Procedure to claim life insurance if someone dies

It is very easy to buy life insurance. You just pay the premium, attach some documents, get your health check-up done and you will become a policyholder. Even nowadays it has become more convenient to buy, as most of them can be bought online.

So, at the time of buying it’s really the fast process but, have you thought that how will your family get the claim settled after your demise? What all will be the steps that they need to take to receive the claim amount? It is important to have life insurance for your family’s financial security against the risk of your death but what’s more important is, that eventually its benefits must reach the beneficiary.

In this article, we will guide you on what all steps your family members will need to take to get your life insurance sum assured amount so that you can inform them about all the procedures and documents required to get assured life insurance sum.

What is Life Insurance?

Lets first see what does life insurance means by definition. So, “Life insurance is a contract between an insurance policyholder and an insurer (insurance company), where the insurer promises to pay a designated beneficiary a sum of money in exchange for a premium, upon the death of an insured person.” It means the main purpose is to provide a sum of money to the designated beneficiary (a nominee or legal heirs). So, now let’s see what does your beneficiary need to do to get the claim settled.

Claim settlement Form:

Firstly your family member has to get a claim settlement form from the insurance company and fill all the details. Along with the form he/she needs to attach all the documents along with the form. The list of all the documents required is given below:

- Original Policy document

- In the form, it is asked whether a claimant is a nominee or not? If not then the claimant needs to prove that he is a legal heir of the deceased by submitting the “Will” or if there is no will then it has to be proven by Succession laws.

- If the claimant is a Nominee then Nominee ID proof establishing the relationship between nominee and person who died has to be provided.

- Notarized death certificate of the policyholder (deceased)

- In case the death happened in the hospital, document of hospital

- Copy of claimant’s current address proof

In case of Accidental Death along with the above documents following are to be attached:

- Hospital certificate

- Post-mortem Report

- FIR copy

- Final report of police

- Newspaper cutting if any

- Driving license of the person if the death happened while driving due to the accident

- In case of death outside India, was the deceased buried or cremated abroad? If yes, enclose a copy of the burial/ cremation permit.

It is very important to keep the acknowledgment slip mentioning all the documents which were submitted because it may be required for compliance of claim settlement.

Settlement of claim

As you now know how to claim, the next question will be how much time will it take to get the money? So, for this read the provisions on claim settlement provided by IRDAI.

As per the regulation 8 of the IRDAI (Policy holder’s Interest) Regulations, 2002, the insurer(company) is obligated to settle a claim within 30 days of receipt of all necessary documents including extra documents sought by the insurer. If the claim requires further investigation, the insurer needs to complete its procedures within 6 months from receiving the written intimation of the claim.

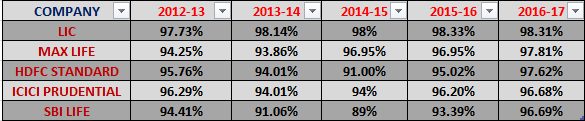

List of top 5 insurance company with death claim settlement ratio for the last 5 years – Below given table shows the claim settlement ratio of insurance companies. It is based on the individual death claim number published every year by IRDAI in its Annual Report. LIC tops the list of death claim settlement ratio for the last 5 years.

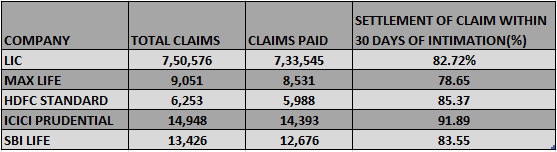

To give you a clearer picture, I have attached the screenshot of top 5 insurance companies during individual death claim settlement within 30 days of intimation.

Where to go if there is a dispute between the claimant and the insurer?

In many cases, life insurance claims have been delayed or denied due to a lack of proper documentation. So, make sure that your claim should not be denied due to this. And even after this claim settlement is delayed then there is a special court called Ombudsman of IRDAI (is a special court) where all claim-related disputes are solved. So if the claimant feels that they are being cheated or the claim is rejected despite submitting all the required documents then the claimant can approach the Ombudsman of IRDAI.

I hope now you are clear with the procedure to claim your settlement. Please feel free to comment about how fruitful this article was.

March 11, 2019

March 11, 2019

Such a great informative post. Really nice, Thank you for sharing this post with us. Keep posting!

It is very useful article to understand at one grace… Thank you

Welcome

It was a useful article indeed. Thanks for finding the time to prepare a report like this where hardly anyone bothers to pass on the information to their nominee. I have a suggestion for an article. It could be useful if you could prepare an article highlighting the importance of an overview-document of one’s portfolio (including all investments, savings schemes, liabilities , assets, insurance, nominee, allocation etc.). It should be brief and clear. Should be updated regularly. It is useful for the spouse or the close ones to get a quick overview of what we have left unfinished (or handed over). I feel it’s useful in a time of grief.

Hi Renjith Paramban

Thanks for your comment.

We will definitely work on your suggestion.

Vandana

this is realy great information! Thank you very much

Hey Kuttan K Warrier

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Vandana

Dear Jagoinvestor, What is claim settlement ratio? Its nothing but a percentage wherein the figure indicates the total no of claims settled as against the no of claims received. It does not mean that all the claims received will be settled compulsorily. It also does not mean that just because a claim is received – it is going to be settled as soon as possible. It only indicates that the Company will undertake the Due Diligence Process before settling a claim. It will make umpteen no of enquiries before settling the Claim. One has to be careful in understanding the figure glamorously called CLAIM SETTLEMENT RATIO published in bold by Companies. Policy Holders – B E W A R E

Thanks for your comment GOWRISHANKAR .. Please keep sharing your views like this..

Vandana

Are soldiers allowed to avail of life insurance policies by LIC of India or any other private player? Are there any hidden clauses, rules/regulations, etc.? Does the insurance cover only geographical limits of the country? Any other disclosure which may affect them?

Hello Faizy,

Many insurance companies don’t give life insurance to soldiers due to their high risky job. If any insurance company is giving the policy then the premium will be very high or maximum coverage will be less as compared to the normal insurance and also there will be certain changes in the terms and conditions of the policy.

As far as LIC is concerned, the Indian army has a tie-up with LIC for Life Insurance. The premium amount gets directly deducted from the salary.

Thank You

Anuradha