How long will you live after retirement? (Its not 80 yrs)

70-80 yrs.

That’s what most of the investors answer when they are asked – “How long are you going to live?”

Truly speaking, no one knows how long will you live!. We may die at 60, 70,80, and 90,100 or may be 47 or next week!. Who knows?

In most of our workshops and even the online webinars, when we asking this question “How long should you plan your retirement?” . The standard reply is 75-80 yrs. Only 2-3 people among the ground of 40 will murmur a number like 95 yrs. or something like that and obviously face the horror from of those who are confident of not retiring with enough corpus.

Today, we are trying to answer this question from retirement planning perspective. When you plan for your retirement corpus, it depends heavily on how long you are going to live!. If you live for a short period, you need less wealth. If you are going to live for a very very long time, you are going to need a very large corpus.

Your answer to “How long will you live after retirement?” will also vary depending on how happy are you with life overall currently. If you are stuck in your job, where you feel frustrated and also have not been able to reach some milestones in life, your answer will show the pessimism and you might say “75 yrs” is enough for me”

However if you are full of life, very happy right now, in a great health and have been doing great in your financial life, you might say “I would love to live till 90 or 95, Life is so beautiful”

But, Most investors get it wrong

Coming to the main question we are trying to answer today, we want to investigate or rather get enough clues on how long we can expect to live in retirement. Finding a good enough answer is critical for every one of us, because then we can design our life, priorities and investment plan for retirement based on the answer we get today.

I want to convince you today, that if you feel that you will just live till 75-80 yrs. only, then maybe you need to change the way you look at it. May be you are planning is wrong. May be you are taking the best case.

The biggest retirement worry most of the people (who are already retired) is “Outliving their money”. Just think of a situation where a person has planned for just 20 yrs. of retirement (retired at 60 and expects to die at 80), but he has already reached 78 yrs. of age and his money is almost finished.

What kind of mental trauma he/she has to go through?

We all want to make sure that it does not happen to us.

We all want to make sure that in our retirement life, we have enough money, freedom to withdraw enough money for our expenses and have a decent margin in case anything goes wrong, so that you don’t have to depend too much financially on others.

Recently we did retirement planning for a 54 yr old person who was an NRI reader and while we created his plan, we made sure that all these elements like legacy, tax optimization, risk-control and growth was taken care while creating his retirement plan and his action strategy. You also have to make sure that if you are almost going to retire or if your parents are about to retire (or already retired) these elements are present in their retirement portfolio.

While we are happy today that India is the youngest country in the world, we also have to remember that in few decades, all we young people will also retire. Many of us may also not have the privilege to live with our children which many senior citizens enjoy. So we need to plan better.

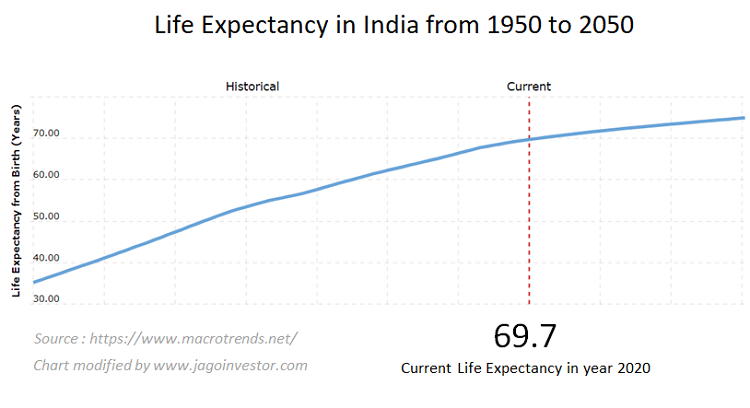

Life Expectancy in India

Let’s start with the basic question – “What is the average life expectancy in India right now in 2020?”

The official answer is around 69.73 in India at birth. For simplicity sake we will take life expectancy as 70 yrs. The life expectancy in India is continuously increasing every year from last many decades (a lot of people have this myth that it’s decreasing)

It simply means that one an average when a child takes birth, He/She is expected to live up to 70 yrs. of age. However we all know someone who died at 85, or 95 and even 53 or 29.

So this 70 yrs. is “Average” – which includes

- All the young people who die because of accidents

- All small children dying of malnutrition

- All people who die of suicide

- All people who die of any illness at young age

- Old age people who die because of illness in age band of 60-70 yrs.

