Rs 10,000 Income Tax Exemption on Saving Bank interest – Sec 80TTA

You can now save tax on an additional Rs 10,000 that you earn from savings bank interest. In the financial bill 2012, A new section called 80TTA was added to the Income Tax Act – 1961. This section allows an income tax deduction of up to Rs 10,000 to an individual or a HUF for interest earned on the savings bank account held with a Bank, Post Office or a Society.

Note that it’s not applicable on Fixed Deposits or Recurring Deposits. It’s only applicable to a normal savings bank account. The section is applicable with effect from April 01, 2013 and will apply from AY 2013-14 onwards.

Few Clarifications on 80TTA (Amendments)

- If the interest earned out of saving bank account is more than Rs 10,000 . You will have to pay tax on the remaining amount over and above Rs 10,000

- This tax deduction is over and above Rs 1 lac deduction under Sec 80C.

- Rs 10,000 is the total deduction allowed by combining all the saving bank accounts interest. If you earn Rs 6,000 from each of 3 different accounts (Total Rs 18,000) , you will get deduction of Rs 10,000 and pay tax on remaining Rs 8,000.

- The filing of income tax return would not be mandatory if your Gross Total Income is below the applicable basic exemption limit even though interest on saving accounts exceeds Rs. 10,000/ . (For example , if your saving bank interest is Rs 40,000 , but overall income is still Rs 1,60,000/year, you dont have to file income tax return)

Relief from tracking Small interest amount

The best thing I love about this tax deduction is that for tax purposes, investors will no longer have to worry about considering small amounts of interest that they earned on their savings bank account. It was a common occurrence to get a few hundred rupees as interest multiple times a year and it was a real pain to include them while computing taxable income. Almost all investors avoided including them, and thus were officially coming under the scanner as tax avoiders. With this tax deduction, they can now breathe a big sigh of relief.

Will fixed deposits give better returns ?

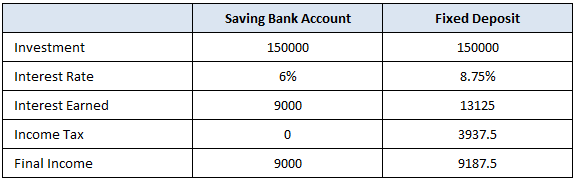

The answer is YES, in almost all cases, Fixed Deposits (despite being taxable) will give better returns than a normal savings bank account. However, there is a special case where Fixed Deposits are going to only marginally beat a normal savings bank account. It’s for those who come under the 30% tax slab and those whose saving bank interest rate is close to 6% (like Kotak or YES Bank).

I know this is a small percentage of investors, but if they invest some money in Fixed Deposits, the net returns are going to be very close to those of a normal savings bank account. Assuming they want to invest Rs 1 lakh or 1.5 lakhs for a year, returns on a 1 year Fixed Deposit after tax will be very close to interest earned on a savings bank account, because the latter will not be taxable. The table below explains this in more detail

Huge Balance in Saving bank Account ?

If you are earning 6% from your savings bank account, it takes Rs 1.66 lakhs to get Rs 10,000 interest in a year and if you are earning 4% interest, it will take 2.5 lakhs balance through the year to get the full exemption. However in our experience, we have seen a lot of our clients, as well as other investors, who keep a huge savings bank account balance – as high as 20-30 lakhs in some cases. In that case you will be earning a huge amount of interest on your savings bank account and it will all be taxable. So it is always a good practice to create a Fixed Deposit for the excess amount and only keep about 1-2 lakhs in your savings bank account.

Is your saving bank account interest more than Rs 10,000 in a year ?

September 12, 2013

September 12, 2013

Dear Manish,

I earned interest on bank FDs for during the year 15-16 Rs.1,20,000/- for which I have submitted FORM 15G – so no TDS was deducted by bank.

No other income. Do I have to file return for the assesement year 16-17 ? Please clarify.. Thanks.

