Why Investors are from Mars and Financial Advisors are from Venus

This article is a must read for every investor and financial advisor. The best part of this article is that it is about YOU (the investor) and it is about them (financial advisors). I and Nandish always discuss how financial advisors cant live without investors and vice-versa, but still their world are very different from each other. Both Investors and Advisors think very differently. It is extremely important for both to understand each other’s world and that is what today’s article is all about.

Right now I think advisors and investors both share love and hate relationship and the world of investment is structured in such a way, that they are inseparable. Even if they want, they can’t avoid having interaction or association with each other. Their thought process are at times very different, they view the game of investment from completely different place. Just imagine How magical the world can become if these two entities engage powerfully?. What can happen if they come on the same page and start to respect each other’s world. Such oneness can spread prosperity all over.

Before I write further, I want to make one thing clear that the world right now is full of good and bad financial advisors and investors both.

Step into Each Other World

Unless both Investor and Advisor step into each other world, its really not possible for help and co-exist with each other in a happy way from long term basis. This article is like ticket for both advisor’s and investors to step into each other’s world, it is an opportunity to embrace each other’s world and to accept their mistakes or the damage that they have done to each other’s world.

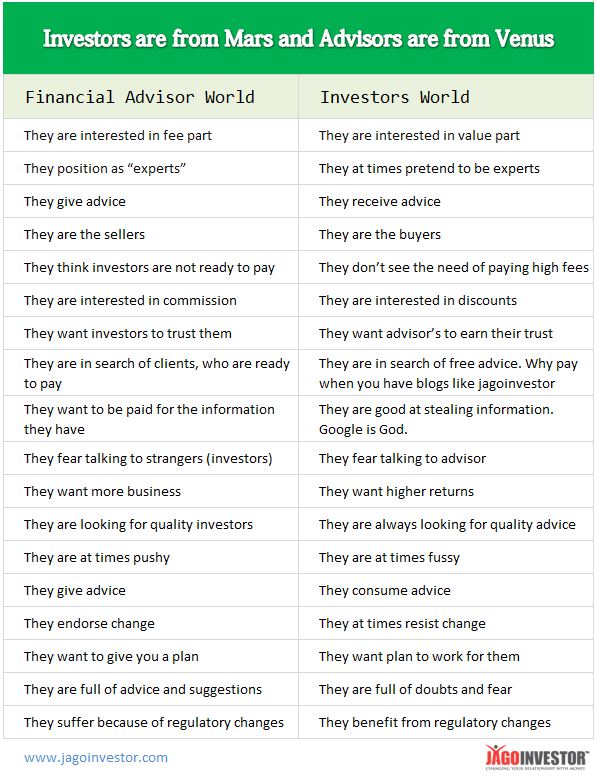

From last few months, We have closely observing and interacting with both advisor’s and investors community and have come-up with some differentiation. Some of the observations, you might agree and some of you might not. No need to react to them, but just see if you agree to them or not.

The intention of this article is to help you get in touch with each other’s world. Let us know what you think about this ?

July 25, 2013

July 25, 2013

Yes, you are right. Currently I am leaving in Dubai

Siyad

In that case we are not sure about it 🙂 .

But Zurich Futura is international, its claim rate is 98%. I just want to know about the concept. Futura gives insurance & critical illness coverage for both husband and wife up to the age of 95 years. There are around 20 illness covered in the program. Do we have anything similar to one in India?

I dont think there is any bundled product like this in India. you have pure term plan seperate than critical plan. I would say better search for it on net and you will find some reviews !

I am new to this site, but very infromative it look like. I am just thinking of going for a critical illnes coverage policy plan. Zurich Futura is in my mind. Can you throw some light on this policy?

I dont think is from India ?

