Just Keep Buying

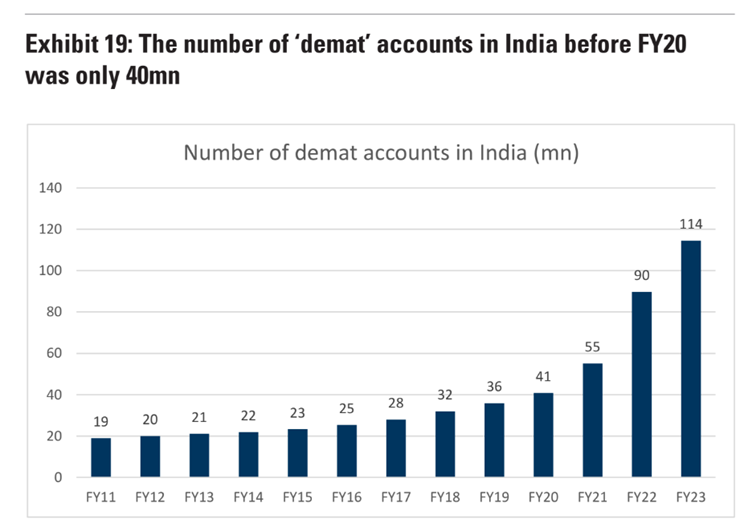

Post Covid-19 hit lockdowns, India has seen a surge in demat accounts being opened.

Around 114 million demat accounts were opened in 2023 alone which is around 2.8 times of 2020 number. Such has been the craze of the bull market we are witnessing.

As a result, there has been an unprecedented increase in the number of traders offering tips for undisclosed fees. Add to that, there are so many YouTube videos where people knowing very little about finance and how stock markets operate have now become overnight financial influencers. Too much irrelevant information is now floating around for no reason at all.

In short, the drama around stock markets is increasing.

Think about it.

Stock prices of several railways and infrastructure companies have multiplied in the last couple of years with absolutely no change in their earnings or their fundamentals. Whereas a high quality bank like HDFC Bank which has been holding the ship steady has lost around 18% in January 2024 alone.

So now you get people on YouTube and television trying to justify everything.

- If the market goes up, there’s enough justification.

- If the market crashes, there’s enough justification.

So what should an investor do in such a scenario?

It’s simple, just keep buying!

In the long run, stock markets are a net positive indicator for wealth creation. They cannot become zero. It’s not in their nature.

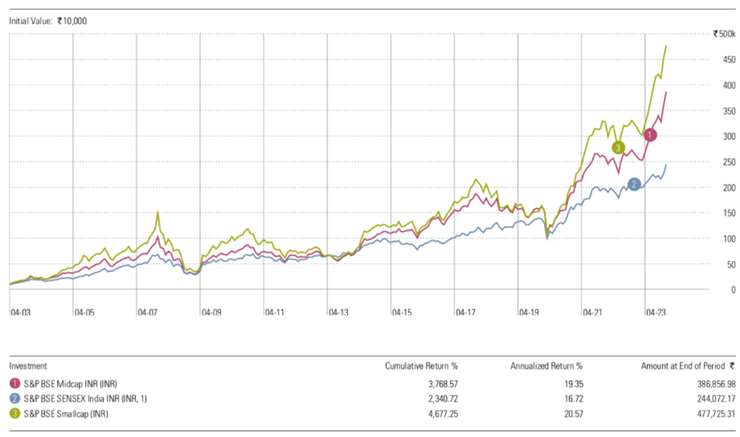

Check this chart out

It’s a simple chart of Sensex, Mid cap and Small cap index performance over the last 20 years.

You don’t need to go into tremendous details to understand that in the long term, markets keep going up. We have seen the fall out of the 2008-09 debacle, the 2013 crisis of India being a Fragile 5 nation and the Covid-19 meltdown.

Yet, the prices keep going upwards.

