Don’t keep too much money in your saving bank account – Here are 2 strong reasons !

Today I want to talk about a mistake which we are all guilty of at some point of our life – “Keeping too much money in saving bank account”

I can understand how confident and great we feel when we know that we have a big amount in our savings bank account and if required we can just walk to the ATM and get the money within minutes. Nothing can beat that feeling !, however, there are some downsides to it too.

I want to talk about 2 problems (one small and one big) associated with keeping too much money in your bank account today.

You must be thinking, how can keeping money in my account be a problem? After all, more money into account is a good thing – RIGHT?

Let’s see

Problem #1 (small problem) – Negative Real Return

Let’s talk about the small issue first.

The money in your savings bank account earns a small interest of just 3.5% per year (in most of cases). Inflation is around 7-8% on average and if you consider that, you are actually earning a negative real return (real return = return – taxes – inflation).

So your purchasing power is only diminishing over time. What you can buy in the future is less than what you can buy today!. If the excess amount you keep in your saving account is very small, then you can dismiss what I said because the excess money in a way serves as your emergency fund, but when you keep big amounts, its an issue.

Don’t keep too much money in savings accounts

I have seen investors keeping a very large amount in savings accounts for a very long period of time.

We recently saw the data of one of our client, and he was having 90 Lacs in his saving bank account from the last 4 yrs. He had sold his house because he wanted to purchase a new house, but then he did not finalize the new house for a long time and never invested that money for better returns. It just did not hit his mind! (not taking any action is so EASY)

So he earned just 3.5% on that 90 lacs for 4 yrs, which is around 13.2 lacs of interest (without considering taxes). If only he had put that in a liquid mutual fund or a fixed deposit, he would have earned 26.2 lacs as interest (without considering taxes again).

Which means that he said NO, to that potential extra 13 lacs by just leaving that big amount in his saving bank account.

Now in your case, the quantum of potential loss will be only to the extent of the money you have in your account.

A lot of us, don’t keep 90 lacs in saving bank account (do we even have that much networth?), but its not very uncommon, to see large amount like 3 lacs, or 8 lacs lying in saving bank for many months just because the investors does not calculate the potential loss, or is just lethargic of breaking the status quo (I think, this is the real issue)

What you can do to solve this issue?

The simple approach you can take is, that apart from 4-6 months of your monthly expenses, you can park rest of the money at least in short term debt mutual funds (earns around 8% per annum, with better taxation than a FD) and deploy the rest amount as per your financial goals in other avenues and let it go out of your bank account and your sight.

The 6 months’ worth of emergency fund can be broken into 2 parts, where you can keep one part in saving account and other parts into a liquid fund (earns 6.5-7% and available in 24 hours notice). This is a far better arrangement compared to just leaving all the money in saving bank account.

Problem #2 (Big problem) – That excess money gets SPENT unconsciously

I don’t see many people talking about this 2nd point often and its related to behavioral finance. This is a very big topic, which deserves a whole book, but I will try to cover it quickly here.

Money is like water, it finds its own direction, if you don’t give it one!

Our mind works in a very different manner when we have money lying in front of us. Supply creates its own demand is one of the principles of economics and very much applicable to money. If you have money in a savings account, you can be sure that your mind will come up with every possible reason to spend it.

So if money is lying around in your saving bank account, which can be easily accessed then,

- Your TV will look old enough to you and your mind would like to upgrade it for a bigger one

- That Amazon Cart will automatically have those unwanted items which you really don’t need (but you feel you need it)

- You will feel that you can easily afford to give a bigger and fancier gift when you are invited to a marriage

- Those swiggy / uber eats orders will never stop

- The next vacation will feel within the reach somehow

- The eating out will often happen

In short, your spendings will increase sub-consciously

The human mind is very interesting. You always feel that you are in control of your spendings, but research on this topic has shown that we humans are our own enemy. It’s extremely tough to be in control and think rationally about spending’s especially when you have the excess supply of money.

Your environment and which kind of situation you are in, mostly decides how you will behave and think, not rationally! (you need to exercise right? Did you wake up in the morning and go for the jog if that’s the rational thing to do?)

