How EPF Fraud of 100 crore was done from Inactive accounts?

In the last few days, there is news that some EPFO employees have done fraud and siphoned off Rs 21 crores from some EPF account.

How was this EPF fraud done?

So the fraud was done on those EPF accounts which belonged to small companies which are inactive from 2006 and there were some checks and balances which were not done for those old accounts. Another thing they did is that they only withdraw 2-3 lacs because it does not for any kind of audit (it happens above 5 lacs withdrawal).

This was done by few employees of the Mumbai office and one of the clerks was the mastermind for this. Around 8 people have been suspended already and it points out that a bigger fraud may be in place. More investigations are going on right now!

I am going to share some startling facts today about EPF Frauds that have recently come to light and have been written about and highlighted in the press. And it is highly likely that some of you who are reading this article might be victims of this fraud – just that you are unaware of the fact at the moment.

Fraud Withdrawal’s from EPF accounts

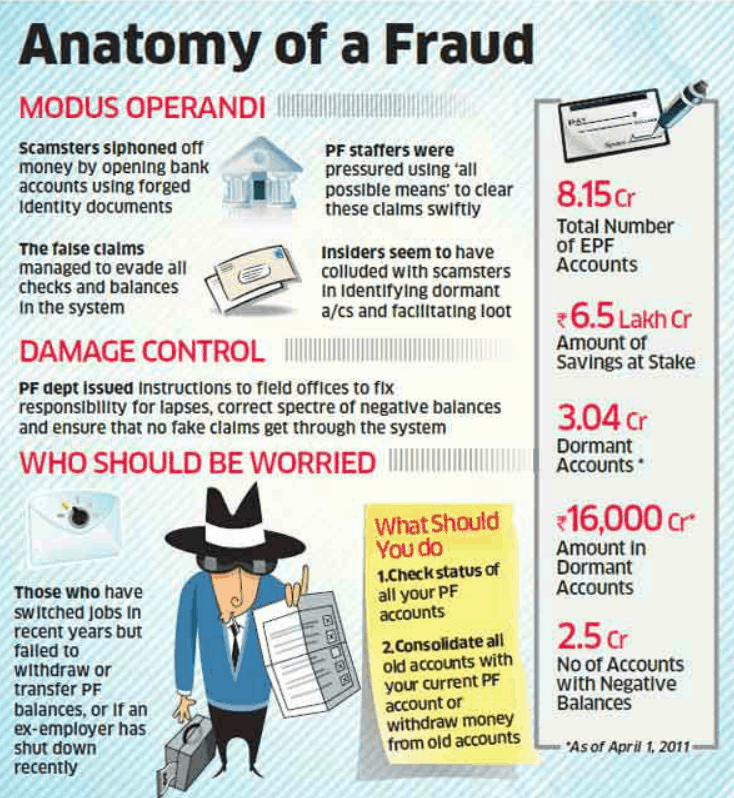

Sanjay Kumar is the Chief Vigilance Officer at EPFO and on 7th Oct 2013, a circular was issued to all the EPFO establishments of all regions in the country with the subject- “Fraudulent withdrawal from the account of EPFO by furnished forged statutory returns”.

The letter talked about scammers making fraudulent withdrawals from various EPF accounts by submitting forged bank accounts and KYC details/documents. It also mentioned that EPF officials had colluded with these scammers and helped them withdraw money from Provident Fund accounts – especially ones that were inoperative (no activity on those accounts) and/or where the employer no longer existed (closed or shutdown).

I have paraphrased below important excerpts from the circular

Point 2. The investigation has revealed that the fraud was committed mainly in respect of those establishments where remittances had not been received for many years, records not updated and the establishment had not submitted statutory returns. Further no pre-coverage or post-coverage inspections were carried out of the firms and no claims were received or settled since long,” it said.

Point 3. The investigation has revealed that the fraudsters had submitted forged/fabricated returns viz . Form 3A/6A, 9(R), Specimen Signature Cards and therefore, Submitted fictitious claims in the name of original members of non-members. The claims were settled by putting pressure on dealing hands/office by all possible means.

