bills beyond that number by paying a small premium

Other Important Points related to Super top-up plan

- A super top up policy can be taken stand alone – A super top up policy can be taken without a base policy. There is no compulsion that you should hold a base policy.

- Premiums will rise as per age slab – You should be aware that just like a normal health insurance plan, a super top up plan premium will also rise as per age slab in coming years, so even if the premiums look very small right now, it’s bound to increase later

- No Claim Benefit not present – Generally super top up plans do not offer No Claim Bonus (NCB) . This is the primary difference between taking a base cover of a high amount and combining a small cover with top up cover, because then you loose on the benefits of a No Claim Bonus over the years.

- Not always a great option – Just because the premium is less, it does not mean that combining a small base cover with a super top up is always the best plan. Depending on situation, you need to find out if its a good option in your case or not. It might happen that you might loose out on some benefit and feature on the top up plans

I hope this article helped you to understand how you can increase your health cover at a small premium. Please ask your questions if any below in comments section

October 13, 2015

October 13, 2015

Hi, need your opinion on max bupa health companion plan, it coverz almost all the benefits with the lowest premium. I am thinking of taking a policy for mother for 20 lakhs and one policy for me, wife and kid for 50 lacs what’s your opinion, my mother’s age 52 and my age 29 my wife 29 and son 19dayz

Hi Sagar Grover

Thanks for asking your health insurance question. We will get on call with you and help you resolve your query. Please fill up your details at

http://jagoinvestor.dev.diginnovators.site/pro

We will call you back

Manish

Hi Srinivas

JUst fill in http://jagoinvestor.dev.diginnovators.site/solutions/buy-health-insurance-policy and my team will connect you to get this action completed.

Manish

Hi Manish,

.I will fill the details today. Let us know once I speak to your team.

Thank You

Srini N

Sure

Hi Manish,

I already have a health insurance of 7 L for my family but I’m confused if it’s better to opt for top up 0r should I go for critical illness cover. Can you suggest which one to go for considering if there are any major health issues i future.

SBI GI also has a top up – Aarogya top up

It is a good option in my view – kindly check before taking

Its a simple vanila top up and not a super top up. It will be triggered considering single claim and not all the claim during a policy period. Hope this information will be useful for taking a well informed decision.

Health insurance today has become an necessity and not a luxury and with the ever increasing costs of medication it becomes all the more important to have larger coverage and the top up plans are really a cost savers with add on benefits at reasonable cost.

I recently bought a Super Top Up from L&T, they declined my policy stating they don’t cover Non Alcoholic fatty liver i has in 2013, my recent medical reports being crystal clear and recently have purchased a life insurance

Now what do you advice?

What choice do you have? A company has its own way of evaluating the customer and if they have rejected the policy, you cant do much other than applying to other companies

Manish

Indeed great article, clarified many doubts and made me aware of the medical insurance industry.

Thanks for writing great article.

Thanks for your comment Amit

Hi manish

i m regular reader of articles find very informative and useful

Thanks for your comment BHUSHAN

Hi Manish,

I have been following your website for years now and it has helped me a great deal in taking important financial decisions.

I have a question. Is it true that insurers can not increase the premium on individual policies arbitrarily (they are supposed to be approved by IRDA), while for group insurance policies it is not so. So do group insurance policies always carry the risk of your company suffering losses and increasing the premiums astronomically in future. And does this apply to family insurances too. (ie Religare Care, cover for more than one individual in single policy.)

Thanks,

Adarsh

Adarsh

Its not like that, but the association of the company with the health insurance company can change and the premiums can change that way !

I want to know more about stand alone super top up policies. My Parents age are 67 and 59. They are fit and fine. I would like to go for policies which has no room/ICU limits. But the premiums works out on an avg around 22k which are quite unaffordable for me. But at the same time I can afford to spend around 1-2 lakhs from my savings in case if they run into health issues in future. Since it is mentioned, Super top up policies can be stand alone, Is it good idea that I can have super top up policies coverage from 3 Lakhs onwards? What are all the conditions I should take care

Generally super top up treshhold start from 5 lacs in most of the policies, but I think Maxbupa has super top up where you can choose 3 lacs to be the lower limit. However note that the premiums will not be dirt cheap in this case, it might be around 50% of the regular premium. However considering the fact that 80% of the times the bills are anyways in the range of 1-3 lacs, I dont think its a very smart way to choose the super top up plan.

I think the best think you can do is right now is leave your details at https://www.coverfox.com/jagoinvestor . And you will get a expert assistance on selecting and buying the right policy for you.

You can then take the decision.

Manish

Manish

Thanks for your reply Manish and whatever you have said are valid points.

UIIC has Super top up policies for my parents age 67 and 59 at a very low premium around 5k per person for threshold of 2Lakhs and coverage of 5 lakhs. I think this will be more affordable and I can save and invest the rest of the premium for future expenses. Would like to know if you have any further comments on this

YEs, I think you can do this . Looks like a good plan .

Thanks Manish for all your articles and time to support us

Hi,

Which one of the health insurance companies you would recommend in terms of claim settlement assurance? Especially Future generali’s product fits my requirement, but want to have reviews before buying it. (this question is about base policy and not super top up). Future generali is the only comapny having floater coverage for both my mom and dad for their ages. But I would like to know expert opinion about their claim record before purchasing it

1. Bajaj Allianz

2. L&T insurance

3. Future generali

4. Royal Sundaram

Thanks,

Partha

Hi Manish,

If one buys the Apollo Munich Optima Restore policy, is another top up plane needed? The way i understand is, that Optima Restore will restore the base sum insured, if the amount gets used up within a policy year. Am i missing something or is that the way Optima Restore works? It then should take away the need for any Top Up policy. Please explain. Thanks.