Let money go out of your bank account automatically each month

The beautiful thing about a recurring deposit or SIP is that it takes away a part of your money out of your sight and makes it tough for you to access it. It creates wealth for you because your manual intervention is not involved in it. You are not taking manual decision each month if you want to save it or not. I don’t claim that manual investing is superior or not, but it looks great on paper, but not in reality.

If you are struggling to save each month, I think 90% of the reason is that you might be trying to do it manually, thinking – “I will save something for sure if I am left with it at the end of the month” . Trust me it will not happen.

We have had clients, who tell us that they are surprised after 2-3 yrs when they accumulate so much wealth, which happened only because they started a SIP and nothing else changed in their life. It’s a structure that automatically helped them in their wealth creation. Its the battle half won when you want to create long term wealth for meeting your financial goals.

Paytm, Amazon Pay and Cashbacks!

Have you observed that the money you add in your paytm wallet, Amazon Pay or similar wallets gets spent without guilt and so fast. The moment you add it in Paytm or other wallets, you look at that money in a very different way. It’s now “available” for spending (that’s called mental accounting). Well, this is a topic in itself, but I wanted to just make a point that when money is not visible, you think about it totally differently.

Listen to the below podcast to learn more about behavioral finance (its an audio uploaded on youtube) which I did along with Siddhartha K Garg.

You become a bit careless with money and don’t think too much when you have Rs 2,34,965 in your bank account compared to say when you have Rs 12,500.

What you can do to solve this issue?

Here are a few things you can do.

- Start your SIP / Recurring deposit 2-3 days after your salary date for your financial goals.

- Keep minimal amount in your saving bank account (unless is needed in next few days).

- Open a Liquid mutual fund folio, just to transfer the extra cash, and whenever you need it, you can redeem it and get the money in 24 hours

- Don’t keep more than 6 months of expenses in your liquid mutual fund.

- Try to use cash, if possible and add only small amounts in online wallets.

- Artificially create the “Low account balance” especially, when your spouse or you yourself are a shopaholic

- Do your financial goals planning and be aware of the future targets to achieve, it will help to know if you are lagging behind in reaching your financial goals

- Try to forcefully lock your money in financial products just to win over your ‘lack of self-control’

These were two common problems with having too much money in saving bank account or by any other means. It’s always a great thing to let money get locked somewhere (only that part which is not needed for long term).

What are your views about his topic? Do you agree with what I said?

February 21, 2019

February 21, 2019

Major reason is capital got blocked with very less return. can we make short term FD from these funds.

Hi,

another good article. Personally had great benefits by this approach; by keeping minimal amount – firstly you invested majority in SIP and then have automatic control on spending.

As for spending you do top-down approach; in which you have to mandatorily limit your spending with amount leftover.

Also, in worst case if there is an issue with bank, at max 1,00,000 Rs will be return; so there is not much safety and additionally loose interests.

I have a doubt, on this, normally the cyber crime will focus only on either ATM theft or unauthorized transaction from our savings account. Suppose if we park the maximum funds in FD, whether the risk will be minimised from these cyber attacks or not.

Hi Siva

Thanks for your comment.

As from FD, withdrawal can not be done as we do through ATM or online banking. So, there is no question of crime.

Vandana

Yes… I agree with you cent percent.

U people are great, I got a lot improvement in my finances and also acquired wealth.Keep up the good work…..

Hey DEBAJIT SHYAMAL

Glad to know that you liked the article.

Please share it on your social media profile so that it can reach more and more people !

Vandana

Also if you are holding a huge amount for a very sufficient time period there is the every possibility of you crossing the rupees10000 threshold interest credited in your bank account in a financial year for which a sufficient amount will be deducted by the bank IF YOU ARE NOT A SENIOR CITIZEN.

Thanks for your comment Sumitava Chowdhury .. Please keep sharing your views like this..

Vandana

This is a very apt article. It would be useful to mention that some liquid funds permit an investor to withdraw a portion of the funds (ranging from 50% to 90% or Rs. 50,000 whichever is lower) within 30 minutes. So, no need to wait for the next day to receive funds. In fact, I have received an ATM card from a MF house to withdraw cash from a liquid fund (up to 50% of the funds or Rs. 50,000 whichever is lower) and this ATM card works. So, in reality a liquid fund substitutes cash in a savings bank account earning a higher rate. The latest problem with the banks is to maintain Monthly Average Balance which is a sunk amount. If the savings bank balance falls below this minimum balance amount, there is a small penal cost. The minimum Average balance in some of the private sector banks could be as high as Rs. 25,000.

