Can Cryptocurrency be considered as an asset class?

So the topic of debate today is “Is Cryptocurrency like Bitcoin be considered as an asset class?”

Till now we all know that there are many asset classes like Equity, Fixed Income, Real Estate, Cash and Commodities. Some people also argue if “Art” is an asset class or not.

And now, there is this new debate is crypto is the new asset class in itself or just an alternate currency or at best a speculative instrument?

Does Cryptocurrency fall under the definition of “Asset Class”?

Investopedia defines Asset Class as follows :

An asset class is a grouping of investments that exhibit similar characteristics and are subject to the same laws and regulations. Asset classes are made up of instruments which often behave similarly to one another in the marketplace.

If you look at “fixed income” asset class and see various instruments under it like Fixed Deposit, PPF, EPF, Senior Citizen Saving Scheme, NSC, Debt mutual funds etc. you will see that they have common characteristics (As they all are basically a loan given to someone) and various laws and regulations are similar across the country and globally (though the names of products can be different)

The same thing can be said to the Real estate asset class where Land, bungalow, REIT, Commercial shops all are physical spaces and their prices go up and down mainly due to similar reasons.

Can this be said for various cryptocurrencies also?

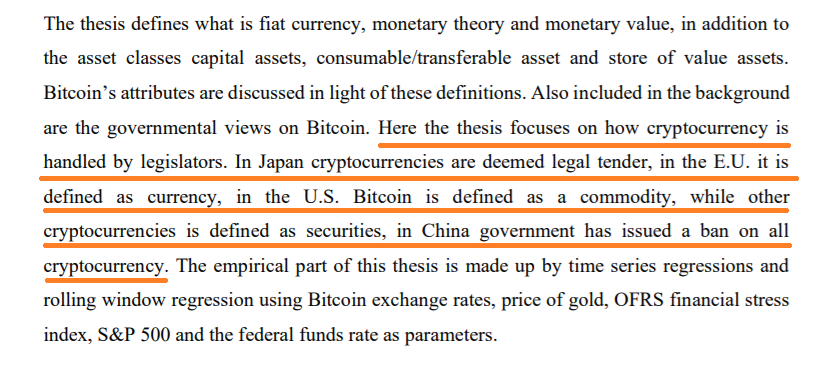

While all of the cryptocurrencies are basically a digital payment alternative based on blockchain technology, we are not very sure if it can also be considered a “store of value” unlike other asset classes. Also, there is no common agreement on how various countries want to see cryptocurrency? While there are various countries that have legalized crypto, there are many that have not done that.

At the same time, a large chunk of crypto investors is buying it mainly for speculative reasons and not as a fundamental investment instrument where they want it to grow in value due to some fundamental reason linked to the economy or its usage.

Here is an excerpt from a paper, which gives more idea on what I am saying!

Why I personally don’t want to consider Crypto as an asset class?

Cryptocurrencies have gained extreme popularity in the last 3-4 yrs and major crypto’s like Bitcoin, Ethereum, Tether etc has seen its market cap go into billions. It’s a complex world based on a very complex technology, which is again not like other asset classes which are quite easy to explain and understand for a common man.

Try explaining Real Estate or Equity to someone against the Crypto mining process and you will understand what I am trying to say.

Another reason why I personally don’t consider Crypto as an asset class is that cryptocurrency is in the end purely a software code. While it’s widely accepted and used, Are we saying that something which is so much dependent on a computer and electricity is considered as an asset class? What will happen if one day the world runs out of energy or all computers crash?

In the same case, things like equity, debt, real estate, cash (in any form), commodities, art all will survive and be there in some form.

