Can you get a plot loan if you don’t want to construct a house?

Lots of people in India want to buy land, especially investors from big cities as land is a scarce commodity and it sounds amazing to build your own house on a piece of land instead of staying in apartments.

However, do remember that there are no specific loans available to buy agricultural land. The only loans available to buy the plot are for “residential plots”, which means that if you take these “plot loans”, you need to also construct a house within 2-3 yrs of buying the plot. You can’t just buy a residential plot and skip building the house.

However, many people do that. Some intentionally and some out of ignorance.

- What exactly happens when you dont build the house on a plot taking on a loan?

- Is there a penalty?

- Can there be any actions against you?

What happens if you dont build the house on the plot?

When you take a plot loan, it comes at a lower interest rate because the assumption is that you will be building the house on that land within 2-3 yrs. But if you fail to do that and dont submit the required documents (completion certificate) to the lender on time, your loan will be converted to a normal loan and the interest rates will be increased by 2-3% with a retrospective starting date as per the agreement between you and the lender.

This means that your loan outstanding amount will go up by some amount due to this change and you will have to now pay that additional amount. At the end of 3 yrs, the bank will ask you for the proofs of construction, and if you fail to submit them, you will have to pay an additional amount.

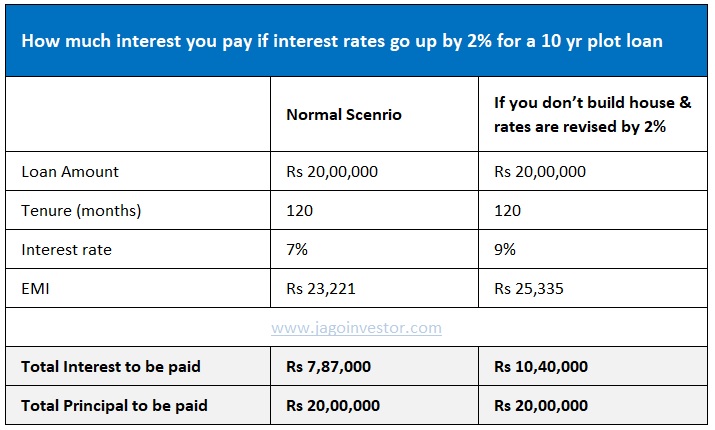

Here is an example of a Rs 20 lacs plot loan which is taken for 10 yrs @7% interest rate. The interest to be paid in this case will be 7.87 lacs apart from the 20 lacs principal amount.

Now if the interest rates are revised to 9% (2% increase) the interest, in this case, will increase to 10.4 lacs, which is 2.53 lacs more than the original amount.

Is there a single loan for plot and house cost?

Some banks like SBI (as told to me by a representative) first issue a plot loan and then after 2-3 yrs issue another home loan for the purpose of constructing the house (two separate loan account numbers), whereas some banks may issue a single loan itself for both purposes and it will be mentioned in the agreement (for example 40% amount is for plot and 60% for house construction).

Note that you can avail of 80C benefits as these loans are issued as home loans (the part of the loan which will be used for house construction).

Wrong information was given by the bank representatives

Many times you may get wrong and misleading information from the bank representative. They may tell you that “Nothing will happen after 3 yrs, dont worry” or “These are all just formalities..” mainly because he is interested in getting the loan approved due to their targets. This is wrong and makes sure you dont believe them. Always rely on what is written in the agreement.

Note that the loans are given at a cheaper rate for plots because there is a bigger agenda of RBI and govt that everyone shall access to housing. If you are buying the residential plot simply because you can sell it off in future for profits then you cant get the benefit of the lower interest rates.

For you, the interest rates will be revised because you will have to construct a house on the plot after 2-3 yrs as per rules.

Some features of plot loan

- The age requirement is between 18-70 yrs.

- A CIBIL Score of 650 or above is required (in most cases)

- Up to 60% to 70% of the property price is given as a loan depending on the bank.

- These loans are given for a maximum of 15 yrs tenure

Points to remember before going for the plot loan

Make sure you take these plot loans only in case you are really interested in building the house. You can also ask the bank to first disburse only the loan amount for the plot and later release more amount at the time of house construction. It’s really not worth playing around with bank and playing tricks as it will mostly waste your time and you won’t gain much in case you dont want to build the house.

Here are some more important points which were shared by our reader Jayaprakash Reddy

- Generally, banks calculate plot value based on the sale deed value, most of the cases sale deed value is lesser than the market value. Also, as mentioned above, banks like SBI will only consider sale deed value but some private banks might also look at market value in that area and which will be derived through their certified valuers. SBI will give a loan on plot purchase (House construction in future is intended) up to 60% of the sale deed value and it is the same with even private banks but that will be on market value.

- There is no clarity even with bankers about what happens if you sell the plot within a year or two without construction, most of the representatives told me that it will be like closing a home loan but I guess that’s a false statement and depends on the bank and agreement if mentioned specifically in it.

- The total loan again depends on the construction value in that area. For example in the area where you are purchasing a plot, the construction cost could be 1500/sqft. Then based on the sqft you are planning to construct the total loan amount will be derived. Let me put it in numbers:

Plot Area: 300 sq yards. – SBI bank loan – Sale deed value is 10000/sqyd – 30 lacs. For plot purchase – 60% of 30lacs will be given to you as a loan. 18lacs loan will be provided by the bank, this is given as cheque payment directly to the seller. For the construction of the house, they will provide it based on the sqft permission you got. For example, in a 300sqyrd plot if you are constructing G+2, then you might get permission to build ~3000sft (not an exact number). So the construction value of the house will be 3000*1500 = 45lacs, out of this bank will give you up to 80% loan, which again depends on your credit rating.