You might be aware of multiple cases where investors face a slew of obstacles while withdrawing their Employee Provident Fund money. At times, it takes years before they get any status of their EPF money and even when a payout is made, cheques go missing or are sent to the wrong address. So, it doesn’t require much imagination to see how in the wrong hands the cheques can be cashed simply by opening a fake bank account.

Here is an incident where an EPF investor faced the issue

Preliminary investigations revealed that there had been huge withdrawals and transfers of money from the individual fund accounts of a number of school employees without their consent and knowledge,” they added. “An FIR was registered and investigations were initiated by a special investigation team. During the investigation, it came to light that funds were withdrawn by the treasurer of the school by forging signatures of the principal and staff members,” police said. (Source)

Some Numbers

To put things in context, we are not talking about a few isolated fraud cases or few crore rupees here. The actual scale of the fraud is mind-boggling and will cause you sleepless nights.

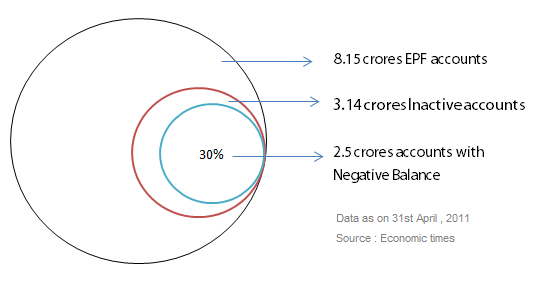

Consider this – as on April 2011, there were close to 8.15 crore EPF accounts, out of which 3.14 crores EPF accounts were dormant with a balance of close to 16,000 crore rupees. Of these 3.14 crore dormant accounts, 2.5 crore accounts had a negative balance, which meant that they did not have any money in them (money had been totally withdrawn!).

How does EPF Fraud work?

Let’s talk about the modus operandi of the fraudsters in detail, so that you can understand the loopholes in the EPFO system. Note that this whole fraud is highlighted mainly for dormant accounts, especially those where the employer does not exist now. However, it would not surprise me if frauds started to happen even on active accounts anytime soon.

So here are the steps that are taken by fraudsters

Step 1 – Identify a dormant EPF account

The first step is to find out all the details of the dormant EPF account. If you have some money to spend on bribes or lots of time and patience to search the Internet, you can get all the information you want. The Internet abounds with people who have given their EPF numbers, names and addresses without realizing the risk they are exposing themselves to.

Also if you have the money, you can quite easily bribe officials and get information. A dormant EPF account is one that does not get any fresh contributions for 36 months. At times the employer depositing the money in the EPF account closes operations and now the EPF account is totally orphaned and the money is sitting idle.

The EPF holder is either in another job waiting for that perfect moment when he will start the withdrawal or transfer process or he is working outside India and has totally forgotten to take action on his EPF account. It may also be that the money in the EPF account is such a trivial amount that he/she does not bother to do much about it.

Step 2 – Open a bank account with Forged details

The fraudster’s next step is to open a bank account with forged details and prepare a PAN card, address proof etc. In an environment, where obtaining fake passports or completely forged educational degrees is child’s play, it’s no stretch to assume that it would be easy to get fake KYC documents made.

Step 3 – Apply for Withdrawal of Claims with forged identity

After all the documents and identity are set, one just has to fill up a withdrawal claim while posing as the target of the intended fraud. If the company depositing the money in the EPF account is now non-existent, then EPFO relies on the bank branch to confirm the authenticity of the bank account (as per the Livemint article)

In any event, the structure of EPFO is not centralized i.e. each state has its own EPFO department and things are controlled locally. Therefore there are different EPF account numbers for the same person and different EPF accounts opened at different intervals. Even the process followed at each step is not extraordinary but rather the same old rotten way of doing things.

If there are issues at some stage, it has been found that insiders have been influenced and helped to pass the claims (as per the EPFO circular itself). There is no wonder that bribes are given and taken and things are bent. Here is proof below

The RTI reply also revealed that at least 1,350 EPFO employees have had corruption charges against them in the past five years. Of this, 450 are from the officer grade. Most of these officers have been accused of misusing power and colluding with companies to turn a blind eye to their wrongdoings. And every year, more and more such officers are coming under the scanner.