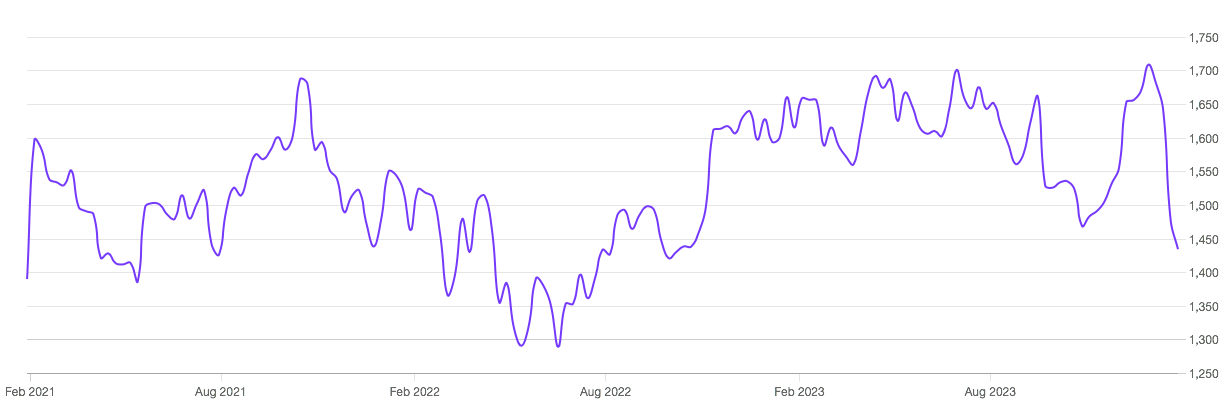

Take HDFC Bank for example.

Over the last couple of weeks, there has been a considerable amount of discussion around this stock. A lot of the youngsters who were born alongside the Bank’s launch date are declaring that this Bank’s future is over.

I believe some of these youngsters mindlessly comment via Telegram and YouTube, their careers are in grave danger.

Because if you take a 3 year horizon, then HDFC Bank’s stock has not gone anywhere.

But if you look at the last 2 decades, then the story is completely different.

It’s been a massive wealth-compounding machine for investors. I’ve written my own story of owning the stock which is up 30x now. (read here)

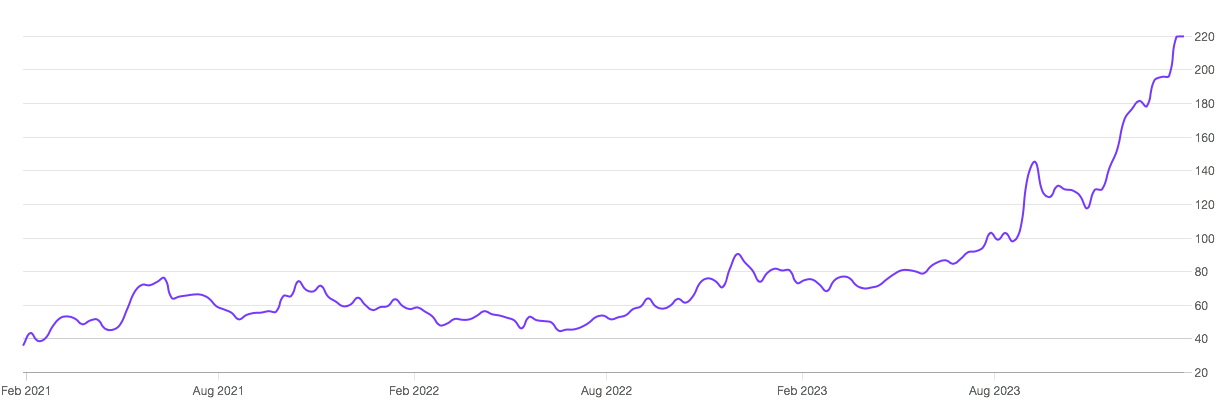

Now let’s take another example: Bharat Heavy Electricals Ltd. (BHEL)

In the last 3 years, it has become a darling of the stock market. Some people want to own it and some people are wondering what stopped them from owning the stock.

Let’s see the charts.

This chart makes your heart melt by missing out on the stock.

Just look at the chart, if you had owned it for the same period as you would have owned HDFC Bank.

It would have been your worst nightmare of a stock in the portfolio.

Agree to disagree?

So as an investor, you would have made money if you had simply invested with your mutual fund or a portfolio manager whose one of the top holdings has been HDFC Bank and not BHEL.