In total, you can get a 63 lacs (18+45) loan, provided you are eligible for such a loan based on your income. - To prevent malpractices, in the case of a home loan, the bank keeps the sale deed of the plot. With documents not available, one can not legally sell the plot. There can be a word of mouth agreement whereby the buyer can give money to the seller to release the loan and documents and then purchase.

Also, here is a checklist before buying a plot in India in case you are planning to buy one!

Do let us know if you have any questions

March 10, 2021

March 10, 2021

What if I pre close the loan within the tenure. Should I still construct the house still?

I guess it wont be allowed that way. When you prepay it fully, there will be a check done and more interest will be put on you

Manish

What if we pay the loan within three years? Do we still need to construct the home?

Yes.. else pay the higher interest

The interest is for the entire loan tenure or what ever EMI which needs to paid.

Nice article. It is good to know that I can apply for a plot loan. But have a query. Can I convert the plot to commercial after getting the residential plot loan?

I dont think so . Every land has its usage defined..

There are many issues where clarity is not there in this process(at the bank level). Hence each bank is following its process and only a few banks give this loan.

Housing is a priority sector lending, that is why the interest 1.5 to 2 % less than normal loans. Plot purchase can be considered a priority sector, only if there is an intention to build a house subsequently.

Plot loan:

One can purchase any size of the plot and construct any size of the house(within rules). Thus the area of construction (theoretically) is not known at the time of loan approval. The ratios of the plot: house thus are not absolute.

Now the circle rates. In many states, circle rates are much less than the market rate. Generally, banks go by circle rate and provide 50-60% of circle value as a loan. If a bank is aggressive, it can take the market rate as a basis and provide a loan. But it is risky, as market rates are not absolute. As a bottom line, one will get a percentage of plot rate as a loan. The complication with sale deed value is that the sale deed happens on sale. The bank loan component is to be given for the sale to happen and the sale deed to be generated. Hence banks can go by circle rates on a conservative side for this assessment. This is what happened to me @HDFC a few years back. For a requirement of about 25 L of plot value, they offered 6 L, which i did not utilize.

House construction

Though it is a combined loan, value is not precisely known upfront. So banks give a period for construction(3 years is the period given by HDFC 4 years back). In this, if one is going to construct, get the plan approved and submit the estimate to the bank for approval of the construction loan.

There is no clarity on loan closure after plot purchase. When a plot is purchased(or a house is being constructed), the bank takes the sale deed documents of land(and returns on the closure of the loan). So without bank consent, the plot cannot be sold legally. In this context, it will be dangerous for one to purchase such a plot, as subsequently bank or seller may renege on the sale.

Thanks for raising an interesting topic.

Thanks for sharing more points.. Can you elaborate more on “it will be dangerous for one to purchase such a plot, as subsequently bank or seller may renege on the sale.”

Are you saying that one may face issues in selling the plot if house is not bought?

Manish

Real estate purchases as tricky. One needs to check and go by original documents.

To prevent malpractices, in the case of a home loan, the bank keeps the sale deed of the plot. With documents not available, one can not legally sell the plot. There can be a word of mouth agreement whereby the buyer can give money to the seller to release the loan and documents and then purchase. I am referring to this type of purchase, which can be dangerous to the buyer.

Got it 🙂

That’s why customers go for Top-Up Loans/Mortgage loans as a workaround

Yea thats always an option 🙂

HDFC Plot loan is till 5 years provided at home loan interest. After 5 years, there will be additional 2% interest if house construction is not started. If we close the plot loan with in 5 years, will there be any additional burden.

Thanks for sharing that. I came to know about HDFC 5 yrs policy yesterday itself

This additional 2% interest will b eon the remaining EMI’s to be paid or added to the entire principle amount ?

That was informative and good to know. There are few more points we need to consider while going for such loans.

1. Generally banks calculate plot value based on the sale deed value, most of the cases sale deed value is lesser than the market value. Also, as mentioned above, banks like SBI will only consider sale deed value but some private banks might also look at market value in that area and which will be derived through their certified valuers. SBI will give loan on plot purchase (House construction in future is intended) up to 60% of the sale deed value and it is same with even private banks but that will be on market value.

2. There is no clarity even with bankers about what happens if you sell the plot within a year or two without construction, most of the representatives told me that it will be like closing home loan but I guess that’s a false statement and depends on the bank and agreement if mentioned specifically in it.

3. Total loan again depends on the construction value in that area. For example in the area where you are purchasing a plot, construction cost could be 1500/sft. Then based on the sft you are planning to construct the total loan amount will be derived. Let me put it in numbers:

Plot area: 300 sq yards. – SBI bank loan – Sale deed value is 10000/sqyd – 30 lacs.

For plot purchase – 60% of 30lacs will be given to you as loan. 18lacs loan will be provided by bank, this is given as cheque payment direct to the seller.

For construction of the house, they will provide it based on the sqft permission you got. For example in a 300sqyrd plot if you are constructing G+2, then you might get permission to build ~3000sft (not an exact number). So the construction value of the house will be 3000*1500 = 45lacs, out of this bank will give you up to 80% loan, which again depends on your credit rating.

In total, you can get 63lacs (18+45) loan, provided you are eligible for such loan based on your income.

This is very recent information I got from couple of bank representatives.

Thanks for sharing these points Jayaprakash

I have added these points in article and given your name as credits 🙂 . Thanks for your contribution!

Manish

What if we sell the plot in 2 years and pay the loan back ? Will there be any extra charges or normal closure.

I dont think its going to be normal closure. It will still be requiring the documents .. else you need to pay as per higher interest rates

Manish

Very informative article…please keep sharing

Thanks