Difference between Growth and DIvidend option in mutual funds

People are confused , really confused …

There are 3 Mutual Funds Options (Growth , dividend , dividend Re-investment) and we will discuss those today. There are lot of misconceptions and myths which add to confusion in the world of mutual funds and agents use it against investors and make them fool …

Different Options in Mutual funds

1. Growth Option

Under this option you get the units at the time of buying and you have same number of units till the end. The NAV keeps changing according to performance.

2. Dividend Option

This is the most misunderstood option in mutual fund.

Dividend option in mutual funds means that you will be repaid some amount of your investments every year and it will be called as “dividends”, this helps those people who want some regular returns every year from their investments in mutual funds.

People think that dividend is something extra which they receive other then their investments which is not true 🙂

Dividend is declared per unit basis, if you have 100 units and MF declares dividend Rs.4 per unit, you receive Rs.400, and you think that your earlier investments have the same worth, where as it decreases by the amount you receive as dividend, because its paid out of your investments only.

The NAV of the unit goes down after paying dividend proportionately.

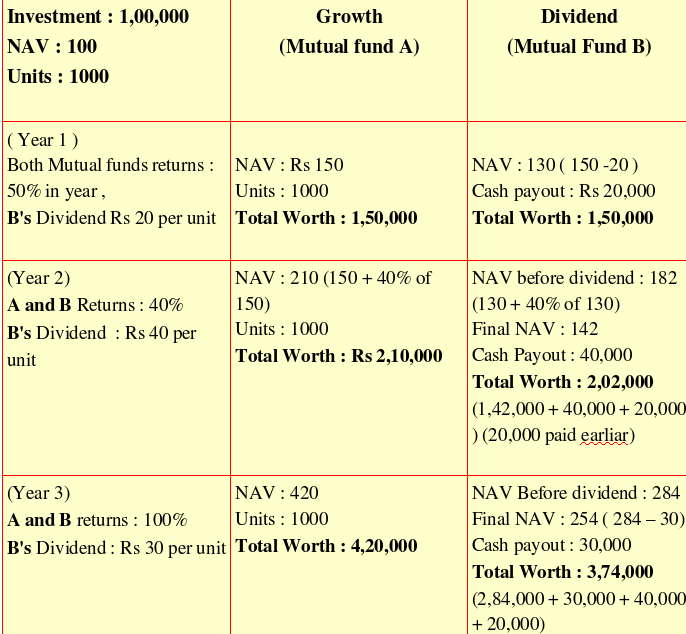

Example : Let assume you have Rs 1 lac of units in a mutual fund with NAV of Rs 100, you will have 1000 units. dividend declared : Rs 20 per unit

How it works :

You will get Rs 20,000 and then your remaining worth will be Rs 80,000 and as you have 1000 units, the NAV will go down to 80. So your actual worth is same as Rs 1 lac. The only advantage to you is that you are getting liquidity with your investments and getting regular cash every year, unlike growth option.

Agents generally lure investors to invest in NFO’s claiming that if company declared dividends, they will get more dividend compared to existing funds as they will have more units, Which is nothing but a idiotic myth 🙂

3. Dividend reinvestment

In this option ,the step is as follows

- Re-adjust the NAV assuming that dividend is paid.

- After that buy more units of same MF with that dividend money and allot it. So ultimately the number of units increases and the NAV goes down. In this case dividend money is not given to the investor but re-invested in the same scheme.

Example : Let assume you have Rs 1 lac of units in a mutual fund with NAV of Rs.100, you will have 1000 units. dividend declared : Rs.20 per unit

How it works :

Your dividend will be Rs.20,000 , and NAV will come down to Rs.80 like it happened above. Now this 20,000 will be re-invested in same mutual fund and you will get extra 250 units (20000/80).

Your Total units = 1250

NAV = Rs.80

Worth = 1250 * 80 = 1,00,000

Which one is better Dividend or Growth?

It depends. There is no thumb rule to decide which one is better then the other, it depends on the situation and your needs.

Watch the video to learn more about growth and dividend option:

When is Growth Option better?

If you are a person who earns well and does not need regular money back from your investment and if you are looking at long term investments then growth option is best for you because your investments gets compounded, which does not happen on the dividend part in dividend option as it goes back to investor and its never part of future growth.

When is Dividend Option better?

If you are a person who need regular money every year from investments for some purpose, It may happen that you have more responsibilities and more dependents and if any small money which you get extra every year is helpful to you , in that case you can go for dividend option.

Conclusion : Different options in mutual funds are for different types of investors, before investing just see what do you want from your investments and take appropriate option.

