Why super topup insurance plans are cheaper than a big cover?

Shall you buy a single big health insurance policy or divide it between two policies (Base cover + a super top-up policy) for a cheaper premium?

The whole insurance industry is busy promoting and selling super top-up policies as a “cheaper way of upgrading” your health insurance cover. But no one is educating investors on the limitations of such combo or exactly why they are cheaper compared to a single cover.

Today, I will do that to the best of my abilities.

Investors have bought various combinations of base plan + super topup plan

- 5 lacs + 5 lacs

- 5 lacs + 10 lacs

- 10 lacs + 10 lacs

- 3 lacs + 7 lacs

- 10 lacs + 20 lacs

and many more…

Recently, we also saw health insurance policies of “Rs 1 crore” sum assured for unbelievable premiums and many investors have also opted for those. Basically, they are simply a combo of Rs 5 lacs + 95 lacs cover (with 5 lacs deductible).

Was that a great choice?

Let’s dive deeper!

Let’s start with an example!

A family of three people (with age 37 yrs, 36 yrs and 6 yrs) wants to buy a 25 lacs health insurance cover. They can do two things

[su_table responsive=”yes”]

| Option | Policy | Premium |

|---|---|---|

| 1st Option |

|

Rs 28,091 |

| 2nd Option |

|

Rs 17,907 |

[/su_table]

In this case, the premiums of the combo (2nd option) is 37% cheaper.

Most of the investors think that both the policies are a “25 lacs cover policy” and the 2nd option is exactly the same as the 1st option but with a cheaper premium.

This is obviously not true!

How is it possible that you get the exact same thing, but with a cheaper premium?

If a combo is cheaper, surely it will also have its own limitations or will fall short of in some situations? That’s exactly what we are going to look at today.

Disclaimer – “Super Top-up” policies are a great choice

I don’t want to sound against super topup plans. They are a wonderful product and have a great role in health insurance, but problem is that people are buying them as a replacement for a strong base cover policy and living in the illusion that they are getting the exact same deal as a big cover.

Let’s start to get into details now.

1. Two Claims instead of a single claim

What does a person wish for at the time of a health insurance claim?

The answer is a smooth and hassle-free claim experience.

I have already made 3 different claims (2 in my own policy and 1 in my father in law policy) in the last few years and hence I can tell you that the claim process is something you dont want to complicate.

When you have a single policy, it means a single claim each time.

What happens when you have a combo plan? Let’s see!

If both policies are from the same insurer

If the base policy and super topup cover are from the same company, then it’s quite a smooth and seamless process, as they can internally cross-check things and coordination is much better. Basically, they have to technically anyways settle both claims, so they will combine them and process the whole thing faster and easily.

If both policies are from a different insurer

However, if both your policies are from different insurers, then it can get complicated and confusing. Don’t worry, you are not losing any money here, but surely it’s a bit of hassle and delay in follow-ups and coordination if the super topup plan gets triggered (which will happen when your base plan is not large enough). Also,

- You will have to keep hold of 2 health insurance cards

- Dealing with 2 claim forms especially for pre & post hospitalization claims (even in case of a cashless claim)

- Communication for 2 policies (this may be easy when the insurer is the same)

- And finally, in case of reimbursements, more documentation (hospital bills/prescriptions)

- With 2 insurers, there may also be a wait time involved for getting the xerox of the bills/claim settlement letter

Also, imagine the scenario of how your family will be able to claim if you yourself will get hospitalized (due to any emergency). Will your spouse/family have enough understanding to follow the intimation and claim process from both the policies.

2. Lower Coverage due to NCB missing in Super topup

Contrary to popular belief, the combo (base + super top-up) gives you a lower coverage compared to a single large cover, simply because of the NCB component which many do not consider!

Surprised?

