How much tax benefit can be claimed u/s 80D? (Rules + Limits)

Are you clear about the tax-saving which you can do when you pay health insurance premiums every year? You will be glad to hear that it’s over and above sec 80C.

Yes, it comes under a separate section called section 80D!

What is section 80D?

Health Insurance policies have become very famous in the last 10 yrs and to encourage it, the govt gives tax benefit when you pay the premium for yourself, your family or your parents

Section 80D defines all the rules and limits related to health insurance premium payment and tax saving.

How much can you claim under section 80D?

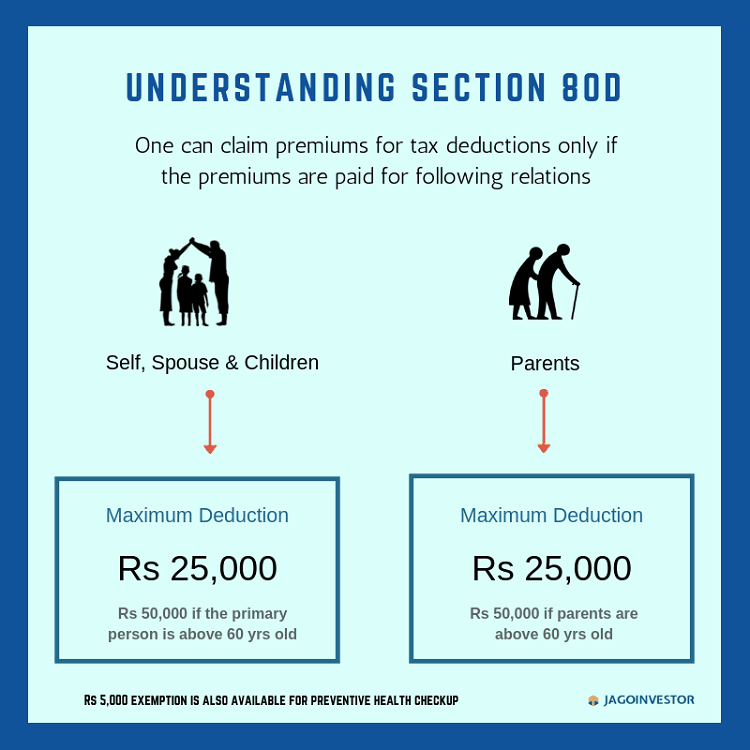

One can claim a deduction of premium amount on health insurance of self + family (spouse + dependent children below 18 yrs.) and parents. If one pays a health insurance premium of his brother or sister then he/she will not be able to claim a tax deduction. To make it more clear, I have mentioned the list of people who will come under this benefit –

- Self

- Spouse

- Dependent Children (below 18 yrs.)

- Parents

How much you can claim Tax benefit u/s 80D?

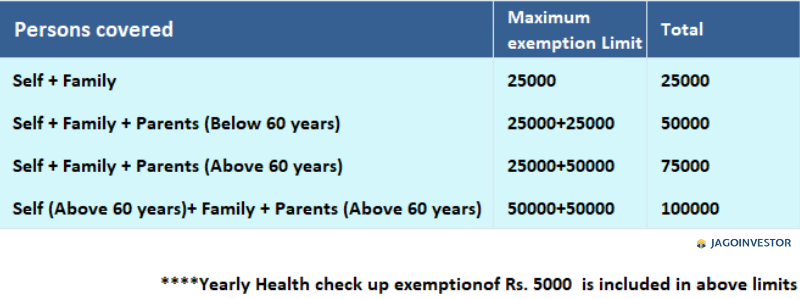

- You can claim a maximum Rs. 25000 of the deduction for premium paid on health insurance of you, your spouse and children (under the age of 18 yrs.), if you are below 60 years

- The same amount of Rs. 25000 you can claim for deduction of premium that you pay for your parents (father+mother).

And if the age of you or your parents is above 60 years then the limit will increase to Rs. 50,000/- in each case. In the above limits, exemption of Rs. 5000 for yearly health check is included.

For getting a clear understanding of the calculation part you can refer the info-graphic given below.

Let us now understand this through some examples –

Case 1 – Ram (35 yrs.) with a spouse and 1 kid + parents (mother 55 yrs. and father 57 yrs.)

In case 1, Ram pays a yearly premium of Rs 15000 (for self+spouse+1 kid) and Rs 34000 (both parents). So now let us see how much exemption Ram can claim u/s 8oD.

As self + family exemption limit is Rs 25000 and Parents exemption limit is Rs 25000. Then Ram can claim exemption of Rs 40,000 (15000 + 25000) u/s 80D.

Case 2 – Rakesh (48 yrs.) with a spouse and 2 kids + parents ( father 75 yrs.)

In case 2, Rakesh pays a yearly premium of Rs 32000 (for a self+spouse+2 kids), Rs 63000 (for father) and Rs 8000 (preventive medical check-up). So now let us see how much exemption Rakesh can claim u/s 80D.

As self + family exemption limit is Rs 25000 and parent (senior citizen) exemption limit is Rs 50,000. So, Rakesh can claim exemption of Rs 75,000 (25000 self + 50,000 parent). As Rakesh has already exhausted his self exemption limit so he won’t be able to claim his preventive medical check because preventive medical check is already included in the self exemption limit.

2 Benefits into 1

I think getting tax deductions on health insurance is a wonderful thing. Health Insurance in itself is a very important financial product most people should buy and you are also getting some tax benefits on it. So, do buy health insurance for yourself, your family and parents to protect your wealth and save tax.

Let us know your views in the comment section about this article.

April 15, 2019

April 15, 2019

Thank you for the information

Welcome

I have a query, I want to take health insurance for myself and parents. However, my parents too have their own health insurance. Will it create conflict of interest while tax saving?

NO, it will not . you can take it if you wish !

Thanks for advice.

Very informative article, can you please confirm if I can claim for my parents if they are living on pension and filing their tax return however their tax liability is almost none so in case I pay their medical insurance then can I claim in my return.

Yes, you can claim the premiums which you pay for your parents in health insurance. Its allowed

Manish

Sir,

Can I club multiple health insurance premiums (one provided by my company where I pay premium for my dependents and another one taken by me separately) as long as the claimed premium (clubbed) is within the max limit mentioned above?

Thanks,

P Kumar

Yes you can do that. Your limits are always for the total health coverage and not for single policy

Thank you very much

very good article again Manish . very well explanined & clear about the tax saving under 80D

THanks

NRIs are not eligible to claim this, EVEN for the payment paid for their parent’s insurance, am I right?

No true . NRI’s can surely claim it, but it will be useful only when they are paying tax in INDIA. Otherwise what it he point of exemption !

Preventive check up for spouce and its limit

Its for the whole family. The limit is fixed at 5,000

Tell us more about what all is covered by ‘ Yearly Helth Checks ‘ with examples

Its the health checkup you do in diagonastic centers .. all kind of tests are included in that

In your signature style… Once again a very informative article written in a simple style. Thanks for enlightening.

Thanks

Sir, Thanks for your Article.

Preventive medical check-up 5000 limit is per person or it is only 5000?

If I paid 5000 for my spouse preventive medical check-up and 5000 for my father, so what amount will be available for the deduction if there is no premium paid for health insurance.

Its total of 5000 , not per person !