RBI Retail Direct – Buy Govt bonds online

This week, govt launched a long-awaited portal called RBI Retail Direct which allows investors to buy and sell various kinds of govt bonds online. You can directly buy the bonds without any intermediary and without any Demat account. All you need to do is open a Retail Direct Gilt (RDG) account on the website.

The retail investors will be able to buy bonds in primary and secondary markets. Primary market means when a bond is issued for the first time and secondary market means buying and selling of bonds after they are issued. Note that there is no intermediary/agent in this and you will be directly dealing with RBI here and all your bonds will be with RBI itself. This is 100% FREE service and there are no charges at any stage.

What kind of bonds you can buy on RBI Retail Direct?

You will be able to buy various G-Sec bonds issued by govt like

- RBI Bonds

- Central Govt Bonds

- State Govt Bonds

- Sovereign Gold Bonds

- Treasury Bills

Who can open the RDG account?

As per the RBI notification, the retail investor needs the following to open an account.

- Rupee savings bank account maintained in India;

- PAN issued by the Income Tax Department;

- Any officially valid document such as Aadhaar, Voter ID for KYC purposes;

- Valid email ID; and

- Registered mobile number

Other points

- The account can be opened in single or joint names

- NRI’s can open this account, provided they are able to meet the eligibility criteria

What type of Govt bonds are available to invest in?

IF we leave aside the short term bonds, you will be able to buy bonds with 5-40 yrs of tenure. Govt of India issues very very long term bonds also like for 30 yrs, where if you buy the bond today, it will mature after 30 yrs and you will be able to get the interest (mainly called coupon rate) for every 6 months. The rate of coupon is fixed for you, so in a way, you are able to lock in the returns once you buy the bonds

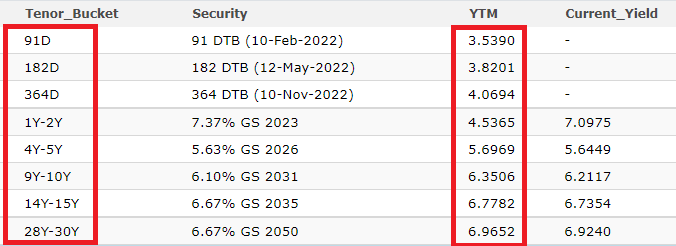

Here is an indicative table that gives you the idea of the yield as of 15th Nov 2021

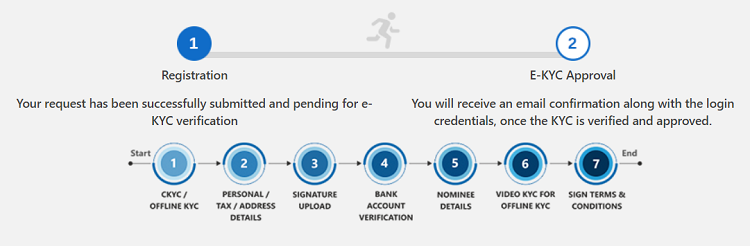

How to register on RBI Retail Direct Portal?

- Go to https://rbiretaildirect.in/#/rdg-account-registration

- Choose Single Holder or Joint Holder from the dropdown

- Enter Name (better enter as per PAN)

- Enter PAN

- Enter Email ID and Generate OTP to validate

- Enter a Phone number and generate OTP and validate

- Choose Date of Birth

- And finally, enter a login name

On the next page, you will get the application request number

- Click on “Initiate KYC process” button

- Be ready with the following things

- Scanned Image of Signature

- Scanned Image of Cancelled Cheque

- Any Valid Address Proof

- On the next page, based on your PAN, if you have a CKYC number, your details will be fetched like your date of birth and other details

- On the next page enter other details like personal details, nominee details, bank account, signature upload, cancelled cheque,. nominee details along with nominee bank details etc

- Finally, you need to eSign the contract towards the end

- A signed contract is sent to you over your email

- Important: Your login and password details will be sent to you after 3-4 days, which was not clear on the portal, but I confirmed this by calling their customer care.

