Past, Present and the future – Wealth Creation & Life

I (Nandish Desai) and Manish Chauhan recently did zoom call for our wealth creation clients and from the call I am sharing a few points with all of you.

The three words past, present and future have connection with our life, every area of life and also our wealth creation journey. We all have some past history; present moment and we are all walking towards a future. The stock market also has a past history, present condition and is moving forward.

The sharp correction in the stock market has made many investors think whether they should stay invested or quit the market- Kindly go through all my points in the article and also go through our zoom call recording to find out your own answer. I am not here to ask you to stay invested, I will also not advise you to quit. All I can do is share my experiences, share my thoughts which will help you to take your own call.

1. Past, Present, Future- what space are you in?

All the workshop or offline events we have done we see investors operating from three different spaces- Some are regretting about missing past investment opportunities or regretting about starting their investment journey late, some are shit scared about the future (they constantly worry about the future) and very few operate from the PRESENT space – The decisions and the actions you take today will shape your future.

In fact, NOW is the future, if you want to see your future check your present actions be it wealth creation or area of health or any other area of your life.

The current market correction, different investors have chosen a different path. Some have chosen to quit the game and some saw it as an opportunity to invest more, some have shown the courage to stay in the game- If you operate from a long-term vision, the vision will help you to shape your present actions. If you have an empowering future in front of you, you will always stay in action in the present moment- Let an empowering vision drive your financial journey and not the markets.

2. The biggest mistake advisor, Investor and companies have made

Making returns the hero of your financial life is one of the biggest mistakes.

When markets fall only those who have made returns the hero of their financial journey suffers and starts to panic- Why not make discipline the hero of your financial journey, who not make consistency the hero of your financial journey- Wealth creation is a game of discipline and not about what is happening in the stock market.

If I have to give an example a few years ago people use to go to the watch movie based on face value.

If Amitabh Bachchan is in the movie people go and watch the movie, the scenario has now changed, people look for good content and the hero of the movie is not just the actor but a good story or a good script- I think it is a time to get authentic about choosing the wrong hero – choosing Discipline will give you complete peace of mind and you will start to enjoy the overall game of wealth creation.

Let’s choose a new hero, let’s choose discipline.

3. You don’t think about leaving a legacy

Let’s say we are in 2055 and you are sitting with your grandkids – What is the greatest wisdom you will share with them about wealth creation? I am sure you will ask them to stay disciplined, start early, stay invested, don’t try to time the market, don’t panic when markets fall etc. etc.

Now, when markets fluctuate you have to remind yourself about the wisdom you are going to share in the year 2055 with your next generation.

Your financial life is one big story and at the end your financial journey has to inspire you and your next generation- A lot of people must have stopped their SIP or must have quit in the 2020 market fall, the decisions you take today will shape your future money story and so be careful and take actions which helps you to leave amazing legacy.

May be the money you invest into equity you are not able to enjoy the fruits but at the end you will have a great story to tell them. Think in terms of legacy and not just returns.

4. What you can learn from Sachin Tendulkar

Manish gives the following example in the offline events we do, ” He asks people what makes Sachin the greatest batsman in the realm of cricket?”-And we get answers like, because of his talent, because of his practice, because of his passion etc. from the audience. Now, he will agree to all the answers and will add a new dimension to the conversation.

He will say Sachin has played 37558 balls in his entire journey of cricket- Along with talent the real secret is about staying on the pitch and facing the balls- Investors also need to learn to stay on the pitch- Each day you stay invested in the market has to be seen as number of balls you have played – The investors who will face all kinds of balls will win the game of wealth creation.

You become Sachin in the world of investment.

Fund management, picking funds, designing portfolios, financial planning, and advisory are important but the most important aspect is staying invested (staying on the pitch) no matter what.

5. Heads or Tails

I started my investment journey in 2007, the person who asked me to start my SIP handed over a coin to me and asked me to get heads every time I toss the coin. I took some chances and it was a mix of heads and tails. I told him, “It is not possible to get heads every time”.

To that he said, ” Markets and tossing the coin are both the same, you will have risk and return both in the game of investment” I became very clear that there are two sides to the game of investment and I need to choose and embrace both- Risk and Return, Most investors only want returns, it’s like they only wants heads every time- It is just not possible.

