10 major changes for salaried person in Budget 2023

Today we will be highlighting the important points from the budget 2023 that would be most relevant for the salaried people.

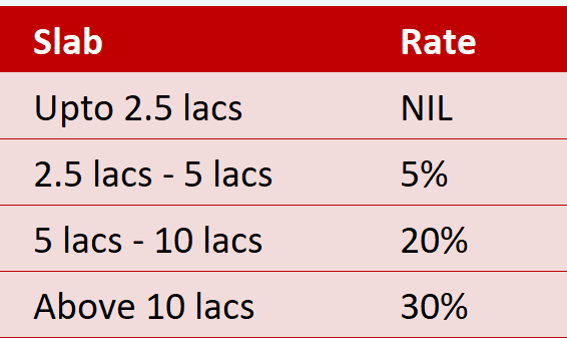

1. There is no change in the old tax regime.

So first thing to know is that the old tax slabs remain unchanged. The slabs are same like last year which are as follows

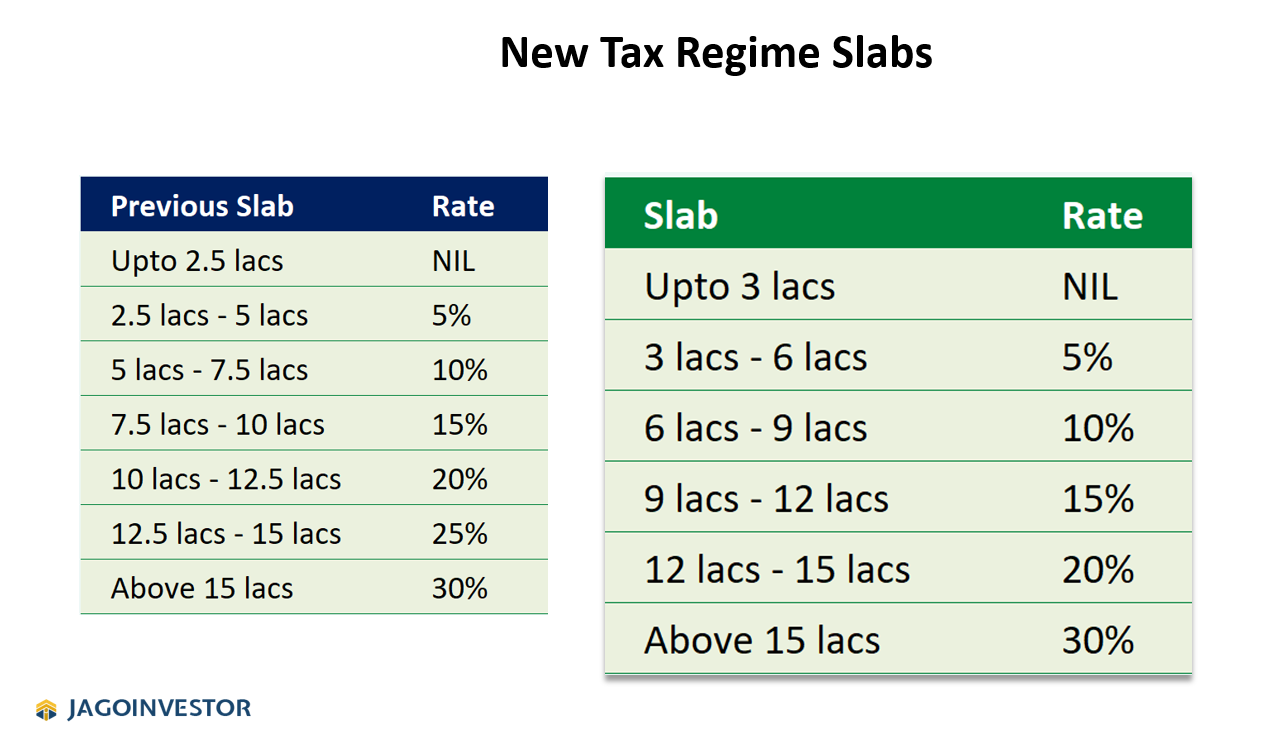

2. New tax regime tax slabs made more attractive

The taxation slabs got better in the new tax regime, which are as follows. The taxation got better for middle class and all the people who will choose new tax slabs will pay lower tax. Here are the new and previous slabs