- Old age people who due because of illness in age bank of 70-80 yrs.

- Old age people who die of depression and loneliness

- Old age people who die because of no access of good health care

- Very old age people who die at age 90+ yrs.

So, you now understand that “average” is kind of a fraud number. It gives some idea to you about something, but does not reveal enough to take decision. We also have to look at standard deviation to get a better sense. And people age at death can vary by a big margin.

A big population dies below life expectancy of 70 yrs. and many die above 70 yrs. The average is 70 yrs. Which means that for every person who dies much before 70 yrs. , there is another person who is living till 100 to average it out

You can’t take these 70 yrs. as the base to plan your retirement life.

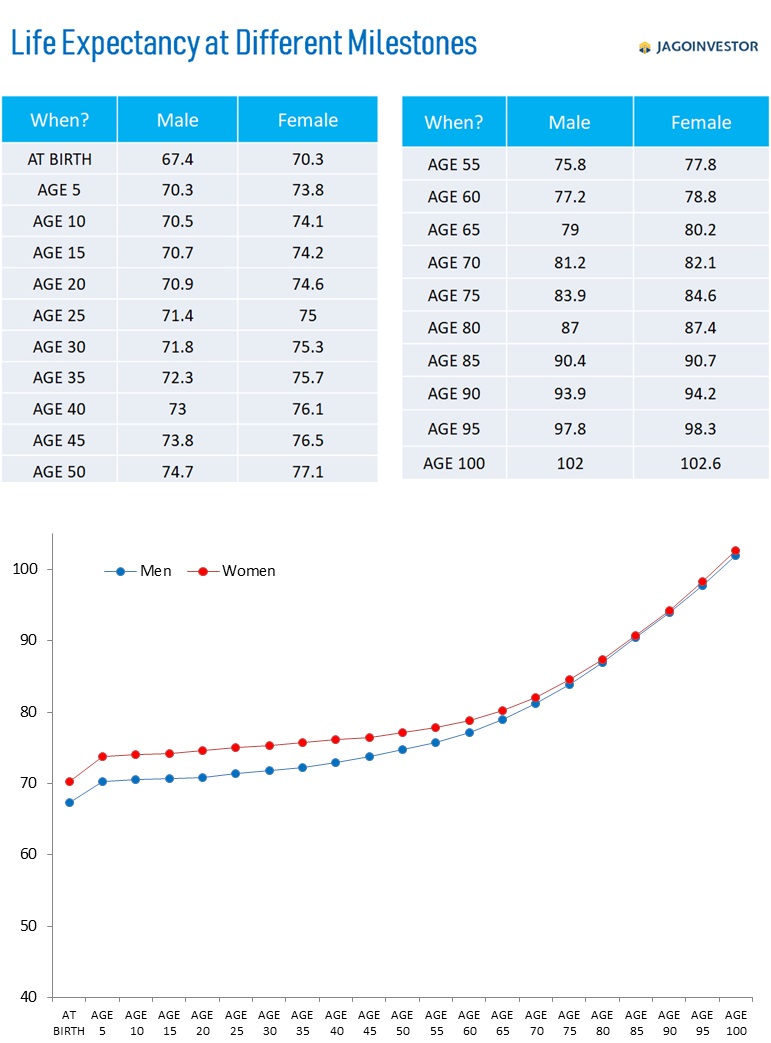

Moving Life Expectancy in India

A better data to look at is moving life expectancy number, which gives you an idea of what is the expected life expectancy once a person has reached an age. A person who has already reached 60 yrs. of age, won’t have the life expectancy of 70 yrs., it will be much more than that.

And here are the official numbers

So to conclude, a person who reached 60 yrs. of age as per above data can expect to live till 77-78 yrs. (another 17-18 yrs.) and this again is the average. This includes an unhealthy, broke retired person and a healthy, happy and wealthy retired person also. One of them will mostly die before 77 and another one will live longer than that.

You probably will belong to the other side and you know where this whole conversation is going.

Women live longer than Men

Let’s change the track a bit. I want to now talk a bit about Men and Women life expectancy.

Another thing you should know is that women in general live longer than men all over the world. In India also its true, and its truer for couples. You will often see men dying before their wives for simple reason that men generally have higher age compared to women, and men are exposed to more risks like accidents etc. because men mostly drive, get involved into those tasks which often have danger of life.

There are many other evolutionary and behavioural reasons, but it’s out of scope of this article.

