How Ready Reckoner rates by Govt affect real estate Prices ?

A lot of investors wonder how the real estate prices go up and down (do they?) over years. A very big role in the movement of real estate prices is played by something called “ready reckoner rates” . Ready reckoner rates for each area in the city are defined by the state govt. Let us understand this thing in detail.

what is ready reckoner rates

Ready Reckoner rates are the prices of land, residential properties, and commercial properties for any given area defined and published by govt each year. It’s revised from time to time whenever govt feels that there is a need for prices revision. Stamp duty and registration costs that are paid by a real estate buyer cant be below this ready reckoner price or the actual price of the property.

For example – Let’s say that ready reckoner rates for some location is set at Rs 4,000 per sq ft (as per state govt) and the cost of the property as per that comes at Rs 40 lacs. Now imagine that the builder is quoting the cost of the property to you at Rs 50 lacs. Now the stamp duty will be paid on Rs 50 lacs only because its higher than Rs 40 lacs. However – suppose you decide to pay Rs 20 lacs in black and only Rs 30 lacs in white money, still, your registration & stamp duty will be paid on Rs 40 lacs costs because that’s the minimum pricing set by govt itself.

Ready Reckoner rates are linked to Built-up Area

Note that the ready reckoner rates are linked to the Built-up area of the property, not carpet area or super built-up area. So if ready reckoner rate is Rs 4,000 sq/ft and builder tells you that he will also sell the property to you at Rs 4,000 sq/ft, don’t get fooled!, because builder tells you the pricing linked with super built up area and not built up area, which in most of the cases is higher, so eventually the rate charged by builder is always higher, if you convert it for the built-up area. Just for example if super built up area is 1,000 sq/ft and built up area is 800 sq/ft, then Rs 4,000 per sq/ft area quoted for super built-up area (Rs 40 lacs cost), is same as Rs 5,000 sq/ft quoted for built up area (same Rs 40 lacs) .

Just to make sure you understand the terminologies –

- Carpet area – A Net usable area of the property (imagine you put carpet, what all part of flat, it will cover)

- Built-up area – Carpet area + walls and doors area (imagine you remove the thick walls and all doors, then what you will be left with)

- Super built-up area – Built-up area (which you get) + everything from the staircase, garden, gym, swimming pool and everything you use (your proportion)

How ready reckoner rates affect the prices of real estate

Now – It’s very clear, that ready reckoner price is the FAIR PRICE (which is fair value) set by govt itself. Now builders can charge the premium on that fair price depending on market condition, demand, quality and their goodwill and their exploitation power :). So the market price (the actual prices prevailing in the market), will definitely be always higher than ready reckoner prices (benchmark). Now if the benchmark itself is higher at any given point of time and also keeps increasing over years, the market price quoted by builders will also be high.

Example – Just to give you an example, in one of the areas called “Kondhwa” in Pune, the ready reckoner price set by govt is around Rs 3,700 per sq/ft, however, the builders are charging anywhere from Rs 4,500 to 6,500 per sq/ft at the moment. Imagine if this year govt increases it to 4,000, then automatically the rates will go up by that much margin because builders get a good reason to escalate the cost.

One of the largest revenue sources of any state govt is the stamp duty from property registrations and it’s always in state govt interest(from a revenue point of view) to keep the ready reckoner rates higher or increase it if there is any justification for it, live development done, roads constructed, etc…

Where to find the Ready reckoner rates for your area?

Now, you cant control the actual price you have to pay to a builder, but it’s a good idea to check out the ready reckoner rates of the area, where you are thinking of buying the property. Now there are few ways you can find out the ready reckoner rates of your area (or any area). Here are a few of them, some easy and some tough.