Almost all the policies come with the NCB feature (No Claim Bonus), where your sum assured keeps going up for every claim-free year. Here are some of the examples

[su_table responsive=”yes”]

| Policy | NCB |

|---|---|

| Care Insurance | 10% increase in sum assured up to a maximum of 50% of sum assured |

| Max Bupa Companion | 20% increase in sum assured per year up to a maximum of 100% of sum assured |

| HDFC Ergo Optima Restore | 50% increase in sum assured per year up to a maximum of 100% of sum assured |

[/su_table]

Now let’s see a case.

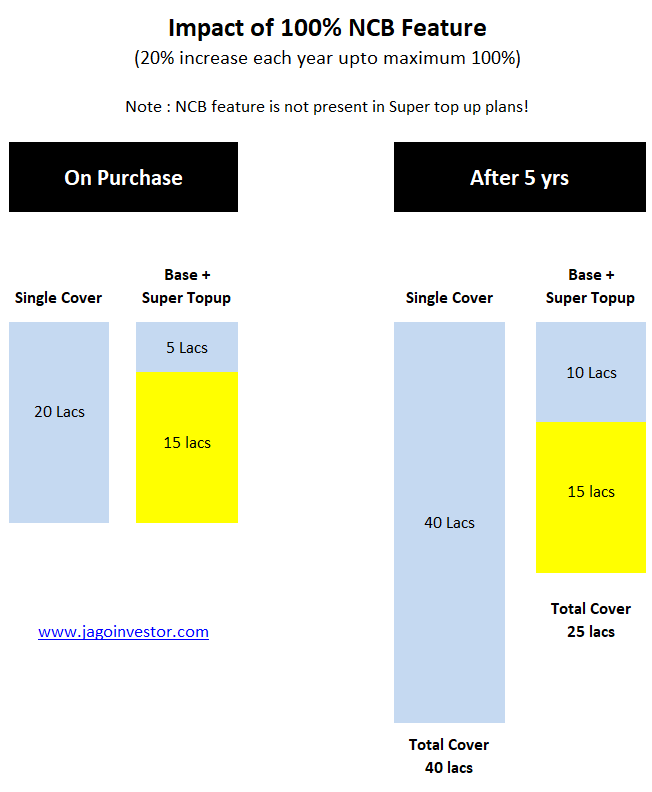

Assume a person wants to buy a policy with a sum assured of 20 lacs. He has two options

[su_table responsive=”yes”]

| Option | Option 1 – Single Cover | Option 2 – Combo |

|---|---|---|

| Combination! | The single policy of 20 lacs | The single policy of 5 lacs (base plan)

Super Topup cover of 15 lacs (with 5 lacs deductible) |

| NCB Benefit | 20% each year (up to 100%) | 20% each year (up to 100%) applies only on the base plan

NCB feature is NOT applicable in Super topup policies |

| Total Sum Assured at the start (when you buy policy) | 20 Lacs | 20 Lacs |

| Total Sum Assured after 5 yrs (claim-free years) | 40 lacs

(base policy X 2) |

25 lacs

(base policy X 2 + super topup) |

[/su_table]

Now you understand why the premiums for super topup cover is less than the single large cover.

Here is the pictorial representation of the above example

So, you can see how after a few years there will be a gap of 15 lacs in sum assured in the combo plan. Now do the maths for a total cover of 10 lacs. What will happen if you divide it into a 5+5 combo?

3. Lower Coverage due to Recharge Benefit (2 large claims in a single year)

There is something called “Recharge benefit” in health insurance policies these days, which refills your policy again up to the sum assured when the sum assured reduces due to any claim. Like if you have a 10 lacs cover, and you claim for 4 lacs, then the policy will come down to 6 lacs, but then due to recharge benefit, the sum assured will again rise to 10 lacs (the added sum assured can not be used by the same person for same illness for which he/she claimed)

Now, let’s imagine a case

Assume, that in the worst case there are two big claims in the same financial year. Like what happened with few people in this Pandemic. Imagine one person getting hospitalized due to corona and then after 4-5 months, another person in the family also getting hospitalized. Or imagine someone in the family getting treated for a big illness and then after a few months, another family member getting hospitalized due to a severe accident also.

Very low chances of this happening. RIGHT?