Thanks S. Krishnan for sharing a very informative insight.

We would have added this point to the article. 🙂

Vandana

Most banks have flexi deposit options, where they convert chunks of money in FD. Also new age banks, specially e-accounts give 6+% of returns. Isntvit much better than liquid funds or even pure FD?

Hi vikash,

Yes you can consider this option as well.

Vandana

I like the insight and the behavioural spending traits awareness that you have brought out. A lot of people including myself are culprits and personally have not been analysing the saving account transactions for real returns. I need to start.

Hi Boyd,

Glad that you liked the article, Please share this in to your circle and social media so that it can reach many people.

Vandana

Some new and big banks (read Yes Bank , Kotak) give good interest rates these days and an ease to break FD with a click without any penalty. I prefer keeping my money liquid in small FDs with 7.8% return rather than park them in regular banks (read ICICI, HDFC) with 3.5% return on savings (breaking an FD attracts additional penalty in these banks)

Hi sheena,

Thanks for sharing your views. I don’t agree 100 percent on this point. Because even if you get higher rate of interest on saving bank account from some banks, it will not help you in controlling the behavioral finance part. That means you will be spending excess money unconsciously.

Vandana

Very good article with valid points. But, is it still better to park excess amount in debt or liquid funds when the same is automatically getting transferred to quantum optima account having returns almost equivalent to one year fixed deposit?

Hi Binod,

As you said if the excess funds are getting transferred to quantum optima account then your money will be away from your eyes.. so that you won’t spend unnecessarily. That is a good way if its also giving the same returns as liquid mutual funds are providing.

Vandana

dont agree with Liquid mutual fund folio, which Liquid Mutual Fund folio will give you 7-8% return for 1-3 months, over a 1 year period I agree it gives 7-8%, but if you are looking for short term 1-6 months no liquid mutual fund folio will give 7-8%, correct/educate me if i am wrong

Yes, you are correct. In short term there is no guarantee (only high chances) that returns would be in range of 6-7% .. but over 1 yr period the probability is very very high (almost 99.9%) .

But for sure it will be better than a saving bank account.

Recently tata Money market fund came down almost 6% in a single day. How you can believe the liquid funds. there is a risk there also.

Hi srinivasa,

Its not that all liquid funds will be same. Because every fund has its own features and investment strategies. Selection of a good fund is very important.

Vandana

No, liquid funds have a linear chart. They give 7% around CAGR, in all time periods

@Zoeb: Manish is referring to 7-8% as annualized return in liquid funds.

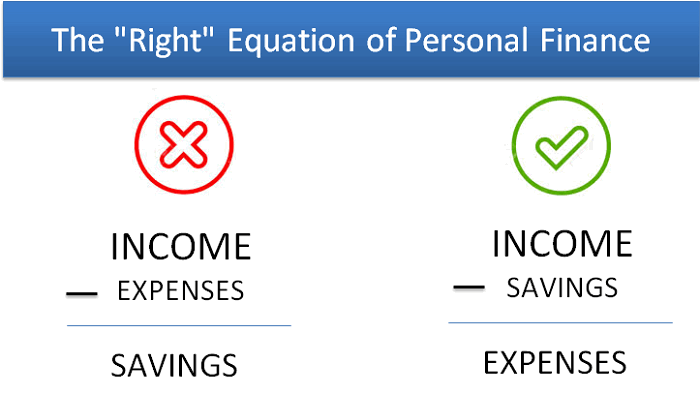

Yes you are right. I agree with the statements made in the article . I liked the right way and wrong way depicted in red and green. That is the right way being earinings-savings=expenses and not the red the other way earnings-expenses=savings.

Thanks 🙂

Another biggest risk is ….cyber crime. One can always minimise risk from unauthenticated financial transactions if we have less money.

I had thought of putting that point 🙂 .. Glad that you mentioned that. Will add it