How I survived a Credit Card fraud today! – Experience Sharing

One of my Twitter followers Mr Ravi shared with me a potential credit card fraud attempt that he survived. I would like to share that with you all with his permission.

Here is goes

—

I hold an RBL Bank Credit Card along with a couple of others.

Today, I got a call from a mobile number 6391504865. The person was speaking fluent English and claimed to be from the RBL Bank. He asked me – at the time of getting the card whether I was told if this card is lifetime free or there will be a joining fee. Then he asked if I was actually given the credit limit which I was told. Till this point, I answered the questions.

Then he told me that the bank is offering me a credit limit increase of 1 lakh if I want. And then asked – “Please confirm if the PAN number I am telling is correct.” Then he told me my correct PAN number. He further proceeded saying that he was sending an OTP which should be shared with him for authorisation of this limit increase. Here comes the scary part. I received an OTP from the legit RBL messaging service (VK-RBLBNK) from which I usually receive the transaction messages. The content of this SMS was as following:

“234567 is OTP (one time password) for updating your RBL Bank Credit Card settings.”

Just to ensure that this is indeed a fraud, I asked him to tell me my existing card limit before I share the OTP. He couldn’t answer it well and started beating around the bush. I told him unless the SMS mentions that this OTP is for credit card limit increase, I will not share the OTP. I asked him to send me an email from his RBL email id about this. He said yes and hung up the phone.

Mr Ravi, soon after the fraud call connected with RBL bank customer care (fraud detection department) and came to know that it was indeed a fraud call.

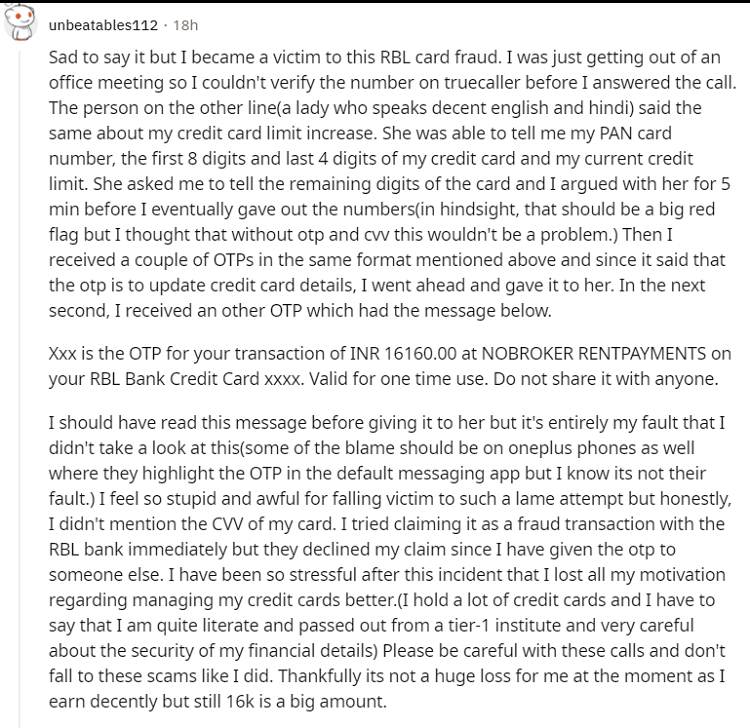

Here is one more similar kind of incident

PAN and Credit Card Leaked

It’s very clear that all his details were with the fraudster.

No one asks for any OTP for increasing the credit card limit. It’s always informed to you by SMS, or you get to see that message when you log in to your banking portal. The OTP which was generated was surely for some other purpose (like transferring money or authorising some purchase).

So beware if you get a call for increasing your credit card limits and the other side has your PAN, Card details, Card current limits, etc. They might be a fraudster

Make sure you never share the OTP with anyone overcall. There are many youngsters who may be new to how a credit card works and fall for this fraud. Looks like Jamtara Gang is back with new tricks.

His original sharing was posted here and some part of it is reproduced with his permission

Have you faced any kind of credit card fraud ever? Can you share in the comments?

September 3, 2021

September 3, 2021

I have new strategy for not falling for this. Dont Answer any call from unknown numbers on the first go. If someone is calling in for some emergency he will call again. This gives you a first layer of defense or give you time to go back and check whether the call is from authentic source. In case if you have missed a genuine call you can return the call immediately.

This can save fortune

Thats a great advice 🙂

Great Eye Opener Story. The way these fraudsters talk is so convincing that we get carried away with the flow.

true

All persons who are using net banking, credit card, debit card or any electric mode for any purpose, they must not share their OTP, Password. Besides I would suggest that on social media like face book or any other social media where the date of birth is displayed, the official date of birth should not be used as the fraudsters may misuse it for authentication.

True

Also once shall not make that info as public