Yes, but it can not be ruled out at all!. It’s the extreme end I know.

How will be the claim experience in both cases? Let’s compare the same example (forget NCB for the moment)

[su_table responsive=”yes”]

| Option | Option 1 – Single Cover | Option 2 – Combo |

|---|---|---|

| What? | Single cover of 10 lacs | Single Cover of 5 lacs (base plan)

Super Topup cover of 5 lacs (with 5 lacs deductible) |

| 1st Claim by husband for Rs 8 lacs | The claim will be paid for 8 lacs | 5 lacs claim paid by the 1st base policy

3 lacs claim will be paid by super topup policy

|

| 2nd claim by a spouse in the same year for Rs 10 lacs | Because of the recharge benefit, the spouse will be able to claim for a total of Rs 10 lacs | Because of the recharge benefit, the base policy will pay 5 lacs

But the super topup will pay the remaining 2 lacs only. 3 lacs will have to be paid by policy-holder LOSS of Rs 3 lacs here compared to 1st option |

[/su_table]

The point is that recharge benefit can also come into play in some very unlikely situations, but that feature is missing in super topup plans.

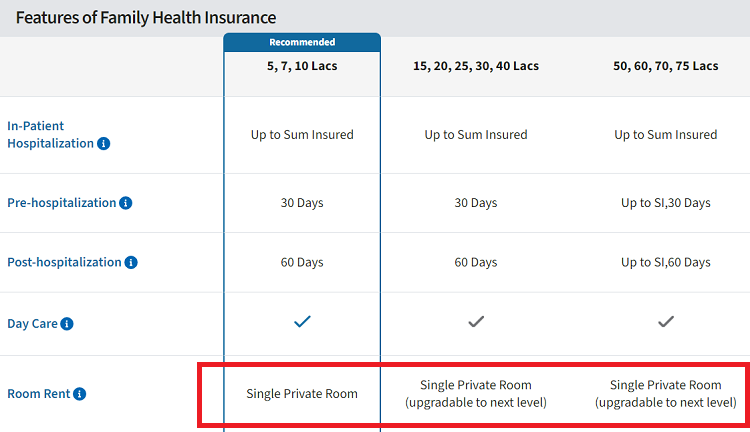

4. Difference in room rent limit

One major thing you have to consider is the difference between room rent limits in both base and super top-up.

Here is an example.

- At the time of writing this article MaxBupa Reassure plan (recently launched) has no room rent limits.

- However, its Health Recharge plan (the super topup policy) mentions that you only get a single private AC room in the plan.

Note that there are various types of single private AC rooms in a hospital. What you get from your insurance policies is the cheapest “Single Private AC room”.

Now let’s see 2 cases with an example

- Total health cover: 20 lacs

- The room category: A higher grade single AC room (higher quality and better facilities). Imagine the cheapest AC single room was not available or you wanted to go for the better facilities.

- Final Bill amount: Rs 11 lacs

Case 1: You have a single policy of 20 lacs (Maxbupa Reassure, just for example)

In this case, because there is no room rent limit, your total claim amount is admissible and your claim process will happen smoothly.

Case 2 : Now imagine that you have a 20 lacs cover but in combo form.

You have a 5 lacs base plan (Reassure policy) + 15 lacs of super topup with a deductible of 5 lacs (Maxbupa Health Recharge)

Now the first policy will pay the claim of 5 lacs easily because there was no room rent limit in the policy.

However when you go to claim the additional 6 lacs in the super topup, here is what will happen.

If you had chosen the cheapest AC single room, your total claim of 6 lacs would have got admissible and processed. However, because you choose a higher category room, you will not be paid proportionately only.

If the room rent for the cheapest AC private room was Rs 8,000 per day whereas you choose the one whose rent was Rs 12,000 per day. You will be paid just 66.66% (2/3rd) of the claim amount, which is only Rs 4 lacs

This is called a Proportionate claim in health insurance. This may happen in reality if your base cover is a small amount and a big claim arises. If you choose the cheapest single private AC room, then there won’t be any issues, but otherwise, there can be issues and this can happen even if you bought the policies from the same insurer (like in this example I gave)

Another example is of Care Plan from “Care Insurance” formally known as Religare Care.