But what if you want sum assured even higher than the restore amount .. !

Hi Manish,

Thanks for getting back so quickly.

How does the restore thing work? Suppose in a single hospitalization, i acquire a bill above the policy amount? Do i have to pay the extra amount out of my pocket or will the restore factor kick in immediately and cover the extra amount?

Regards,

No , restore will not come into picture immediately. restore means once the claim is settled for first time, then after that the amount is restored.

So if your SA is 10 lacs, then bill is 14 lacs, then 10 lacs will be paid by company , 4 lacs by you and once everything is done , then the amount will be restored to 10 lacs again .

If it worked the way you explained, then it means unlimited sum assured which is not possible

Thanks once again Manish.

You are indeed doing a great job.

By the way, do you provide any professional services for investment or taxation purpose, that someone can avail of?

Regards,

Hi Rajashri

Yes, we do have professional services . You can check it out here and fill up the form to have an intro call if you want – http://www.jagoinvestor.com/services/financial-planning

Manish, Great article. I read your review of Religare CARE and bought a 10 Lakh cover the next day (nearing 45 years age in few months) . I did see this article as well, but did not see the cost for my case. I saw it later and LT top up prices of 4000 for 2 adults and 1 child shocked me . I am considering taking this on as well right now and discontinuing CARE after 2 years. I already have National Insurace cover for 2 adults 1 child for many years which I dont think I should stop. Is it wise to by Super topup now and discontinue CARE after 2 years paid up time expires ?

Anirban

Adeb

Yes, you can do that ..

Top up benefit is useless in case of apollo munich optima restore + optima super.

I have 3 lakh cover of optima restore for 9906/- (additionally i have accrued bonus cover of 3 lakh after 2 claimless years, so cover is 6 lakh for now), and for a cover of 10 lakh it costs 16353/- for a family of 3.

Now if i take a optima super top up plan of cover 7 lakh for a family of 3, with deductible 3 lakh, it is costing 6606/-.

so total cover of 10 lakh via Base+ topup comes 9906+6606= 16512/-,

that is 159/- costly than plain plan of 10 lakh.

Am i missing something?

No, you are correct. In some cases, it might make sense to not go for topup plan !

Hi Manish,

If we have a family floater policy, How will the Top up plan work?

I wanted to know more on weather Top up is on inusrance or person.

Top is on insurance

Hari

Did you go through the article ? Because everything is already discussed and explained

i Have gone through but was confused as you mentioned that top can be taken with out actual insurance.

Other Important Points related to Super top-up plan Point 1

Yes, Topup or Super top up can be taken stand alone. Lets do one thing. You give me a scenario and I can tell you how top up will work in that case

Hi Manish,

Thanks for guidance. This article is really very helpful for me.

I want to buy a health policy for my parents & both of them are above 60.

Would u please suggest any policy which cover PED early.

Your response will really great full for me.

Hi Sushil Kumar Pandey

Thanks for sharing your health insurance requirement. I think the best think you can do is leave your details at https://www.coverfox.com/jagoinvestor . And you will get a expert assistance on selecting and buying the right policy for you.

You can then take the decision.

Manish

Dear Sir,

Thanks for valuable inputs. I am looking for policy for 2 Adults (Self 35 Y + Spouse 35Y ) + 2 Kids (Sons 14 Y & 12 Y) Please help for choosing policy between Maxbuppa v/s Rel v/s any other good option:-

Maxbuppa offer is as under:-

Total Premium is Rs 30,985 for 15 lac floater & 1 individual in Heartbeat family first gold plan for 1 year for your family ( 2 Adults + 2 kids ).

Please help me.

Regards,

Dharamvir Singh

Hi Dharamvir

Thanks for sharing your health insurance requirement. I think the best think you can do is leave your details at https://www.coverfox.com/jagoinvestor . And you will get a expert assistance on selecting and buying the right policy for you.

You can then take the decision.

Manish

Sir,

can you explain the term “deductibles” in proper?

I have a base plan of 10 lakhs cover. recently i saw religare super top up (enhance) which has super top up cover of 10 lakhs with 10 lakhs deductible!! what does this imply?

Have you read the full article ? Its already explained with details !

Hi Manish,

Thanks for this valuable info.

But my experience about coverfox is not good. The executives do not have any knowledge about health insurance policies. There is quite delay in receiving my policy & after that I sent mail for my queries but there is no reply.

I request you not to suggest Coverfox to anybody.

Regards,

Amol

Hi AMOL

You might want to talk to them about this. I am also informing this incident to them

Manish

Hi Amol,

Could you provide me with your Coverfox order no. – So that I can personally look into this?

Hi Mahavir,

Thanks for your attention.

After a month now, the issue has been resolved & I had received all the documents as well as name of RM .

Regards,

Amol

Hi,

I have family floater policy of 7.5 lac. With no claim bonus SA can get doubled i.e. 15 lac. I am planning to buy Super top up policy of 10 lac with 7.5 lac deductible. I have a question though. Suppose I get hospitaliztion expenses, say, 20 lac. My family floater SA is 15 lac (due to no claim bonus at that point). Can I claim 15 lac under normal plan and remaining 5 lac in Super top up (Notionally, here deductible will become 15 lac) ? or I will have to claim 7.5 lac under normal plan and 10 lac under Super Top up and remaining 2.5 lac from own pocket?

Thank you for your time.

You can claim 15 lacs under main policy and rest 5 lacs from the super top up , Note that super topup is not concerned with your other bills , they will just pay what they are entitled for.

Manish

hello