Everything you wanted to know about Advance Tax and Penalties under it

Are you paying your income tax only at the end of the financial year ? If your answer is YES, then understand that you are doing it in wrong manner. Today we will learn about Advance Tax which is not widely understood and its quite important thing to know. I know that majority of the people don’t follow this process and pay the income tax at the end of the year only (infact on the last minute many times), But today you should understand if advance tax is applicable in case your case or not.

You can either view the youtube video below to learn about it, or skip it and read the article below.

What is Advance Tax ?

As the name suggests, Advance Tax is part payment of your income tax liability in advance. So instead of paying everything at the end of the year, you pay it 3 times in a year in parts. The concept of Advance tax exists because govt wants you to pay income tax as you earn month after month and not at the end of the year. Advance tax is to be paid when your annual tax liability exceeds Rs 10,000 overall .

However important point is that Advance tax is applicable on your Income from sources other than your Salary like

- Interest on FDs or Savings bank deposits exceeding Rs. 10,000/-

- Rental income on House Property/properties

- Capital Gains on sale of Mutual Funds or Shares

- Income from any other sources not mentioned as above.

Which means that if you are a salaried employee who does not have any other income source and if your employer deducts TDS regularly, then Advance Tax is not applicable in your case. You dont need to worry about it.

On which date you have to pay Advance Tax ?

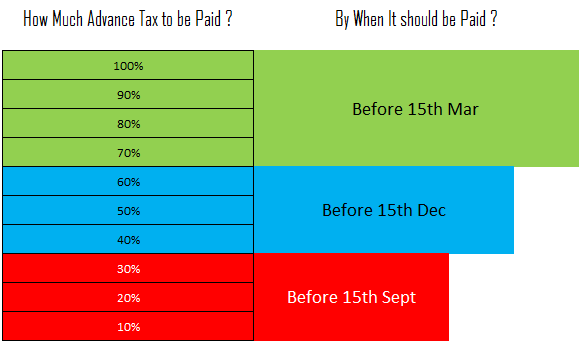

You have to pay advance tax 3 times in a year, which is 15th Sept , 15th Dec and 15th Mar and you should be paying not less than 30% , 60% and 100% of your income tax liability before these dates. Below picture makes it clear for you.

Which means that if your income tax liability for a year is Rs 1,00,000 , then you should pay advance tax of Rs 30,000 by 15th Sept, another Rs 30,000 by 15th Dec and rest Rs 40,000 by the end of 15th Mar

What if I don’t pay Advance Tax on time ?

If Advance Tax is applicable in your case, then you should be paying it on time, but if you don’t pay it on time, then you can pay it on the next due date along with the interest. So those who have not paid the first installment (i.e. September 15) of Advance Tax (if applicable to you), then you can pay it together with second installment (on of before 15th Dec), but with interest on the first instalment for deferment of the same by three month and if you are not paying it even on Dec 15th , then you can pay it by the end of the year along with the interest.

You will be charged with penalty under Sec 234B and 234C incase you ddon’tpay your advance tax on time. Let me quickly share what is sec 234C and sec 234B

Understanding Penalty under Section 234C

Lets first understand sec 234C. Under this section, if you don’t pay your installments of advance tax on time, then you are charged 1% of simple interest for next 3 months on the amount of shortfall. So this is the penalty to be paid because of DELAY!

Understanding Penalty under Section 234B

If your total advance tax paid by last due date (15th Mar) is less than 90% of your advance tax liability, then you will have to pay 1% interest on the balance amount each month until you complete the payment. which means that suppose your income tax liability is Rs 1,00,000 in total and if you have not paid anything upto 15th Mar, then you will be charged 1% on the outstanding balance (Rs 1 lac in this case) each month, unless you pay it, so if you pay in June , then you will be charged for 3 months penalty and it would be Rs 3,000 in total other than penalty under sec 234C.