If this was your total income for the year, then no , you dont have to file returns. !

Good afternoon sir,

I am VRS RETIREE from Andhra bank. Have I go to show the details of gratuity, commutation of pension in the return and again deduct or is it not necessary to mention because these amounts are not taxable I suppose- if I have to show n deduct where I have to mention in the online form. Please guide

Thanks n regards,

Yes you can choose to not mention it !

hii,

I am a taxpayer with income from salary amounting Rs. 550000/- I have also earned Rs. 35000/- as interest on saving bank account (Other than salary), but tax on this amount has not been deducted by the bank yet. kindly clarify whether Tax on this amount (Rs. 25000/- i.e. 35000-10000) will be deducted by bank itself or I have to submit the tax via another channel.

kindly also tell me that channel and the date by which I have tosubmit the Tax, in case the latter one is applicable.

It has to be paid by yourself !

Hi..I wanted clarity on whether gross savings interest amount is to be shown or net interest amount needs to be shown under income for other sources while filing IT return?

Eg. If gross interest earned is Rs.20,000 but bank deducted TDS @ 10% and gave me Rs.18,000. So what amount needs to be shown under income from other sources…Rs.20,000 OR Rs.,18,000/-??

Thanks in advance!

It has to be 20k .

Hi

While filing the returns , I missed the income on savings bank account interest which is greater than 10000 for the FY12-13 and FY13-14.What should i do now for those years ?

This year FY14-15 i am including the Savings interest component in my returns,Will there be any issue as i have not included the interest income for previous two years

Please mention in which schedule in ITR returns these exempted incomes are to be shown.

Hi TVRAAO

A CA is more qualified to answer you query, hence I suggest better get in touch one.

We are not right people to talk on this

Manish

Schedule EI

in saving account interest on mod will be assumed under saving interest(80TTA) for FD interest?

What do you mean by MOD? If you are referring to Multi option deposit as in sbi. Then the answer is, it is a fixed deposit and 80tta won’t apply.

Hi Friends, My Interest for this financial year is 18,000/-, My Capital deposits happened in the previous Financial year which was above 20 L. Should I file the ITR for the 18,000/- interest gained in the account. Should I also show the source for the capital.

It does not depend on interest, but your overall income. If your overall income is below the taxable limit, you dont need to file returns and pay the tax, Else you do

Dear Manish,

Please clarify me that if my saving account’s interest is Rs. 750 for full year, so is it compulsory to add it in other income column in itr1, then add it in 80tta or i can skip to mention this small interest received amount.

Thanks ..

Mention it atleast !

Thanks Sir.

Dear manish,

My interest income from savings account is around Rs. 10850 this year (2014-15),

In ITR 1 form, i included this amount in B3. income from other source and also entered ammount 10000 in C17. 80TTA.

is there any more information declaration required for 80TTA ?

what information should enter in Tax details tab << sch TDS2 details of tax deducted at source of other income salary grid ?

please suggest on this.

thanks

Hi sachin

I am not aware of that form.

Hi Sachin,

First you have to Pay the over n above tax on rs.10000 i.e. on rs. 850 as per your slab rate then you have to mention BSR Code, Date of Deposit , Challan no. and Tax paid amount i the tds2 details.

Thanks..

You are correct.

There is nothing else you need to do.

My interest income from savings account is around Rs. 15,000 this year (2014-15). How will I calculate and pay the tax on Rs. 5000? Is it possible to deposit the tax amount (saving bank interest) online? If yes, how? If I have to submit tax offline, please also suggest the procedure.

You need to see your total income and see which tax bracket are you into , if its 20% , then your tax will be 1,000 . You can pay it online using challan 280 http://jagoinvestor.dev.diginnovators.site/2015/03/pay-income-tax-online-challan-280.html

Dear Manish, Thanks a lot for clarification and link. I must appreciate your help.

Dear Manish,

Please clarify the tax implications on joint bank accounts on the interest earned?