Confirming the trend, DL Sachdeva, a member of the EPFO board, said it would be next to impossible for any company to siphon off money without the help of EPFO officials. (Source)

What you should do now?

If you have an old EPF account that needs attention, you should ensure you withdraw the money or transfer it to your current EPF account. Make certain that you only have one single active EPF account running.

Do not leave it unattended for extended periods or else be ready to face unpleasant surprises in the future. If you need any information or need to move things forward, use the RTI application to the EPFO department and things will move quickly. Also, make sure you take general precautions like not revealing your EPF number and other details in public without a strong reason.

Please share your views on this topic and EPFO in general in the comments section below?

August 24, 2021

August 24, 2021

Hi Manish,

This is scary but real. I am waiting for payment of balance amount of my PF account for last 2 years. My PF epassbook shows balance amount (i.e. amount deposited v/s amount withdrawn). However, whenever I applied for withdrawal, I got reply that there is no balance in my PF account and hence not eligible to get any money. Now I have raised this claim on pgportal.gov.in and waiting for reply from there.

my PF account is in Mumbai – Kandivli RO. Hope to get the balance amount now.

Did it have money earliar?

Hi Ajit,

I recently got two of my problems solved by marking chief minister and CEO-of-insurance-company, respectively. I was so pleasantly surprised!!

Apart from whatever remedies you are taking, can you please tag your applications/documents/attachments to email-ids of your state’s finance minister and chief minister?

Despite our anger at many politicians, I have to admit that many political leaders are working very hard in today’s competitive politics. They love to solve people’s problems if it is a low hanging fruit and, in the process, win our well-deserved gratitude.

Thanks a lot Sambaran for sharing this info 🙂

Good artical which reveals scary things.

It is good that for many companies (TCS, Infy, Wipro) manages their employees PF through their Trusts.

Thanks for sharing your views ..

Let me share my exp with PF Issue:

In 2006 i worked with MNC. When i joined this company i transferred my 2.5 yrs old PF acct(old company’s) to this one. Year later moved to a start up in 2007. Since my start-up didnt have 20 employees there was no PF there, i didnt want to close and waited for 6 months for the start-up to reach 20 employees. I didnt happen and hence decided to close the PF acct with the MNC. Just to initiate the closure the HR/Finance team dragged it for 1.5 yrs and finally after lot of communication they did close my PF. When i checked the amount i will be recieving, it was a shocker. I worked there for exact 1 yr. But the PF i recieved was just for 5 months. Only saving grace is my old transferred accts amount was intact. Then the fight started on the remaining 7 months PF. The HR and third party PF trust DKM were giving contradictory statements. Then i tried to resolve the puzzle and found the issue.

“When i joined this MNC, i was actually under a subsidiary company which it acquired year before my joining. During the course of my stay there the sister company was duly integrated. Obviously new PF accts where created but the old acct money was never transferred. This is the reason i lost the 7 months PF amount”

Even after finding the issue they didnt resolve inspite of my repeated communication. One fine day i decided to send a legal notice and did so. But no response from them, i don’t know whether they recieved the notice.

I got busy with other stuff and stopped following up on the same.

Now the department i worked in that MNC was aquired by another big MNC.

What are my options now ? Any help will be great

Adding to my previous comment:

Now i still work for the same start-up i joined in 2007. But is is no more a start-up and was aquired by another MNC. Now i made sure my start-up PF amount is transferred to new company’s account and i keep track of the PF acct details.

Funny part is the third party PF trust manager for my new company too is DKM.

What is DKM ?

DKM online Pvt. Ltd. is the third party payroll processing for MNC’s. Sorry for not being elaborative.

Kiran

I think if you use RTI on this, you will get the success in getting the exact status, but it will surely test your patience.

