Buying a new House? Here are 10 additional expenses you should be ready for!

Are you planning to buy a house? If yes then, you would have planned your investments and saving in line with the “Cost of the house”, you are looking for. But, when we buy a house, there are so many other events/costs which comes during or after buying the house which we do not plan well beforehand.

In this article, we will look at various things where we might have to spend money for. If you are planning to buy a brand new house, this article will give you a good direction on how to plan out your finances.

List of expenses associated with the purchase of a new home

1) Stamp Duty

Stamp duty is a tax, levied by the state government on every transaction of property i.e. buy and sell, whether it be commercial or residential property. As it is levied by state govt. the rate varies from state to state. It ranges from 3% to 10%, depending on the slab decided by the particular state (in Maharashtra it is 5% of market value or agreed value of property whichever is higher).

Stamp duty is calculated on the higher value of any of the following:

- The ready reckoner rate also known as circle rate/market value which is predefined every year by state government for every town, state or village, or

- The agreement value of property. For example, if the agreement value of a property is Rs 50 lakhs and the value according to the ready reckoner rate is Rs 40 lakhs, then, the stamp duty would be calculated on the higher value, i.e., Rs 50 lakhs.

2) Registration cost

For registering a property on your name, the state government will charge you a registration fee. It varies from state to state. But most of the cases it is 1% of Market value of the property. Registration fee is lowered if the buyer is a senior citizen or a woman. In most cases, the builder will add this cost when they quote the house value to you.

3) Interior Cost

When you get the new house, its the bare minimum house with walls, electric points. It’s your job now to furnish it and decorate it as per your taste. So, it is suggested to consider the cost that you may need to spend on interiors. And if you want to do marble flooring, designer wallpapers, texture paintings on wall, chandelier, modular kitchen, etc… the interior cost will tend to go up.

4) Advance maintenance fee

When we move to a new house, and if it is in a newly constructed project, usually we are asked to pay a maintenance fee for a year or two by the builder. It can be a decent amount if you consider advance payment, so please consider that.

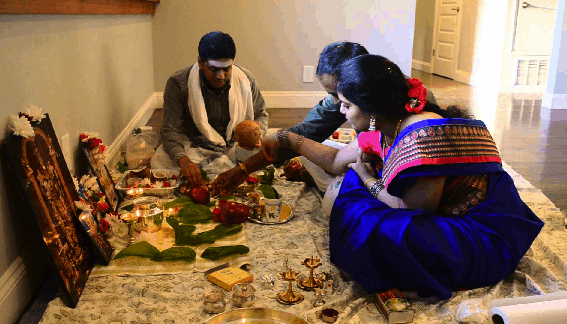

5) House warming party

When you move to a new house, you may feel like celebrating it with your friends or family. Some people may like to have a grant celebration or some may like to have a small party with close friends & relatives. So, the cost of house warming party varies from the taste of person to person, find out how do you want to celebrate it? And accordingly, plan for that cost separately.

6) Furniture

Many people want to set up furniture before moving to the new house and some people do it after 2 to 3 years of moving in, which is also okay. So, if you want to move in, to furnished new house then, you will require to buy or appoint a carpenter to make your home furniture best suitable as per your needs and requirements. You need to be prepared for the cost of furniture such as sofa, bed, almirah, dressing table, dining table with chairs, shoe rack, study table, electrical appliances, etc… depending on your needs.

7) Additional charges in flat

Now, these costs are subjective, it depends on the needs of a family. These additional costs include a video security system and iron grill at the main entrance for security purposes, pigeon net if your new house is having open balconies and mosquito net for windows, etc.

8) Sinking Fund

Sinking fund is a cost, which you may need to pay, to the society you will be living in, every year for a certain period of time such as 5 to 10 years. These charges are paid by all the house owners in the society, so that society’s huge maintenance cost, which can be for Lift maintenance charges, Building painting, clubhouse renovation, parking space, and building renovation charges, etc.

For example, if the lift of your building is not working and it requires 10 Lakhs to get repaired then it will be made from the sinking fund collected by society.

9) Small house alteration

Now, this cost again is subjective, it may change from person to person. Many people want to make some changes in the existing layout of the new house before moving. So, they will be needing extra money for this. Examples of small alterations are changes according to Vastu Shastra & creating storage space (storage room or shelf) etc.

10) Packers and Movers Charges

Moving your home stuff from one place to another can also cost a bit, especially if its an inter-city move. Do consider this cost as well when you are buying a new house.

Conclusion

For many of us buying a house is like achieving a huge milestone in our lives. When we plan our savings and investments according to, not only for the cost of the property but, also for other additional expenses to be incurred, then we will have more clarity & avoid the burden of so many expenses before buying our dream home.

And I would say around 10 – 20% of your house cost, should be kept aside to meet all these expenses. eg. if you are planning to buy a house of Rs. 50 Lac then additional 5 – 10 Lac has to be taken into consideration.

If anyone in your circle of friends and family is planning to buy a house, let them know about these additional costs. And also, if I have missed some points so please add in the comment section.

September 12, 2019

September 12, 2019

Hi Vandana,

Thank you very much for sharing valuable Information.

I would like to know if charges will be incurred for things such as Documents , Lawyer Verification ?

Also,

I’m a first time home buyer , Planning to buy plot and construct own house in Chennai.

It will be really helpful for me , if you can suggest guidance ,tips, things to be aware of etc.

Yes, its always a good idea to do thorough research and investigation especially incase of Land .. you can reach out to Vakilsearch.com for their property verification services or catch a local lawyer!

Manish

nice information

What about property tax.. You missed that

Hi Ram,

Property tax is a recurring cost, in this article we have covered one-time expenses that may be incurred immediately on buying a house.

Vandana

Most of the builders are charging following charges not mentioned in the article. Interiors run up to 10-15% easily. If someone is going for new furniture, all loadings add upto 100% of the home cost.

Car Park

Club House Membership

Facing Premium (E, N or Corner)

Floor rise premium

Documentation Charges

Club house monthly maintenance

Penalties for violation of society rules

Hi Krish,

Thank you for comment,

You are right, these costs are there and also subjective, it will depend on ones personal choice and also the society or location in which you are buying a house.

Vandana

Is it better to stay in rented out rather than owning a house. Seeing the recession in Property Mkt, the annual appreciation in property would be hardly 1-2% annually, so keeping money even in savings account is better than investing in property .

Hi Ravi,

In this article, our motive is to inform people about different costs they need to plan for in advance, while buying their own house. It is not about investing in property. So, we are not encouraging property investments.

If the article would have been on – whether to invest in property or not? Then, what you have said is correct to some extent.

Thank you,

Vandana

The additional expenses will certainly be above 20% if you opt for premium apartments or villas. Furnishings a kitchen with branded premium fittings and accessories will cost roughly 10lk. Each bedroom sets you back by 5lk. So ensure you understand your budget and not fall in for upselling by vendors.

Hi Sreejith

You are absolutely right, one should consider his financial situation then only go for these kind of big expenses.

Thank you for your valuable input, it will surely add value to our article.

Vandana

1. Shifting cost from old to new home.

2. Utility cost if electricity, gas, water, internet not installed.

Hi Zaheer

You are right! Both of these cost should also be considered.

Thank you for adding points,

Vandana