Further what if the account is on sweep facility? How will the interest be taxed , considering that the interest on sweep is like small term deposits?

thanks

The interest will be taxable to that holder, on whose money its earning . If husband deposits some amount , he will pay tax, else wife

I am already a salaried person and submitted the tax as per my income. I have a savings account which was not used frequently. My dad works in a separate location & he had to transfer monthly amount to my mom. Now he transferred the same in my account in the begging of the month. Further I transfer it to my mom by cash or some times in her account as per her requirement. My dad also pay tax separately for his income.

I want to know whether this will be treated as a separate income. Also how to avoid this situation ?

No this will not be treated as income. Dont worry ,you are ok !

Bank paid an amount of Rs 322 to me as interest for that amount Rs 32 @ 10% was deducted as tax but I am in the slab of 30%. Can any one advice me how can I pay the remaining amount and which challan form shall I use?

You need to use challan 280 – http://jagoinvestor.dev.diginnovators.site/2015/03/pay-income-tax-online-challan-280.html

Thanks

Dear Sir,

I am regular tax payer since last 10 years . I have income of Rs 39000 as a interest from three saving bank accounts. How much amount has to be included for calculating income tax. Is interest amount of Rs 10000/- from each bank has to be deducted separately and amount of 9000 is included in income. Pl. suggest

No , only total of 10k income from all bank interest will be tax free. Rest 29k is taxable !

Hai

My gross income is 2 lakh 40 thousand rupees per year.

I HAVE 3 SB Accounts (2 sole accounts, 1 either or survivor with mother)

MY MOTHER IS A HOUSEWIFE.

Recently through property sharing my mother received 3 LAKHS CHEQUE.

My mother deposited in HER EITHER OR SURVIVOR ACCOUNT.

WILL I BE TAXABLE???. BECAUSE THE SB ACCOUNT INTEREST ALSO WOULD CROSS 10000 and my GROSS INCOME ALSO WOULD ACROSS 250000 (TAX SLAB)

KINDLY CLARIFY…Expecting a reply at the earliest

Thank You

No you will not be taxed !

Thank You sir

Hai Everyone

I am a housewife (Home Maker).therefore i have no income

Recently my father passed away and i received my share of property (ie) around 5 lakh rupees.

I want to open an SB ACCOUNT and deposit this money there, so that i can give it to my son when he needs some money.

But i am afraid whether i will be posted income tax , since income from SB Interest will cross 10000 rs.

Kindly clarify….whether i would be taxed.

I WANT TO SAFEGUARD THIS MONEY WITHOUT MY HUSBAND’S KNOWLEDGE.

Kindly help.

There wont be any income tax . The interest would be around 40-50k per year and there wont be any income tax if the total income in a year is less than the tax limit of 2.5 lacs. But there would be TDS of 10% which you can claim it back . So either you break this FD of 1 lacs in 5 banks , or just deposit form 15H in bank so that they dont deducted any TDS

Manish

thanks a lot for your information sir

Hai everyone.

My gross income is rs 250000 (2 lakh 50 thousand). i earn rs 17000 as interest from SB accounts from multiple banks.

THIS IS MY TOTAL INCOME FOR AN YEAR.

SHOULD I PAY TAX. Kindly tell….

How can i exempt myself from paying Income tax for the above mentioned income

I dont think you will have to pay, because anyways 10k interest is exempted , and your net income would not cross 2.5 lacs. So no need to pay tax.

Thank you very much sir

Sir, I’m central Govt. employee. I have a saving bank a/c in SBI. This a/c is subscribing govt. salary package A/c. (Above 25000 Rs. it is auto sweep to MOD and giving me 8.25% interest.) My total interest for this accont in a fin-Year is above 25,000. I’m also a Tax payer on my salary. What will be with me? what can I do for better saving? As I’m new one for this type of matter.

Ram Gupta

Its not so easy to just suggest you something on tax saving like this. ONe has to understand your full details and what elements are there in your financial life.