Manish

ePassbook never gets generated with PF entries for “inoperative accounts” in EPFO language. Inoperative accounts are those with no contribution coming in for 36 months. If employee had contributed for 2 yrs, then the employer sent the employee on deputation to foreign nation for 3+ years, then also the account turns Inoperative and interest credit is stopped. If employee returns back to India and starts PF contribution again, then also account remains Inoperative and ePassbook is generated but it is empty.

EPFO affairs at ground level are very bad.

Thanks for sharing that insider info .. was not aware of that 🙂

Dear Sir,

I would like to know what is the equivalent product of EPF, as i would like to invest the PF withdrawn money to other product which gives same return like EPF for long term….

Can i invest the money withdrawn into MIS+RD in post office schemes for similar return, please advise

Regards

K7

In that case I suggest PPF only

There is a facility called E-Passbook available on EPF website. Just login in there. You can check you PF balance on monthly basis and confirm. http://members.epfoservices.in/

By doing this, you can be sure of your money.

I like to property kindly help to take right property. My budget is around 10 lac only.

Not sure what is your question exactly ?

very thankful to you for the information

will it effect to VPF also, becuase I am contributing 25% of my basic and its only my main retirement fund

will it effect to PPF …if not Can I change to contribution from VPF to PPF

Please suggest

VPF is same as EPF . VPF is the name of concept , not the product . It will not affect PPF

Manish

Thanks for your reply

Can i chnage it to PPF rather than putting money in corruption risk EPF even though interest rate is less?

Kindly suggest

Nice article Manish. Very scary that corruption hit EPF also. I just changed the job and applied for transfer to new company. Hope it get transferred to new company without any issues.

Hi Manish,

Scary to see this. Do you think PPF accounts can also be affected?

No nothing on PPF front !

Change the position of gagets….facebook..twitter etc as I can read properly, moreover its annoying too…

Hi Dinesh

Now you should see another version of mobile site which must not have those social icon , is it coming now ? please remove your cache before you visit the site again !

no its not comming.

There are two ways to look at this problem. First from systems and governance perspective. There are many loop holes in governance of many institutions, which unless plugged, will give a way to the fraudsters to make good.

Secondly, from a personal perspective. Unless one is conscious of his financials, such personal tragedies cannot be prevented.

I would like to quote an example, though not exactly same, which i had heard. There was a benefit scheme in a firm, which promised to pay the retiring subscribers a good % of their last drawn salary as a monthly payout for rest of their retired life(till death). At a first glance, this looks very good and very user friendly. From the first year onwards the retirees started getting these great payouts, even though they paid paltry some as premium. However, the truth came out when 15 years down the line, when it was found that there is a big hole in the corpus and the pay out was to be very much restricted to the subsequent beneficiaries to keep the scheme alive. Now an employee with no sound financial knowledge can say he is unaware, but can the same be true for highest level office bearers?

From such incidents, i became very skeptical and now, work hard to learn the nuances of each investment avenue, i am planning to invest in. Vigilance appears to be the only solution.

You made a very good point that there are internal and external issues . Both EPFO and EPF holders have to be cautious from their end to make sure no issues happen in future !

Hi Manish,

How to withdraw money if company not exist or shuts down branch? Its more than 8 years I did not withdraw money from the pf because of laziness and negligible amount.The Head office was in mumbai and I was working in gujarat. Pls guide me.Can i submit the form to my present employer? I have pf account no with me.

You need to contact EPFO on this .. It would be a regular procedure where you fill up withdrawal form for EPF . just that in this case you will have to take help of RTI now to ask specific procedural questions .

Hi Manish,

Really nice aritlce, which indeed helps us in knowing the fraudulent occurring now a days!

yes its true that most of them will share EPF number on public which is not safe.

Again thanking you…!

Regards

-RB

Welcome

Thanks for suce a nice article Manish.

PS: Siva, Manish is referring to the pension fund and not the provident fund which I suppose you have assumed. Check once.

Regards,

Karthik VR

Dear Manish,

Nice article as always,

How could there be a negative Balance in EPF account?

Regards

By Negative balance, it means zero balance.. its just a way of saying

Hi Manish,

Thanks for the eye opener article. For this reason only I close the PF and take the money whenever i change the job.

Siva

Good to hear that !