1. On the website of “Registration and Stamp Duty Department”

Each state govt has its own department of “Registration and Stamp Duty”. You can reach the website by searching the sentence “Registration and Stamp duty department” and adding state name along with it on google. Like if you want to find out the website for Maharashtra search for “Registration and Stamp Duty Maharashtra” (direct link) and the first link you get it “igrmaharashtra.gov.in/”. On the website, you need to search for a link – which says something like “market rates” or some equivalent in the local language of the state. If you are lucky, you might reach the final page which helps you find out the ready reckoner rates for all the cities in the state. It will help you find the rates as per city, taluka, location or survey number. I tried this trick and was able to find out the websites links for 3 states

- Andhra Pradesh (for Hyderabad) – Direct Link

Note – The rates might be displayed in per sq yard, per sq meter etc, so better change them to per sq feet and also make sure you use IE or Firefox to access the websites because they still don’t know chrome exists!

2. Using RTI application

The second way to find out the rates is to use the RTI application against the same Registration and Stamp Duty department (many times called “revenue department” like in Delhi). All you need to do is file an RTI to the respective officer and to your jurisdiction asking for the rates in a particular city and area. You can take help of this article to understand the format and procedure

3. Office of Sub-registrar

One of the best ways would be to go to the sub-registrar office (where the properties are registered) and find out the rates from there itself. If you do not find the support of the staff there, don’t forget to mention words like RTI, CIC and “One of my friend works in Media” and they should accept doing some work for you.

4. From the newspapers

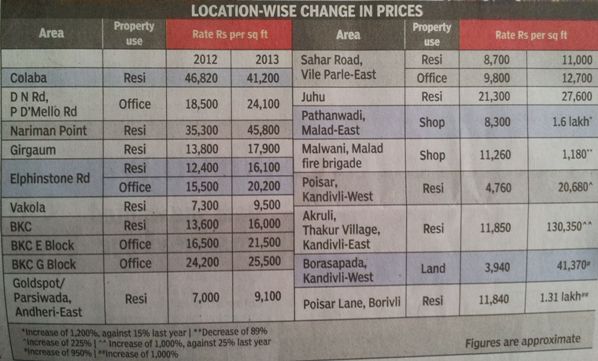

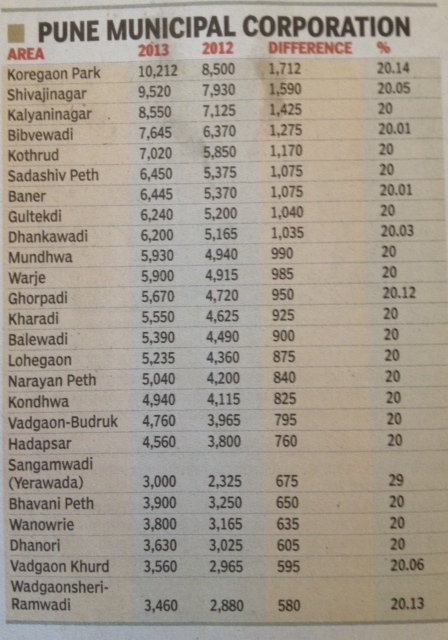

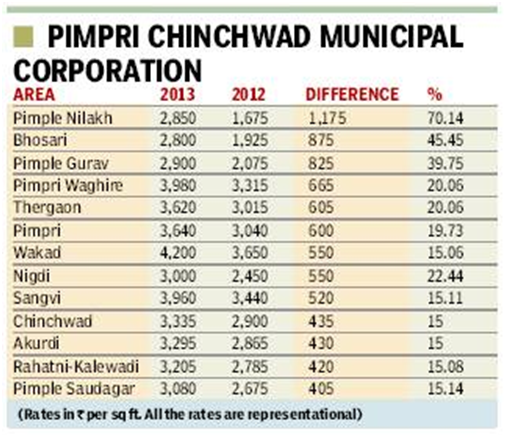

All the newspapers keep on publishing these rates from time to time. Just keep an eye on real estate section from time to time and you should be able to get some info. Below I am attaching some snapshots I got from the Internet for the revised rates in the year 2013 from 2012.

No Ready Reckoner rates for rentals

There are ready reckoner rates for buying the properties, but there are no ready reckoner rates for rentals. It would be amazing if govt comes up with that too, it would then help us to understand which area is doing better then others and how much premium home owners are asking for over govt defined rental rates.