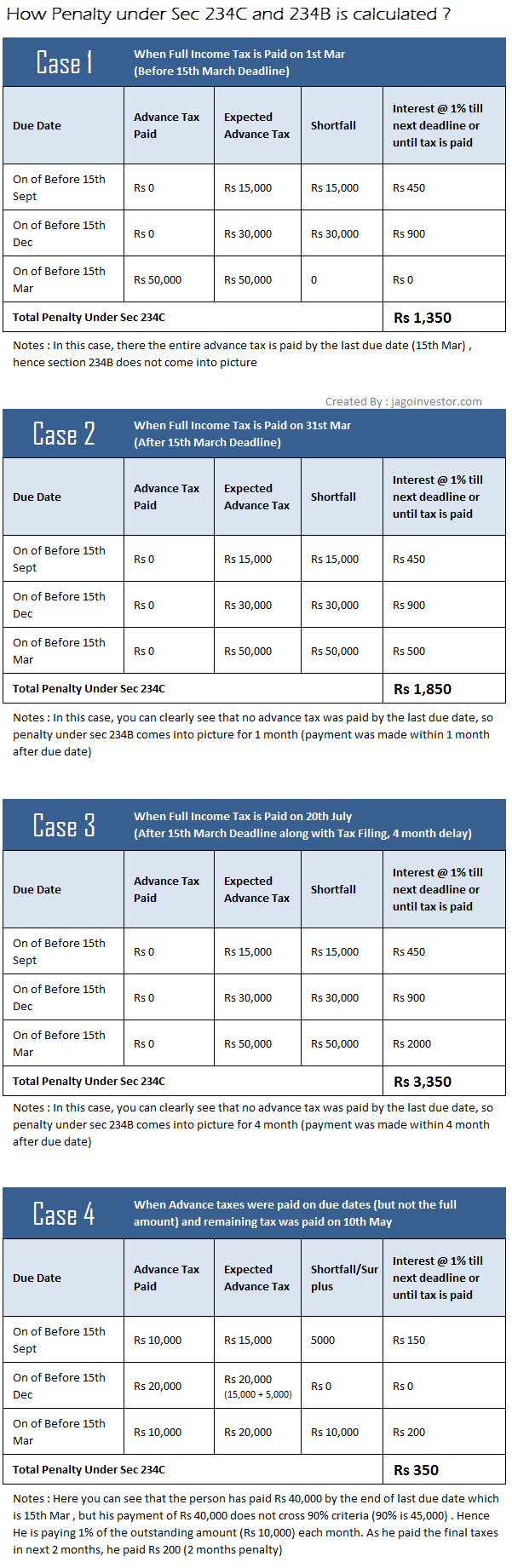

Lets understand sec 234B and 234C with help of case studies. Lets assume that your total Income Tax payment for the year would be Rs 50,000, then as per rules of Advance tax, you should be paying

- Rs 15,000 by 15th Sept

- Another Rs 15,000 by 15th Dec

- And Rest 20,000 by 15th Mar

Now imagine you don’t pay any advance tax , then how much penalty you will pay under sec 234B and 234C under various situations ? Below I have explained 4 situations where you pay your full income tax on different dates. Check out how much penalty you will have to pay under these situations !

How to pay Advance Tax ?

Now comes the final question, that how can you pay your advance tax ? Most of the people are worried on this, as they feel that paying advance tax would be very tough or involves lots of hassles, but thats not correct. You can make payment of your advance tax in less than 5 min.

There are mainly two ways of payment advance tax.

1. Offline option

Almost all the banks have tie up with govt for accepting the advance tax from the taxpayers, you can go to the banks which have the tie up and fill up the challan number 280 and pay your advance tax to them.

1. Online Payment of Advance Tax

The other faster way to make payment online. Here is how it works

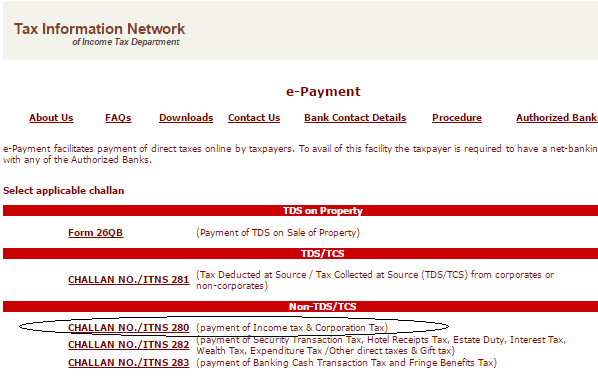

Step 1: Go to https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

2. Choose Advance Tax option and other details and make payment

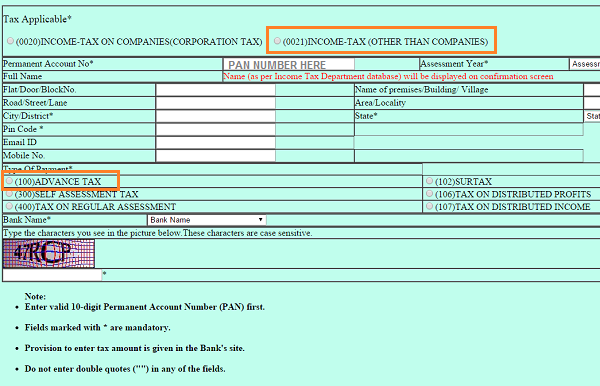

When come to the next page, you will have to choose various details here. Make sure you choose your