Hi Manish,

I am a regular reader of your blog and hired a CFP based on the advise in your blog 2 years back (Unfortunately it was not apparent that such services were available on Jagoinvestor – not posted on the front page besides the blogs). He took asked for legitimate annual amount and we had 3 hours discussion instead of agreed one hour. After the agreement, he asked me so much information that i started to get fed up. But two years down the line when i tell my frens that I hv few properties + planning in place ——— for the education and marriage of my child + for my another house + for my entrepreneure venture + for my retirement + adeqaute insurance for my self, my parents and properties + annual vacation + annual gift for family + extra to give to my friends and family when needed in emergency. It raises shock – HOW IS THIS POSSIBLE? Before the financial planner I used to invest without purpose and took non fitting insurance policies – which rendered me moneyless at the most important times. It was one of the articles on Jagoinvestor which led me hiring a CFP. It took two years for tuning our strategy and we still fine tune it from time to time. A good Advisor will lend a patient ear to the customer’s demand and a good customer will be the judge of the pros and cons of the investment and will take a call to invest as per the advise. If you wont trust your doctor, you wont heal, no matter how expensive and best suited the medicines be. I believe that an initial amount be legitimate and an increment should be performance based.

It was great to hear that experience and what happened with you Mayank 🙂 . You seem to have a good advisor, stick with him 🙂 . If possible, may be you can share his name ?

Hi Mayan, Is it ok with you to share the name and contacts of CFP. i can share my email id or mobile no based on ur inputs.

Hi Manish. What is your opinion of this mutual fund?

Birla Sun Life MNC Fund (G)

category: small and mid cap

Thanks a lot. Really appreciate all your opinions and suggestions.

Seems like its a good one in that category !

Thank you so much Manish. I thought you would go a bit more into small cap and mid cap funds and give out suggestions or elaborate opinions 🙂

Do you have any stake in mid cap or small cap funds?

Now a days this(mars and venus) can be said of many dependent divergent entities. First example that comes to my mind is schools and parents. The expectations are different and each perceive reality in their own way. Each of the set of concerns is somewhat reasonable.

Now the way out? I personally feel, that one has to understand dynamics of the interaction. More importantly one has to understand the surroundings in which a pair(investors/advisors, schools mgmt/parents) operates, to enable them to take a reasonable decision for themselves.

Incidentally the number of these pairs are increasing and less aware persons see this as overwhelming/system trying to con individuals.

Empowering oneself with knowledge is the only way out.

Thanks for sharing your views on this topic Srinivas

This happens in most of the fields. Both parties tries to get max out of the given deal but they all need to know that they are / will continue to co-exist.

In this world of uncertainty no one shd expect and think that all advice and plans will be full proof and perfect. My observations and suggestions are:

1.Investment per se means some amount of risk and that’s the part the investor need to very categorically needs to advise the advisors before hand.

2.The selection of advisor shd also be done carefully. Only hi fi technical presentations/ jargons ; only the past records and armed with only the bookish knowledge is not enough.

The person shd have sufficient exposure, shd hv been on the other side of the table, shd be able to understand the basic human psychology and above all wd have been witness to life situations.

3.you are playing with your hard earned money, what is wrong in paying the fee to get unbiased advice.

There is nothing wrong in anything . The article just presents some points .

Mainsh, The image above is not visible…can you change with a better one….

Not visible ? You cant see it ?

Actually, the daily newsletter has link of mobile view. This is why the comparison table is not visible

Ohh ok .. mobile version might not have it

“Investors are from Mars and Financial Advisors are from Venus”. Both are on the earth and will remain so. Finacial advisors are expected to be smart enough to foresee the inflation, GDP, interest rate, stock market movement… RBI’s policy.. global liquidity and what not. Despite his best efforts he can not be 7/10 correct.

Investor wants only the best. All risks are advisors’ and all returns are their. Investor wants proof of performance before investing which they are never going to get in this uncertain world. I think over a period of time both advisor and investor will learn to adjust their expectation. The only truth is nobody is perfect and both wants to be perfect in demanding and expecting.

Thanks for sharing your views Pankaj