In Care Insurance the room rent for a 5 lacs base cover and 15 lacs of super topup cover is “Single Private AC Room”

Whereas if you take a larger single cover, the room rent is “Single Private AC room (upgradable to next level). This gives you enough flexibility and freedom to enjoy better quality health care and facilities. Sometimes, the single PVT AC room of the lowest category may not be what you wish for.

Imagine you need a bigger space and better facilities in the room, in that case, more deluxe rooms will be required by you. This is where you may lose in a big way (not today, but maybe in future or in case of large claims).

Here is the snapshot from the Care Health Insurance website.

Old Policies – If someone has taken 3-5 lacs of sum assured a few years back (especially from PSU companies), there is a good chance that there is a room rent limit of 1% of sum assured (example – Oriental Happy family floater plan). Now if you are buying a super topup plan, there will surely be a difference in the room rent limit.

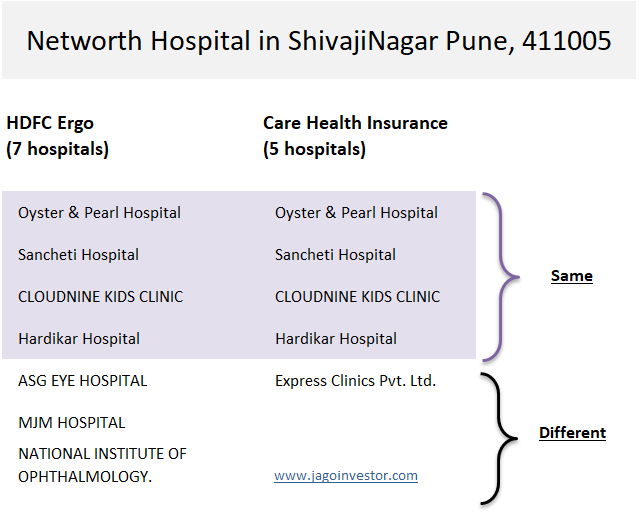

5. Different Cashless Network of Hospitals

If your base policy and super topup policies are from different companies, there may be a possibility that the hospitals in their cashless network are different to some extent. You may face some issues in future due to this.

Here is an example

I checked for network hospitals between HDFC Ergo and Care Insurance for Pincode 411005, which is Shivajinagar, Pune.

I found that HDFC Ergo has 7 hospitals and Care Insurance had only 5 hospitals in their network (in March 2021). Out of these 4 hospitals were common, the rest were different.

Now, what if your first policy is cashless but your sum assured in the first policy is small. In that case, the 2nd policy (super topup) will get triggered, but here you will first have to spend the money as it’s out of the network of the 2nd insurer)

You will then have to file a reimbursement claim later and do the documentation part too.

This will not be the case if you had a single large cover from the 1st company itself. You may argue that you will plan well before getting admitted to the hospital and try to match the one which is there in both policies, but trust me, in real life it will be tough.

When a doctor tells you or recommends that you get admitted to hospital XYZ (often he is also a practising doctor in that same hospital), it becomes quite tough to challenge that or counter his suggestion.

6. If policy tenures are different for both policies

In some cases, you can face issues in the claim, if you purchased both base and super topup policies in different months (same or different insurer, does not matter).

It may happen in some specific cases that your claim is not admissible under any policy.

This is explained very well by Mahavir Chopra of Beshak.org in his article here. I am just sharing what he wrote originally.

Say you have the following Combo plan.

Base plan of Rs. 2 Lakh (Plan year: January 2021 to December 2021)

Super Top-up of Rs. 5 Lakh with an annual deductible of Rs. 2 Lakhs (Plan year: April 2021 to March 2022). (This means for the Super Top-up to pay, the hospitalization expenses should cross Rs. 2 Lakhs in the policy period in question – which is April 2021 and March 2022.)

Now, say you undergo two hospitalizations in the year 2021.