- PAN Number (of utmost importance)

- Advance Tax (under Type of Payment)

- Email, Phone and Address details

- Assessment year (to know more about this, click here)

Once you choose these details, you can then click on “proceed” and it will connect you to the Bank which you had selected, It will show you your NAME on the next page, so that you can confirm there was no mistake from you end, then you can make the payment online, and you will be able to print the receipt online (you will also get it on email)

Are you paying your Advance Tax

I guess, you are now clear about the advance tax and how its calculated . Its a good practice to pay your advance tax on time and do not delay it because it can mean a penalty of few thousand rupees in most of the cases. I know its tempting to delay the headache and complete the payment once in a year, a lot of people might be ok with paying some penalty, but then you also invite related problems with it. Pick your choice.

December 12, 2014

December 12, 2014

Hi Manish, I have a query regarding Advance/Self Assessment Tax. I worked for first 2 months with a company in current Financial year(2015-16) for which they did not deduct any taxes as income was less than 2.5 Lakhs. Since June to Mid September I worked as Consultant for a US based company which use to pay my salary through direct remittance from US to my personal Bank account in India (no taxes deducted and deposited in India). From Mid September, I have again joined a company as full time employee so company will deduct taxes as per my salary. Here I have not mentioned my past earnings so my current company will only deduct taxes as per my earnings from them.

Now in this scenario should I calculate my tax liability for the duration of April 2015 – Sept 2015 and pay advance tax or Self Assessment tax or should I pay tax after 31st March 2016. Also in case of my tenure as Consultant what is the tax liability as I have heard its different than regular employee. Please guide.

Hi Vijay

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

Tax deductors do not give form 16a or TDS certificate till after 31 Mar, so how can we be sure of having paid 100% advance tax before that, ie, by 15 Mar? This year I have to pay fine on late payment of advance tax because a tax deductor gave entire interest with TDS on 31 Mar & my estimate turned out to be an underestimate. The bank had refused to give me an estimate of what I would from my deposit get till 31st March. Shouldn’t the IT dept allow tax payers time till 15 Apr for 100% payment?

Yes, thats an issue , But you can then pay the difference a bit later

Hi Manish,

I paid the advance tax upto 92% but there was some error in calculation now i am planning to pay the remaining tax after 31st march…

how to calculate the penality on it, as you mentioned if one paid more than 90% then penality is not applicable?

BRs,

Lokesh

You need to get in touch with a CA for that

I am a retd amy officer and a senior citizen. I want to take advantage of Rs 1.5 lakh exemption limit under 80c. Could you kindly as to where should i invest

You can look at 5 yrs tax saving FD !

I had sell shares because of my company acquisition on march 12 for which i need to pay tax on capital gains of Rs3500. Do i need to pay it as advance tax or self assesment tax .Doi need to pay any penalty for this.

Self Assessment tax

I came across this advance tax calculator hosted by Income Tax Dept –

http://www.incometaxindia.gov.in/Pages/tools/advance-tax-calculator.aspx

Might be useful for those looking to compute their tax liability and the appropriate advance tax amounts to be paid during the year.

Hey Karthikeyan

Thanks for sharing your experience with all of us. It was a great learning.

Manish

HI Manish,

Is there any option to see how much advance tax to be payed by entering my PAN card?

No

Hi Manish,

I had paid additional tax on savings account ,but i received another notice to pay an additional amount of 2500, which i believe is interest calculated on late payment.I had not paid an advance tax,but had paid it during the year tax filing process.

Now how do i pay this 2500 additional using the website you mentioned,i mean what should i select in the Challan 280 – Type of Payment (Tick One).

Should i select Advance Tax (100) or Self Assessment Tax (300).

Earlier i had used the Challan 282 when i paid the tax;does it create any issue?

Kindly guide.

You can use challan 280 with “Self Assessment Tax” option !

This was really helpful and helped me understand certain things. I would definitely share it!! Keep going!

Thanks and regards

nazia

Welcome !

Dear Manish,

Thanks for the informative article ! I have one query. I have a home loan running and I claim the home loan interest deduction each year at the time of filing IT return. The approx. loan interest outgo is approx 2 L whereas the rental income received on this house is approx 1 L (per year).