So if you are women reading this, you need to understand that you will live much longer and have to plan for your pension. If you are men, you need to understand that while you may not believe that you will live longer, it’s your spouse who will outlive you and you have to do your planning more carefully for her as she may live for another 5-10 yrs. after you on average.

The following memes can give you a small hint (in a funny way) of what we are talking about.

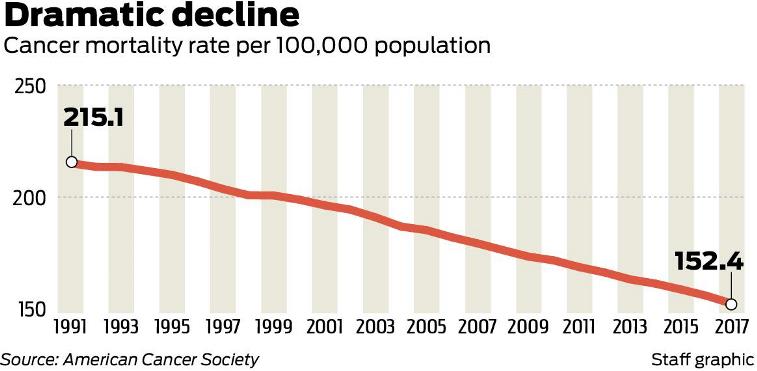

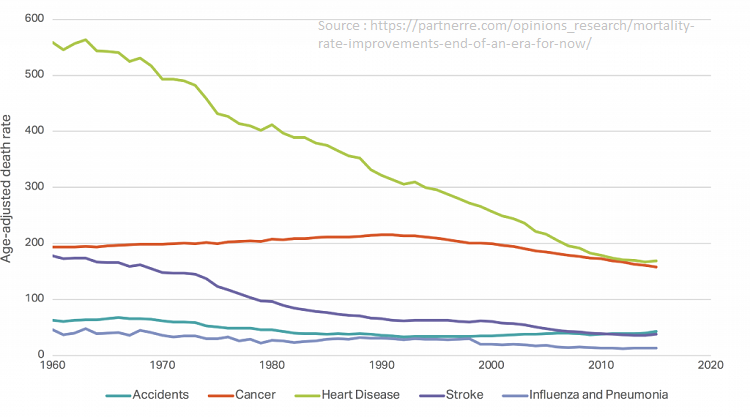

Medical Advancements will contribute to your longer life

Decades ago, people died because of illnesses and diseases/inflections which look very normal today. The medicine and vaccines are available today which were not available few years/decades back (in future people will also talk like this for coronavirus).

Then over time various discoveries and inventions were done in the field of medical science and medicines, vaccines and treatments were available for masses at lower costs. This makes sure that the mortality rate comes down over time.

Check out how the mortality rate for Cancer is coming down (not the number of deaths, but the mortality rate)

Even the other types of mortality rates are coming down from last many years.

If we talk about the current Covid-19 related deaths they are mostly because we have no cure or vaccine available. But very soon, we will have some cure available which will make sure that not too many people die in future because of this virus.

The point I am trying to make is that the whole world is on the mission to make sure that there is further medical advancements and they are constantly trying to find ways to make sure that people live longer and longer.

If you have money with you, it will get tougher and tougher for you to die as no one will let you die easily. Neither your family members nor the hospitals that benefit out of treating you.

India is developing faster

Another angle to the same conversation is that our country is making progress every year and we are on our journey towards becoming a developed nation. India in 2040-50 (When I will be retired) be a different place than today (like its different than 1990)

As a nation develops we have better access to everything. We have more money, we have better healthcare system, we have better roads and infrastructure (imagine less accidents and all the people who didn’t meet accident also adding to the pool of retired people).

If you compare yourself to your parents, you will agree that you have much better access to better housing, quality food (ok this is controversial), quality entertainment, quality travel, quality healthcare, quality roads and infrastructure. They might not have been able to afford a good hospital, but you can!.

