How Top up loans are good alternatives of Personal Loan ?

Imagine you already have a home loan and now after few years of payment, you again need some extra loan for some purpose? What would you do? One would ideally think of applying for a fresh loan from scratch and might get it too. But there is a faster option to get a loan if you already have a running home loan and its called top-up loan.

How does top-up loan works?

When you take a home loan for the first time, you have some home loan eligibility up to which you can take the loan. If you have consumed that full limit, then you are not eligible to get any further loan immediately, but over the years when you have paid back some part of your loan and if your income has also increased, then it may happen that your loan eligibility has gone up. At that point, you are eligible to take up a top-up loan which is over and above your existing home loan. What exactly happens if you get a loan up to an amount of your loan eligibility minus your existing outstanding loan.

Almost all the bank rules say that you are eligible for a top-up loan only after 6-12 months of paying off the earlier loan because only after some time is over, your loan eligibility changes.

Let’s take an example

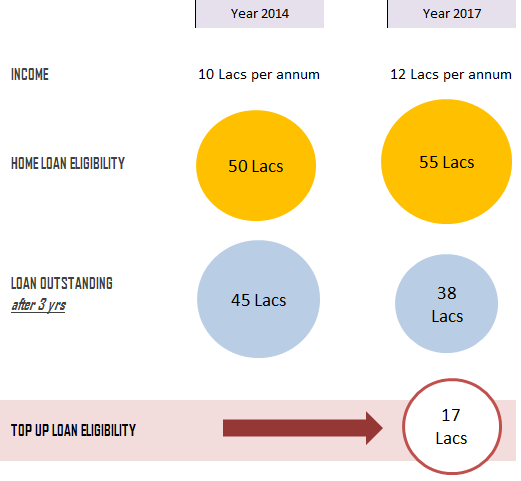

Assume that Ajay, a software engineer working in Bangalore has an income of Rs 10 lacs a year. Assume that his loan eligibility was Rs 50 lacs and he takes a home loan of Rs 45 Lacs. Now assume that he has serviced the loan EMI for the next 3 yrs and now his overall income has gone up to 12 lacs per annum and his outstanding loan balance now is only Rs 38 Lacs. Now based on his current income, his new loan eligibility is 55 lacs.

Now if he applies for a top-up loan, the bank will deduct the 38 lacs of an outstanding loan from his new loan eligibility of 55 lacs and only provide him 17 lacs (55-38) of the top-up loan. The documentation and the overall process will be faster in this case, as there is an existing relationship and also the history is known by the bank. Below is the graphical representation of the same example I took above.

You need to have a good repayment track record to avail a top-up loan. Just because you have some loan eligibility does not mean that there is a guarantee of getting a top-up loan. The final decision is always with the loan provider. The bank will also investigate with you the purpose of taking the top up loan. Below you can see for what purpose the top up loan can be taken.

- Renovation at home

- To be used as a personal loan

- To buy another property

- To buy a plot or Land

- Purchase of consumer durable products

- Children’s marriage/education

- Business requirements

- Medical expenses

5 Benefits of Top-Up Loan

Benefit #1- Tax Benefits on a top-up loan

You will get tax benefit on a top-up loan only if the loan amount is used for buying a house (on principle and interest) or if you are using it for renovation purpose (interest part). For any other purpose, if you use the money, you will not get any tax benefits.

Benefit #2- The interest rate for a top-up loan

A The interest rate for the top up loan is around 1.5% to 2% higher than the home loan interest rate of the bank, which means it can go up to 11.5% to 14% finally.

Benefit #3- No Security Required

A top-up loan does not need you to mortgage some asset, because its given on top of your home loan and anyways your home documents are with the bank. So one important point to note here is that even if you close your original home loan, you need to also close your top up loan before you can ask back your original house papers from the bank.

Benefit #4- Top-up loan amount

Generally, the amount of top-up loan cant exceed the original home loan amount you have taken and also there is always an upper limit defined by the bank for the top up loan, which can range anywhere from 15-40 lacs. So if you have taken a Rs 30 lacs home loan, you can take the maximum top-up loan of another Rs 30 lacs if your eligibility supports you after some years.

Benefit #5- Processing Fees

Almost all the banks will charge a processing fee for approving the top up loan . The charges are same as their home loan processing charges . For example – if you take a case of HDFC LTD , the charge 0.75% of the loan amount or Rs 2,000 which ever is maximum as the loan processing charges for the top up loan.

Top up Loan is a good alternative of Personal Loan

By now you must have understood that a top up loan is a much better alternative to a personal loan. there are a much higher chances of getting a top up loan if you already have a home loan and have a clean and good track record of payment in past. Also if you have already passed 3-4 years of your home loan repayment , you can get a decent amount of top up loan. Given the interest rates of personal loan can be as high as 18-24% , its always a good idea to try for top up loans.

Let me know if you knew about this concept or not ?

November 3, 2014

November 3, 2014

Hello sir, I have a home loan since last year. Now I am applying for additional loan. i had no idea about top up loan and i have prepared blue print, valuation and search report. should I go for additional loan or top up. which is more beneficial for me?

The better would be TOPUP loan, because its more easy to get and also at the same rate of interest (home loan one) . The only thing is you will have to check how much is your eligibility. Talk to your home loan company

Hi manish, i took a personal loan of 2 lakhs in the month of July and Emi is 6800 per month for 3 years. When I took loan my package was 1.86lakhs per annum and now my package is 2.65lakhs per annum. I want to take another loan now. I thought I can re an either repay full amount and avail new loan for a bigger amount as I would be eligible for a bigger amount now or take a loan top up. I have paid only 2 emis till now and 3rd Emi is due next week. Can you let me know the options which I have. My loan is with hdfc bank and Salary ac is also with Hdfc bank.