As every year I apply for IT refund , is it necessary to pay advance tax on the rental income ?

Regards,

Yes, you still have to pay it .. But its not to be paid on each items separate . Do one thing .. make an estimate on your TAXABLE INCOME which will be there at the end of the year and then calculate the tax on that.

This seems like an unnecessary headache to save some money. If I don’t pay the advance tax now and pay it along with my ITR return, I anyway earn interest from the bank on the money not paid.

I would also have no clue at the beginning of the year on my tax liability. I have filed my own taxes online for the last 7 years without any issues and don’t need an CA on my back for this.

Yes, you can choose to look at it . There are many who would prefer to pay it at the end of the year ..

Manish

hi Manish ,

thanks a lot for the such nice article , before this i was not aware about the advance tax . i have few doubts below ,

1) other than salary if we have income from the FD or RD (interest) but it is less than 10,000 then in that case we need to pay advance tax right ?

2) & whatever the interest income may be around 5000 or 6000 , that we need to highlight , when we file for ITR ?

1. Yes

2. Yes

hi manish ,

just for carification , for point 1. i mean to say we need not pay advance tax in case we have income othar than salary but less than 10K. is it right ?

Yes thats correct !

thanks Manish

Very useful article. The contents may not be known to many people, I presume. Thanks.

Thanks

Hi Manish,

Does sole proprietorship comes under individual tax rules? My friend told me it I should pay 75% December. So little confused here.

No , Sole proprietorship will not come under individual as its Business . Contact a good CA on this . I will connect you to my CA on email

Mr. Vijay if ITO does assessment, then penalty will be levied depending upon the failure made by the assessee, for failure to furnish return of income as required u/s 139(1) before end of relevant assessment year then penalty is Rs.5,000.00. With reference to second query senior citizen can pay his balance taxes at the time of filing his income tax return as per the provisions of Income Tax Act

Manish,

What if I have RD’s maturing at different months… like March ,December, should I pay the advance tax in that case also?

Yes, even then !

Recently I declared that I am having Income from other sources. I pay taxes at the end of the financial year. I am applicable for fines. But there was no intimation from Income tax that I am fined.

What to do? Please advice.

its your responsibility to find out if you have any fines or not . If there is no notice from govt , then enjoy ! .. But in future it might arise !

Nice coverage. Here are some additional points that would’ve been a nice add in the article:

1. For 30% bracket people, more common sources of advance tax are bank deposits and rental incomes.

2. In case of bank deposits, they deposit the tax to IT every quarter, and send us the details (I receive thru physical copy). This can be seen through TRACES website.

3. On a related item, it is important for IT filers to keep track of all the deposits made to IT from different sources through TRACES. Now that it is made very transparent, it makes very good sense to know what our bank(s) is/are sending to IT, and then calculate advance tax according to that!

4. There is a penalty, yes. Usually, banks TDS with 10% and if I fall in 30% bracket, I need to calculate the difference, and pay the rest as advance tax, yes. But what happens is, for the last quarter (Jan-Mar), banks will not deposit the remaining taxes till April (closure of their books last day of March), and we will not know that amount till end of April (same reflected in TRACES).

So what I do is, I pay it as assessment tax end of April or early May (I fall in 30% bracket, so I need to pay the diff), so that I end up paying less penalty (1% simple interest, for me, is not too much :-)).

Thanks for sharing that piece Bharani !

Karthikeyan, if you have interest on FD , then you just need to estimate the interest earned for the entire year, and calculated the advance tax for the same.

If you redeem share/ mutual fund in the middle of the year, then you need to check first whether it is long term/short term and then the taxability will be decided accordingly.

Nice very educative.

However, it would have been better if you have also covered up that the payment of advance tax is not applicable, quarter wise, in respect of senior citizens. They can pay the same at the time of filing their income tax returns.

Now the question to you is: As per law a person can file his income tax return for any FY till the end of the AY ( 31 Mar of the AY) without any penality. Only difference lies is that if the ITO somehow does the assessment in his respect before that date then what are the consequences ?

Also if a senior citizen files his return as contemplated above then can he deposit his amount of balance of taxes ( less TDS on salary/pension etc) on the date of filing of his tax return ?

Please clarify through a message on my e mail pl.

Hmm .. I am personally not sure on payment of advance tax for senior citizen .. I will check with our trusted CA partners on this and get back !

Manish