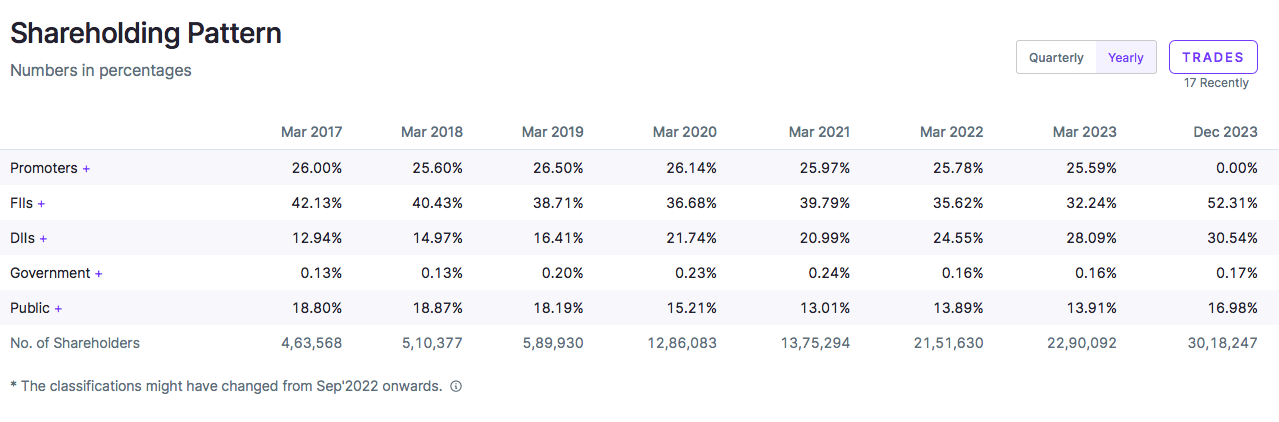

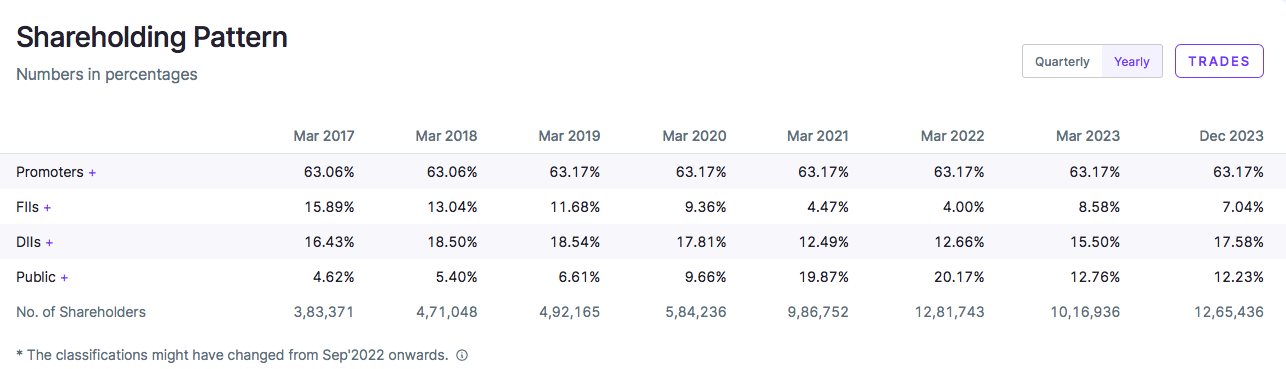

The shareholding pattern of both companies give a clear insight.

HDFC Bank

BHEL

BHEL has had a very low ownership from institutional investors (FII +DII) with 25% at best vs HDFC Bank with an ownership of 82% as of Dec 2023.

Yet, we often get swayed by making a quick buck. So we tend to make a mistake of timing the market. This never works. As a result, in 2024 itself we are going to see too many people closing their social media shops or being financial influencers.

One fine day they would vanish into thin air leaving your trading capital in the red zone.

So what should you do if you don’t wish to be in red?

So all you need to do is switch off from the markets and keep investing all the way through. If you don’t need your money for the next 15-20 years, then why bother about what’s happening today.

Just leave it to the experts.

Conclusion

With the information flow increasing with each day, it’s hard to understand what is signal and what is noise. It’s even harder when you have a full-time job or a business to run. Such stress tends to take a toll on our family lives too.

Some of us might even be thinking of making a quick buck in this bull run so that we can retire early. That can be a big pitfall too. Because you are trying to make immediate money without understanding the very nature of the beast.

So it’s best to leave it to the experts to navigate the bulls and the bears, while you take a good vacation on the beaches of the Bahamas. At the end of the day, what’s the use of money if we cannot spend it.

This article is written by Jinay Savla, Jagoinvestor

January 29, 2024

January 29, 2024

Interesting read. These financial influencers on social media simply replicate Western content for views without exploring reality. However, they are the ones driving the trend of opening new trading accounts among the youth, leading to significant growth for platforms like CSDL, 5 Paisa, and where actual traders made money 🙂

Thank you.

Financial influencers and new traders go hand in hand. It’s demand meeting supply. One cannot exist with out the other.

But soon as market turns, these influencers will face trouble too. In a nutshell, market will adjust itself. Happens all the time.

Sir can you guide me? I have also done research in the stock market on my own. I am a freelancer. But now I have to do proper work. Can you tell me how I should find a financer for myself with whom I can work with my strategy with proper method. Have you been able to guide me regarding this?

Sure. Connect with me on jinay@jagoinvestor.com

Let’s arrange a call and understand your current progress.

Your apricate your good knowledge of market.

Thank you

One of the things that i always struggle and dont agree with is the time led ownership of a stock – Long/ medium/ short term.