Overall what do you think about ready reckoner rates and does it helps the overall industry or goes against it? Please put your comments!

June 24, 2013

June 24, 2013

Dear Sir,

I would like to inquire that I have a commercial shop at Mazagaon Mumbai which was repaired and renovated by me in 2007 this is a 1961 prior property as given in assessment documents sir the said placed was awarded and new RRR was applied as a wooden stall was made into ladi coba attic place was added as it was assess in the new RRR value since 2006 now some local blackmailers have conplaints in bldg & factory dept regardonregarding the attic floor to be illegal this is 14 ferry below height place with 11 mtrs ground & 13.28 mtrs attic floor as mentioned in assesment dept u/s 162 sub sec 2,special notice sec 167 of MMC. ACT,I would like to ask if the said attic floor is legal as per MMC act.please guide me.Arshad 09892663986

Hi Arshad

The question asked by you is beyond our scope. Its suggested that you hire an expert on the issue and pay them for the advice.

Manish

what the meaning of ready reckoner

IN the context of the article, it means the pre-published rates , or its also called circle rate !

Hi Manish, most useful

Please enlighten re bungalow-plot of 3000 sq ft, with bungalow having built-up area 1000 sq ft, and with RR rate of 5000/- per sq ft

Will stamp duty be on 50,00,000/- or on 1,50,00,000/-

What about IT – what will be considered

Grateful early advise – readers will be enlightened too.

Thanks and regards,

It would be on 15000000

Thanks Manish

Sorry, typed 3000 instead of 5000 sq ft plot area, on which basis , I had arrived at 15000000. I believe this holds.

if not please advise, appreciated……tony

Still it holds true !

Thanks a lot Manish! Very useful article. Many of us dont even know that such government websites exist or even how to access the proper links! Thank you again!

Welcome !

useful article in the field of construction as though I am civil engineer i was not fully aware of this .

I am scared that such type of pricing would made it difficult for living to the masses .

If such thing is happening it will lead to downfall in construction industry as there will be no motivation tu common buyers. There is the urgency to streamline sales process in construction.

Thanx for sharing .

Thanks for sharing your views on this topic Aneesh !

i think this is the site for gujarat.

http://www.revenuedepartment.gujarat.gov.in/stamps/

Hi Jig,

Did you find it informative? I could not find any link to jantri rates or circle rates.

I have done a AGREEMENT TO SELL (flat bought from builder). Is SALE DEED different?. If yes do i need to execute it? Thanx in advance.

now landlords are asking revision in house rents even for 50 years old buildings and from 40 years old tenants, depending on the present ready reckoner i.e. present price of the land(according to govt. announced ready reckoner + present construction cost); that means now there will be lot of litigation between tenants and the landlord for fixation of standard rent freshly. Whether this ready reckoner can revise the rents of old tenants and the old buildings.

Yea .. but if rents are in accordance with market rates, then whats wrong with it ?

[…] very good article from Jagoinvestor. Links and credit:How Ready Reckoner rates by Govt affect real estate Prices ? A lot of investors wonder how the real estate prices go up and down (do they?) over years. A […]

Thanks for an informative article. I want to highlight that even when a seller is ready to accept all the money in white it will be difficult to find a buyer who would be ready to do so, especially when actual rate is more than the circle rate because that would increase the registration cost. Can you may be through another of your articles highlight the benefits for both buyer and seller and suggest a viable alternative for who want to do the things the right way?

Thanks for sharing your view .

good one manish, helped me understand how pricing is done for property

Good to hear that Ram !

It will be great if you could also write on the FSI changes that are taking place these days. this will also help everyone to understand the relation between the FSI and the per square feet rate

Will do a post !

Hi,

Another GEM.. 🙂

I have one query here. Generally builders offers facilities like Gym, club house and garden. Is it fair to get costs of these facilities from Buyers? or Builder can not charge for these facilities. I think ultimately these facilities will be used by Buyers not by builder.