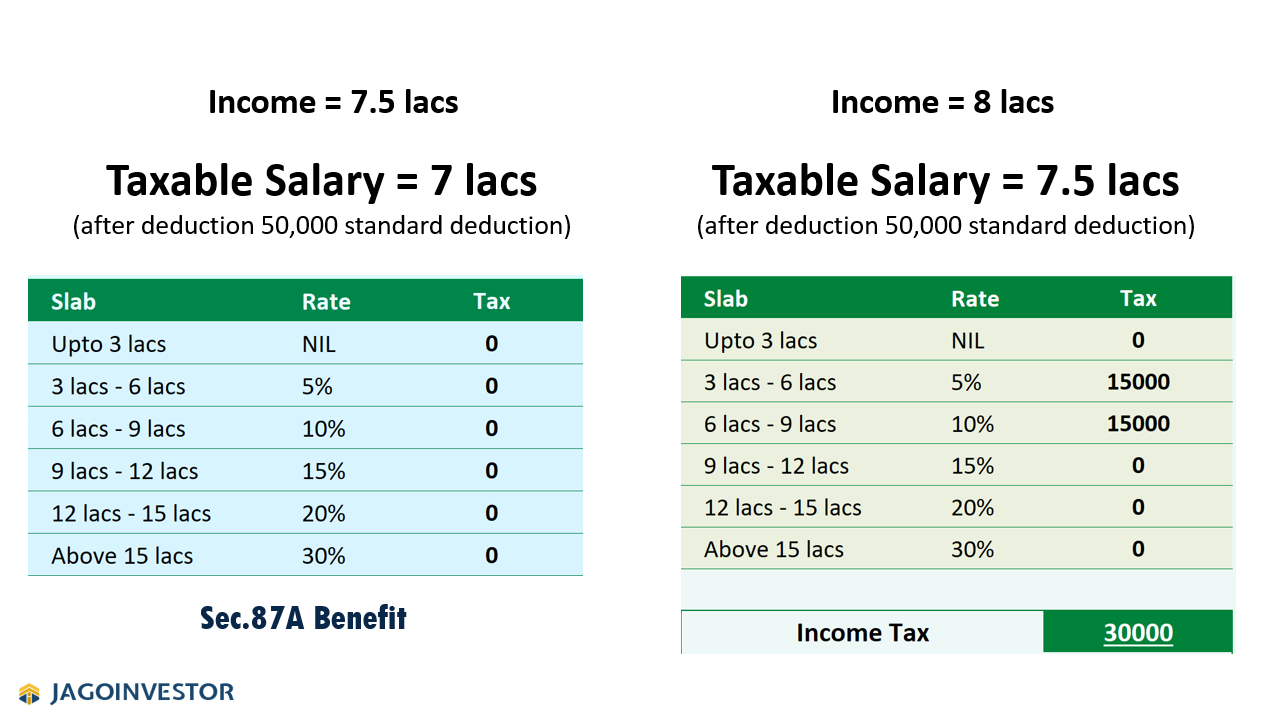

3. Standard Deduction of Rs 50,000 in New Tax Regime

Earliar, the standard deduction of 50,000 was available only for the old tax slab, but in this budget its also extended to the new tax regime. Which means that one can directly reduce their income by 50,000 before finding the taxable salary.

4. No Tax up to Rs 7 lacs income under new tax regime

Its time to cheer up, as one will not be paying any income tax if the taxable salary is upto 7 lacs. This simply means that a person earning upto 7.5 lacs will not pay income tax because there will be standard deduction of 50,000 now which will make sure you come under that 7 lacs limit. here is an example where we show

Based on the information above, when does it make sense to choose between new and old regime?

When to choose New Tax Regime?

- Income is less than 7.5 lacs

- Your Total deductions are less than 2-2.5 lacs (if you claim just 1.5 lacs in 80C and 50k to 1 lac in other things)

When to choose old tax regime?

