Surrender v/s Paid-up – which is better option for your old insurance policies?

Do you want to get rid of your old money back insurance plans, but are confused if you should “surrender” or make it “paid up”?

Today I will explain which one is the best option amongst the two.

Surrender vs Paid-up option in Insurance policies

All those assured insurance plans which your parents made you buy from your friendly neighbourhood uncle is nothing less than a high premium low return policies with not more than 1-5% CAGR return.

These policies don’t provide enough life insurance cover neither they create enough wealth for you for your long term goals like children education, child marriage or retirement and on top of that, these policies have pathetic returns value if you want to close them before maturity and take back your money.

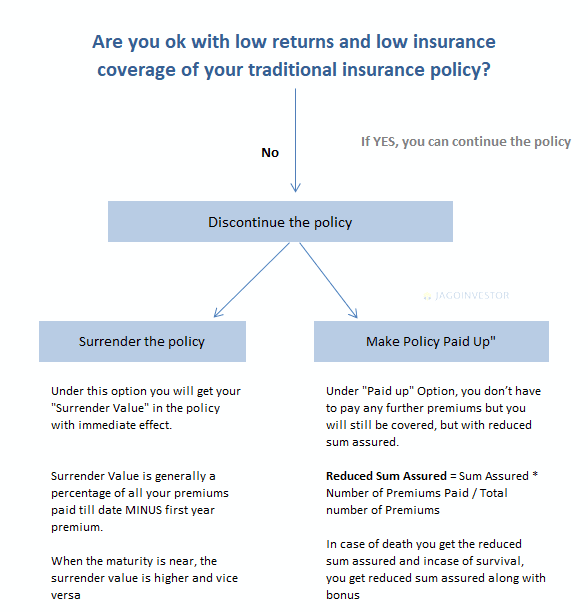

Mainly there are two ways to discontinue these insurance policies which are –

- Paid-up Policy

- Surrender Policy

What is “paid up” option?

Under this option, if a policy holder does not close the policy, but stops paying any further premium. However, note that this option is generally applicable only after one has paid for at least 3 yrs. (however, check your policy wordings for exact years)

The amount which you will receive at maturity will be reduced, in proportion to the premiums paid. This sum assured is called the paid up value. It is calculated using the following formula:

Paid up value = Original sum assured x (No. of premiums paid / No. of premiums payable)

Example – A traditional insurance policy with sum assured of Rs. 10 Lakhs for 20 years with a premium of Rs. 30,000 p.a. paid for 8 years. Let’s find out what will be its paid up value if one wants to stop paying further premiums.

Paid up value = 10,00,000 * 8/20 = 4,00,000

At a high level, the numbers don’t look back. You will get 4 lacs, but you paid just 2.8 lacs overall, however, remember that you will get this 4 lacs after so many years and you will lose the purchasing power because of inflation.

You can simply say that real worth of Rs. 4 lac received after 12 years is Rs. 1,58,000 today, taking inflation at 8%.

Therefore, if you are choosing policy paid up option, keep in mind that converting the policy into a paid-up policy will lock your money for the remaining term of the policy and also, actual worth of the amount, which you will receive in later years will be very less if the maturity of the policy is very far from now.

What is “surrender policy” option?

Under this option, you close the policy completely and take back your money. The money you get will be some percentage of your premiums paid minus the first year premium. And this percentage increases depending on how many years the policy premium has been paid.

A policy generally acquires any surrender value only after 3 yrs of premium payment, which means that if you choose to surrender your insurance policy before 3 yrs, you lose all your money and don’t get back anything.

Note that the surrender value starts with 30% and goes up depending on the number of years you have paid the premium.

Following is an indicative table which shows the surrender value as a percentage of premiums paid

[su_table responsive=”yes” alternate=”no”]

| Time of Surrender | % of premium paid – first year premium |

| After 3 years | 30% of premium paid |

| After 5 years up to 8 years | 50% of premium paid |

| After 8 years | 65% of premium paid |

| Last 2 years to policy maturity | 90% of premium paid |

[/su_table]

This percentage can change from company to company and depends on factors such as the type of policy. Every policy brochure mentions details about surrender value but, it is not compulsory that all the companies mention this percentage which is also called the surrender value factor in their brochures.

Example of surrender policy

Mr Pratik has bought a traditional insurance plan of 20 years with a sum assured of 6 Lakhs premium amount is Rs. 20,000 per year. After paying the premium of 6 years, he wants to surrender the policy.

Surrender Value = 50% of (premium paid – first year premium)

= 50% of (120000 – 20000)

= 50% of 1,00,000

= Rs. 50,000

You can see that he will just get Rs 40,000 from surrendering the policy even if he paid Rs 1,20,000

When to choose “Surrender” and “Paid up” option?