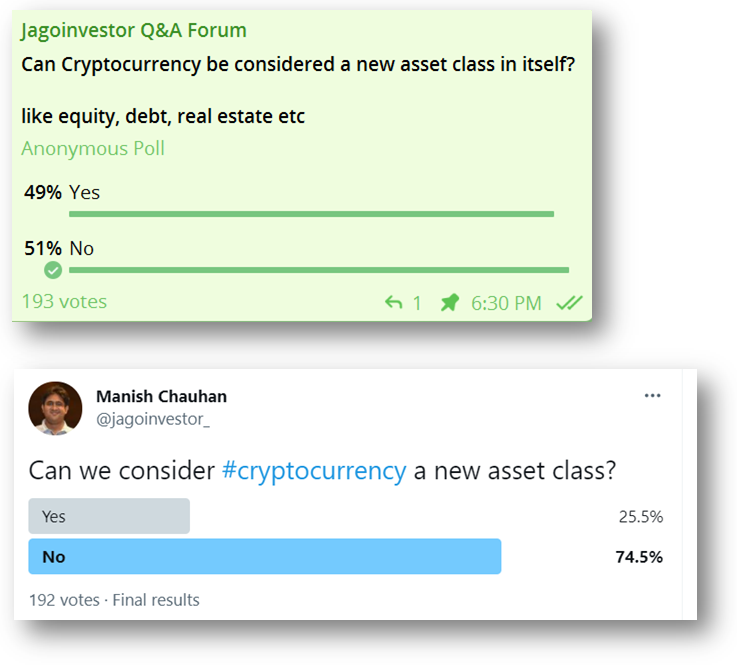

When I asked this question on our telegram group and on Twitter, here were the responses.

Do you consider Crypto as another asset class or just a new-age online payment technology?

Coming to you, it’s also a matter of perception if you want to consider it as an asset class or not. Can you please share your thought process around it? What do you consider it?

Disclaimer: I am not saying that cryptocurrencies will not rise in value? All I am debating is if it shall fall under the definition of asset class or not?

August 11, 2021

August 11, 2021

Bitcoin has already been accepted as digital asset and legal tender. Around the world companies are adding BTC in balance sheet instead of hoarding cash for better returns. You can watch interview of Michael Saylor and Sven Henrich to understand why Bitcoin is disruptive to existing monetary policies.

No doubt on that.

We are debating if it’s an asset class or not?

i would consider crypto is future assest when everything becomes digital. such as banking and real estate handling in digital .digital means digital payment. one can become rich and poor same night. as it is non kyc it should be the future .govt already started digitalise and once digitalsing finishes . these digits will be handles by crypto. so future it will be sure an asset.

I think it can be classed as an ASSET. But a very very risky asset. Of course the trend seems to be bend towards this new found gold, driven mostly by the younger crowd. But what value does it bring in an economic perspective? It is a speculative commodity. What are we able to gauge in the economy by it’s value? One person buys or mines it today hoping that more people will want it tomorrow. One can argue that it is the same with all assets out there. But we must also understand that there is only a predefined number of them that can be mined, beyond that the value of it is just hot air. This hot air ballon will burst one day and many people will loose. Then the next popular crypto becomes the hot cake and the cycle repeats. Then there is also the risk of electronic theft and pick pocketing, as many people will fail to understand it.

Thanks for sharing your view on this Renjith

At present, I do not consider crypto currency as an asset class. I agree with Mr Arun as he rightly pointed that as of now Crypto currency has no RBI/Govt. BACKING, from Indian context.

Secondly, Crytpo currency cannot be considered as a Currency also since the fundamental characteristic of any currency shall be STABILITY. Unlike, a 10 rupees note retains its value of 10 though purchase power may reduce. Crypto currencies fluctuate so much that single tweet had eroded its value by many times.

As of now I would better avoid considering Crypto as any Asset class.

Thanks for sharing your view Mr. Debraj

A 10 rupee note will always remain a 10 rupee note. It’s actual purchasing power reduces over time. Crypto is no different. 1 BTC will always remain 1 BTC. Only it’s purchasing power fluctuates over time. Most of the time purchasing power of BTC increases as opposed to fiat currencies whose purchasing power can never increase.

No fiat currency in the world has any backing or value. The value of rupee is not backed by any hard asset like gold. So it’s absurd to claim that BTC is not a real currency when it’s value is actually decided by the market forces.

There is no doubt that its a real currency. The only question was if its an asset class of its own like equity/real estate etc.

Cryptocurrency cannot be an asset at all because it does not generate income to the holder

Thanks for sharing your perspective

The operational model of BTC has been to safeguard interests of some, at the cost of others. The bigger holders enjoy whilst the smaller holders keep buying and selling to prop or reduce the price like mules. Regulatory oversight is a must, but given the disparity between countries to regulate it, there will be no concerted regulatory framework. FATF travel rule, etc that are still not fully implemented hamper recognition. In any case, the hype is due to the illicit trades on the dark net. It affords enough anonymity to misuse than for any use of value. If BTC is an asset class, then it is ether. Gold can be touched, but ether cannot.