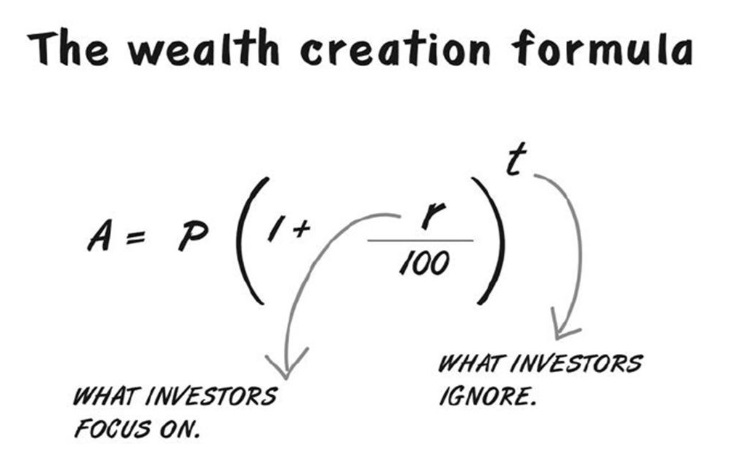

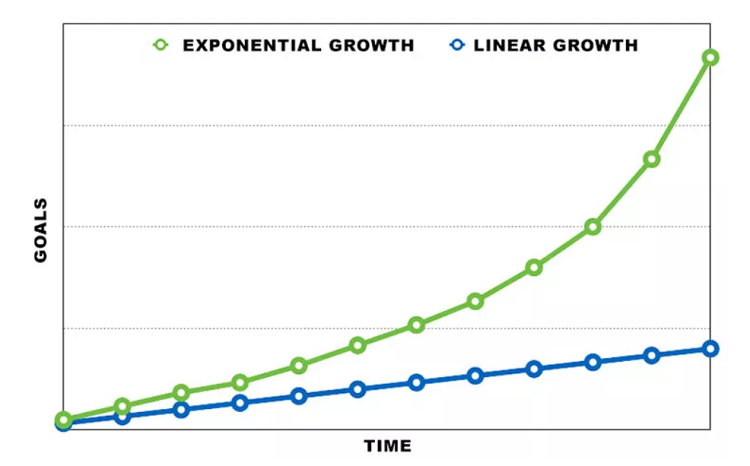

6. Markets are non-linear

The person who helped me start my SIP also told me one more thing. He told me – “Nandish markets are non-linear by nature and they will always remain non-linear” Fixed Deposit is linear by nature; they are not volatile but markets are non-linear and volatile by nature.

Always remember, you make money only in non-linear products that is where all the opportunities reside. Now, when markets fluctuate, I always remind myself, ” Markets are non-linear and I got to love both ups and downs”

7. The nature of the market is growth

Market started from 100, then it became 1000 than 10000, 20000 and right now around 30000. Very soon it will become 50000 or 100000, Mark my words markets are a sum total of flats, dips and ups.

The nature of the market is expansion, it is here to expand and grow. it is up to you to stay in the game or not?- I have got many emails from clients and readers whether they should stay invested in the market or not- I just told them,” it is a choice you make, it is your wealth creation story and you are the writer of your money story”

8. Where the Equity train is headed?

One of the example I love giving is when people board a train which has open seats to occupy, some passengers will chose to sit on the left side of the train and some on the right side – Some think left side will show a better view and some think right side will show a better view- But the important thing is not left or right side of the train, the important point is where is the train headed, that is where the passenger has to focus on.

Right now, some are choosing to invest and some are choosing not to invest but focus has to be on where the equity train is headed. As an investor you are just a passenger, if you are clear where the train is headed you will start to enjoy both sides of the train.

9. Learn to take the pain in the start

Equity investment is always painful in the start- The first 3 years are always painful, after 7 years it stabilizes a bit and after 10 years things start to gain momentum.

The first 10 years creates a solid base for another 10-15 years of your investment journey. Without the first few years’ pain you won’t be able to create massive wealth. Pick any successful investor and you will find the pain element in their wealth creation journey. No pain – No gain (wealth creation).