The first one happens in January 2021, the bill amount is Rs. 2 Lakh. Now this is covered by your base-plan there is no confusion, and the claim amount is paid.

Next – you undergo a hospitalization in April 2021. And the bill comes to 1.5 Lakhs.

Now, take a guess on – who will pay for this?

A. Base-plan

B. Super Top-up

C. You

If you guessed A or B – then you’ll be up for a BIG surprise! Here’s how your two insurance plans will look at the second claim.

Your base plan will not pay: Because – you have already exhausted the cover amount available for the year (January 2021 – December 2021)

Your Super Top-up will not pay: Because the Super Top-up plan pays only when the hospitalization expenses during the policy period of April 2021 to March 2022 crosses the deductible of 2 Lakhs. In this case, the total hospitalization expenses during the period in question (Apr 21 to Mar 22) are only Rs. 1.5 Lakhs – hence the claim won’t be payable.

These were some limitations of the super top-up you should be aware of. It’s better to get educated about this aspect, rather than getting shocked and disappointed in future.

Some other small Differences

Apart from the major points discussed above, there are other minor but important points you should know

- Annual Health Checkup Benefit: With a single large cover, you may get superior annual health checkup packages that cover more tests. But with combo plans, you may get normal test packages in both base policy and super topup, which is of less use as no one will do the test twice just for the sake of it. Some policies also offer health checkups only once in two years for smaller covers.

- Hospital Cash Benefit – In many small base plans like 5-10 lacs, the hospital cash limit is Rs 1,000 per day. However for a bigger sum assured, the hospital cash will be in the range of 3000-4000. If you stay in the hospital for 10 days, this means getting 10k only in combo plan vs 40,000 in a single bigger cover.

- Organ Donor Cover / Ambulance Charges – Again, a lower sum assured plan night have a lower benefit compared to a single big cover.

- Waiting period – It might happen that the waiting period for pre-existing illness is different in both policies, just check that.

- Pre & Post Hospitalization Tenure is different – It may also happen that both policies have different pre & post hospitalization tenure.

- Other Minor Changes – Apart from the points above, there are many other minor differences in the bigger sum assured (single policy) which may be useful for you in some specific cases, which we are not covering here

How to look at Super Top-up policies? What is the right combination?

Everyone shall have a large enough cover with a single policy as the first step.

With NCB benefit, that large cover will also get ballooned to every large cover. And with recharge benefits, you will also get those edge cases covered. This will make sure that for many years to come, this single policy will be enough for you.

There are very low chances that in some worst cases, you may still have a very big claim when this single big large cover will not be enough, and that’s when super top-up cover shall come into the picture and that’s exactly why they were designed for.

To cover those extreme end cases!!!

But investors have just started using them with a small cover for the sake of saving some premiums. No doubt you will have a few thousand for many years to come, but there are also limitations which we talked about.

Considering the point above, the minimum base sum assured which I feel one shall take in 2021 is Rs 10 lacs. With NCB benefit, it may become a 15/20 lacs cover, which is good enough for the majority of claims. Anyways the average claim is quite small!

How big was your last #healthinsurance claim?

(Only for those who filed a claim, irrespective of how much was paid)

— jagoinvestor.com (@jagoinvestor_) March 17, 2021

Does it mean you need to take a 50 lacs cover? NO 🙂

So what combination to buy?

Speaking for the majority, I think a Rs 10 lacs base policy with an NCB of 50%/100% and a super topup of 30-40 lacs with Rs 10 lacs deductible is a good enough choice right now. This will balance the premiums and coverage. If you want an even high single cover policy like 15-20 lacs, go ahead!

But also remember, that within the next 10-15 yrs, even the 10 lacs coverage may look like a small one and you may feel that the base policy should have been for at least 20-30 lacs. So take your decision after careful thought.

You can always upgrade your base cover sum assured at the time of renewal.

Do let me know if you have any queries or comments?

