Decoding “Rs 10,000 invested in Wipro became Rs 500 crore” example

I am sure you must have seen the famous example of how Rs 10,000 invested in WIPRO turned out to be Rs 500 crore in 2019. That’s a massive wealth. But today I want to decode this story and let’s see what are some of the issues and problems. I have created a video on this topic, Do watch below

First of all, note that it’s not just WIPRO that has created massive wealth for its investors. There are many other examples as well, like

- CIPLA: Investments of Rs 10,000 in 1979 will fetch 95 crore

- INFOSYS: Investments of Rs 10,000 in 1992 will fetch Rs 1.5 crore

- RANBAXY: Investment of Rs 10,000 in 1980 will fetch Rs 19 crore

- HDFC BANK: Investment of Rs 1 lac in 1995 will fetch Rs 8 crore

While there are some examples of people who were able to hold the stock for 35-40 yrs and created massive wealth for themselves the one question which we shall ask ourselves is – Is it remotely possible for a common man to do it?

2 problem will WIPRO example

Problem #1: Survivorship bias

The Wipro example is a classic example of survivorship bias, where we pick the example which has worked already and survived for 40 yrs. It’s damn simple to look back and say easily that 10,000 become 500 cr if you waited for 40 yrs?

It’s nothing more than a data point. You are just looking at the statistics.

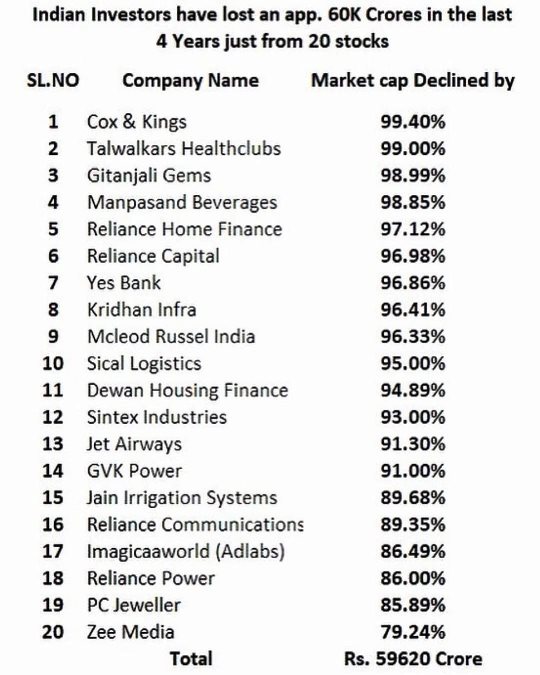

For every Wipro, Infosys, and Reliance example – there is a Reliance Capital, Unitech, and Cox&Kings example that has destroyed all the wealth in so many years.

How will you pick WIPRO in 1980 with so much confidence for the next 40 yrs? It is almost impossible.

Problem #2: How will you handle your emotions all these years?

“If you invest for 40 yrs” is the point.

- Who invests for 40 yrs?

- Who buys and holds for 40 yrs?

I will tell you, it’s mostly people who are dead or someone who really forgot about the investment made.

And then there are promotors of the company who hold for so long. And finally, there is a tiny minority of few people who might have done it successfully whose example we see on the net. But it’s never going to happen with most people because it’s almost impossible to control your emotions when you see the stock going up or down so much.

- When you invest Rs 10,000 and it becomes Rs 1 lac in 1 yr – Will you, not sell-off?

- If not, then what if that Rs 1 lac becomes Rs 5 lacs in the next 2 yrs? – Now will you not sell-off?

- If not, what if that 5 lacs now becomes 1 lacs and drops in value by 80%? – Will you still have “conviction”?

- What if that Rs 1 lacs comes back to 5 lacs? Now?

I think you got my point!

Only robots and machines can stay calm and not react. We are humans and we do.

Here people sell when prices go up by 10% and we are talking of keeping stocks for 40 yrs?

Note that I am not saying that there are people who don’t keep the stocks for 20-30 yrs, but it’s not as easy a game to play as it’s made to look.

If you had bought Wipro in 2000, you would get back your capital now (adjusted for dividends). 20 years of 0 return. Meanwhile the Revenue of the company increased by 26x and PAT by 40x. This is what happens when you buy growth at any price. pic.twitter.com/AByCccmd9V

— Equity Markets (@EquityMarkets_) December 30, 2020

Enjoy the journey of equity bull runs and keep using the money

Note that buy and hold for 40 yrs is not always practical. Even if you have a good stock and patience, it only makes sense to take out profits from time to time and use it for your life goals. Go on vacations, buy a house, travel, and use it to buy stuff. There is no point in dying with Rs 500 crore unless you want to exactly do that.

Another point is to have a well-diversified managed portfolio where you are betting on multiple stocks and not concentrated on few ones. So have realistic expectations from stock investing and take these examples with a pinch of salt.

Only use these examples to reassure yourself that equities have huge wealth creation potential and its an important part of your portfolio.

Do share your comments below

September 24, 2021

September 24, 2021

Excellent article Manish! I was talking to a friend of mine yesterday who was very feeling sorry for the fact that he did not invest in Bajaj Finance in 2009 when it was around Rs. 10 per share and today it would mean more than many crores.