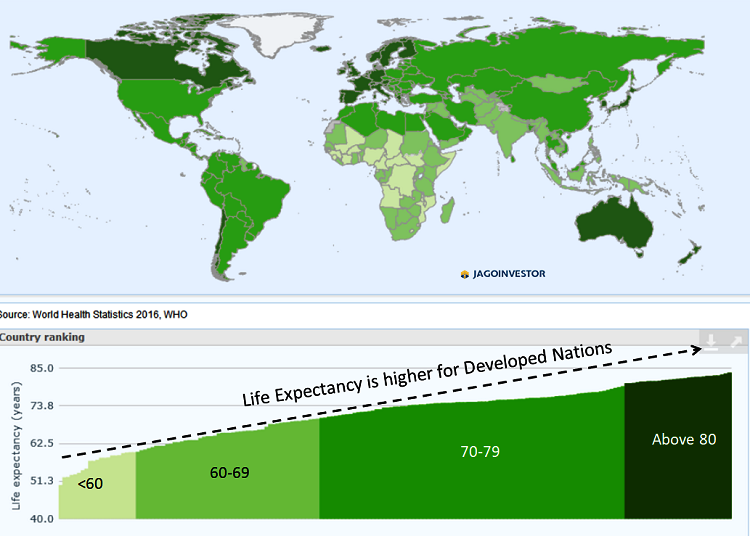

All these together contribute to a higher life expectancy. Check out this world map where the developed nations has higher life expectancy

Share of old age people in overall population

If you currently have a look at the share of aged population in developed countries, you will see that it’s very high in developed nations compared to developing or poor nations. For example, Japan has 26% of people who are senior citizen and Italy has 22.4% .. India will reach to that point in next 30-40 yrs.

In Japan, there is a village called Ogimi, where people generally live up to an age of 100 yrs. I am just showing a glimpse of what can happen with a developed country

Here is the data, I found in this report about share of senior citizens in overall population for developed countries. Check below

[su_table responsive=”yes”]

Rank |

Country |

% Share |

| 1 | Japan | 26 |

| 2 | Italy | 22.4 |

| 3 | Germany | 21.1 |

| 4 | Portugal | 20.7 |

| 5 | Finland | 20.3 |

| 6 | Bulgaria | 20.1 |

| 7 | Greece | 19.9 |

| 8 | Sweden | 19.6 |

| 9 | Latvia | 19.3 |

| 10 | Denmark | 19 |

[/su_table]

Source : https://www.prb.org/which-country-has-the-oldest-population/

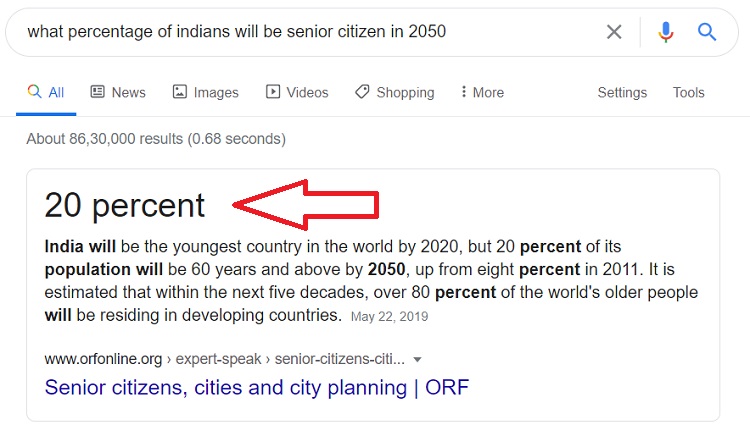

In India, currently the senior citizen population share is around 8-9%, which is expected to rise to 20% of population, which will be quite huge. This might be a disaster unless we all are prepared for with sufficient retirement corpus. Here is what Google tells me about the future

So if you are 30-40 yrs. old person reading this article, you need to be clear on this that once you get older, you will have much higher chances of living longer compared to our parents or much older generation. It’s a different thing that you live long in reality or not. But you have to plan thinking of the longest you can live, not the “average age”