Credits – Thanks to Mahavir Chopra of Beshak.org to correct me on some points in this article and also give his valuable insights from time to time because of which I was able to bring depth to this article. Mahavir Chopra is a veteran and a well-known name in the insurance industry and they are doing some cool stuff on beshak.org in the area of insurance. Do check out their website!

April 14, 2021

April 14, 2021

Hello Jagoinvestor, I read the article and it was very helpfull for the peoples like me ? I need real quick advise… I have group mediclaim from company coverage of 7 lakhs. I am thinking to buy a priavte policy to have higher coverage because 7 lakh is not enough for family of 4 incase of any unfortunate. Planning to go for 10 Lakh base + super topup ( may be 50L or 1 Cr because premium differnece is very less). Verified HDFC Ergo Optima restore (felt expensive) Niva bhupa Max saver (combination of Re assure and Recharge). Niva bupa comes with very reasonable premium but unable to decide anythig yet due to delima ? I do not have personal experience\heard anythiing about claim process\arguemnts with pvt insurance peoples. Also please explain about PED’s and loading charges. I understand loading charge is to waive off the waiting period (3\4 yrs) of PED’s. Regards, Prem

Hi Prem

I suggest you contact our team who can help you understand various points and also help you in choosing the right policy between HDFC and NIVA

Do mail me at help@jagoinvestor.com and I shall put you in right hands

Manish

A very insightful article, Manish. Thank You.

Thanks Pratik

Hello Manish,

Your post is awesome. You made it a skyscraper on the topic of super top-up health insurance. The way you describe each phase with visual elements and comparison is much appreciable.

I am from Vital, a startup that is offering innovative and personalized health cover. After going through your blog, I understand your deep knowledge of super top-up health insurance. I hope we can give more value to the audience by working together.

I am exploring your more blog particularly on health insurance topics with the hope that you will publish more such stuff.

Thanks

Bibhu Prasad Sahu

Thank you for sharing the information. Wonderful blog & good post. It’s really helpful for me, waiting for more new posts. Keep Blogging!

Welcome

a very good article manishji,

i have one doubt kindly help me to clear it

I have indian bank arogyaraksha floater policy with 5 lac coverage for last 20 years which include my family (2+2) + my mother(73) . now i want to take super top up plan but i am not able to get plan for 5 people. if i purchase super top up for my family(4 person) for 15 lacs and if i claim for my mother for 5 lacs and if in future i have to claim for my family then super top up will activate or not ?

what to do kindly guide me.

thanks in advane

PRASHANT DOSHI

Super top up does not know anything regarding your base cover.

When you claim for super topup for a person, it will just pay above Rs 5 lacs bill. Thats all

I have a 25 Lakh super topup with 10 lakh deductible. Base policy and super top up policy tenures are different

Your point no.6 – ‘If policy tenureus are differnt for both policies’ has exposed lacuna.

A big thank you.

I will try to sync the tenures

Great.. yes just fix that!

Manish Sir, As usual, you articles are always insightful, detailed, factful and beautifully scripted.

Kya Sumeet, kya haal hai .. Thanks 🙂 .. Good to see you are reading the articles written by me 🙂

such a great article through which you can know about many things regarding health insurance, but in this pandemic, it best to take an online health policy through which there is not no agent present and no any commission with be charge.

Nice article. it explains edge scenarios too.

I have a base policy of 5 L, Super top-up of 15L ( deductible of 5L)/

wanted to increase coverage, planning to take another Super top up with 50 L as premium.

( when I checked, they say, no option to increase premium now).

having 2 super top-up plans, does it benefit. ( what will be deductable to choose in the second super top-up., either 5 L or 20L )?

Please share your thoughts.

Does not make sense to take 2 super top up .. JUst have one !

Thank you for your response.

As no option to Increase of premium now.. recently seen that 50L/1Cr policies of My: health Koti Suraksha from HDFC ergo. ( my previous one also from the same HDFC).

how about taking 1 cr /50L of above.. does it make sense. ( current coverage has 20L ( base+super topup)

Please share your inputs..

exclusive 1 cr policy premiums are lesser compare to old policies. ( 1cr policy premiums are near to 20 L old base policy) are there any hidden rules 1cr/50L in these – which are not covered in old base policies?

if possible, write an article on the recent trend of 1cr policies of different comapnies. is it really worth considering…

You can take a supertop up of 40-50 lacs if needed .. but 1 crore is very high .. though premiums are on lower side, it looks on higher end..