Returns in long term from Dividend and Growth :

Below is an example which shows the returns from similar funds with growth and dividend options and there performance over 3 years.

I would be happy to read your comments or disagreement on any topic. Please leave a comment.

April 25, 2008

April 25, 2008

Rs 1000 are debited from my account every month since last three, four years. In pass mentioning P16243580118. 419619403Tr forDDR Transfer to cash management produc

For what purpose are these debited ?

Hi, I have invested my savings in ELSS growth option with a lockin of 3 years.

Also, as per the above explanation, In growth option the dividend is reinvested in the fund.

My question is since the dividend is reinvested once every year, Does the reinvested amount also have a lockin? Or can i redeem all the amount from the fund and close it?

this would really be helpful for me in deciding whether to go for Growth or Dividend option.

Its again locked in for 3 yrs

Dear Manish, I am first to mf.. I want to invest lumpsum rs.1 lac in mf… Which fund,what type of fund.. I want to keep it for 3-5 yrs..

Your guide Pls..

Hi Muniyasamy

We think our pro membership will help you as it fits in your requirement. We have various benefits under it like life insurance, health insurance, mutual funds and your financial analysis too..

Just check out our Pro membership once and schedule a FREE call with us to know more – http://jagoinvestor.dev.diginnovators.site/pro

I read a comment by some reader in the above trail that the Last SIP amount in AXIS Long Terms Equity will get locked for 3 years, and the total lock in is for 6 years not 3 years?? Whats this, please explain.

Yes, because each SIP is locked for 3 yrs respectively. But other units will get free after 3 yrs of its date !

Hi Manish,

I want to start monthly SIP of Rs. 10,000 in Axis Long Term Equity Fund for long term investment (5 to 10 years).

Shall I keep the frequency of SIP weekly (Rs. 2,500 every week) or monthly (Rs. 10,000 every month).

Please advise.

You can keep it monthly!

Never invest in a elss fund in sip format…your last sip will be locked for three years!! If there are open ended fund giving similar returns or better returns with lesser standard deviation and lower beta why choose a elss fund??

Hi,

I am interested to invest in Mutual Funds for monetary gain purpose. this is my first time.

I can invest 2000 monthly for 3 years. please suggest, as to what options are best for this type of investment. And, also if you provide assistance as in step by step how to enroll in fund company and make the payment. moreover, what options i need to look for while tracking the investment. my favourite as per your article is ELSS – Axis Long Term Equity Fund

please suggest.

Its a good fund … Incase you want to invest my team can help you on that

Just fill up this – http://www.jagoinvestor.com/solutions/invest-in-mutual-funds

Manish

Manish has not mentioned that your money is going to get locked for a total of six years and not three years!!

Hi ,

Interested to know what would happen in following scenarios – plz consider lockin of 3 years is completed on the below :

1- switch from existing regular to direct plan in same mutual fund (ELSS) – any charges ? Any fresh lock in period ?

2- switch Fromm dividend to growth option – any charges , any fresh lock in period or I am free to withdraw whenever I like after the switch ?

Fund – icici long term quity fund – tax saver ELSS

No charges and no additional lockin !

Thanks manish

hi manish

i want to ask one thing more that we should invest online/ through agents.

That depends on you . If you can take care of your mutual funds decisions, then you can buy online, else you can go with agents.

We also do help in mutual funds incase you want us to be your agents – http://jagoinvestor.dev.diginnovators.site/start-sip

hello manish,

i am new in mutual fund.

i want to ask one thing-

is our money is safe in any scheme.

i mean to say like in case of company failure/fraud by fund manager/fraud by company/default etc.

No Mukesh

Mutual funds structure is very safe. Read more on this topic at http://jagoinvestor.dev.diginnovators.site/2016/02/mutual-fund-structure-in-india.html

Note that we also help our readers in starting mutual funds – http://jagoinvestor.dev.diginnovators.site/start-sip

No scheme can guarantee such events…satyam was a part of the entire bunch of equity funds and more recently even within a debt fund category there was default by a corporate bond… investments are open to market risks please read the offer document before investing….you work hard to save money ..please don’t rush into any decisions while investing and spend some time reading and researching!!!

Dividend reinvestment is much better. Take a simple excel sheet and do it for 20yr horizon for 100 rupees. Assuming 10% return and 10% dividend. Growth gives u 290 n dividend reinvestment gives u 308.

Great to know that, will try it out !

Manish, effectively dividend reinvestment and growth options give identical returns in current taxation where there is no long term capital gains as well as no tax on dividend for equity mutual funds.