In my mind the correct way to look at this piece is to say that we’ve identified both HDFC Bank and BHEL as great quality stocks, well representing the India growth story, so we will invest in both. As and when they give us lets say 30% annualised return (3x of an SBI 1 year FD), we will book profits and then wait to get back in again at a reasonable price and correct opporutnity becasue selling these companies does not mean we stop liking them, it only means that intead of getting married to a share, we realise the profits, when they happen rather than just leaving them as notionl profits on paper. And why only these 2 companies? The same logic can be applied to all good companies e.g. all the 30 sensex stocks.

That that think is sensible investing and much more relevant that time bound investing…

One thing that gets missed while communicating the long term nature of stocks is constant ‘evaluation’.

This requires a separate post which I will write next week. But here’s a little gist.

Suppose you make 30% gains in the stock, how will you evaluate the stock?

You will book profits and the stock continues to go up. So you are now looking for something else. It’s a gross waste of time because you again start to wonder whether that ‘Sell’ decision was correct or not.

But you can always check the fundamental thesis behind why did you buy that stock in the first place.

Holding the stock means constant evaluation. Not buying and sleeping it out. Unfortunately, it’s not like that. It’s just glorified wrongly.

Here you are constantly evaluating your stock thesis. If HDFC Bank was good at 100. It should be good at 130, then it should be good at 180 and so on.

With this process, you can hold the stock for the long term. You have to do all the work all the time. That’s why compounding for decades is hard and very few do it.

It’s a lot of work. You have to evaluate the company based on financials, corporate governance, valuation and its competitive advantage.

Think about it – HDFC Bank has made money because it has remained relevant and competitive for the last 2 decades. While many small banks came and went, only a few survived.

It’s not simply buy and hold. While holding you are doing tremendous amount of work.

My thumb rule is Hold decision is much more difficult than Buy or Sell. Because you have to learn to accept the profits or losses on the basis of valuation of the company and not on the basis of our portfolio position.

But I can definitely tell you that, if you take care of the first which is the stock valuation, your portfolio performance takes care of itself. It takes time, but it definitely does.

Well well. Remaining invested and SIPs are great, but the examples given in this article is weak and lacks substance. Instead of HDFC you should talk about index funds as they will eventually go up over a longer period of time. Why and how did you pick HDFC only and you are comparing it with what is the theme of the market for about 3 years now. The whole story around long term is good, however you need to compound and multiply at a good pace and that is where themes come into play. With Indian Economy on the right track,, digital literacy improving, orthodox comparison to Fixed Deposit fading and regulatory controls coming into real estate, the old fashioned way of buy and hold is going to lose lusture. You need to come to terms with the fact there are multiple ways to skin the cat and efficient ways are taking shape as compared to the old fasnioned ones. Days of buy and hold are gone. Of course, eventually HDFC will turn back and resume its upward journey. Thats when you switch from the current BHELs and HUCOs to HDFC and others !

Well, when you spend a lot of time in the stock market. You realise it’s cyclical nature. It’s perfectly normal to right now think that Buy and Hold is gone. There have been several instances in the past that justify it.

But if you spend enough time and realise that stock market is not voting machine. It’s an option for long term wealth creation, your thoughts will change.

And it’s easy when your capital is small to rotate the capital from one stock to another stock. But when your capital increases, you don’t want to play the voting game anymore. That’s my thought.

So yeah, accept or reject any thesis – it’s based on you. And why do I take a certain stock or not, it’s meant for a wider audience and not for few. So examples need to be created in a certain way.

Lastly, all this HUDCO and all, their success is realised in the hindsight. It’s 20/20. Hence, the best way to go about it is to stay away from the voting game and have the guts to play the long game.

Good read , thx for this sharp, precise and insightful article. Hope to read such nuggets often.

Thank you. Surely.

Surely. Thank you.

You explained for long stock keeping ok but what about intraday and 5 day trading? Please suggest tq

Intraday and swing trades require a detailed way of understanding. I will surely write on it soon.

Thank you.

While the concluding statement that stock markets will make money in the ling run is true, the illustrations are faulty – the article gives 2 examples of HDFC creating massive wealth and BHEL a miserable loser – which clearly indicates that just remaining invested for 2 decades is not going to help unless you pick the right stock. Moreover, the reference to MF is even more scary indicating that if the Fund had invested in BHEL, the investor would have lost – so picking the right Fund is also important. On the whole not a well researched article!!

That’s why MF always had HDFC Bank as their top holdings. Because picking the right stock is important.

Yet, when the prices don’t run for 3-5 years, investors tend to write them off and go for momentum stocks that don’t have a good fundamental strength.

Stock picking is important but investors tend to be swayed by market darlings. Thats the whole point.

Buying momentum stocks would have made you money in last 2 years, but would you have put 10% of your wealth in such stocks?

Don’t worry about picking the right fund. You can see the institutional ownership of BHEL – it’s less than 25% which means MFs stay away from these stocks.

Excellent Article and good analysis and comparison between 2 stocks

Thanks Sandy