Will write on that!

Manish

I found only this article to clear the doubts about single vs top up policys, Thanks for the efforts 🙂

Welcome

Thanks

Nicely explained. I have base cover of 5L wanted to increase sum insured. Got to hear from insurance that company base cover cant be increased and only super top up can be done and its fixed to 15,30L. why is it so.?

Some policies do give option to increase base sum assured of the policy but at the time of renewal. Which one do you have?

i have Tata AIG. In general how is the feedback and CSR?

Its good enough .. nothing to worry

Very informative article, Manish. Thank you.

Reg. 6. If policy tenures are different for both policies => This would be a problem in case the base plan has exhausted. The “ReAssure” plan in MaxBupa provides unlimited reinstatement of SI for any person under the policy for any illness( same or different) which would solve the issue.

Super topup comes into picture when one single claim is of a big amount, in that case even reinstatement will not help

Manish

I with my wife and two adult sons have taken Bajaj’s Individual Health Guard policy of 5 Lakhs each. I also have taken 25 Lakhs Top Up policy of Bajaj Extra care Plus with 5 Lakhs as deductible. I plan to increase the sum insured of Extra care Plus to 50 Lakhs on renewal either this year or next.

What is your take on this ? Is this good or need a change ? Expert opinion solicited.

Thank you

As you have already taken then, its fine

But I would recommend increasing the base cover to 10 lacs. Top up increase it secondary at this moment for next decade!

Manish

I think one should create a corpus for medical expenses. Insurance companies do their best to complicate the claim process. I had one successful claim till now, but the insurance company settled the amount one year later!

In another case, they created so much difficulty that I chose to pay from my pocket. One does feel cheated but unfortunately, going without insurance is too risky. So the bitter truth is to take the insurance despite knowing that the system will make you jump through fire to get the claim.

On the side, add 30-lakh/50-lakh/1-crore to your retirement goal and keep it aside just for medical expenses.

Also, create a ‘death protocol’ by talking with your loved one when things are okay (not during a medical emergency when emotions and stress run high). One needs to decide to stop treatment after a threshold. There are stupid platitudes like ‘human life is invaluable and blah blah’. But in reality, we know that survival in abject poverty and bankruptcy (which medical costs can impose) is not a good choice either. So create the threshold after which you should tell the doctor to stop treatment and accept the “grim reaper” as inevitable (rather than throwing your family under the curse of poverty or other’s charity).

Very good point Sambaran 🙂 . thanks for sharing these ..

Hard pill to swallow. But truth as i understand 🙂

Very well put sir. Totally agree, seems harsh , but it is necessary. I personally strongly believe in the Do not resuscitate option ( DNR ) being exercised and the family being appraised of this choice of the individual

In the example, age of insurers have taken 37, 36, 6 but in reality, young people are not much required medical treatment except in some extreme situation like accident etc. so, young people is required such policy which have lower premium and cover such situation like accident insurance policy rather than top up policy. Article is not speak about people above 50 years which much needed health insurance and now a day, premium of policy after 50 years is very high and I don’t think every above 50 years may able to take health policy for 15-20 lacs, its near to impossible. Even, premium of 5 to 10 lacs policy is very particulars from last year after corona. I noticed that my health policy premium is now double then last year.

Health insurance for people who are nearing retirement is tricky. We just need an audio session on that topic on our telegram group.