My Experience with the registration process

I personally registered on the platform under a single name and my overall experience was quite satisfactory. The moment I entered the PAN number, it fetched the CKYC number linked and then fetched all other details like Adhaar number, aadhaar image, address etc. I just had to upload my signature and cancelled cheque.

The registration process was a bit lengthy and will take time (15-20 min). Some people on Twitter said that it was quite long for them and they were frustrated, but for me, it worked fine. Dealing in bonds directly with RBI may require too much documentation and it’s ok if it’s lengthy a bit at the start. It’s a one-time process anyways!

Why did govt brought this platform?

This is a big development in our country as there was no easy way for a retail investor to invest directly in govt bonds with RBI directly. There were platforms that had some ways of buying bonds, but still, it was never comprehensive. With this platform, now retail investors will be able to sell the bonds directly to other investors (anonymous transaction) directly from the platform itself.

The whole bond market will expand as all retail investors have a way to access it. Also, the govt will be able to raise the funds for infrastructure by issuing the bonds to a larger market.

How can you sell the bonds later?

There is a screen-based electronic anonymous order matching system called NDS-OM by RBI which can be used to sell the bonds to other entities. Till now it was only available to big institutional players, but with this platform, all the users already registered will get access to this platform where they can trade the bonds. You will be able to put an order for selling/buying the bonds on the platform and if it matches with other users (like the stock market), the transaction will go through.

Suitable for senior citizens and assured income seekers

While anyone can invest the govt bonds, it’s important to note that the money will be locked in for a very long time if you buy long term bonds and income in form of interest will be paid on a bi-yearly basis. So it is most suitable for senior citizens who want to park some part of their portfolio into assured bonds from govt to generate some regular income.

However buying very short term bonds does not make sense, because the yields are not that attractive and anyways there are simpler options like debt mutual funds or banking products like fixed deposits.

The biggest disadvantage of the platform for retail investors is that the bonds market is not quite liquid as of now for small investors. So if you want to sell your bonds and urgently need money, it might happen that you are stuck because there is no one else looking for buying.

Final points

Note that this platform is quite new and we shall give some more time for it to evolve and things to get clear. There might be small bugs in the platform, so be a little patient. This platform adds a new way for retail investors to invest in debt markets

November 16, 2021

November 16, 2021

I think couple of issues with these investments are

1) The taxation will be at margin tax bracket for the coupons we will receive

2) The yields are even lower than Liquid funds and Arbitrage funds

Gov should allow inflation linked bonds for retail investors

Yes.. for very low duration it does not make much sense.. the longer tenure bonds like 30/40 yrs are fine !

WHILE REGISTERING IT IS ASKING “WHETHER FATCA APPLICAPBLE?”

WHAT IS IT SHOULD I OPT ‘YES’ OR ‘NO’

If you are not in US or Canada, then choose NO

Can these be pledged with stock broker?

Yes

It’s tax in-efficient. Only part I might be interested is – buying a 30yr bond might be more useful than buying annuity as they have similar taxation but bonds might yield more.

Yes they are tax inefficient. However incase where the senior citizen comes under tax bracket of 5 lacs of income, it wont make much difference !

Manish

Nicely explained Manish.

What is the tax liability on income from the interest or P/L from selling in Secondary market of these bonds in RBI Retail Direct. Is it similar to Debt Mutual funds.

I think You missed an important point, especially when you advocate buying Rs 50 /100 lakhs of govt bonds to retirees. Since these bonds always return dividends/interest on the whole amount deposited after every 6 months, the tax liability is high. Instead, in the case of Bond funds, you can opt for SWP to save tax, which is very important for pensioners.

Yes correct.. Very valid point

Is this platform available to NRI customers?

Yes

As Retired person, I am thrilled to learn about this investment avenue. I am hopeful that as this pltaform becomes available to public at large, secondary as well as primary markets would develop at great pace.Most important fact is that RBI, a most trusted Bankers Bank is itself managing this system so that confidence is created in public to buy and trade in Bonds. Thaks for sharing the information and good video.

Glad to hear that Mr. Anand

Do check out the RBI Retail Direct site and register. Do give feedback later!