Many of you if you are new to equity investment, learn to take the pain. Market dips are amazing, they build your immunity to create wealth.

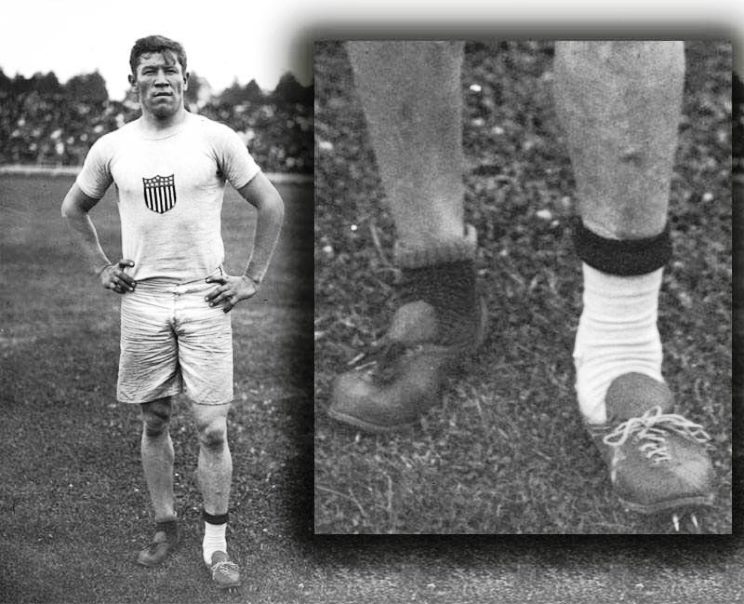

10. Run your race

We ended the zoom call remembering Jim Thorpe, the runner, ” His shoes got stolen just before the race was about to begin, he found two different shoes from his garage, wore extra pairs of socks to fit in the shoes and won 2 gold medals” – He ran his race and did not get stopped by his circumstances. Below is his photo, where you will find him wearing different shoes and different pair of socks, it is not a fashion statement, it shows his commitment to complete his race, to win the race- No matter what

Now, apply his inner stance to your life

- If your gym is stolen how you will exercise?

- If your office is stolen, how will you work from home?

- If your routine is stolen, how will you spend your day?

- If your returns are stolen, how will you continue playing your game of wealth creation?

I exercise every day, evening 7 pm to 8 pm – No matter what.

My gym has closed (stolen like Thorpe’s shoes) but I have found a way to exercise. My health has in fact improved by staying at home, by following a strict diet. My team is working hard from their home. I am spending quality time with my kid and also doing household work to help my family.

Come on get in action, don’t think about what is happening in the market right now, focus on discipline. It is about your commitment and nothing else.

Conclusion

Go through all the 10 points once again and see how they can apply to your financial life and other areas of your life. Focus on having good health, focus on staying disciplined, stay away from all the negative noise outside and choose to stay on the pitch of wealth creation. If you have never experienced financial planning, we have the online course ready for you.

The first program of Jagoinvestor school is been launched and it is loved by many. Invest in the program and start planning your finances, choose to invest your time in your own financial future.

April 12, 2020

April 12, 2020

This piece was very helpful to me.

Thanks alot

Welcome

Hi,

your blogs are really effective and make it really easy for people without non financial background to understand fundamentals of finance

Thanks

In Point no. 5 – head or tail, very well explained about the risk and return involved in stock market.

I liked the explanation.

Glad you liked it ..

As always Superb..

Thanks

Dear Sir…Superb article …Touches every aspect one can think of…Those who are thinking of quitting were converting their notional loss into real loss…Thanks for educating us.

Hello sir,Good article. I want to ask a question, if a person is having a SIP currently running or say number of SIP’s. In worst case scenario he loses his job and has a saving of 6 months as per general rule to survive. Should the person continue investing in those SIP till he gets a new job or should he stop it. Your comments awaited.

That will depend on the confidence the person has about getting the job. If its low, then better stop SIP and wait for the right moment. If confidence is high, better invest. After all in worst case, you can withdraw back your money ..

Manish