I have to tell u something. Jago investor you r a brilliant mind. We think alike ????. 6 years ago, I spent 7-8 month deciding which is best for today and would take care of future inflation. I opted Health companion family first… having base sum 5 lakhs and 20 lakh floater. Now it is 10 + 20 ( after 5 years of NCB ). I am 42 now. But just to be a little safer for future or unforeseen may god forbid bigger claim… I am adding a top up of 25 lakhs ( Health Recharge ) with 5 lakh deductible ( on 25 lakhs sum assured I will get NCB of 5 % upto 50%, then my top- up would become 37,50,000 in next ten years) in total all of this I’d costing me Yearly 15400 INR approx at the age of 42 with safeguard rider ( which take care of consumables and increase base sum on CPI index ). What’s ur take on it…? I have spent months and hours going through all possible scenarios I can think off to keep the premium affordable but still have a very strong policy.

Its a wonderful strategy 🙂 .. Good job ..

Just one point is that over time this premium will change and we have no clarity on how that will happen , so just be ready for that.. other wise you are doing great!

Manish

Yes ! I am aware that premium will keep on increasing & So would medical inflation . I have a very strong strategy to take care of premium so that I never have to worry. The 20 lakhs floater is shared between me and sibling. So we need a individual Top- up to take care further unforceen.. I always tell family and friends that a lot of ppl invest in Wealth and property but a very few invest in Health, I am investing towards health. Money come and go. ????

Great thought process sandeep 🙂 ..

Thank you so much Manish. Keep education people. Good karma always pays ????????

Thanks

Few years back Jagoinvestor itself was promoting Top up policies and were telling those are best suited for individuals. Wish the amout of inisight which was done now was done 3-4 years back before suggesting to customers.

Topups are recommended and we still buy/sell them.

Just that we have got better visibility now. Health Insurance is complex subject. Are you not happy that we are bringing this to you all now and not sitting mum on this?

Manish

Very insightful article. I believe that one should take a base cover for 20L and a super top up of as much as 1crore with a deductible of 20L. At such a high deductible, your super top up premium is very low. I think it will be useful many years down the line. I dont even like to consider the employer provided health insurance of any use.

Yes sort of.. 20 lacs or 10 lacs or 5 lacs, thats the customer decision now!

One of my recent experience (Apr 2021) with the health insurance really shaken my beliefs in the health insurance. We checked quite a few hospitals to admit our patient and all the doctors said that there is no bed available for you, if you are backed by insurance but if you are willing to pay by cash without bill, we can arrange something for you. I was a big fan of insurance until then having base policy + super top policy in my pocket. Insurance doesn’t come to our rescue during our need. Common sense and love for patient made us surrender and our got hospitalized and discharged with hepty bill. Now I am rethinking…

1. Have I took insurance for happy day scenario?

2. Why shouldn’t I be like 90% of an uninsured population in india?

Hi Abhay

No denying that this can happen and happens. I also went through 3 claims in last 3-4 yrs, 2 cashless and 1 reumburement. So its can be specific to your geography also at times.

There are many who dont experience what you experienced personally.

This is not a failure of insurance itself. It shows the greed and opportunistic mindset of hospital.

Insurance is for risk mitigation, not for avoiding it altogether.

I understand the frustration of feeling cheated. But, there are lakhs of people who would have claimed benefits under insurance in covid related admissions. Hope the situation gets better soon.

I think your examples are created just to drive your point and not close to reality. who will take just 5lack as super top up as pointed in point no.3, forget about who will take, who is offering such low super top ups.

Hi Harsha

5 lacs super top with 5 lacs deductible means you bear the first 5 lacs and the next 5 lacs is given by insurer. This is industry term.

All insurance company give this combo

Also I have already shared that there is low probability of these scenarios and these are not going to happen very frequently. I mentioned that already.

Manish

A very insightful article, Manish. Thank You.

I believe that super top-up comes as a good cushion for people who have employer provided insurance (5/10 L), from my understanding, the super top is something like you should “buy and forget, and keep renewing”. 20-25 years down the line post retirement, this will become more fruitful and then it will make sense to take a base policy of same insurer, as your employer insurance will cease.

Kind of yes.

But in future, you may not be eligible for the base cover if there are any illnesses or major issues with you.

Yeah very true .. have seen some real time cases. Once a major illness occurs no company provides health insurance