Dividend reinvestment is helpful only if there is long term capital gains but dividends are tax fre, else it is same capital at work in both the cases. Reinvestment option will have more units with less NAV, though effective Wealth will be essentially the same.

Thanks for sharing that Avinash

Hii Manish I want to Invest 1lakh in Axis Long term Equtiy fund to get get Tax benfit through 80CC..

Plz suggest

Yea its a good fund. You can go ahead and do this ..

Manish, Can you please provide some illustrative calculations for any 20 year old fund by comparing dividend and growth option? My query with regards to long term if we reinvest dividend amount to buy new units. Because I feel it is very much required to understand the clear winner of the two because after all money matters. Can you please suggest options of best performing mutual funds (with minimum expenditures like entry load DDT) with dividend option with reinvestment if dividend option comes out as winner ?

I am yet not clear what conclusion you need in this? Growth option will always give the higher corpus because the money keeps accumulating. and dividend option will not have that much because it will keep paying the dividends in between.

Sir,

Can u explain me your last calculation in 3rd year in dividend plan. I think that the net worth should be 344000 (254*1000+30000+40000+20000). Its looking that sir you also consider last year Rs. 30 dividend in NAV (254+30).

Please help me am I right or wrong

Its written that its the NAV before dividend and its 254 after ..

right

Please Work out example to compare growth and dividend reinvestment plans,considering the dividend distribution tax the MF has to pay from the investors kitty.Let us compare both as both plans have no intermittent pay outs.

Further if investor opts for SYstematic Investments say every month, then dividend reinvestment option appears more profitable considering the fact that new investments are made at a lower NAV

We will add that soon in that article.

Really nice answer

Hello Manish,

Nice article. Could you give a calculation example between growth and dividend re investment option.

I am looking to invest in Tata Ethical mutual fund @ 10k pm for next 5 years. What your take on it. Being Muslim I can only invest in Shariah compliant MF.

Go for growth option ..

Hello Sir,

I am new to the mutual funds and i want start monthly SIP in 2 to 3 different AMC’s MFs as per my requirement below:

1. Tax saving

2. Low to moderate risk with good returns

3. Ability to withdraw some part of money if required during crucial time.

I have been searching and looking for options of mutual fund on internet from last few days and have come across a few mutual funds listed below:

ELSS FUND

1 Axis Long Term Equity Fund(G)

BALANCED FUND

1. SBI Magnum Balanced Fund (D)

2. Tata Balanced Fund – Regular Plan (MD)

DEBT FUND-LONG TERM

1. Tata Dynamic Bond Fund – Regular Plan (D)

2. HDFC High Interest Fund – Dynamic Plan (QD)

EQUITY- LARGE & MID CAP

1 Birla Sun Life Top 100 Fund (G)

2 SBI Blue Chip Fund (G)

3 SBI Magnum Midcap Fund (D)

DIVERSIFIED FUND

1. UTI MNC Fund

Please help me to choose best option out of these.

I suggest just doing two SIP in any two funds chosen by you like

1 Axis Long Term Equity Fund(G)

1. SBI Magnum Balanced Fund (D)

Hi Manish,

I would like to invest in the below mutual Funds in SIP Mode. I have identified the below MF’s.

ELSS – Axis Long Term Equity Fund – 3k

Large Cap – SBI Bluechip Fund – 3k

Midcap – Can Robeco Emerg-Equities (G) – 3k

Balanced Fund – Tata Balanced Fund – Regular (G) – 3k

I have 2 questions.

a) Is the fund choice correct?

b) Which one is a better option, Dividend Reinvestment or Growth Option in terms of volatility and long term growth. I have a Long Term Time-Frame for these investments (>5 years).

Please advice.

Regards,

Ritesh

Hi Ritesh

The funds you have choosen are good choice. Go with it

Hi Manish,

I am thinking to invest 2500 in SBI Magnum Equity Fund. Is it good scheme for 2 years?

No equity fund is good for 2 yrs. Your amount can double or get cut into HALF . Its risky from that point . Prefer a debt fund to a equtiy fund. You can also look at arbitrage fund !

Hello Manish,

i am new to Mutual fund and I want to invest 1lac in Birla sun life for long term investment 3-5 years which is best option to Good with?

2) I want to ask is mutual fund is better In terms of profit for long term 3-5 year or Birla sun life insurance ?

3) what is profit difference between insurance fund and mutual fund and which is better?

Good day ….

Go for birla mutual fund

Thanks for your reply Manish

But can you tell how much annual return I can expect in Birla mutual fund for 5 year plan?

And which plan to choose in Birla mutual fund for long term investment for good return ?

You can expect anywhere from 10% to 20%