Surrendering a policy is suggested when

- You are not able to pay the premiums

- You need money for some reason

- When remaining number of years in policy is more than 8-10 yrs

This option is suggested because you still have many years left and you can pay the same premium amount in a better product which will do wealth creation for you.

Making a policy paid up is suggested when

- You don’t need money but don’t want to pay further premiums

- When you don’t want to pay premiums, but still want the policy to run

- When your policy maturity is very near (2-4 yrs)

Making a policy paid up is generally not suggested, but a lot of times, investors are not able to take the pain of getting the reduced amount from their policy and feel like “they will get something in future”, however considering “time value of money“, it’s not a great option.

How to deal with the emotional part “I am facing so much loss”?

In both the options, there will be a loss for sure. Money back insurance plans are designed to give low yields and penalize you if you quit in between.

I think dealing with closure of insurance policies is more of a psychological battle You know you have got a wrong product and its bad for your future, but people can’t deal with the fact that they are facing so much of loss – “I paid 8 lacs, and I will get back only 4 lacs, I will lose 4 lacs”

Note that if you consider TIME VALUE, things will be easier to decide.

If your friend borrows Rs 100 from you and returns you Rs 110 after 10 yrs, you are not in profit, you are actually in LOSS. Because you could have created Rs 250 with an alternate investment and now you just have Rs 110, that’s Rs 140 loss.

Just looking at it from absolute numbers point does not make sense.

For example, imagine a sum assured of Rs 10 lacs with a yearly premium of approx. Rs 53000 per year. Now if a person has already paid 5 premiums and wants to surrender the policy, they will just get back around Rs 85000 (assuming 40% of 4 premiums, as one premium is deducted). The immediate loss of mind is for Rs 1.8 lacs (paid 2.65 lacs and getting back 85,000)

This is a tough situation for the mind and very tough to handle. A person feels why to take a loss when one is not recovering the amount paid also and just continues the policy till the end. The person will get back anything between 15-18 lacs, depending on the bonus amount declared.

This translates to only 5.69% and this the best case (it will get better if you die early after taking the policy, but I am sure you would not like it)

Now if the same person reinvests the same 85,000 along with Rs 53,000 premiums yearly into some equity-based products like equity mutual funds or index funds, even if assume a modest 12% returns which have happened in past, the wealth one will have will be 24.5 lacs and the IRR will be approx. 7.4% of the whole scenario. This second option also gives you better liquidity and exit option whenever you wish to get money.

January 22, 2020

January 22, 2020

I have Purchased a Kotak Assured Savings Plan in 2023 and Two Premiums of 36000 ie total 72000.

The term of the Policy is 15 and the Premium Paying Term is 10. Guaranteed Maturity Benefit: 602783. Kindly Tell whether to surrender or paid up or to continue.

Money back policy with sum assured of 10 lakhs , Yearly Premium of 29000 RS for 20 years term and it gets matured in 25 years. I have paid 7 years now. I am planning to surrender but there will be 1.3 lakhs loss out of premium paid 4 lakhs. Instead for insurance will go for Term plan and for investment i will go for either PPF or any fixed plan as already i am investing in Mutual funds. Lose of 1.3 lakhs making me emotional to rethink again. What is your opinion on this please? Will this be a worthy choice? Please suggest.

Thats what happens with money back policy. You loose a lot in long term

Better do term plan + invest in something else

HI,

The article is very informative. I was lucky to have chosen LIC jeevan saral policy in 2010. I have paid the policy premium regularly. Recently, I checked my surrender value and to my surprise it is INR 12.45 lacs ( against premium paid INR 6.6 lacs). So, I have decided to surrender the same and make a FD @ 7.5% in a decent bank & I will take a term plan of INR 1 CR + an additional health policy in the annual interest amount.

Good to hear that.. incase you want to buy a term plan our team can help you with that whole process with right guidance, so mail us at help@jagoinvestor.com

sir, i have a savings plan with tata where i have to pay premium x for 12 years, then wait for a year and then 12 years after that i will get 1.6x yearly for 12 years. in the last i.e., 25th year i am to get 3.5x as maturity lumpsum. i have paid the 3rd premium this year and after reading this article feel i shd convert it to reduced paid up. but will i keep getting the pro rata basis 1.6x every year for the 12 years and the maturity lumpsum also. kindly guide

Tata plans are good overall.. The XIRR is above 6% in most cases. You should have thought about the tenure in the start while buying the policy. Why do tyou want to reduce the tenure now?

Hi I have bought jeevan Labh policy with annual premium of 45000 with premium paying term of 16 years & maturity of 25 years. I was missold by LIC agent & also by own father who believed in the words of agent rather than me(This still hurts me till date). I had paid premium for three years. I could policy has accumulated around 2,55,00 Rs. till date with bonus. Which is best way out for me ? Paid up or surrender ?