He should not charge for this, but you will pay for it in maintaince each month to society !

Hi,

Can u pls provide such ready-reckoner rates for Thane city areas ?

Also I have heard that, there is a ready-reckoner for houses rent amount, is it true ? Can you give any details on it ?

Thanks & Regards,

You will have to find it yourself 🙂

No links for Gurgaon (HRY) rates as well. Any clues?

No idea here, you need to find it yourself !

Can anybody tell me where to find the rates for chennai? thanks

thank you very much for the post. in Gujarat , it is called jantry rates. you are correct that builder’s rates are higher, but sometime before, i heard from my friend’s (builder ) son, in Vadodara , Gujarat , the Govt. rates are higher than theirs in his area. in such cases, i understand that the builder will prefer all money by cheque, and not cash, i.e. black.i feel, sometimes , govt. is also increasing the rates for increasing the revenues. fair on builder side, now a days they develope lot of infrastructure like swimming pool, gymnasium, community hall, paved road, garden, seatings in the campus of the scheme, and there is some common utility area as common passage on each floor, lift passage, staircase, cop etc. in addition to built up area of the flat. then some are providing extras like ac units, water purifier, hot water line, emergency light points in flat. thus the superbuilt up comes in picture. otherwise who would bear these cost. of course it differs project to project. i think , rather than considering the jantry rates, one should know what land rights he would get as the flat owner , and its (land) market value at present plus the cost of construction of the project at current construction cost for his part, and then arrive the intrinsic value. i think, in most cases, the new flats are overpriced whereas old flats are underpriced for the same area.

Thanks for sharing that .. never knew that there can be areas where its selling before the govt fixed rates !

I know you are from surat . So can you please share how to know the rates for Vesu area specially for commerical building.

would be happy if you can throw your personnel id.

Thanks

@JIG i am from Surat .i think you can have jantry rates of any area in Surat from SMC . i am not sure, but you may try SMC website and if not available , then contact personally. i have no problem for mentioning my id here , but i am afraid that it is against the rules of this blog(i think, you may get from Manish , i have no objection) , and for your kind information, i do not know much about local real estate market and trends, for which you may be interested. thank you.

This is How Govt is increasing the real estate prices. So its clear that its the Politicians and Builders nexus that is SOLE reason to HIKE up prices without any

Road/Infrastructure facilities built by Govt. No wonder why politicians are Shareholders in most of the Construction companies. CAG needs to work on this to expose another SCAM.

We badly need a Real estate regulator. Just like SEBI, IRDC, we need a regulator to control real estate transactions and create proper regulations. How are builders allowed to hold on to closed houses when prices have come down ? Ideally, they should sell at a lower price to cover further losses but this is not happening. Even in recession in 2008, we did not see much reduction in prices in property. They just cheated everyone.

The banks, which harass a common man for a loan due, keeps mum and add the loans to builders as NPAs!!

90% of black money in this country is in real estate. Once it’s strictly controlled, the hyenas will get caught.

Thanks for sharing your views !

Hi Manish

Thanks for good article. my question is can we negotiate on price with the help of ready reckoner prices ?

You can try that 🙂 . Only builder can tell you if he is ready to negotiate !

The website has registered the area/taluk registered but the market value throws up blank, is there anything we can do w.r.t updating the info on the website?

No idea on that !

Builder demand prices for their property by several parameters, brand,location, facility etc. Builder are not depend on ready reckoner value, they quote psf rate based on their system & always builder rate is higher than ready reckoner rate. In fact Govt. follow builder prices to decide what could be the ready reckoner value of particular region. Govt. has no control over pricing method of any builder.

So you as a buyer can’t do anything, you’ll have to pay whatever builder is quoting & yes some bargaining you can do with your builder. So if ready reckoner value of certain region is Rs.4000 psf & builder charge Rs.5000 psf, you will have to pay Rs.5000/-psf only, can’t argue with builder why are you charging higher than ready reckoner.

This is mainly applicable when you selling a property, you can’t quote psf below ready reckoner rate.

Thansk for sharing that !