Only the bank will be able to tell you if you are eligible for more loan.

Will top up loan emi be clubed with my original emi or is it separate? And can I repay only top up loan after some years?

Hi Sachin Desai

It will be clubbed.

Can I use this top up loan for commercial car purchase and how many days this procedure takes?

Yes you can use it for any purpose

Hello,

What is the procedure and documents required to avail top up loan. Does that loan coterminate with the HOME LOAN

Hi Manish

There is no special process for it. Its very simple . You just need to visit the branch and tell them you are looking for top up loan. They will ask you for basic documents like your address proof and identity and the filled form along with the recent bank statements and income proof (ITR)

Manish

Hi,

I want to know if i use home loan top up for business, then will it be considered as business expense.

Yes you can . In case of top up loan , it does not matter how you spend that money. The bank will only increase your home loan by that additional top up loan amount and your EMI will change. Nothing else..

Manish

Nice article. If a top-up loan is taken for acquisition of a new property, can one claim tax benefit on principal amount paid as well as interest component?

The certificate issued by the bank will only include the amount of top-up, interest/ principal component as well as details of the borrower. The certificate won’t mention anything about the address of new property.

Yes, it can be done !

Do I have to pay Intimation and stamp duty charges in case of a top up loan?

No

Bank officials did take money for this from me and already did it. They said without it we can’t disburse the loan. I don’ know who to trust.

You should have waited more on this at that time.

Hi Manish,

Nice Article, though I was aware of this concept through your portal only.

I think there is a typo in second last line under heading “Top up Loan is a good alternative of Personal Loan”, Also if you have already passed 3-4 hours of your home loan repayment , you can get a decent amount of top up loan.

It should be “Years ” and not hours.

regards

Bhanu Pratap Singh

Thanks for sharing that. I fixed it 🙂

one year back i have availed Homeloan+topupLoan+mortgage loan from HDFC. They issue It-Exemption certificate only for Home-loan. Do I get Interest paid part from Top-Up loan to avail Tax exemption. Because I have utilised some part of amount from top-up loan for house renovation and painting.

You need to check this with bank only !

Hi Manish,

I have taken up a Top up loan with ICICI bank. They have given a different loan account number but the property address and name remains the same.

Can i consider the interest paid for the top up loan clubing up with the home loan for tax exemption.

I think you should consider that with bank !

Hi Manish,

I have taken a home loan from SBI (joint with wife), and want to apply for a top up loan, so I can repay the loan for the other property (on my wife’s name only). Can this top up loan will be exempted from tax as I am using that amount to clear my other home lone only?

Topup loan is nothing but extending the same old home loan. If your home loan was X earliar, it becomes X + Y later. The tax benefits can be continued in the same manner !

Thanks for response. I went to SBI to enquire about it and they said it’s a personal loan with low rate of interest. It will be treated like a different loan account altogether and will not be clubbed with home loan itself.

Some other banks offer the loan as an increased amount on same HL itself. So if someone is taking a top up from SBI and wish to claim deductions under Housing Loan sections, it wouldn’t work.

Is it ?

Because in HDFC I enquired for it and it was being given as a part of home loan extention . Anyways see if it fits your situaton or not !

Hi, what is the age bar for availing SBI top-up loan? Will the tenure increase or stay the same? What if the borrower is above 70 yrs old, will he be eligible?

I dont think at that age, bank will give a topup loan !

I am taking a top-up loan for renovation. My property is let out and I am staying in a rented house. On the top-up loan, can we claim tax deduction benefit on both principal and interest amount. Please help clarify this question with suitable income tax sections applicable.

yes, you can claim all that because its the same thing as home loan . Your home loan amount will just increase !

I utilised top up home loan to purchase another home on my wifes name.

Is there any tax benefit option available?

Your top up loan must have got added to the first loan itself . You can avail the same benefits like you did before

what documents required for top up home loan from SBI .

I am having existing Home loan from SBI. And recently taken top up loan on existing property to buy another home.

Can I get tax benefit for the interest paid on top up loan?

Yes

I had taken the housing loan from SBI, whereas the sanctioned amount is more but I had taken less then the sactioned amount, but now I required some more amount to complete the house (ie finishing work), so can I get the tax benefit in this case.

Yes

Hi Manish,

i have a home loan with IDBI and after some time i also took top up loan from the same bank. Whether interest paid on top up loan (mentioned as home loan in the disbursement letter for Purpose: Top Up loan for interior works ) is eligible for tax exemption? The original home loan account is also mentioned in the disbursement letter of top up loan.

Yes, its eligible , because anyways your existing home loan gets increased !

Thanks Manish for a very quick reply…

can i club the interest from 2 different premium paid certificates and claim as total interest paid on home loan? (original home loan and top up loan account numbers are different and hence 2 different premium paid certificates..). In top up home loan disbursement letter, original house loan number is mentioned and also top up loan is for renovation is also mentioned ..

thanks a lot for your advice..

Yes you can do that

Hi,

I currently have 2 houses bought with home loans, one is at fixed rate (ICICI), the other is a floating rate one (HDFC).

The HDFC loan ends earlier due to prepayments in 2018 (originally was to end in 2033)

The ICICI loan ends in 2020.

After reading this informative article, I goth the thought of consolidating the two loans. Can you please clarify the following doubts?

a) Can I apply for a transfer of the fixed rate loan (ICICI) into the floater rate(HDFC)?

HDFC has already pre-qualified me for a top up amount that covers the principal outstanding with ICICI.

b) If I close the ICICI loan with these proceeds, would I be able to qualify for tax rebate on the consolidated amount?

Hi Dhiraj

This is very specific query which you should follow up with the concerned authority only. We wont be able to comment on that

Manish