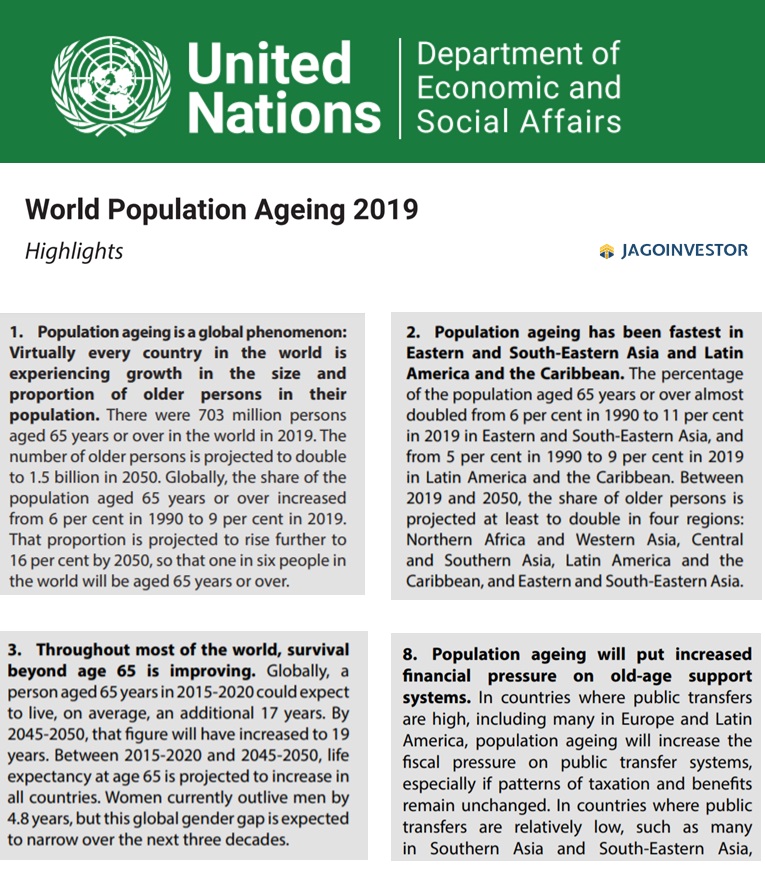

So to sum it up, I will show you what are the recent United Nations, World Aging Population Report 2019 says about all the points I was trying to make above. You can see that they say the same things

Conclusion

I would like to conclude and sum up this article now with some points. Here they are

- You may live for a very long time. It can be 90-100 yrs. and even 105 for some cases. Do plan better

- Life Expectancy is increasing and it will keep increasing in future too.

- Don’t assume or plan that you will be living only till 75-80 yrs. It’s not even happening now, forget about future

- Plan for a big retirement corpus, so that it can last for your lifetime and also leave some legacy for your family.

Please share in comments section, what you feel about this article and whats your views about retirement phase and how long people will live in future?

September 3, 2020

September 3, 2020

your article is good but i was looking for the probability for each additional year of life expectancy at various ages of life e.g. of all living male of 80 years say how many in percentage cross 81 , 82, 83 … and so on so that wud be current probability of living one more year, two more year .. and so on. such tables i believe wud be available some where. could you please indicate where can i find them. thanks

Its here : http://jagoinvestor.dev.diginnovators.site/2020/09/life-expectancy-india.html

This is a very well-written article, the lanugage is very lucid and attention catching. Thank you.

Thanks

Do hereditary factors have a bearing on life expectancy?

In a way yes.. if parents have some illness which can be passed on to their genes, then the life expectancy will get impacted.

Manish

Well written article with detailed analysis…eye opening article for many,like me.

Thanks .. your words are like an “Award” to me 🙂

well written article. i got what i was looking for. thanks for the article.

Good Article about retirement. I have once question in my mind, Shall we take term insurance till age of 90/100 years ?

NO,

Only till your retirement age .. thats max 60

Why are you suggesting to take term plan just till 60 when there are more risk of death at an older age?

You take a term plan, not because “you can die” … you take it because “you can die while others are financially dependent on your income”

Its a risk-coverage tool and not a Profit-making tool, Hence its suggested to take only till 55-60 and not beyond that.

What according to you is the role of a term plan in your financial life. What is the core-reason you want to buy it? May be I am missing your perspective!

Manish

I want to speak to you guys to know the better way to plan

Sure, leave your enquiry here : http://jagoinvestor.dev.diginnovators.site/financial-planning?utm_source=comments

You could have simply said retirement planning should be for 100 years

I wish if people believed that one line 🙂

Need to give enough pointers .. not everyone believe 1 liners !

good

Thanks

Very well explained with all possible cases. I learnt new things like how expectancy is calculated.

However, One worry. If most of the population is 50+ by 2050 then there will be scarcity of Human Resource and could shoot up cost of living. Also, If I have some properties (agriculture lands) then managing them could be more challenging?

Can you plz share your views on these 2 queries.

Yes, thats going to be challenge and it will surely happen. Like its happening in China right now

Its better to not have so much exposure to real estate in future, so better start reducing the exposure and convert money to liquid assets!

Manish