- Your exemptions and deductions are very high like 4-5 lacs ( when you claim full 80C, 80D, HRA, LTA and home loan interest)

Old Tax Regime will most likely get killed !

Govt has made its mind and aiming to move towards the simple tax structure with minimal compliances. In future there will be no 80C , HRA, 80D , home loan interests or any kind of deductions. Slowly New Tax Regime will be made attractive and old tax regime will be abolished.

5. Senior Citizen Saving Scheme Limit raised to 30 lacs.

The senior citizens will feel extremely happy after this amendment as the limit in Senior Citizen Saving Scheme has now increased to 30 lacs which was earlier 15 lacs. The current interest rate is 8% for the Jan-March 2023 quarter

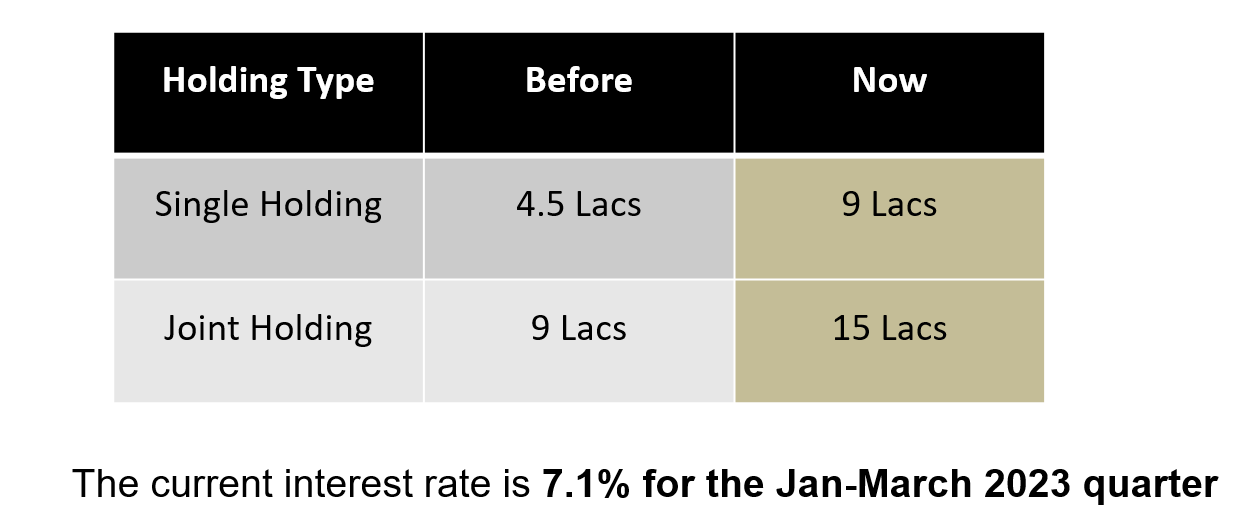

6. Post office MIS limit raised

This clearly shows a glimpse that this budget was in favor of the salaried class. National Savings Monthly Income Account the previous limits have increased.

7. Leave Encashment is tax free upto 25 Lacs.

Now one will not have to pay any income tax when they get the leave encashment amount upto Rs 25 lacs at the time of retirement or leaving their job. This amount was set at Rs 3 lacs till date which was set long back and was very low. So if one gets 40 lacs as leave encashment, then there wont be any tax upto Rs 25 lacs and rest 15 lacs will be taxable.