Thats an interesting perspective Roger !

We consider Gold as an asset but what gives Gold its value is limited supply and demand in the market, if I see from this point then crypto like Bitcoin can be considered an asset because of limited supply and demand in the market.

The only doubt I have is what if demand goes down because of various or any reason, will it hold its value?

If you are judging it on just on parameter, then it can be termed as an asset class

You can also explain why people trust US Dollar. US government is printing US Dollars whenever they want without backing it with equivalent gold. So why should we believe in existance of US Dollar?

Its not about one person. If everyone does (majority) thats what matters!

I consider Jagoinvestor as very value adding site in terms of finance related site and one of my favourites. However this time the article is so poor without any content or value. It looks like the person who wrote the article has hardly any knowledge of crypto and is totally biased against it. And what is the argument ?

What will happen is one day the world runs out of energy or all computers crash?

Can the concerned answer me what will happen to all the electrical vehicles which is where we are heading too, If all computers crash will our banking sector and all finance related sectors stock markets , Mutual funds, Insurance survive ?

This article is not to the standards of what jagoinvestor sets.

Personally according to me accepting crypto as a legal tender isnt happening any time soon atleast in india but as a asset class it has already been accepted by the millenials.

Hi Sarfraas

Thanks for sharing your view. I agree that article is written with limited understanding and is personal view (can be biased) . The article is not about crypto authenticity or usage, but if it shall be called an ASSET CLASS or not. Millenials and many more are investing heavily in it, agree but are they looking at it as an investment option, currency, digital currency or an asset class is the question. How are we sure that they consider it as an asset class or just another new type of investment?

Crypto is definitely a new asset class. There is no denying it. The skeptics among us will take time to accept it just like anything new but they will come around eventually. Just because it’s computer code, doesn’t mean it can’t become an asset class. Today everything has gone digital starting from bank accounts to entire financial markets. All records are kept online on servers.

If in the hypothetical scenario you presented, we run out of energy or all computers crash, the entire financial market will come tumbling down. There are no physical equity shares anymore. Real estate registration records are maintained online. Physical bond certificates are not issued anymore. Bank account balance is nothing but numbers on a screen. In the absence of energy, whole economy will collapse since everything around us need energy to run.

I think posting theories about doomsday and zombie apocalypse to justify theories about why crypto is not an asset class is foolish in my opinion. At the end of the day, it doesn’t matter whether anyone considers it an asset or not. It will continue to exist, make inroads and disrupt the old school financial system which is ripe for innovation.

Thanks for detailed comment Shefali

I think you raised some good and valid points. I am not an expert on that and I gave my personal view as a person. If it is accepted as an asset class globally by everyone, who am I then 🙂 . Will have to accept it

Will wait for it to happen. Atleast for now there is no concensus

Thanks for taking time to share your view.. really appreciate it

Manish

I completely agree with Shefali Das. Crypto tokens – whether they are legally assets or not are going to change the way we run finance and NFTs (Non Fungible tokens) will digitize every physical thing that needs to be represented on computers to prove ownership, or transfer, lease the things to other human beings (or machines or Robots in future – who can be ‘legal’ owners of these things).

I have studied this technology and find it holds a lot of promise to take computerization (now called Digitalization of almost everything that is represented on Computers. So best part for all investors would be to understand the impact of these digital tokens on existing assets and the way they are transacted – much more than just computerization of the banking system.

Tokens will gain value over time, so its up to you to consider them as assets or otherwise.

There is no debate on that and article is not even addressing that. It is only trying to ask “Is it an asset class or not” ..

In my opinion it is not a asset because

1) no regulator- increase illegal funding (terrorism, drug dealing…) so governments will not encourage

2) probable of hackers attack and theft. where to complain? to whom?

3) it is based on technology after few years any technology superior than blockchain may make these currencies less secured or easily create able or …..

4) environmental concern is there

5) the purpose of asset is to generate an income that is it supposed to have an intrinsic value ( atleast for gold u can pledge…)

Thanks for sharing your views