Is 2.55 lacs the paid up value? if thats the case then you can just surrender the policy

Hi Sir,

2.55 Lacs is the total amount gathered in my policy along with premiums & bonus incurred. My paid up is coming around to be 1,87,500 after policy maturity(23 years from now). I am extremely disappointed & in so much confusion. Should I surrender or turn it into paid up ? Is there no other option to get atleast my premiums paid so far ?

You can only get it by continuing the policy, however that would mean loosing further as you wont fight the inflation.

manish

I had procured a Bajaj Allianz Child Gain 24 policy in 2006. I have paid three annual premium till 2008 and then stopped. The premium paying period is till 2023 and maturity will be on 2030. The policy is in reduced paid up state.

In this case, what will be the calculation as currently I am in 2021.

You shall contact the customer care and check with them the current value in the fund.

Thanks for the information sir

Welcome

This article really had cleared my confusion to get rid of my LIC New Endowment 814 Policy of 25 year term with 10 Lakhs assured. I have paid premiums for 5 years and now will get it paid-up. It’s better than taking the surrender value as I’m already having SIP on a diversified portfolio since a year, now going the add the premium amount into that for a better return. I have also bought a traditional term insurance plan with much less premium and 15 times more assured money than the endowmwnt plan.

Glad to see that it helped you Soumyajit ! ..

Thanks for sharing details.

Really dont understand this LIC rules as there is nothing for investor considering all cases(for long term investment) including “Paid Up”, “surrendering policy” OR Paying all premiums.

Why all products are still available in market for sale? 🙂

That’s the point.. Penalize investors if they do not continue till end.. that’s the plan !

I have a Monthly income plan from Max life and now I am going to pay the third yearly premium of 76000I am thinking of surrender after the third premium and get some money back but loss or should I continue it as it will give some monthly income after 15 years .. what will you suggest

These are different than those regular traditional plans.. I suggest you go through their workings and how they work and If they are giving you decent returns or not. If not, then you can think of surrendering them

Manish

How about the accrued bonus of the policy? Will it be paid at the end of the tenure incase of paid up?

Yes..

Bingo!!!

Coincidentally, yesterday I was thinking of doing away with my traditional policies (unfortunately plural). But was wondering about the pros and cons.

And here I get an answer to my queries.

Thank you very much. Indeed the picture is now clear in my mind.

Thanks once again.

Great to hear that Sumeet ! ..

Reliance- Nippon Insursnce agent sold a policy of Rs 8 lacs to me stating that it is Is one time payment policy ,it will

earn 8%,9%,10% interest during first,second, third year. After three years full money with interest wii be paid back.However he forwarded a conventional policy .This policy states that payment term is 10 years Rs 8 lacs per years and policy matures after 12 years. On my contacting him he sent me a letter stating that it is payable after one year. The letter bears no signatures however it bears the insurance company registration number. Please advise.I am a Defence pensioner with 36 years service. I seek your advice and help so that my savings are not cheated.

You have been missold.. its a yearly policy sold as one time premium ..

Kindly return back the policy stating free lookup notice

Manish

Very good write-up. Key is person should have term insurance to cover insurance needs and equity investments to cover investment needs. Your write-up is surely very well written.

Thanks ..

Spot on ! I was in the dillema between paid up and surrender options. You explained them very clearly. Thank a lot for such a useful article.

Welcome !

Thanks for this article,

I’ve LIC Health Plus taken for Rs 6,000/- yearly premium till the age of 65 yrs for the assured amount of 2 Lakhs.

I’ve have been paying this premium for the last 11 years.

I will be surrendering this policy very soon, going by the formula you provided i might get around 39,000/-, right ??

Does this article implies to Term insurance also ?

Regards

Karthik

THis article is only for traditional insurance plans, not term plan .. better talk to LIC on how much is the surrender value to arrive at the exact amount !

Manish

Ok, Thanks but what about my LIC Health Plus which is not a term plan

Atleast do the analysis in the same way I shown here

Hello there,

I’ve a LIC policy with qtrly premium payment of almost 2k..its a money back policy and 4yrs remaining out of 20yrs.

Let me know what you think is a best option.. As per docs ill get a lac & 50k bonus end of 20yrs..is it worth waiting

I think just make it paid up !

In the conclusion that you shared, won’t it be better if the person gets the policy paid up as it would still provide the insurance cover till the policy matures while they can invest the future premiums in alternative asset class like equity or debt depending on their risk profile. In your conclusion it appears that the person does not need the money immediately, so its better not to surrender the policy and loose what has been paid as premiums in the past. Your views please.

“it would still provide insurance” .. But how much? You will be better off buying a term plan ..

Manish

Beautiful article. If we use Paid option does we get Rider benefits (Accidental or Disability) after we select paid up option.

May be , but in pro rata mode !

Nice post. Thanks for sharing this post.

Welcome !