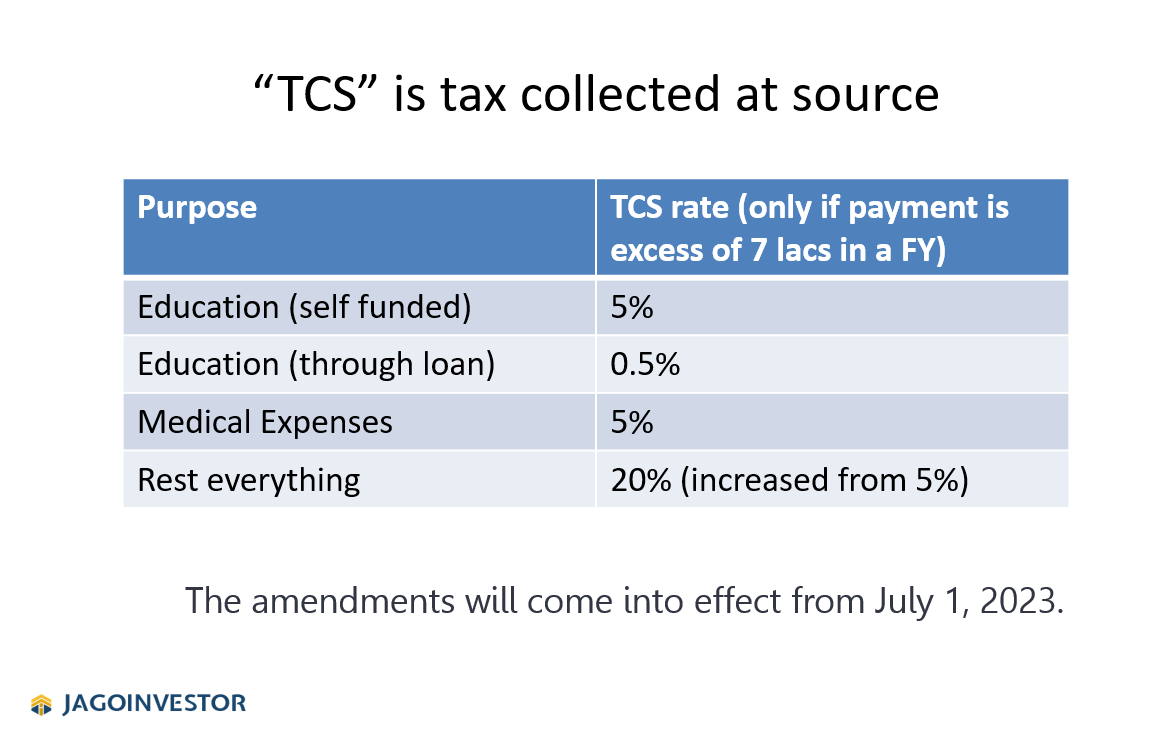

8. 20% TCS on foreign remittances under LRS scheme

Taking a foreign tour package or investing abroad will increase one cashflow, as there is a 20% TCS rate now. which means that you have to pay an extra 20% money which will be deposited as advance tax from your side to govt when you make any high amount transactions which sends money to foreign. This is applicable only when the amount is more than 7 lacs.

Below were the slabs ..

Note that this TCS amount is not the TAX, but advance tax, which means that at the end of the year you can adjust it with your total tax payable or claim it back by filing a refund in your ITR.

9. Traditional Life Insurance policies maturity amount is taxable if the premium is more than 5 lakhs

All life insurance policies proceeds as income/maturity will be now be taxable if aggregate premium paid per year by the person is more than 5 lacs. Aggregate premium means total of the premium paid in a year by the person in his name from all kind of insurance policies

- This rule is applicable only for all policies issued after 1st Apr 2023. All past policies does not get impacted

- This rule does not apply for death benefit (if someone dies and family gets the money, then its tax-free

- This rule also does not apply for ULIPS

10. Capital Gains exemption on investing in other property is capped at 10 cr

Till now there was no limit on the capital gains exemption under sec 54 and 54F, which means that you could buy another property with all the capital gains and just not pay any tax. But now you can only do this till 10 cr.

This is anyways going to impact only super HNI who deal in properties worth multi crores.

Let us know if you have any query on budget 2023. We hope you got a fair idea on all the changes made.

February 6, 2023

February 6, 2023

Jagoinvestor Blog

Started from November 2007 till February 2023

15 Years 3 months or 5579 days

Total Blog Articles- 909

Just Amazing

Thanks

Your article is very informative, thank you.

Could you please clarify the following topic? When one of these two conditions is met, should we opt for the New Tax Regime?

When to choose New Tax Regime?

– Income is less than 7.5 lacs

– Your Total deductions are less than 2-2.5 lacs (if you claim just 1.5 lacs in 80C and 50k to 1 lac in other things)

yes

Old regime makes sense only when you are claiming various kind of deductions amounting to minimum 4-5 lacs

Manish