I told him the facts from this article. Well, he understood but then still can get rid of his logic.

Many C grade youtubers who just passed out of 12th grade have suddenly became stock advisers and next buffets to give strong advices.

Very correct Amol 🙂 .. thanks for sharing your friends example !

Great article keep writing this type of informative content….#Jagoinvestor

Thanks

Great Man, Such a wonderful, thoughtout, analytical article. These days, fake marketing, fake media, fake government, promote false sales promotion to paid media content. like a quote “long time investment means long dead investment”, getting crores after 100 years means nothing & fraud.

Thanks for your comment Mic .. Please keep sharing your views like this..

Vandana

Very good article Manish… Young investors needs to unde yeah

Welcome

Very often we see posts like investing in this stock 20 years ago may have made you a millionaire or billionaire but there is very little attention on the wealth destructors. This article has done well to bring forward that point.

To prevent wealth destruction in the stock market, diversification is very important for retail investors where company-related information reaches last.

Sir, Amazing eye opening article.

But instead of decode world if you will use secret world.

Ok yea one way of looking at it !

Manish Ji,

There was CCI in the past that used to keep upper limit on the IPO price. CCI stands for Controller of Capital Issues – as opposed to some YouTubers shouting CCI as Competition Commission of India … guys learn first. It was partially reason behind attractive pricing of 90’s listings. These days the investment bankers are working mostly for the promotors, they are least bothered about retail investors. There are promotors who think to benefit retail investors, no disrespect to them. The euphoria of bull market conceals many facts. However, it is key not to lose investor money than making profits. Remember, Buffet’s core principles Rule#1) Never lose your money Rule#2) Never forget first rule. The key here is, protect your appreciation not just initial investment. If your investment make 26% gain in an year, your investment now is 126/- for each 100 bucks, not the same 100 which was original investment. It has an inherent meaning of protecting downside.

The new age investors missing the ground, coming up with convincing arguments to prove their investment strategy is correct. Most of these had not seen what crash would look like. But, if you have conviction on the business any crash would give buying opportunity. Question is, do we have money to invest? As Ramdev sir says, spotting right purchase price is difficult, but sizing and selling is even more difficult task, only a veteran investor can understand. Why would Buffet-Monger would bet 47% of their portfolio on one tech stock, which they were away for decades? It was the same strategy they followed even when they bought American Express decades ago. If one has conviction, hold it for long enough and buy more in correction. In terms of Ramdev’s interpretation of conviction, “after the promotors you should be the second to know about the business”.

Thanks for so valuable information Mr. Venki !

Manish

While it is true in general, there are many who have and can hold stocks for many years. Even I have held stocks for more that 10 years despite the ups and downs. It is the amateurs that is not able to hold stocks and panic in certain situation. Stock market is not for everyone. A lot of people don’t have the patience and go with what is speculated in the news with little research.

True !

This is very good article highlighting that such stories look good only in retrospective. No one knows the process of identifying next Wipro or HDFC Bank, hence no one talks about it. Articles floated on Internet/Other messaging apps generally tend to look back and give such examples, which are of not much use to common man.

One investes in equity for his/her financial goals, and hence profit booking and asset balancing is part of the investment journey. Holding a specific stock for such a long period may not be practical for achieving your goals in your life!!

Manish, you have missed one point regarding hind sight bias since when ones invest in any stock he/she do not know that this will be the next wipro due to fast changing nature of business. Also you forgot to mention the point that someone might get return superlative in very short time that is pure luck but to have superior returns over long term you have to invest time and energy means a full time investor to beat market returns.

Yes, this is a good addition you have done Mandar! .. Agree with you! .. A lot of things look great in hindsight!

Thanks

Well written Sir. It is not really possible to hold any stock for even more than 4 years.

Ya its tough especially when its going up up and up

Excellent article. Also very timely

Thanks

All those equities have lost 90+%, may fight back provided it’s business continues to be good. Example Kiri Industries came down from 810 to 5 INR per share. But within the decade it crawled back to 700zone.. so don’t lose heart…

Thanks for giving that example

Absolutely agree with you! Good article with clear thoughts.

Thanks

Perfectly told, it’s always impossible to hold the emotions. But I have invested in a few stocks in my children’s & they are unaware of it & I myself don’t look at the returns from those accounts.

Maybe they will get lucky who knows ????

Nice.. thats great to know

You can’t be more true on this – what’s the point of accumulating 500 crores and not using

Thanks for comment

You hit the nail on the head.

Thanks

Well said!

Thanks

Hi

You have nicely picturised the whole lot of situations and outcomes of holding a stock for a very very long time and given due credit to SURVIVORSHIP bias. Leave aside 40 years, even waiting for a couple of years in loss is not digestable for majority of investors. Typical holding period of a even a mutual fund in India is less than 24 months which is well diversified and better placed to absorb the volatility. The concluding statement is awesome. After all we had bought a share with a goal to meet and not to die with it. Excellent.

Thanks for sharing your views on this Jaswant

Very good article Manish… Young investors needs to understand both sides of the coin before investing and be prepared for it. They shouldn’t enter the foray only by looking at the glossy side…

True Satish 🙂